Coinspeaker

Bitcoin Faces $11.8 Billion Choices Expiry Quickly, What’s Subsequent?

Bitcoin

BTC

$90 799

24h volatility:

3.1%

Market cap:

$1.80 T

Vol. 24h:

$93.11 B

is approaching a crucial deadline, signaling the beginning of considerable shifts available in the market. Because the expiration of $11.8 billion in Bitcoin choices nears on December 27, 2024, merchants put together for elevated volatility. This expiration encompasses each name and put choices, probably influencing Bitcoin’s worth trajectory within the closing days of 2024.

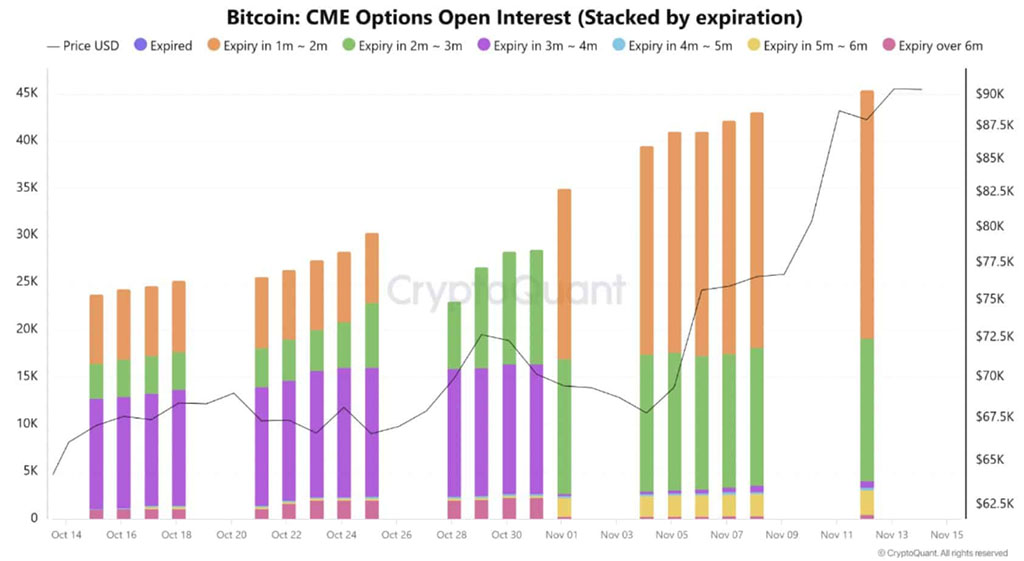

Supply: CryptoQuant

The cryptocurrency has skilled a surge in bullish sentiment following the 2024 US elections. Some analysts forecast an increase to $100,000, fueled by growing capital inflows and a market dominance surpassing 60%. Nevertheless, reaching this milestone presents challenges, particularly with billions in choices contracts set to run out.

Bitcoin’s rising enchantment is obvious within the surge of open curiosity within the choices market, which has not too long ago hit an all-time excessive of $50 billion. Nevertheless, a lot of this optimism hinges on Bitcoin’s efficiency within the upcoming weeks, significantly with the expiration of $11.8 billion value of choices contracts looming.

Bitcoin Worth Hovers Above $90K

Bitcoin’s present worth, simply above $90K, displays a steadiness of bullish and bearish forces. Over the previous 24 hours, worth corrections have emerged, suggesting that the market’s upward momentum could not final. The choices market will play a vital position in figuring out Bitcoin’s short-term worth trajectory.

Of the $11.8 billion in call-and-put choices set to run out, name choices dominate, accounting for almost 70% of the overall order ebook, in accordance to Coinglass information. Traders are optimistic about Bitcoin reaching the $100K mark. Ought to this goal be met, a wave of name choices would seemingly be exercised, producing substantial promoting stress as merchants lock in income.

Nevertheless, this may occasionally not conclude the market’s actions. The expiry of those choices may immediate a short-term pullback. Merchants holding name choices could flood the market with gross sales as they shut their positions. If put choices — bets on a worth decline — start to outnumber calls, market sentiment may shift, intensifying downward stress.

Deribit Leads the Cost in Bitcoin Choices Market

When it comes to market share, the Bitcoin choices market reveals excessive focus, with most buying and selling on Deribit, which holds a 74% market share. CME and Binance account for round 10.3% every. The give attention to Deribit highlights the primary area for Bitcoin worth motion bets.

Bitcoin choices face a fragile state of affairs. Robust bullish sentiment has many merchants anticipating a breakout above $100,000. Nevertheless, the expiration of those contracts would possibly set off a self-fulfilling cycle of promoting stress if costs don’t maintain above $100K. The conduct of those contracts shall be essential for Bitcoin to take care of or exceed this worth.

Bitcoin Faces $11.8 Billion Choices Expiry Quickly, What’s Subsequent?