- There appeared a reluctance amongst BTC merchants to money their earnings.

- Early HODLers have been distributing to newer entrants.

It has been a curler coaster journey for Bitcoin [BTC] after its most up-to-date halving.

The preliminary response was optimistic, with the king coin capturing as much as contact $67,000 three days after the pivotal occasion, in accordance with CoinMarketCap. Nevertheless, the good points have been erased, as BTC pulled again by 4% within the final 24 hours to pre-halving ranges.

It thus turns into important to know the place does the world’s largest digital asset stands after halving, in addition to insights about its subsequent strikes within the close to to medium time period.

Revenue-taking nonetheless on the decrease aspect

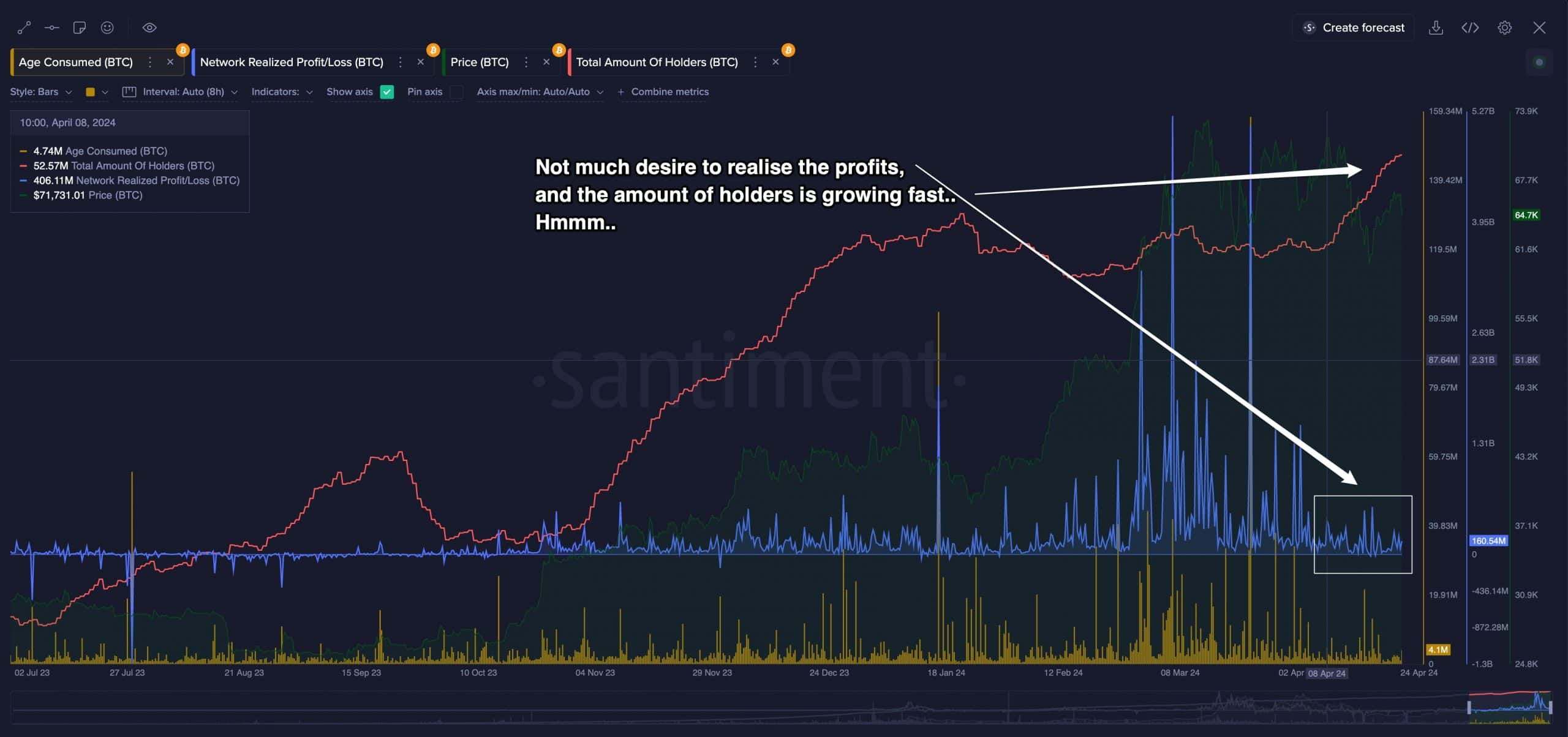

In keeping with on-chain analytics agency Santiment, there appeared a reluctance amongst BTC merchants to money their earnings. The Community Realized Revenue/Loss (NRPL) indicator remained low, and the sample aligned with earlier peak durations of 2017 and 2021.

The variety of BTC holders was additionally seen to be growing alongside.

Santiment referred to this section as “irrational divergence” whereby market was refusing to promote regardless of rising costs.

Whereas rooted within the BTC’s long-term progress potential, the section has traditionally preceded “significant market tops”, thus making it sound extra like a bearish sign.

HODLers have been redistributing

In distinction, the Imply Greenback Invested Age (MDIA) metric declined sharply in current months, signaling an energetic redistribution section.

Throughout redistribution, wealth transfers from early HODLers to newer market contributors. After a 12-month redistribution cycle, the market has traditionally returned to an accumulation section, lending assist to the idea that the bull market will proceed.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

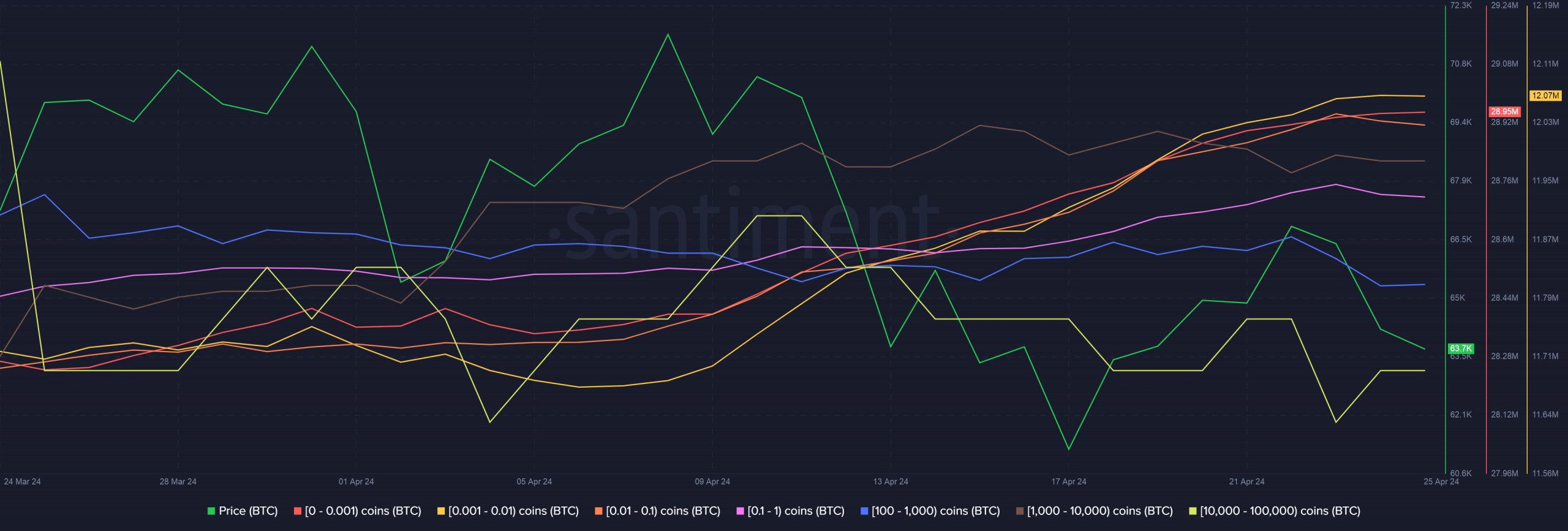

The aforementioned deductions mirrored within the provide distribution throughout key cohorts. Notably, small holders, or these holding as much as 1 complete Bitcoin, have been seen to be shopping for after the halving.

On the contrary, sharks and whales, having reserves between 100 to 100,000 cash, have been distributing their cash.