Following a market rebound on Friday, Bitcoin (BTC) has since proven little value motion gaining by solely 0.42% within the final day. The premier cryptocurrency presently hovers round $63,000 as traders proceed to await the standard bullish surge of “Uptober”. Commenting on BTC’s potential subsequent motion, CryptoQuant analyst ShayanBTC has highlighted key value ranges traders ought to look out for.

Bitcoin Should Overcome Main Resistance To Forestall Crash To $55,000

In a Quictake submit on Saturday, ShayanBTC shared key insights on the connection between Bitcoin’s Realized Worth Unspent Transaction Output (UTXO) Age Bands and potential market developments. Usually, the Realized Worth UTXO Age Bands is an on-chain metric that gives insights into Bitcoin holders’ conduct. Particularly, it reveals the typical value at which sure classes of BTC traders acquired their tokens.

In keeping with ShayanBTC, the realized value for short-term holders of Bitcoin i.e. holders of BTC for 3 to 6 months, presently lies at $64,000 whereas long-term holders of Bitcoin i.e. for 6-12 months presently have a realized value of $55,000. The analyst explains that realized value ranges normally function robust assist as key assist or resistance ranges within the BTC market. This is actually because they characterize the typical value foundation for Bitcoin holders and infrequently type psychological value factors.

Based mostly on BTC’s present value of round $63,000, the short-term holders’ realized value of $64,000 presents a pivotal resistance stage, a triumphant breakout above which alerts would point out the continuation of the asset’s current upward trajectory. Nevertheless, if BTC fails to interrupt previous $64,000 maybe attributable to elevated promoting exercise or macroeconomic elements, Shayan expects the asset to fall to round $55,000 i.e. the realized value stage for long-term holders.

Apparently, Shayan’s observations are properly mirrored on Bitcoin’s day by day chart the place the premier cryptocurrency has constantly oscillated between $55,000 – $65,000 over the past two months. Ought to BTC escape of this range-bound sample, it might want to surpass the resistance at $70,000, which may sign the beginning of a market bull run.

BTC Community Charges Up By 32%

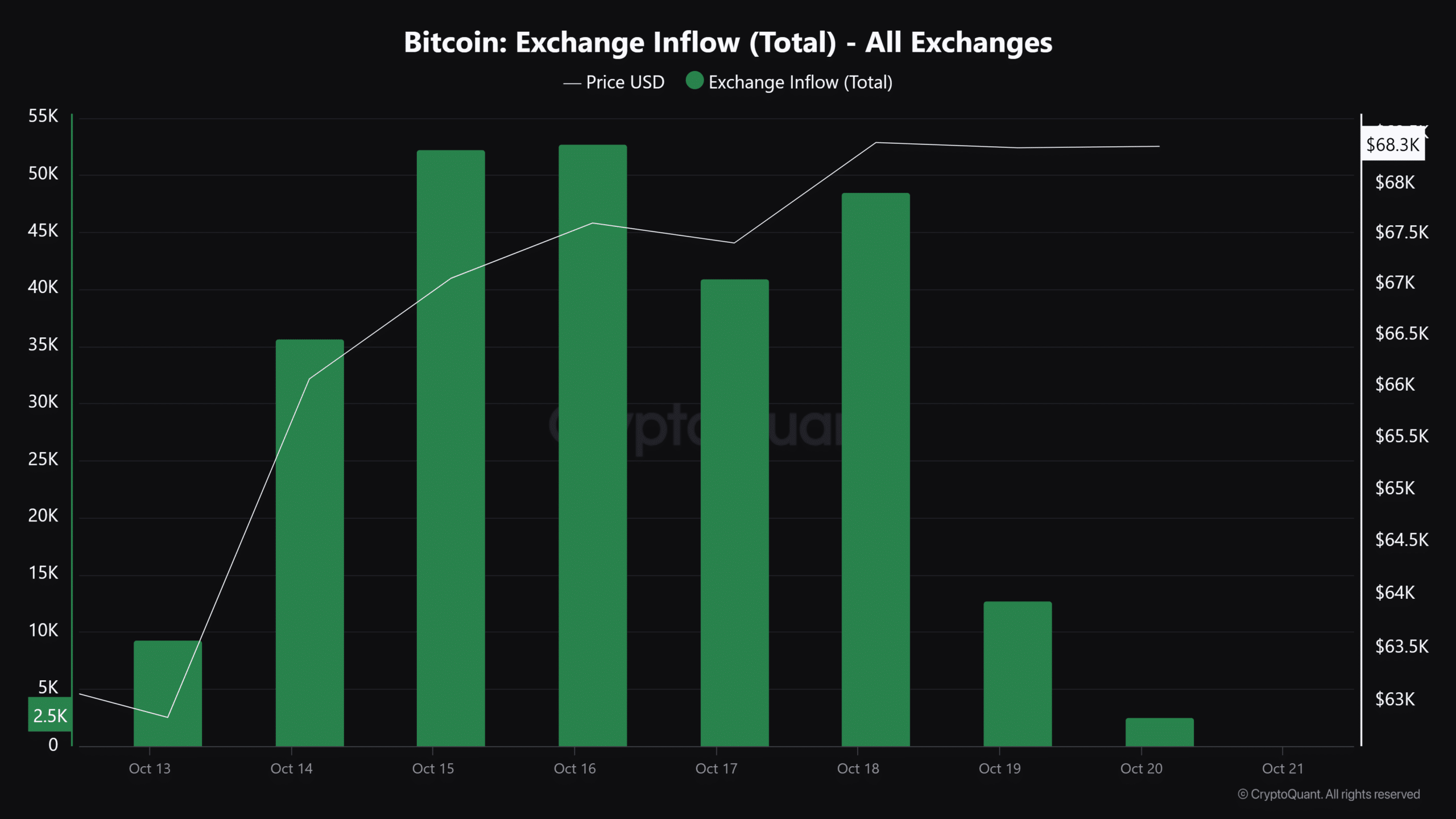

In different information, Bitcoin recorded $5 million in community charges, representing a 32.4% rise over the past week. In keeping with on-chain analytics firm, IntoTheBlock, this improvement signifies a heightened community exercise regardless of calming market volatility.

On the time of writing, the crypto market chief trades at $62,786 reflecting beneficial properties of two.13% and 9.08% within the final seven and thirty days respectively. In the meantime, BTC’s day by day buying and selling quantity is presently valued at $17.57 billion, following a 42.92% decline.

Featured picture from The Financial Instances, chart from Tradingview