Coinspeaker

Bitcoin ETF Sees 4th Consecutive Day of Outflow Streak, Drained $165M Yesterday

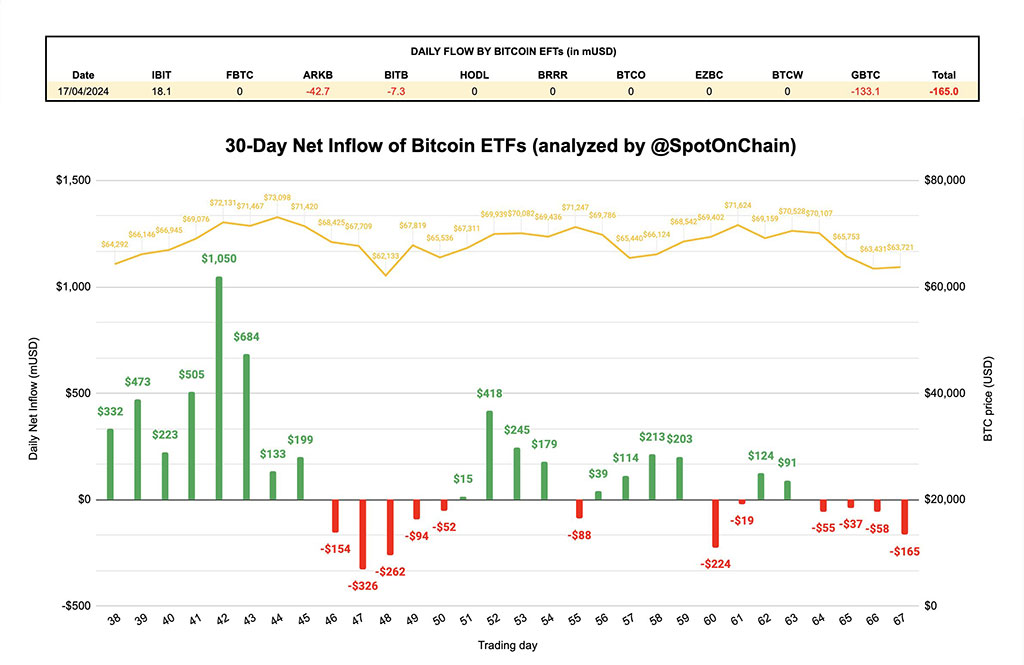

The regular outflow from Bitcoin (BTC) exchange-traded funds (ETFs) highlights the ongoing promoting stress. These funds skilled destructive inflows for 5 consecutive days, closing in a $165 million outflow on April 17, 2024. The destructive outflow follows Bitcoin’s current bearish pattern, which has declined over 13% within the final week.

The Grayscale Bitcoin Belief (GBTC), the biggest Bitcoin investment fund globally, retains dealing with withdrawals from buyers. Yesterday’s outflow of $133 million added to the continual negative inflows, exhibiting buyers’ waning curiosity amid a considerable 1.5% administration price.

Nevertheless, a shiny spot emerges within the type of BlackRock’s iShares Bitcoin Belief (IBIT). Whereas the IBIT’s inflows have slowed in comparison with earlier this week, it remains the one ETF recording constructive internet inflows. Nevertheless, the charge lowerd to $18 million on April 17, considerably decrease than earlier days.

Picture: SpotOnChain

Bitcoin ETFs Sign Shifting Investor Sentiment

The decline in Bitcoin ETFs signifies a broader shift within the Bitcoin funding area. Whereas the introduction of spot Bitcoin ETFs initially sparked enthusiasm, the total influx into these offerings has decreased considerably, highlighting a altering sentiment amongst buyers in the direction of Bitcoin-related funding vehicles.

Nevertheless, the declining outflow stands in distinction to the substantial investments made earlier in April, when BlackRock’s IBIT ETF led the influx by accumulating a internet influx surpassing $25.78 million on Tuesday, driving the collective inflows beyond the spectacular $15.3 billion milestone.

Moreover, Bloomberg ETF guide James Seyffart emphasizes that days with none inflows are typical for Bitcoin ETFs and shouldn’t be mistaken as a sign of product failure. He says related patterns occur throughout many kinds of exchange-traded funds within the United States.

Bitcoin Worth Decline Drives ETF Outflows

The recent sight of ETF outflow aligns with Bitcoin’s downward trajectory. The cryptocurrency misplaced 13% of its price over the previous weeok, at present hovering round $62,300 with an total market evaluation of $1.21 trillion. Bitcoin’s value drop possible impacted investor confidence, driving outflows throughout its funding merchandise.

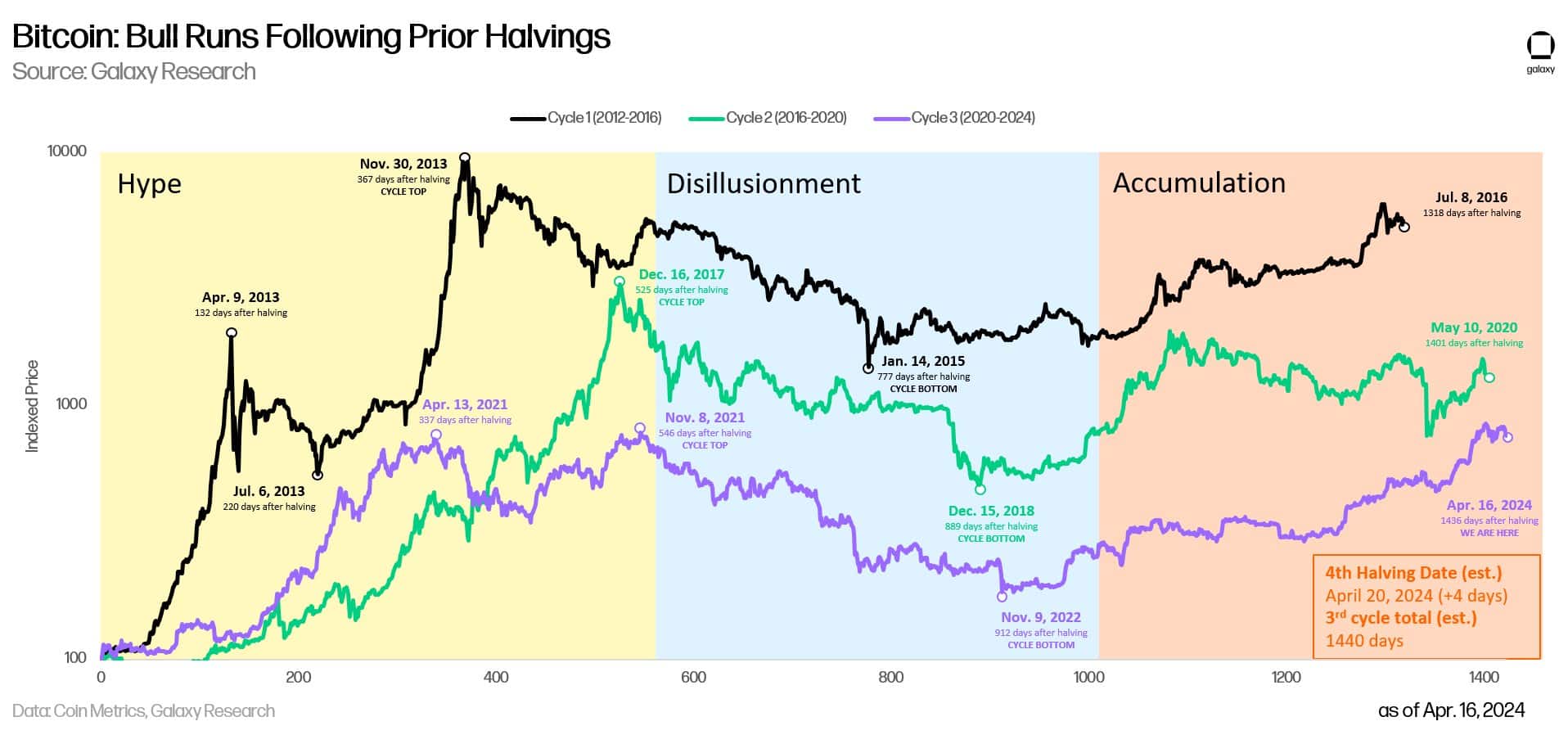

Picture: Bitcoin2go

In line with the technical evaluation from a pseudonym analyst named “Bitcoin2go”, Bitcoin exhibits an essential $61,000 help stage. Though regaining the misplaced 200 EMA (4h) earlier this week is feasible, efforts to recover considerably have confronted obstacles.

The approaching weeks may see a shift in market sentiment relying on components like geopolitical tensions and company earnings experiences. Nevertheless, some analysts imagine that these outflows are merely an acceleration of a correction that was inevitable.

With the Bitcoin halving occasion simply across the nook (lower than 48 hours away as of April 18), opinions are divided on its short-term value impression. Whereas consultants imagine it won’t considerably affect the value, the general market environment will possible proceed to play a serious function in shaping Bitcoin’s trajectory within the close to future.

Bitcoin ETF Sees 4th Consecutive Day of Outflow Streak, Drained $165M Yesterday