- Regardless of corrections, Bitcoin’s value has remained firmly across the $90,000 zone

- Crypto’s value may hike nicely past this stage quickly

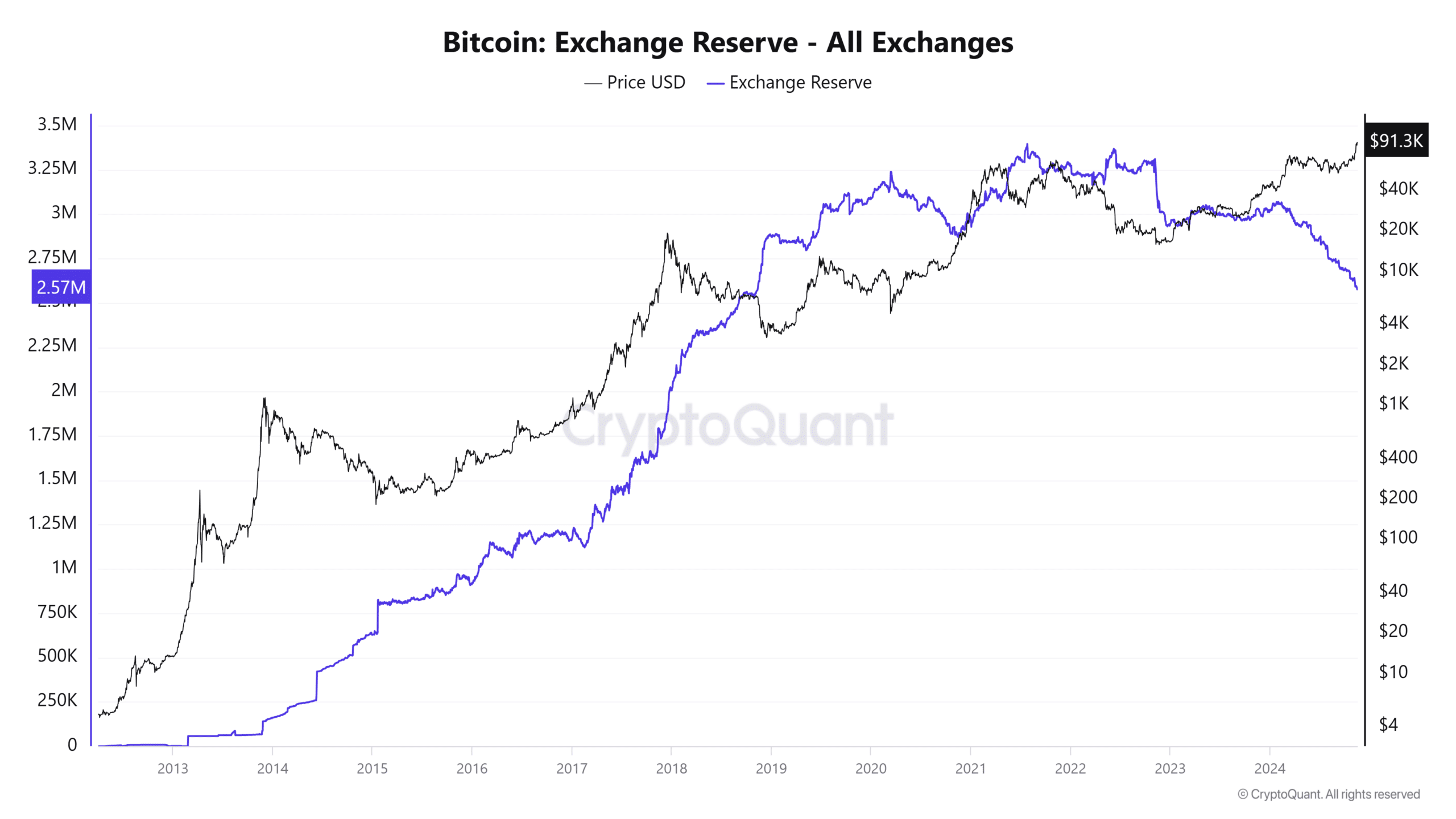

Bitcoin’s (BTC) change reserves have dropped to their lowest stage since November 2018, reflecting a major shift in market dynamics. This milestone was recorded quickly after the crypto’s value surged previous $91,000, supported by rising demand.

Evidently, the confluence of those elements raises important questions in regards to the market’s liquidity and what this development means for Bitcoin’s future.

Bitcoin change reserves and liquidity dynamics

Whole Bitcoin reserves on exchanges fell to 2.57 million BTC, as highlighted by CryptoQuant’s chart. This stage was final seen through the accumulation section earlier than the 2020-2021 bull run.

Traditionally, declining change reserves point out a fall in promoting strain as extra BTC is moved to non-public wallets. This may be interpreted to allude to a powerful accumulation development amongst long-term holders.

With Bitcoin’s value climbing to $91,000, this drop in change reserves underlined constrained provide in opposition to a backdrop of rising demand.

If reserves proceed to fall, liquidity may tighten additional, doubtlessly amplifying value volatility within the close to time period. Nevertheless, this could additionally set the stage for a sustained rally, particularly as out there BTC for buying and selling diminishes.

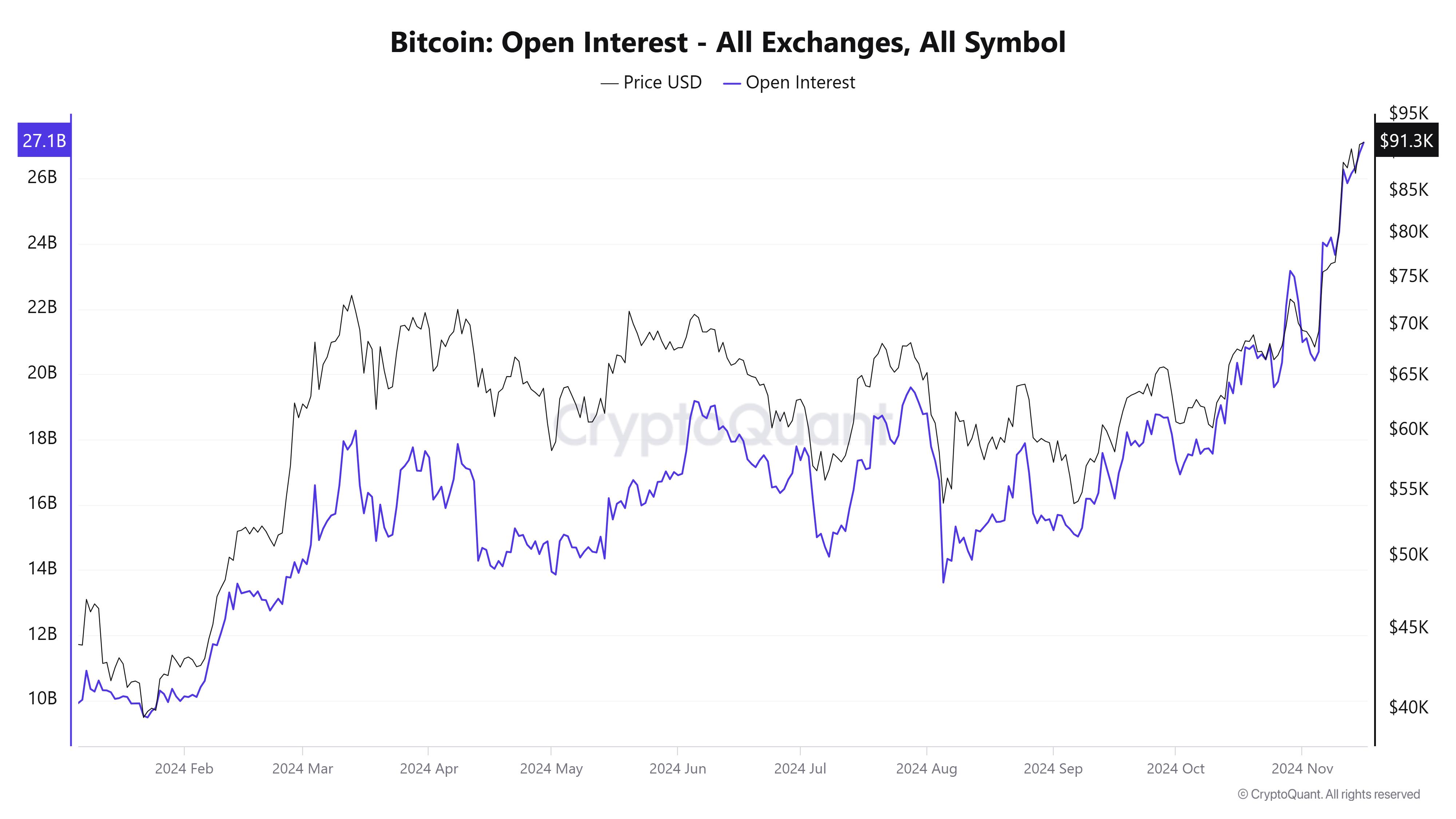

Derivatives information – Bitcoin Open Curiosity hits new highs

The Open Curiosity throughout all exchanges climbed to $26.8 billion, as per CryptoQuant’s information. Such a pointy hike mirrored heightened speculative exercise, particularly since Bitcoin’s value appears to be approaching uncharted territory.

The Open Curiosity rising alongside a rising value is often a bullish indicator – An indication of rising market participation and optimism.

Nevertheless, such elevated Open Curiosity ranges warrant warning. Traditionally, sharp actions in value usually result in liquidations, notably when leverage builds up.

Monitoring funding charges alongside the Open Curiosity will likely be important in assessing whether or not the market stays overheated or whether it is gearing up for additional upward momentum.

Accumulation over distribution

Alternate netflows information underlined sustained outflows, with -7.5K BTC leaving exchanges in comparison with 4.2K BTC inflows. Constant internet outflows align with the narrative of accumulation, particularly as traders transfer Bitcoin to chilly wallets or custody options.

In earlier market cycles, extended outflows have preceded main rallies, reflecting a market dynamic the place provide on exchanges turns into more and more scarce. These developments recommended that market contributors are holding Bitcoin in anticipation of upper costs – One other bullish signal.

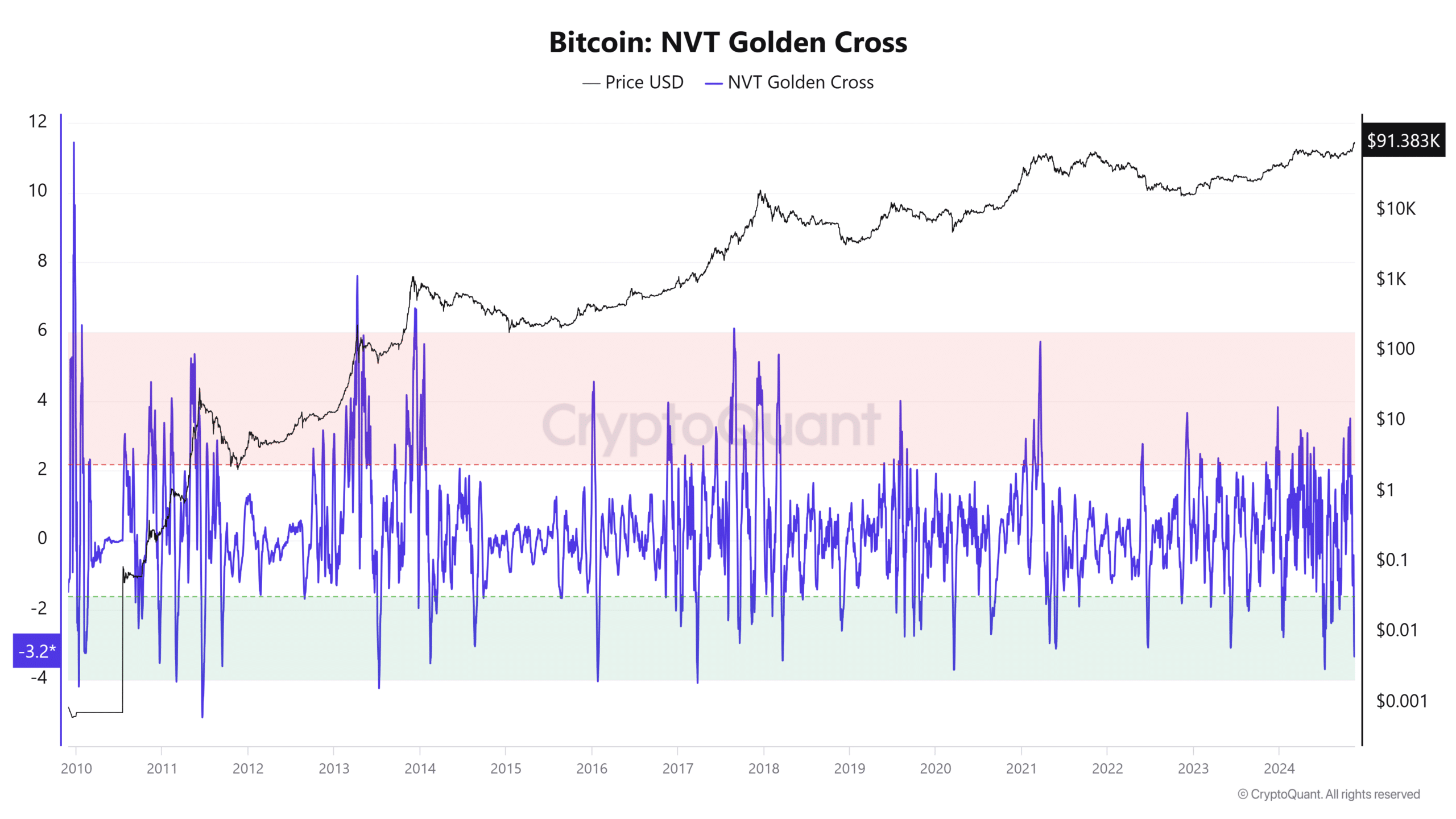

Bitcoin NVT Golden Cross – A sign of market energy

Bitcoin‘s NVT (Network Value to Transactions) Golden Cross recently entered bullish territory too, with the same underlined by CryptoQuant’s charts.

Right here, it’s price noting that this metric compares Bitcoin’s market capitalization to its transaction quantity. It provides insights into whether or not the community’s valuation is supported by its exercise.

Traditionally, when the NVT Golden Cross rises into the inexperienced zone, it signifies that transaction exercise is excessive relative to Bitcoin’s valuation – An indication of wholesome community utilization and bullish market situations.

Conversely, a transfer into the crimson zone alludes to overvaluation or diminished community exercise. Its press time positioning within the bullish zone strengthened the narrative of rising adoption and community confidence. This gave the impression to be in step with declining change reserves and rising Open Curiosity developments.

– Learn Bitcoin (BTC) Worth Prediction 2024-25

The decline in Bitcoin change reserves, coupled with rising Open Curiosity, constant internet outflows, and a bullish NVT Golden Cross, underscored a powerful market setup.

Whereas the diminished liquidity on exchanges may result in greater volatility, the information appeared to counsel that market contributors could also be positioning for sustained upside.