- Bitcoin’s aSOPR was at 1.03 at press time.

- Because it approaches 1.08, the coin is prone to a worth decline.

Bitcoin’s [BTC] worth may be due for a correction as the worth of a key on-chain metric traits towards traditionally “dangerous” ranges, CryptoQuant analyst Woo Minkyu present in a brand new report.

Minkyu assessed BTC’s Adjusted Spent Output Revenue Ratio (aSOPR) utilizing a 200-day shifting common and located that its transfer towards 1.08 put the main coin prone to correction.

BTC’s aSOPR measures the revenue or loss realized when the coin is spent by its holders. An aSOPR worth above 1 signifies that cash are being offered at a revenue total.

Conversely, a price under 1 means that traders are promoting at a loss.

As of this writing, the coin’s aSOPR was 1.03, that means that BTC holders at present file income from promoting their cash.

AMBCrypto reported earlier that regardless of the numerous resistance confronted on the $71,000 worth stage, over 87% of BTC’s circulating provide is held in revenue.

In line with Minkyu, a rise in BTC’s aSOPR worth towards 1.08 indicators a possible danger of a worth decline.

“However, historical data suggests that when this indicator approaches 1.08, Bitcoin prices tend to enter a correction phase. Considering past instances where similar patterns were observed, there is a possibility that the current situation might follow the same trend,” the analyst famous.

Bitcoin continues to development inside a spread

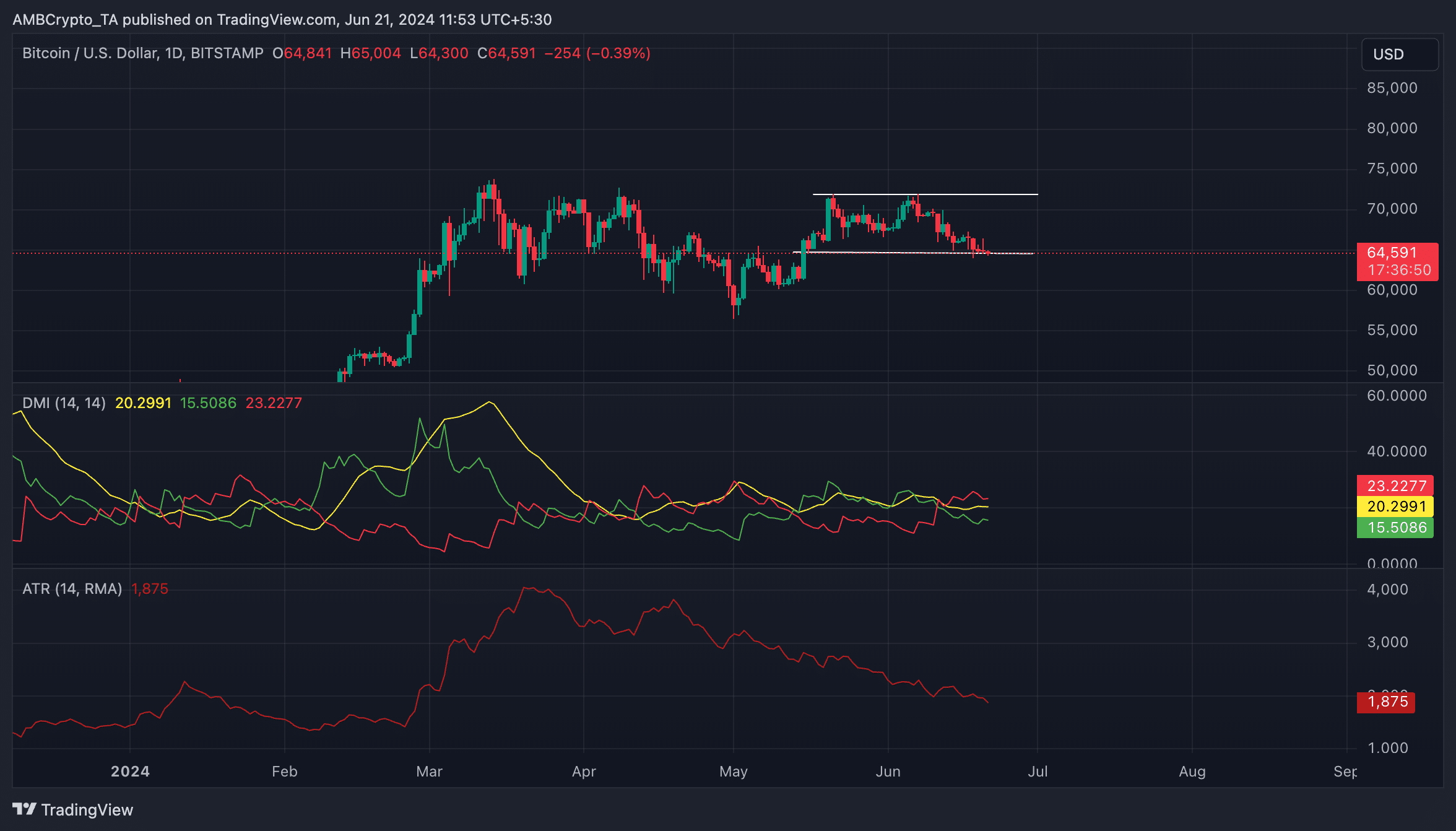

At press time, BTC exchanged fingers at $64,584. It has trended inside a horizontal channel since twentieth Could, bouncing between resistance at $71,926 and assist at $64,529.

A horizontal channel is shaped when an asset’s worth consolidates inside a spread for a time frame. This slender oscillation happens when a relative steadiness between shopping for and promoting pressures prevents the worth from trending strongly in both path.

BTC’s declining Common True Vary confirms the consolidation part. AMBCrypto discovered that the worth of this volatility marker has decreased by 28% since twentieth Could.

This indicator measures market volatility by calculating the common vary between excessive and low costs over a specified variety of intervals.

When it falls, it suggests decrease market volatility and hints that the asset’s worth is trending inside a spread.

Nevertheless, though BTC at present traits inside a spread, the market’s bearish affect continues to be important. Readings from the coin’s Directional Motion Index (DMI) revealed this.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

As of this writing, the coin’s damaging directional index (pink) rested above its optimistic index (inexperienced).

An asset’s DMI measures the energy and path of an asset’s worth development. When arrange this manner, it signifies that the bearish development is stronger than the bullish development. This implies a better probability of a downtrend in comparison with an uptrend.