Coinspeaker

Bitcoin ETFs Witness $303M Inflows as Bitcoin Soars to $66,000 amid Optimistic CPI

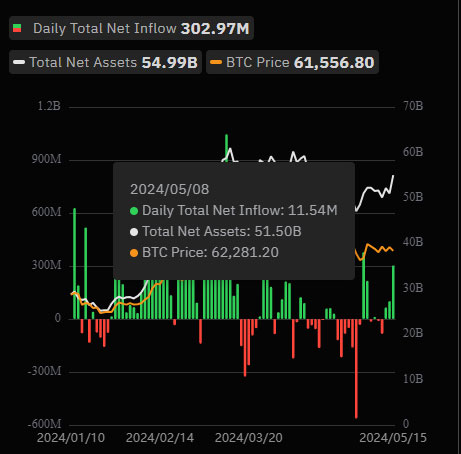

Spot Bitcoin trade-traded funds (ETFs) within the US expertised 302.97 million internet inflows on Might 15, as the value of Bitcoin soared to 62,000. It was the best level of influx for ETFs since Might 3. Curiously, on the similar day, the US Client Worth Index (CPI) knowledge was additionally launchd, acknowledging institutional buyers’ victory.

Picture: SoSoValue

Constancy’s FBTC fund emerged because the frontrunner, attracting $131 million in inflows, the best single-day influx for the fund since March 26. Bitwise Asset Administration’s BITB fund had a notable performance, recording $86 million influx, greater than the earlier excessive on March 4th.

BlackRock’s IBIT fund stays secure at zero inflows for the third consecutive day. Monetary specialists clarify that the zero inflows for large-scale funds like IBIT are frequent occurrences and don’t have any alarming draw back or potential threat.

Grayscale’s flagship GBTC fund, previously going through outflows over the previous 4 months, was apparently revived, with inflows of $27 million. This reversal may point out a shift within the sentiments of buyers who’ve been investing within the biggest Bitcoin funding useful resources globally.

Millennium’s $2 Billion Bitcoin ETF Holdings

Including additional gas to the hearth, latest US Securities and Alternate Fee (SEC) filings revealed that Millennium Administration, a outstanding hedge fund with over $64 billion in property underneath administration, holds a considerable $2 billion portfolio in numerous spot Bitcoin ETFs. This disclosure sparked a witty comment from James Seyffart, a famend ETF analyst. “It’s only retail traders buying the Bitcoin ETFs,” he famous.

Millennium’s portfolio boasts holdings throughout a number of main suppliers: $844.2 million in BlackRock’s IBIT, $806.7 million in Constancy’s FBTC, $202 million in Grayscale’s GBTC, $45.0 million in Ark’s ARKB, and $44.7 million in Bitwise’s BITB. Notably, this makes them the only largest holder of each IBIT and FBTC.

The Might 15 deadline for institutional buyers to file their quarterly 13F reviews with the SEC for positions held on the finish of Q1 additional bolstered the constructive sentiment. This deadline marked the closing window for buyers to accumulate most spot Bitcoin ETFs inside the first quarter.

Bitcoin Soars to $66,000 on Optimistic CPI Knowledge

As Bitcoin ETFs witnessed renewed curiosity, Bitcoin skilled a major worth surge. In accordance to CoinMarketCap, Bitcoin costs surged 6.50% over the previous 24 hours, reaching a excessive of $66,350 throughout early Asian buying and selling on Might 16. This marks Bitcoin is simply 10% removed from its all-time excessive of $73,750 on March 14.

The constructive market response is pushed by the discharge of the April US CPI knowledge, which got here in decrease than anticipated at 0.3%. This report, a key indicator of inflation, has elevated optimism concerning the Federal Reserve probably lowering rates of interest and injecting extra liquidity into the market – a situation traditionally beneficial for high-risk property like cryptocurrencies.

Bitcoin ETFs Witness $303M Inflows as Bitcoin Soars to $66,000 amid Optimistic CPI