- Ethereum has a barely extra bullish bias for the approaching week.

- The Bitcoin consolidation section was nonetheless ongoing, and a revisit to $60k was rising extra probably.

Bitcoin [BTC] merchants had been going by a comparatively robust interval after the straightforward, simple rallies which were the norm since final October.

Ethereum [ETH] has been extra sophisticated, however BTC’s halving occasion final month has modified the market circumstances to cut and vary formations all around the market.

AMBCrypto investigated what the market sentiment was wanting like over the weekend, and the place this week’s value motion might go.

One of many two has speculators expectant of bullish returns within the close to time period

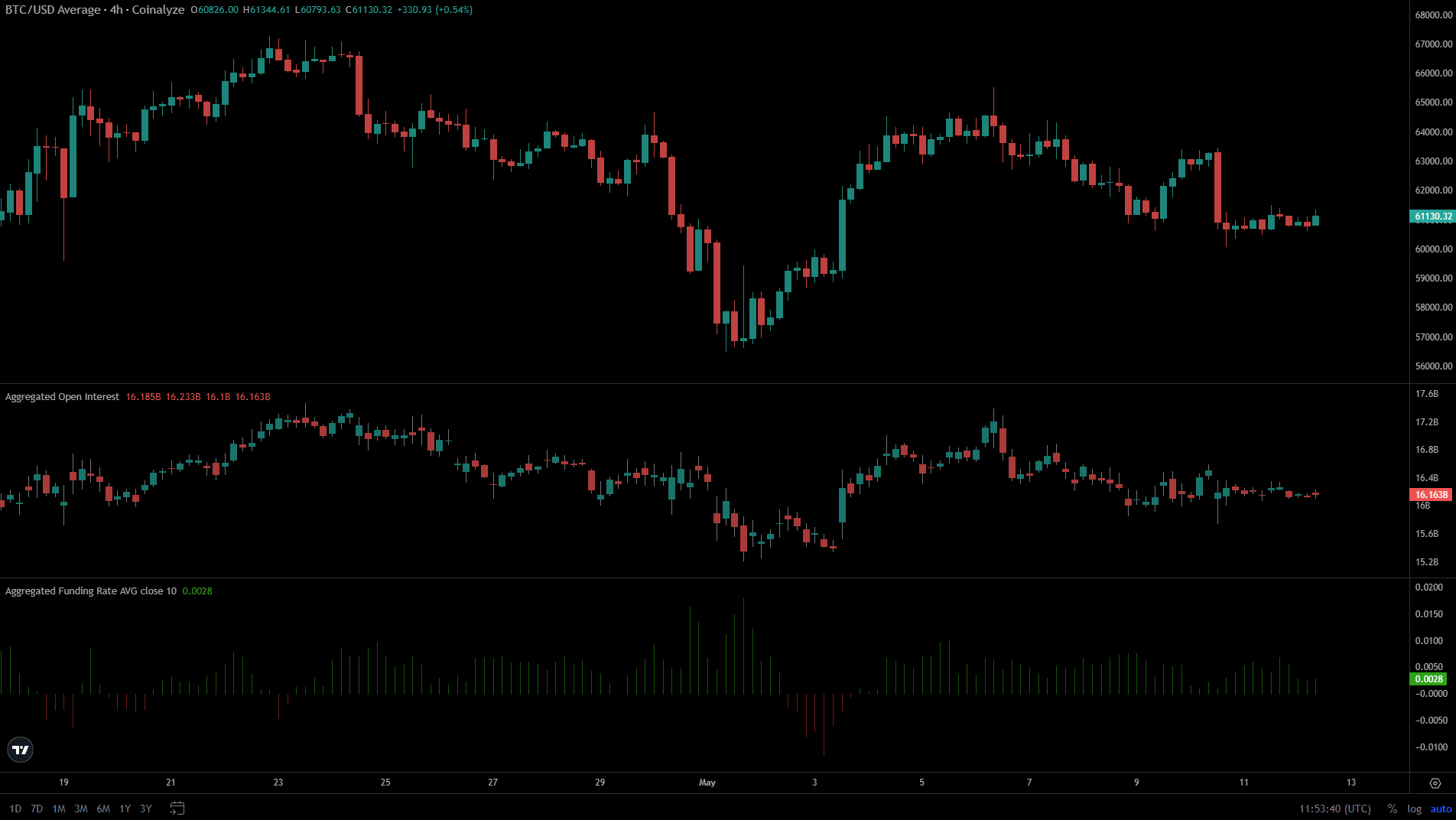

Supply: Coinalyze

The tenth of Might noticed a rise within the Bitcoin Open Curiosity, however the OI has been trending downward because the value spike on the sixth of Might.

In the meantime, the worth additionally shaped a sequence of decrease highs over the previous week, descending from $64k to $61.1k at press time.

The Funding Fee was unfavorable at the beginning of Might when Bitcoin plummeted to $56k. Since then, the Funding Fee has recovered.

Nonetheless, prior to now few days, it has been barely above zero, which indicated the sentiment was not strongly bullish.

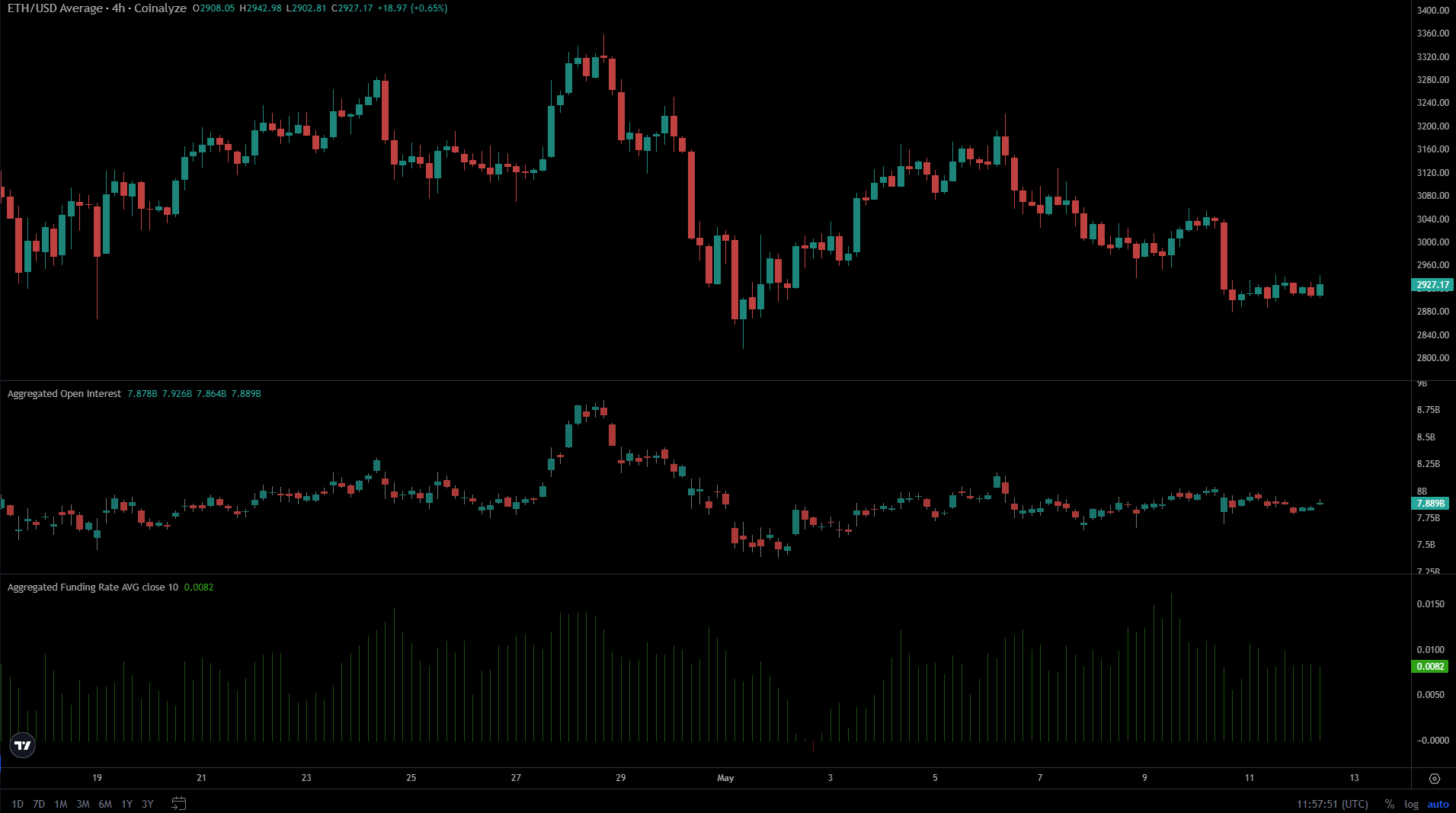

Supply: Coinalyze

Ethereum additionally noticed Funding Charges slip into the unfavorable territory in early Might however has since recovered. The previous week’s downtrend noticed the funding charge hover across the baseline +0.01 mark.

A slight bounce from $2980 to $3040 on the ninth of Might noticed the Open Curiosity and the funding charge bounce larger.

This didn’t repeat with Bitcoin regardless of an analogous value bounce, which recommended that speculators had been extra desperate to lengthy ETH than BTC.

What are the following liquidity pockets that would appeal to costs?

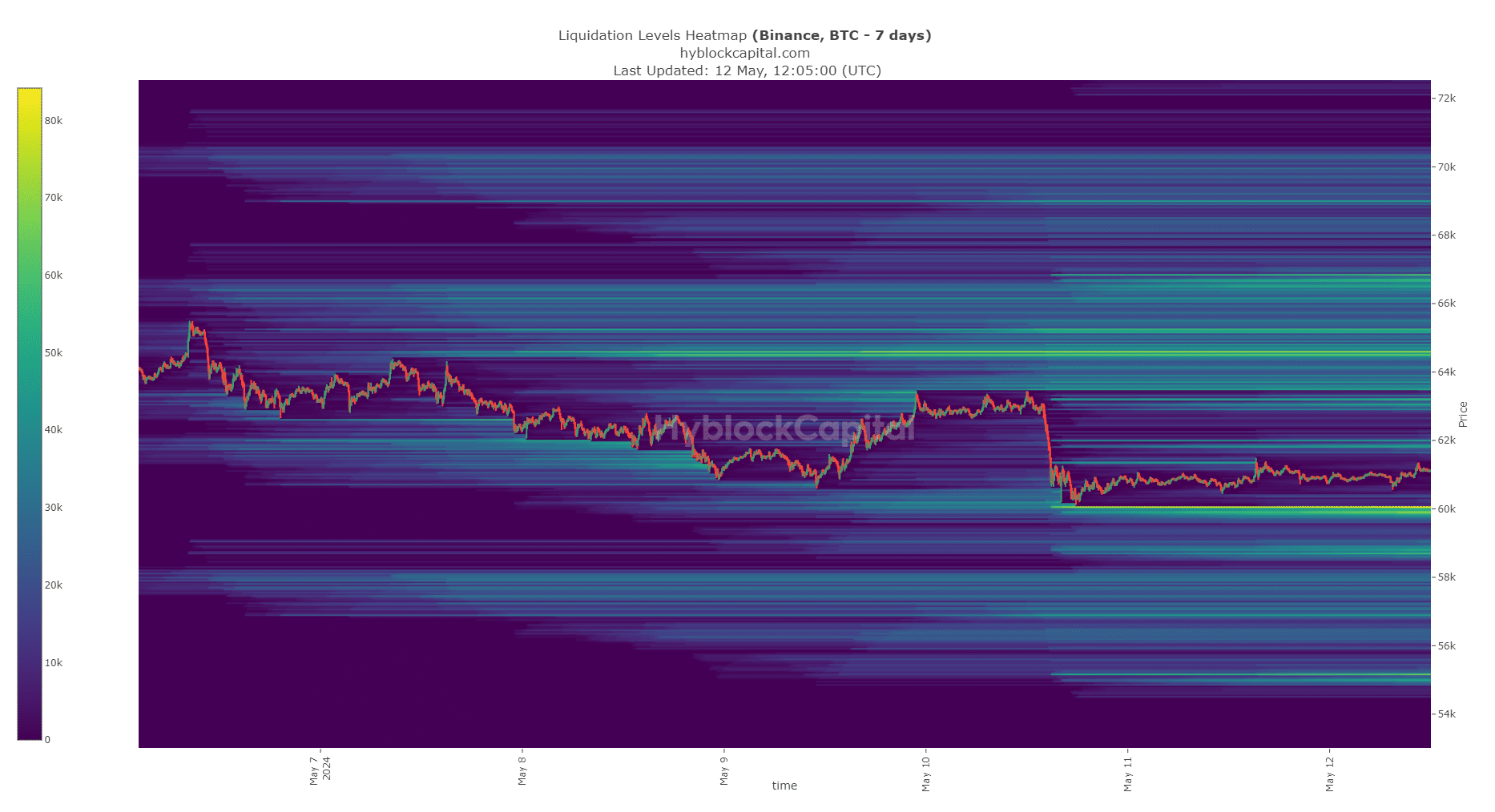

Supply: CryptoQuant

The 7-day liquidation heatmap of Bitcoin confirmed a vibrant cluster of liquidations on the $60k space. To the north, $61.8k and $63k are the following bullish targets.

On the fifth of Might, we noticed costs bounce above the $64k mark to gather liquidity earlier than a brutal short-term reversal.

Equally, we would see a downward plunge on Monday to gather the liquidity at $60k earlier than rebounding larger. Therefore, BTC merchants would need to purchase the dip to the $50.6k-$60k area.

Nonetheless, merchants should even be ready for a transfer under $59.4k for BTC, and set their stop-losses accordingly within the occasion of a dip to $60k.

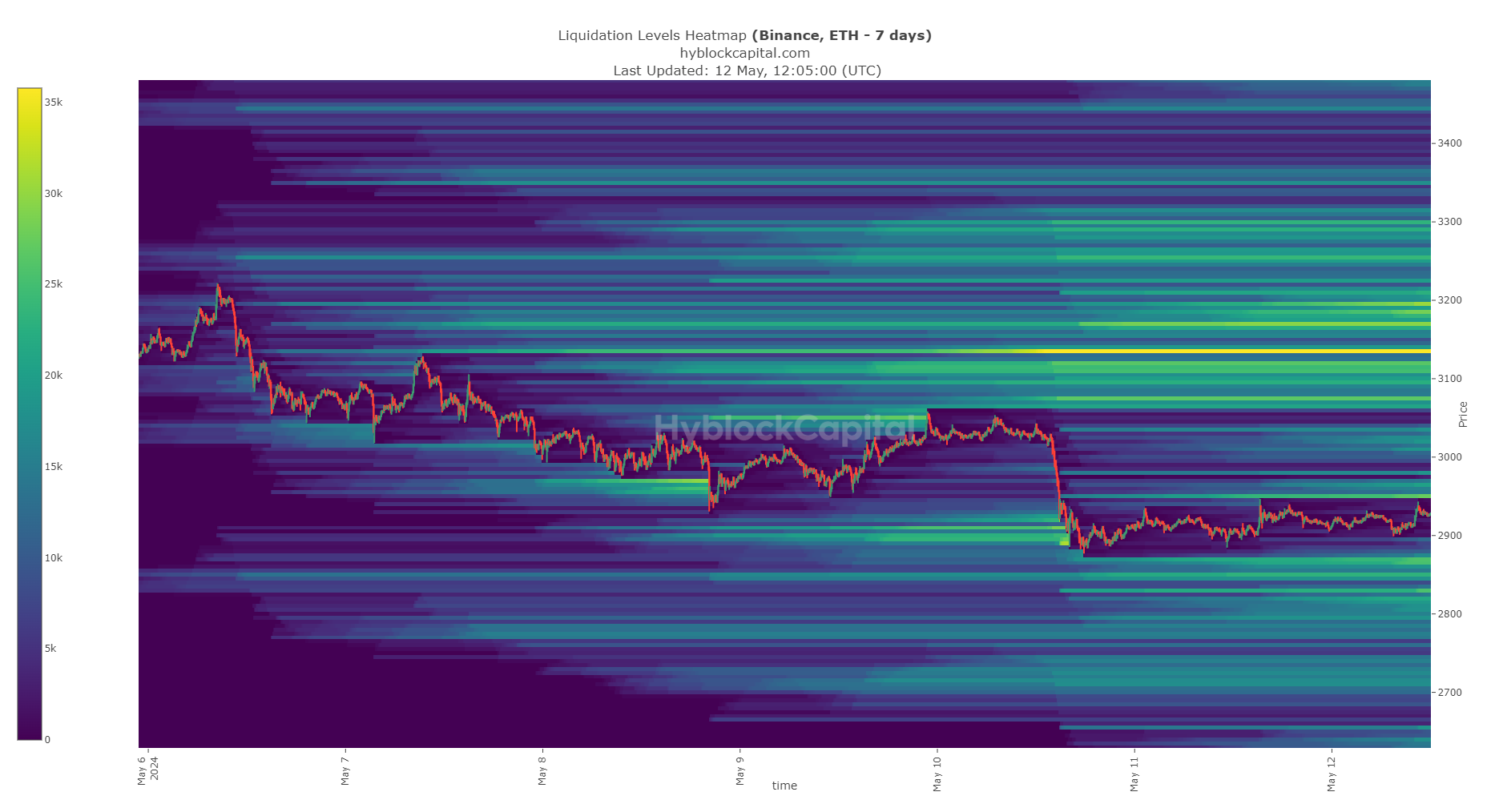

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Alternatively, Ethereum has a cluster of liquidity close by to the north at $2950. This was near the present market value of $2928. A dip to the $2860 area would probably current a shopping for alternative.

The liquidation ranges across the $3.1k-$3.2k space current a pretty goal. A drop under $2.8k would probably herald a powerful short-term downtrend, and merchants can reduce their losses on this situation.