- After touching $61k, BTC witnessed a worth correction.

- Promoting strain on the coin elevated over the past 24 hours.

Within the final 24 hours, optimism within the crypto market elevated as Bitcoin [BTC], the king of cryptos, reclaimed $61k. Nonetheless, the pattern didn’t final lengthy because the coin witnessed a worth correction. Let’s have a better have a look at what’s happening with BTC.

Bitcoin turns bearish once more

The king of cryptos gained bullish momentum and managed to go above $61k on the twentieth of August. However the situation modified quickly because the bears took over the market.

Based on CoinMarketCap, BTC’s worth dropped by over 2.5% within the final 24 hours. On the time of writing, the coin was buying and selling at $59,378.99 with a market capitalization of over $1.17 trillion.

The attention-grabbing bit was that this latest worth correction wasn’t unexpected.

Ali, a well-liked crypto analyst, posted a tweet revealing that BTC’s TD sequential flagged a promote sign. Quickly after the sign obtained revealed, the coin’s worth witnessed a correction.

AMBCrypto’s have a look at CryptoQuant’s information identified fairly a number of elements which may have performed a task in cursing BTC to plummet. As per our evaluation, BTC’s alternate reserve was rising, indicating a rise in promoting strain.

The truth that buyers had been promoting Bitcoin was additional confirmed by its alternate netflow because it elevated.

To be exact, BTC’s web deposit on exchanges was excessive in comparison with the 7-day common. Increased deposits will be interpreted as greater promoting strain. Nonetheless, BTC’s Coinbase Premium remained inexperienced, suggesting that purchasing sentiment was dominant amongst US buyers.

Will this pattern proceed?

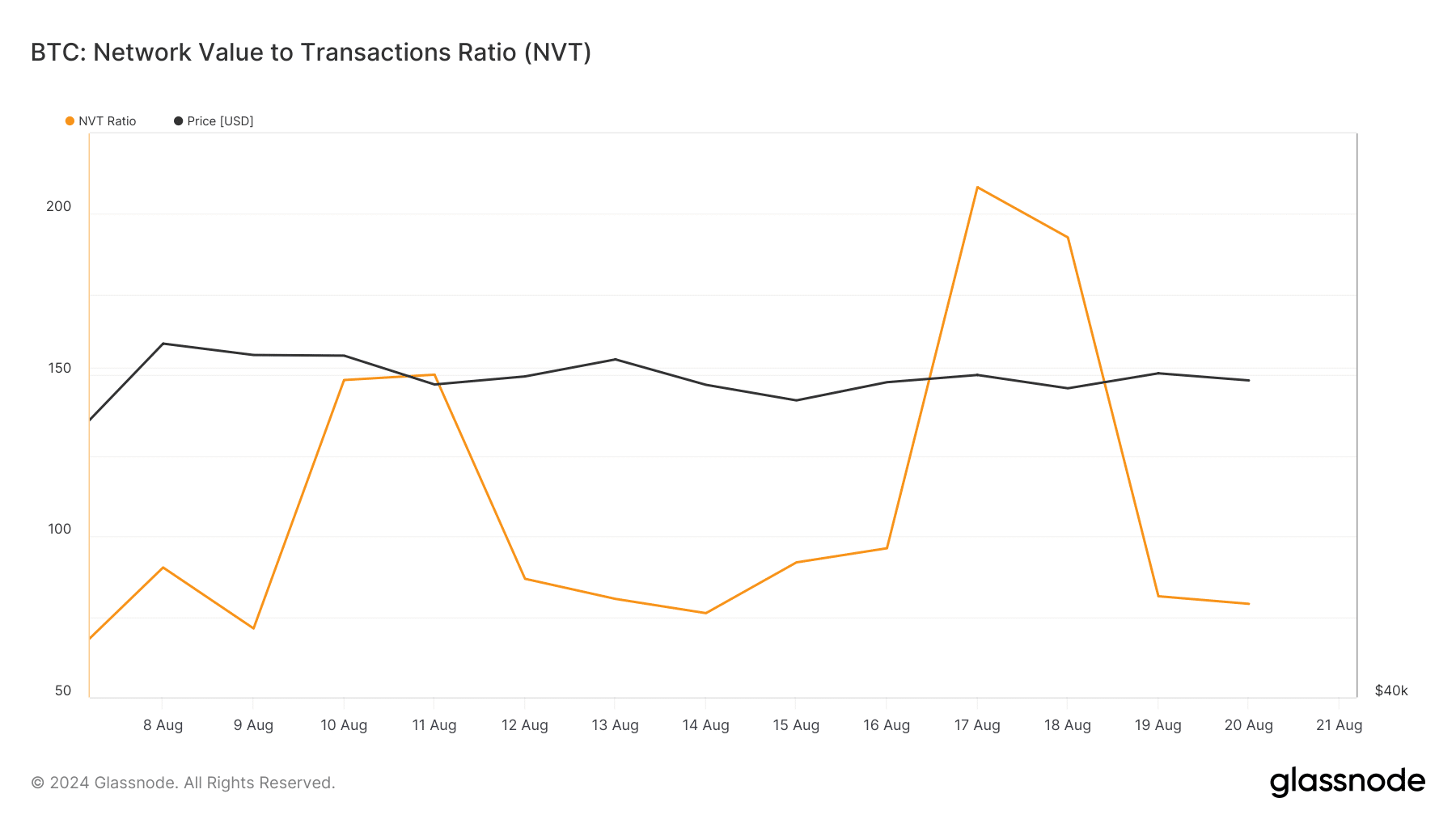

AMBCrypto then took a have a look at Glassnode’s information to seek out out the percentages of this bearish pattern persevering with. We discovered that Bitcoin’s NVT ratio dropped considerably.

A decline within the metric implies that an asset is undervalued, hinting at a worth improve. For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain quantity measured in USD.

However issues within the derivatives market didn’t look in patrons’ favor. For example, BTC’s taker purchase/promote ratio turned purple. This clearly meant that promoting sentiment was dominant within the futures market.

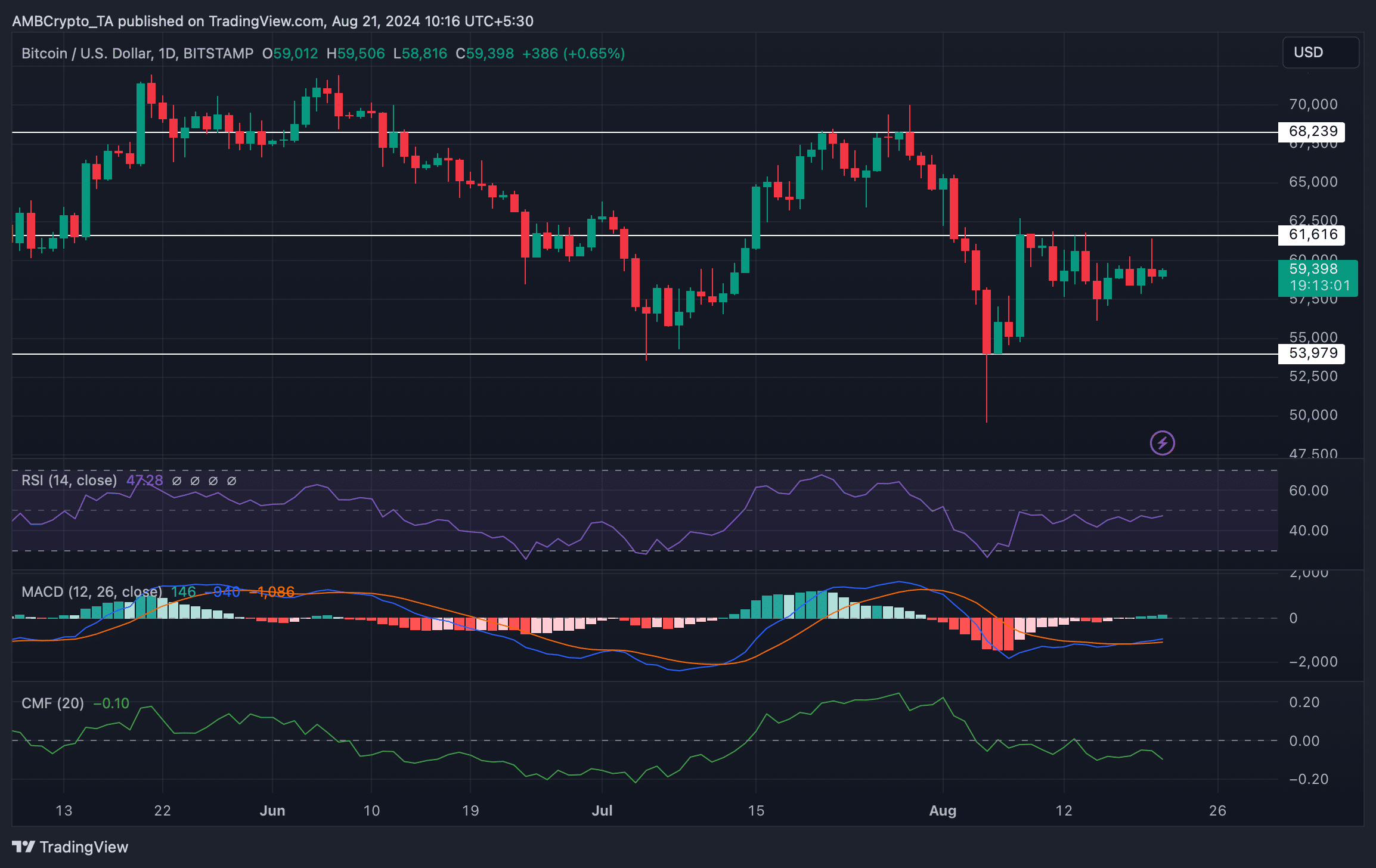

Due to this fact, AMBCrypto checked BTC’s day by day chart to raised perceive what to anticipate. The technical indicator MACD displayed a bullish crossover.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

BTC’s Relative Power Index (RSI) was slowly approaching the impartial mark, which was a bullish sign.

Nonetheless, the Chaikin Cash Circulate (CMF) turned bearish because it registered a downtick.