- USDT inflows sign sturdy demand for Bitcoin, driving worth up.

- Stablecoins are integral to Bitcoin’s continued bullish momentum.

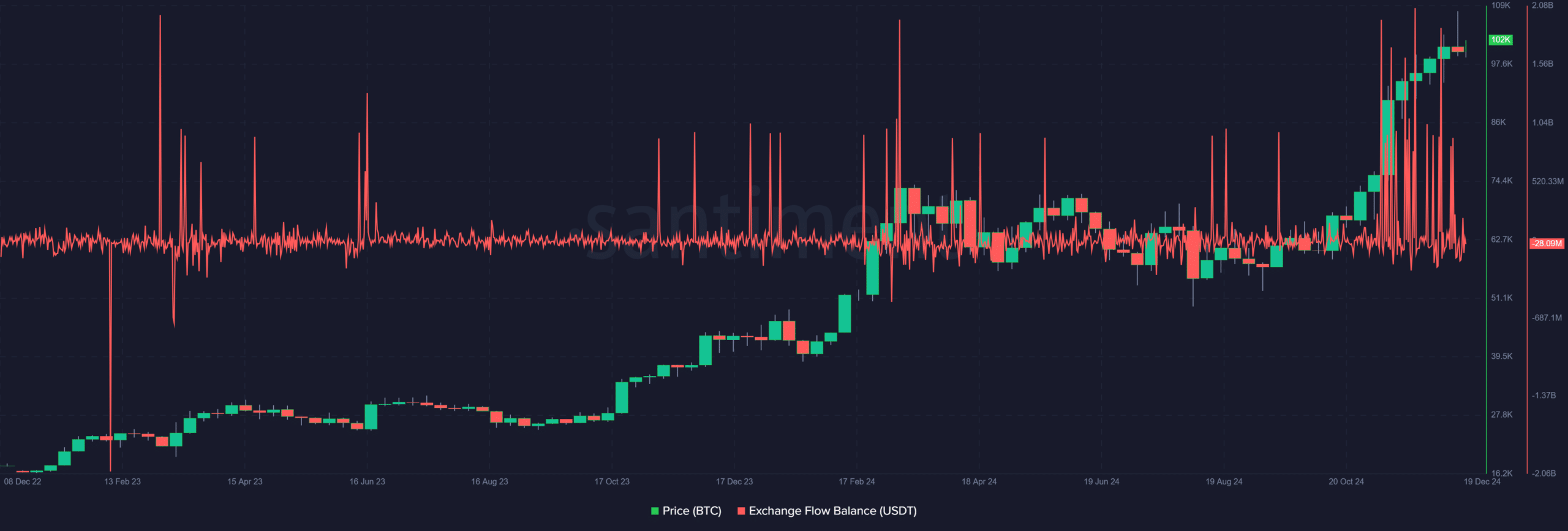

Current on-chain knowledge highlights a surge in Tether [USDT] inflows to centralized exchanges, averaging $40 million per day. This development means that stablecoins will be the driving drive behind Bitcoin’s ongoing rally, which not too long ago noticed the cryptocurrency hit a record-breaking $108,000.

The numerous USDT deposits point out massive traders are positioning themselves for additional beneficial properties. As stablecoins function a gateway to different property, this influx might sign confidence in Bitcoin’s potential for continued development.

Significance of USDT inflows and their influence

The regular influx of USDT into centralized exchanges has grow to be a key indicator of investor sentiment.

Not like different property, stablecoin deposits usually sign preparation for buying and selling exercise fairly than imminent sell-offs. Traders use USDT as a liquidity bridge to buy risky property like Bitcoin when market situations are favorable.

With exchanges receiving a median of $40 million USDT every day, these inflows replicate elevated demand for crypto publicity. This surge highlights institutional and retail curiosity in Bitcoin’s rally, suggesting that stablecoins are taking part in a pivotal position in sustaining market momentum.

The development is especially noteworthy throughout occasions of heightened worth exercise, because it underscores the capital readiness to gasoline additional bullish runs.

Impact of stablecoin flows on Bitcoin’s worth

Stablecoin flows, significantly these involving Tether, instantly affect Bitcoin’s worth dynamics by rising shopping for stress. When massive volumes of USDT are deposited into exchanges, they usually precede heightened buying and selling exercise, driving up Bitcoin’s worth.

This sample aligns with Bitcoin’s current surge to a brand new all-time excessive of $108,000, fueled by vital USDT inflows.

Not like conventional property, stablecoins allow speedy market entry, amplifying the influence of large-scale actions. The constant $40 million every day deposits recommend a robust demand pipeline for Bitcoin, serving to maintain its bullish momentum.

As stablecoin inflows proceed, analysts predict additional worth will increase, reinforcing the important position of USDT in shaping market developments.

Wanting forward

The stablecoin market is ready for vital development and maturation in 2025. Analysts predict that the mixed market capitalization of main stablecoins like USDT and USDC might double and even triple, reflecting their shift from area of interest monetary instruments to mainstream property.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This growth will seemingly stem from clearer rules, elevated adoption, and the rise of stablecoins pegged to native currencies, which can problem the dominance of dollar-backed choices.

Moreover, the mixing of stablecoins into conventional banking programs ought to improve monetary companies, offering sooner and extra inclusive options globally.