Coinspeaker

Bitcoin ETF Choices Debut Sees Practically $2B Buying and selling Surge

Bitcoin (BTC) ETF choices have made a outstanding entrance, amassing practically $2 billion in notional publicity on their very first day, considerably impacting Bitcoin’s market dynamics. On November 20, choices tied to BlackRock’s Bitcoin exchange-traded fund, often called IBIT, started buying and selling.

Bloomberg Intelligence analyst James Seyffart highlighted the extraordinary quantity, stating:

“1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts, […] That’s a ratio of 4.4:1. […] These options were almost certainly part of the move to the new Bitcoin all-time highs today.”

The introduction of IBIT choices marks a pivotal second for Bitcoin buyers, significantly establishments. Market contributors extensively anticipate that the supply of those choices will appeal to extra institutional curiosity in Bitcoin

BTC

$93 507

24h volatility:

2.4%

Market cap:

$1.85 T

Vol. 24h:

$89.17 B

. This follows the US Securities and Trade Fee’s approval in September for choices on a number of of the 11 spot bitcoin ETFs throughout numerous exchanges, with extra choices merchandise anticipated to launch shortly.

Bitcoin Sees 80% Bullish Choices Surge

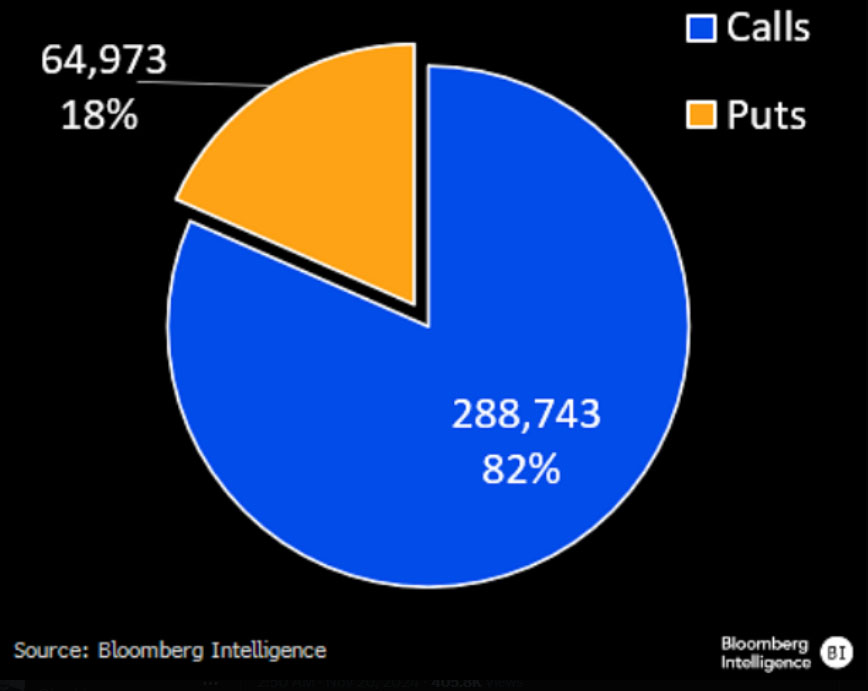

In accordance with James Seyffart’s submit, the launch of IBIT’s choices buying and selling noticed a formidable debut, with $1.9 billion in notional publicity traded throughout 354,000 contracts. The info displays heightened market curiosity, aligning with Bitcoin’s climb to new all-time highs. Name choices dominated the exercise, making up 82% of contracts, signaling sturdy bullish sentiment.

Supply: Bloomberg Intelligence

Out of 354,000 contracts traded on IBIT’s first day, 289,000 have been calls, whereas 65,000 have been places. The decision-to-put ratio of 4.4:1 highlights the overwhelming desire for bullish bets on Bitcoin. The surge in choices buying and selling suggests buyers are optimistic about Bitcoin’s value trajectory amidst the continuing crypto rally.

Monetary derivatives supply patrons the proper to purchase or promote an asset at a set value inside an outlined interval. A name possibility permits the asset’s buy on the strike value, whereas a put possibility permits its sale on the similar predetermined value. Traders typically favor name choices when anticipating value will increase, enabling worthwhile purchases or gross sales if the market strikes upward. Conversely, put choices supply safety towards value drops or enable hypothesis on declines, letting holders promote the asset on the strike value even when its market worth falls.

The rise in IBIT choices buying and selling has launched new methods for knowledgeable buyers, enhancing market liquidity and shaping the broader market panorama. Institutional gamers, hesitant about unregulated platforms, can use IBIT choices to hedge bullish positions and earn further earnings by promoting calls. Speculators, in the meantime, exploit each name and put choices to revenue from Bitcoin’s volatility with out instantly proudly owning the asset.

Can Bitcoin Choices Cut back Lengthy-Time period Volatility?

The inflow of IBIT name choices could form Bitcoin’s implied volatility over time. Analysts recommend substantial name possibility volumes may decrease volatility in the long term. Within the brief time period, heightened demand throughout bullish traits would possibly set off value surges akin to GameStop’s gamma squeeze, the place leveraged shopping for drives fast will increase.

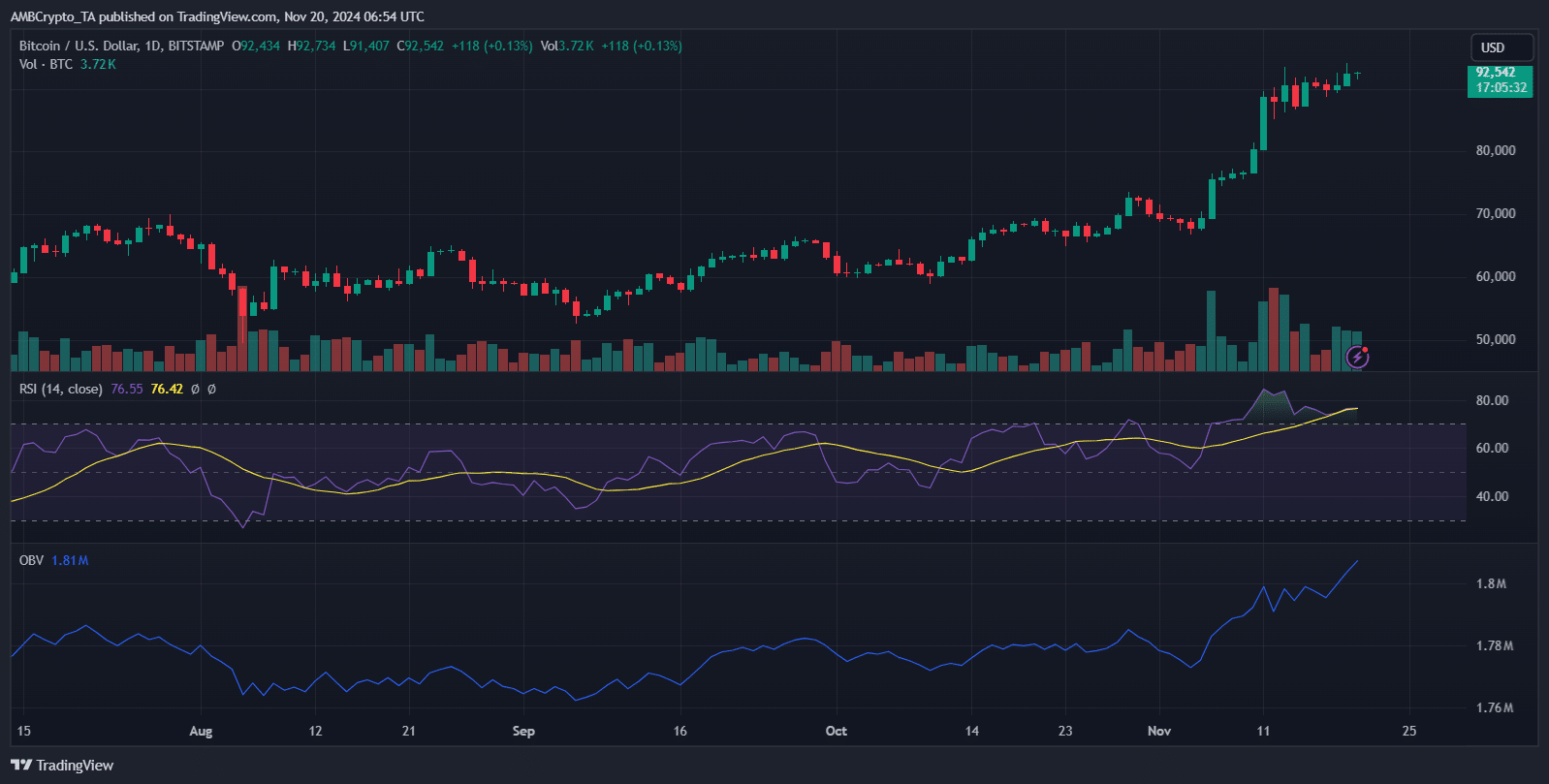

Bitcoin surged to a recent excessive of $93,800 on Wednesday, extending its spectacular post-election rally. Over the weekend, costs steadied close to $91,000 following final week’s climb previous $80,000 and $90,000 for the primary time, marking a big milestone for the cryptocurrency market.

Bitcoin’s rise is linked to the “Trump trade,” fueled by President-elect Donald Trump‘s guarantees to contemplate crypto-friendly initiatives. Proposals like establishing a Bitcoin nationwide stockpile have invigorated market optimism, underscoring the cryptocurrency’s increasing position in each coverage and international monetary markets.

Bitcoin ETF Choices Debut Sees Practically $2B Buying and selling Surge