- Bitcoin trades close to key help as Mt. Gox actions stir market uncertainty.

- Rising derivatives exercise hints at cautious optimism regardless of bearish technical indicators.

Mt. Gox’s switch of $49.3 million in Bitcoin [BTC] has despatched ripples throughout the market, sparking fears of heightened volatility. The redistribution noticed $19 million transferred to contemporary wallets and $30.6 million moved to a ultimate pockets.

This huge motion raises vital questions on whether or not it alerts a wave of sell-offs. At press time, Bitcoin was buying and selling at $94,435.63, reflecting a 0.72% dip within the final 24 hours.

Can BTC break resistance or threat shedding help?

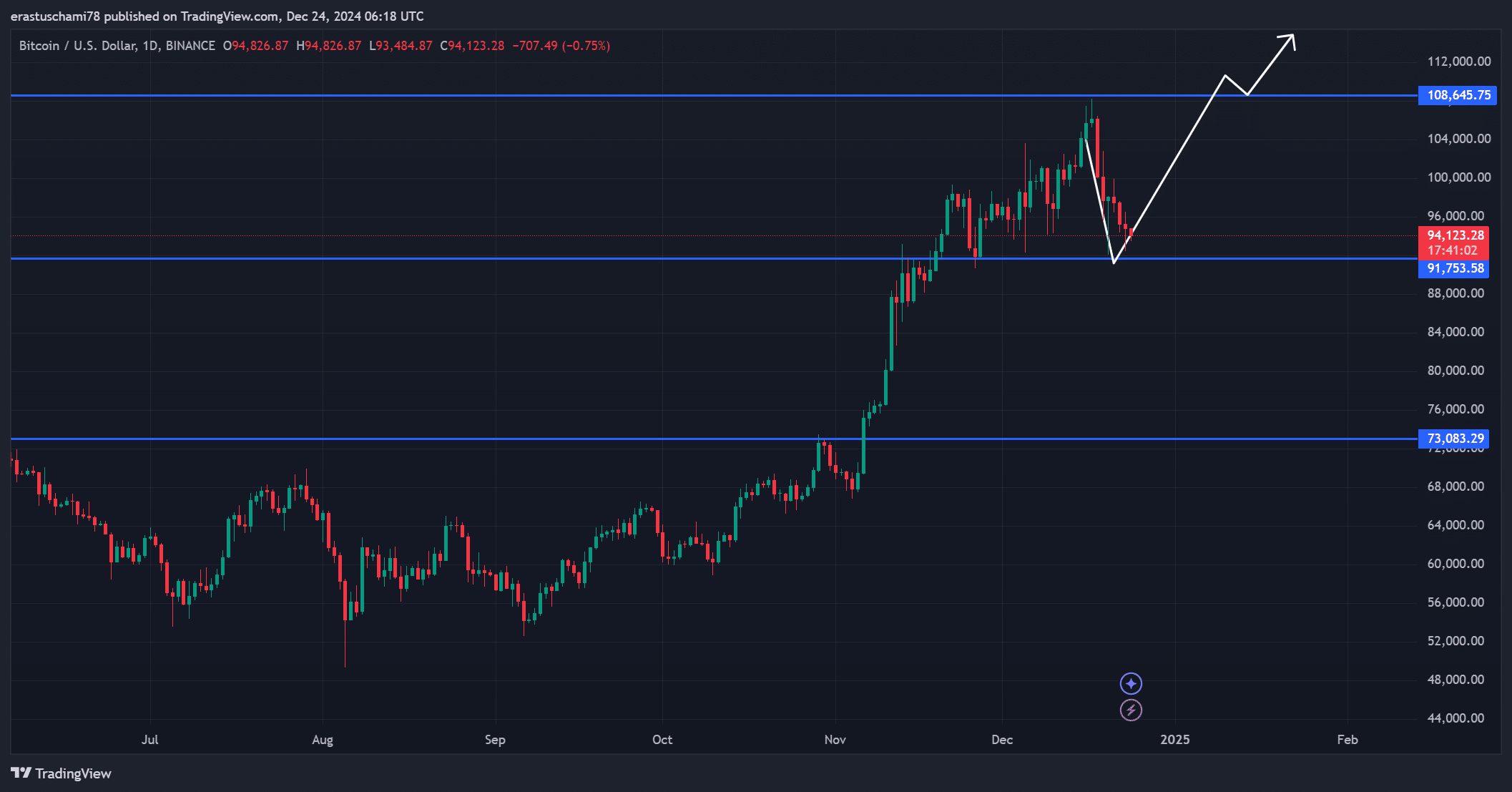

Bitcoin is buying and selling inside a vital vary, with help at $91,753 and resistance at $108,645. A break under $91,753 may open the door to a plunge towards $73,083, signaling bearish dominance.

Nonetheless, if Bitcoin manages to climb previous $96,000, it may construct momentum towards the $100,000 milestone. Subsequently, this era of consolidation will probably decide whether or not Bitcoin rallies or retreats additional within the coming days.

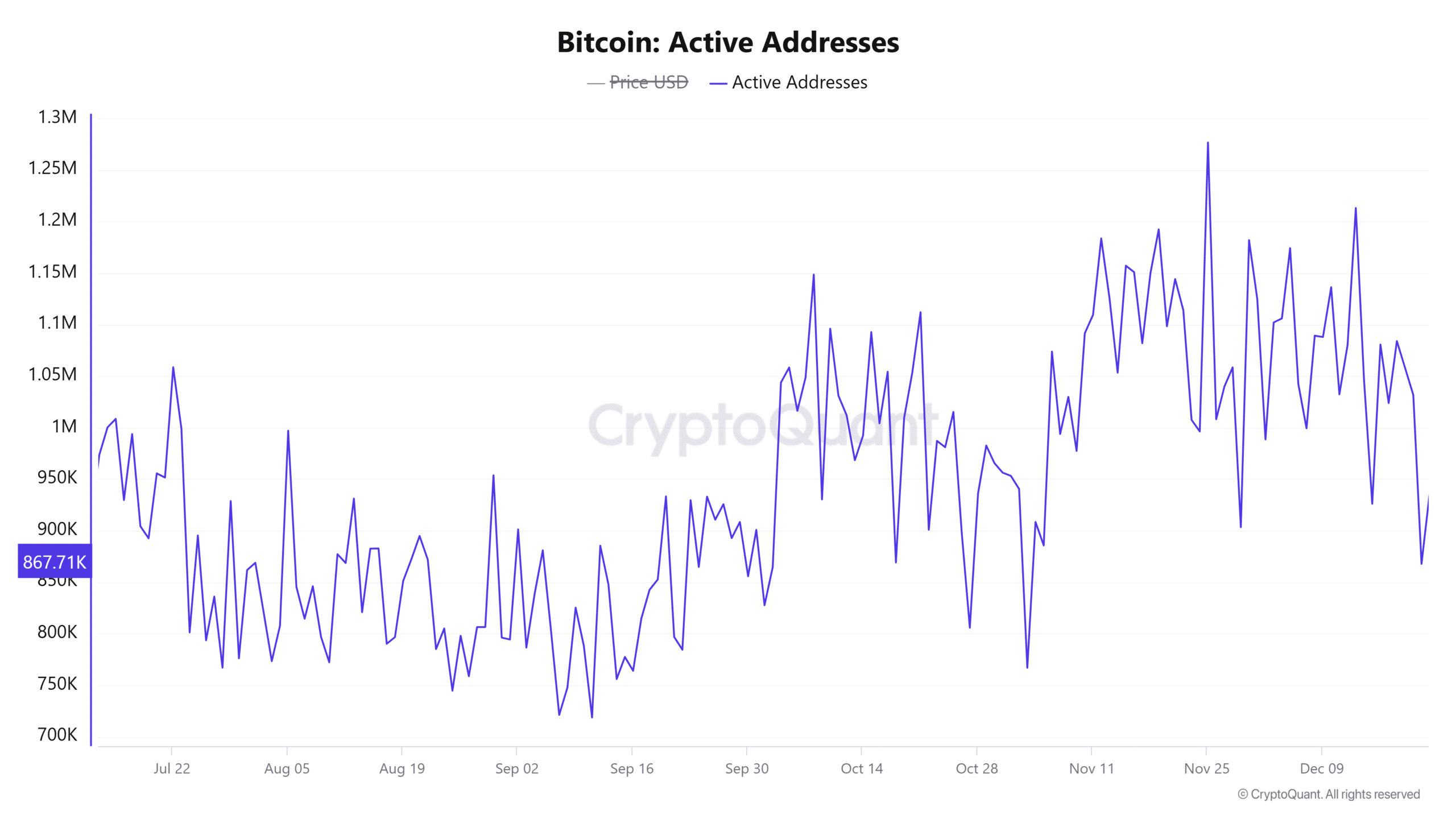

Lively addresses present rising engagement

Bitcoin’s energetic addresses elevated by 1.21% within the final 24 hours, reaching 9,747K, reflecting heightened engagement. This rise suggests extra members coming into the market, probably pushed by hypothesis surrounding the Mt. Gox motion.

Moreover, elevated community exercise is a optimistic signal for demand, because it typically correlates with stronger market well being. Subsequently, sustained progress in energetic addresses may help Bitcoin’s restoration within the close to time period.

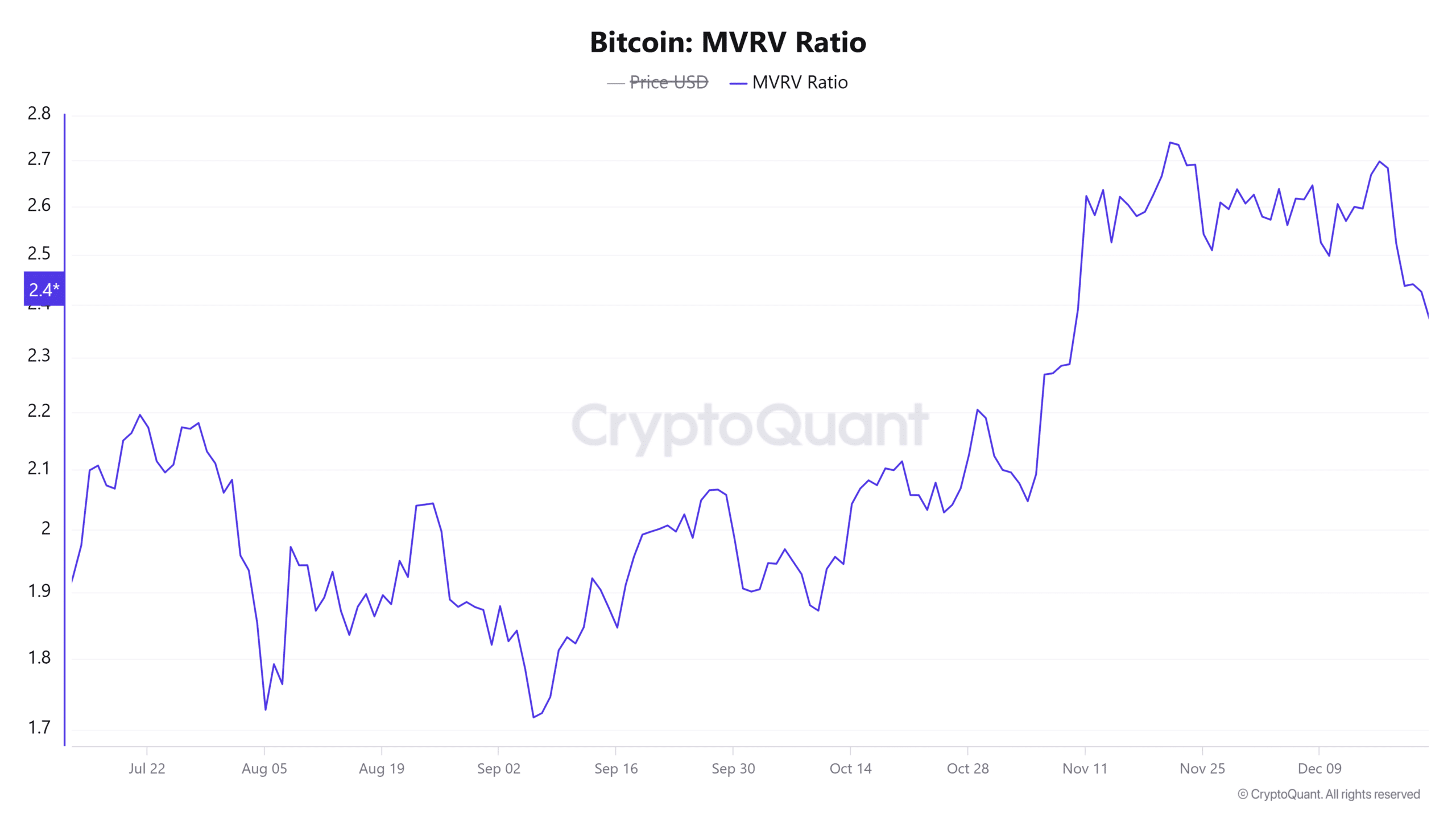

Is BTC undervalued? MVRV ratio insights

The MVRV ratio, presently at 2.4 after a 1.17% decline, hints at a cooling-off section in speculative stress. Traditionally, a decrease ratio has aligned with more healthy worth ranges, attracting long-term traders.

Nonetheless, additional declines may point out waning confidence amongst members, preserving merchants cautious. Subsequently, the MVRV ratio stays an important metric for gauging Bitcoin’s market place.

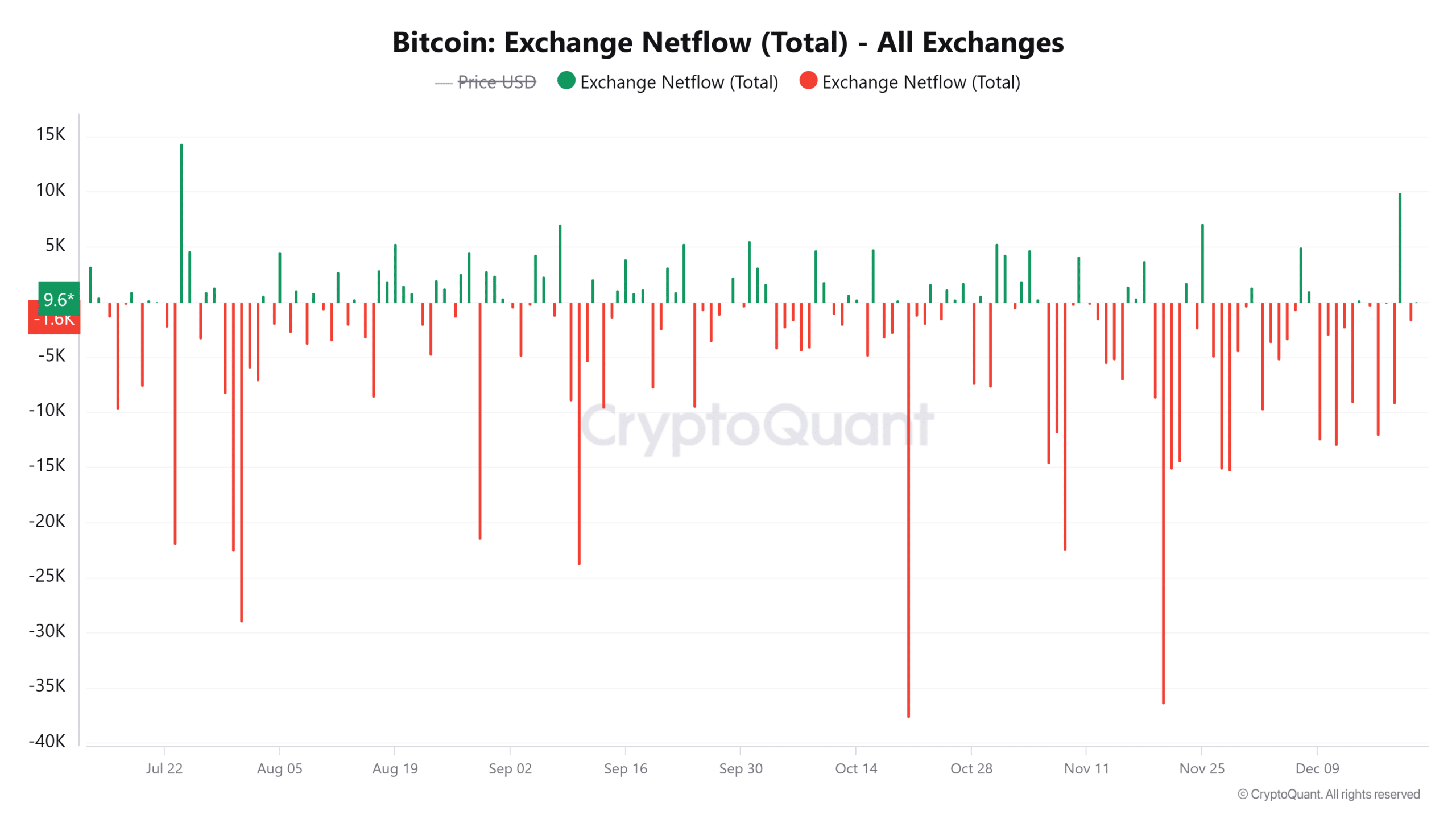

Alternate inflows recommend warning

Alternate web inflows surged by 39.93%, totaling 19.545K BTC, elevating issues about potential sell-offs. Inflows to exchanges typically sign that merchants are making ready to liquidate holdings, though not all inflows lead to fast promoting.

Subsequently, monitoring trade exercise carefully can be very important in figuring out whether or not this surge interprets into bearish momentum or stays impartial.

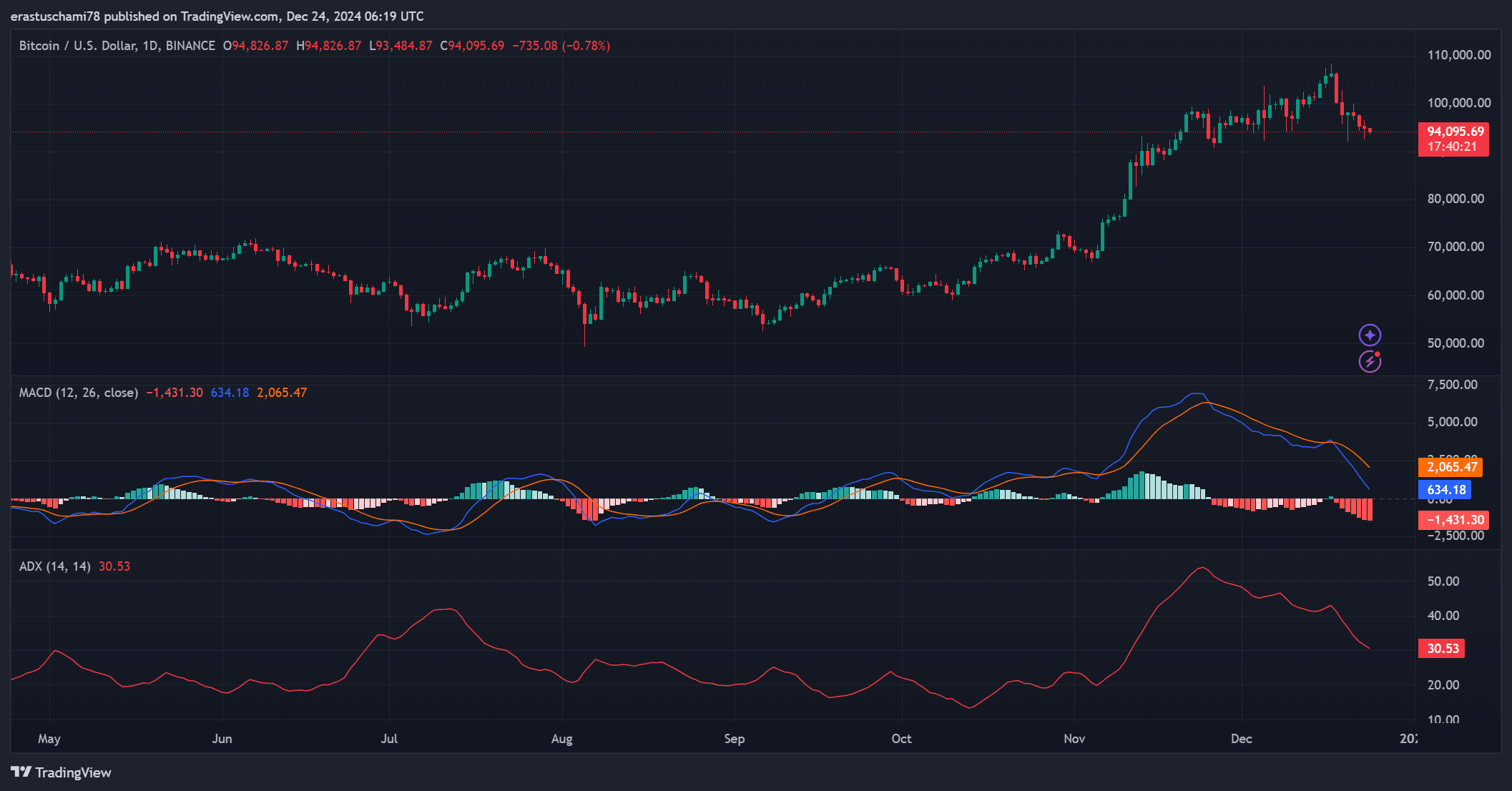

ADX and MACD reveal blended alerts

The ADX, presently at 30.53, signifies a reasonably sturdy pattern out there. In the meantime, the MACD reveals bearish momentum following a crossover under the sign line.

Nonetheless, the MACD’s place close to the zero line suggests potential for a reversal if patrons regain management. Subsequently, the technical indicators spotlight the market’s delicate stability between bullish and bearish forces.

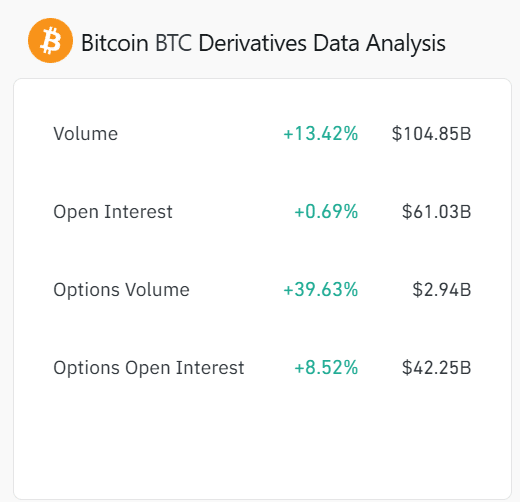

Derivatives knowledge displays cautious optimism

BTC derivatives exercise has seen a notable uptick, with choices quantity rising by 39.63% to $2.94 billion. Open curiosity elevated by 0.69% to $61.03 billion, whereas choices open curiosity grew by 8.52% to $42.25 billion.

These figures mirror rising speculative curiosity, although the modest rise in open curiosity signifies restricted directional conviction. Subsequently, derivatives knowledge suggests optimism however with an air of warning.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Mt. Gox’s Bitcoin redistribution has created a local weather of uncertainty, leaving the market on edge. BTC’s potential to carry vital help and navigate rising trade inflows will decide whether or not this motion triggers a sell-off or evokes confidence.

For now, Bitcoin stays at a crossroads, balancing between worry and alternative.