- BTC’s ‘basis trade’ exploded following the restoration in September.

- The rising foundation premium was being pushed by hedge funds.

Bitcoin [BTC] foundation commerce, the place buyers purchase spot BTC ETF and promote CME (Chicago Mercantile Trade) futures contracts at greater costs to lock the revenue from the value distinction, is again in an enormous manner.

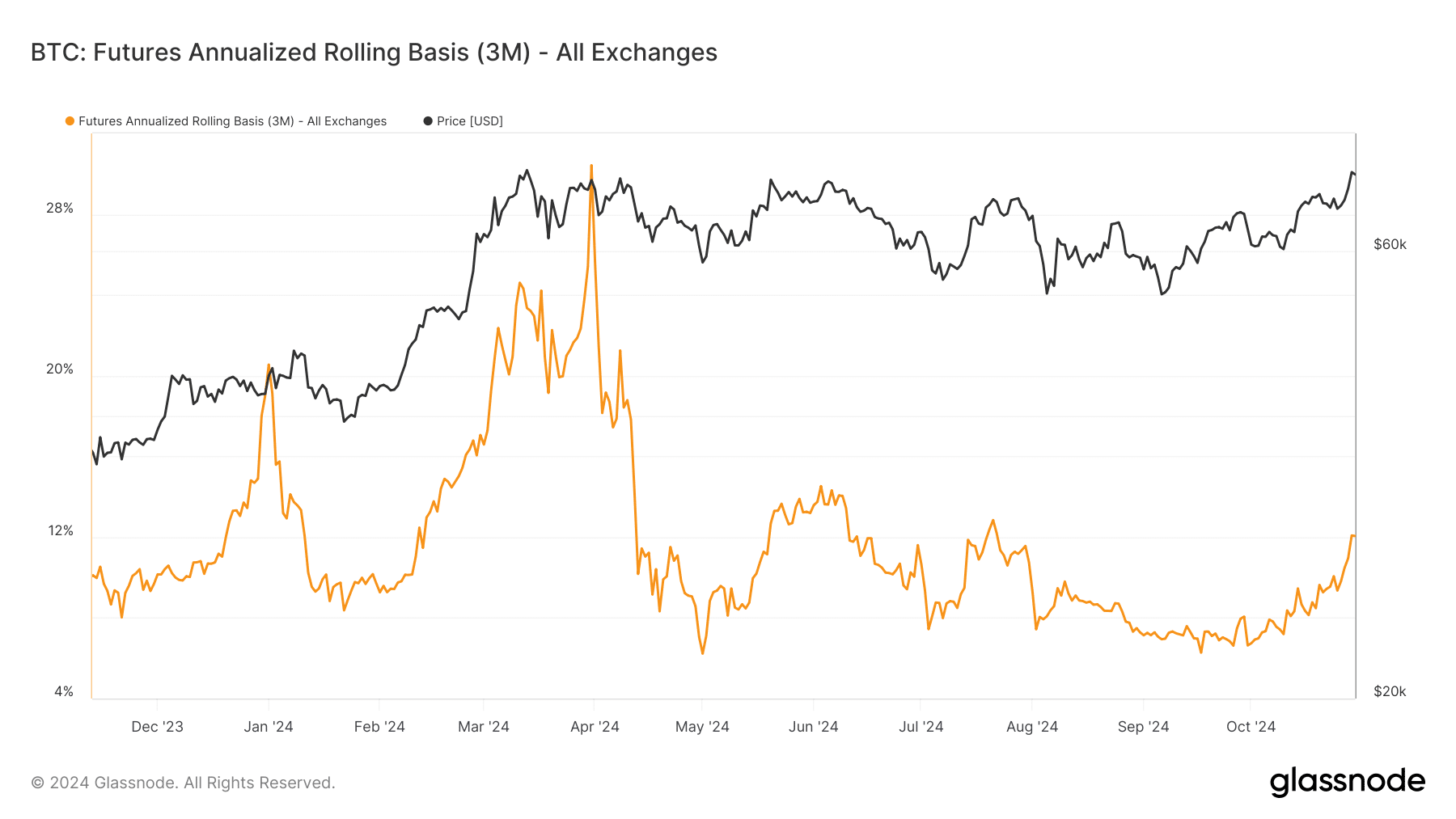

Sometimes most popular by hedge funds and asset managers, the idea commerce premium doubled in October. This occurred as BTC crossed $70K, proven by the Futures Annualized Rolling Foundation metric.

In mid-September, the premium dropped to six.2%; nevertheless, it stood at 12% as of the thirty first of October. That’s a few 2x surge in a couple of weeks.

The Fed charge cuts and implications

In keeping with James Van Straten, a BTC analyst, the rising BTC foundation commerce may very well be linked to ongoing Fed charge cuts.

He acknowledged that the decrease rates of interest made BTC foundation commerce a greater choice with greater returns than conventional alternatives.

“This is over double the current Fed Funds effective rate of 5%, in addition to the Fed cutting further in the next 3 months. I would assume the use of the “basis trade” will solely enhance.”

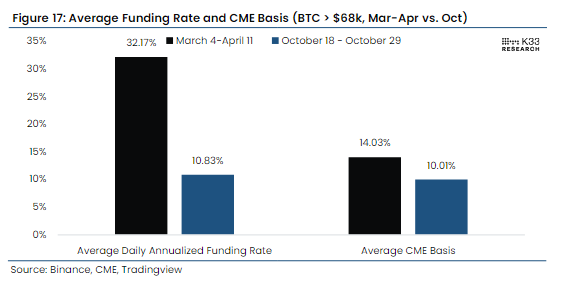

Through the peak of market froth in March, when BTC printed its all-time excessive (ATH) of $73.7K, the premium topped 14%. This was adopted by funding charges peaking above 30%.

In comparison with the present readings, the euphoria has not crept into the market to sign an overheated situation, famous Mathew Sigel, VanEck’s head of digital property analysis. He stated,

“Past BTC peaks have coincided with surging perp premiums, hardly the environment today. Also, current spot volumes are half of March/April, indicative of substantially less panic buying from retail participants – a welcome observation for continued strength.”

That stated, the general BTC Open Curiosity (OI) charge surged to an ATH of $43 billion, dominated by CME futures at $12.69 billion. This indicated big curiosity from establishments.

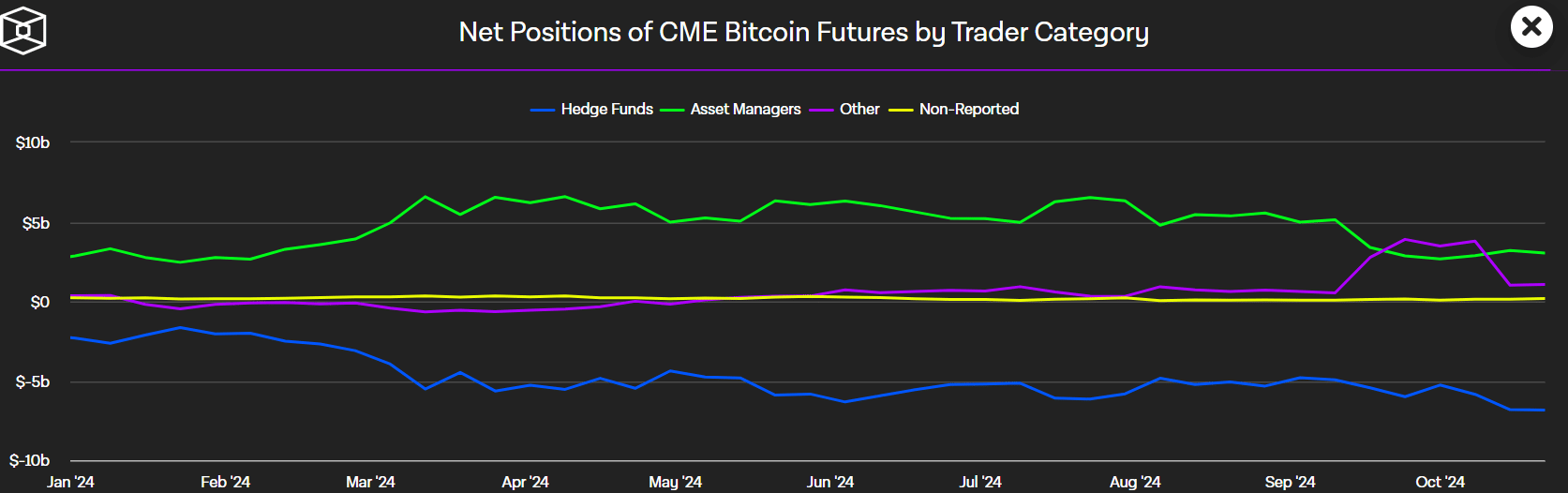

Nevertheless, the CME Futures market positioning confirmed that hedge funds drove the widening foundation commerce premium.

In keeping with The Block knowledge, hedge funds (blue line) had a web quick place of $6.84 billion, indicating huge hedging towards the BTC value decline.

By extension, this additionally widens the idea between spot BTC and futures costs and will appeal to much more gamers.

Nevertheless, a pointy drop within the premium may sign bearish sentiment and a possible BTC pullback. At press time, BTC was valued at $72.2K, up 13% in October.