- Bitcoin lastly managed to leap above its attainable market backside.

- Although shopping for strain was excessive, a couple of indicators turned bearish.

After every week of worth will increase, Bitcoin [BTC] has as soon as once more turned bearish within the final 24 hours. Nevertheless, this development may change within the coming days as BTC was following a historic development. If historical past repeats itself, then traders may quickly witness a serious worth motion.

Bitcoin’s key indicator flashes

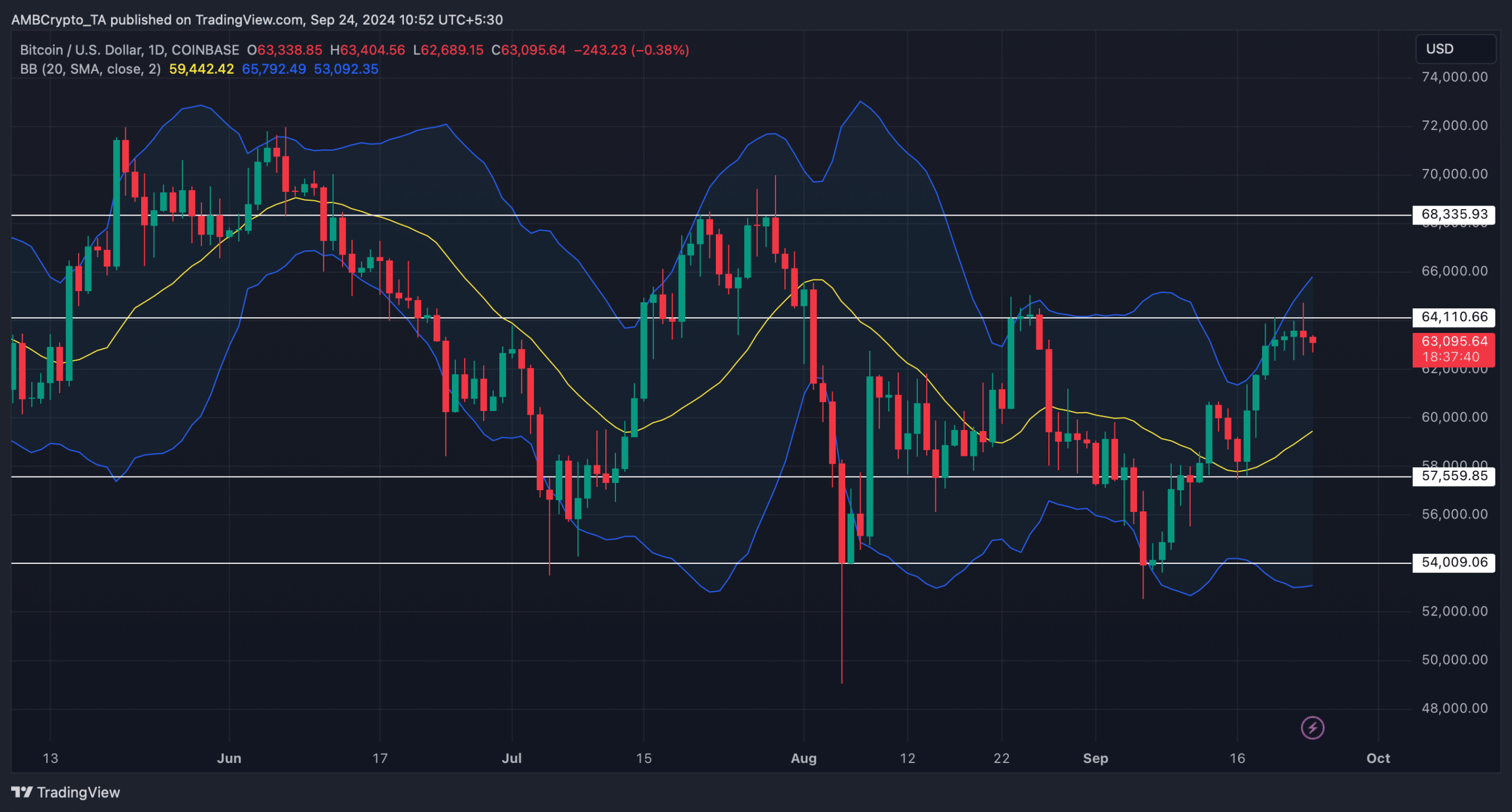

AMBCrypto reported earlier that Bitcoin managed to cross $64k a couple of days in the past, however the transfer didn’t final. The king coin witnessed an almost 2% worth correction within the final 24 hours, pushing it down again to $63,117.53.

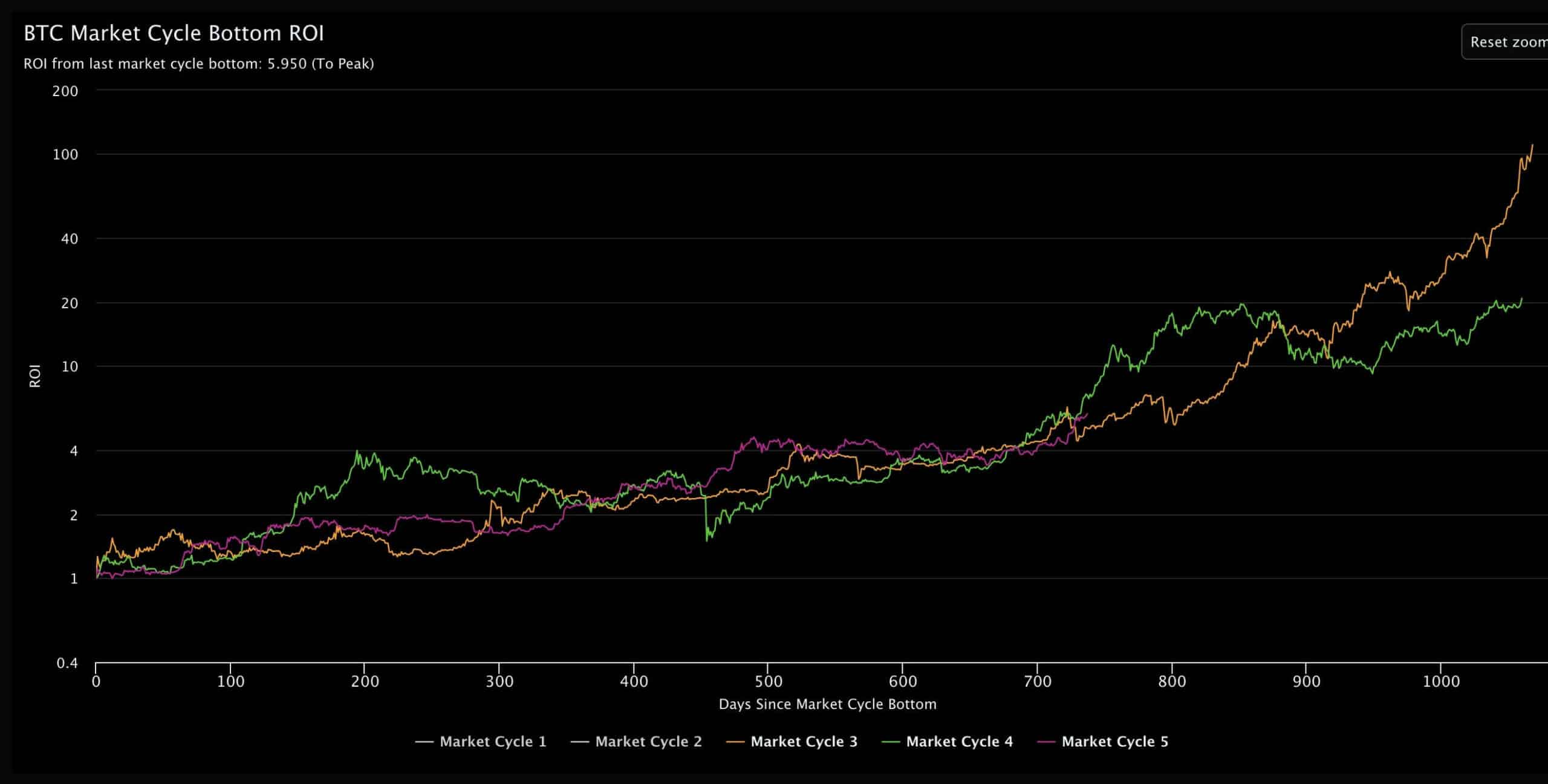

Whereas that occurred, Axel, a preferred crypto analyst, posted a tweet revealing an fascinating growth. As per the tweet, for the previous six months, volatility has continued to compress, and an alert has appeared on the chart.

Notably, the alert appeared for the fifth time in Bitcoin’s historical past.

To be exact, such alerts emerged again in 2015, 2016, 2017, and 2023 earlier than once more showing in 2024. Traditionally, each time this alert appeared, BTC’s worth registered appreciable worth motion northwards.

Due to this fact, if historical past repeats itself, then traders may count on Bitcoin to start a recent bull rally within the coming days.

Is BTC prepared for a worth pump?

Since historical past indicated a brand new bull rally, AMBCrypto checked Bitcoin’s on-chain metrics to seek out whether or not additionally they urged a worth hike. Our have a look at Glassnode’s knowledge revealed that BTC’s worth simply jumped above its attainable market backside of $61.8k.

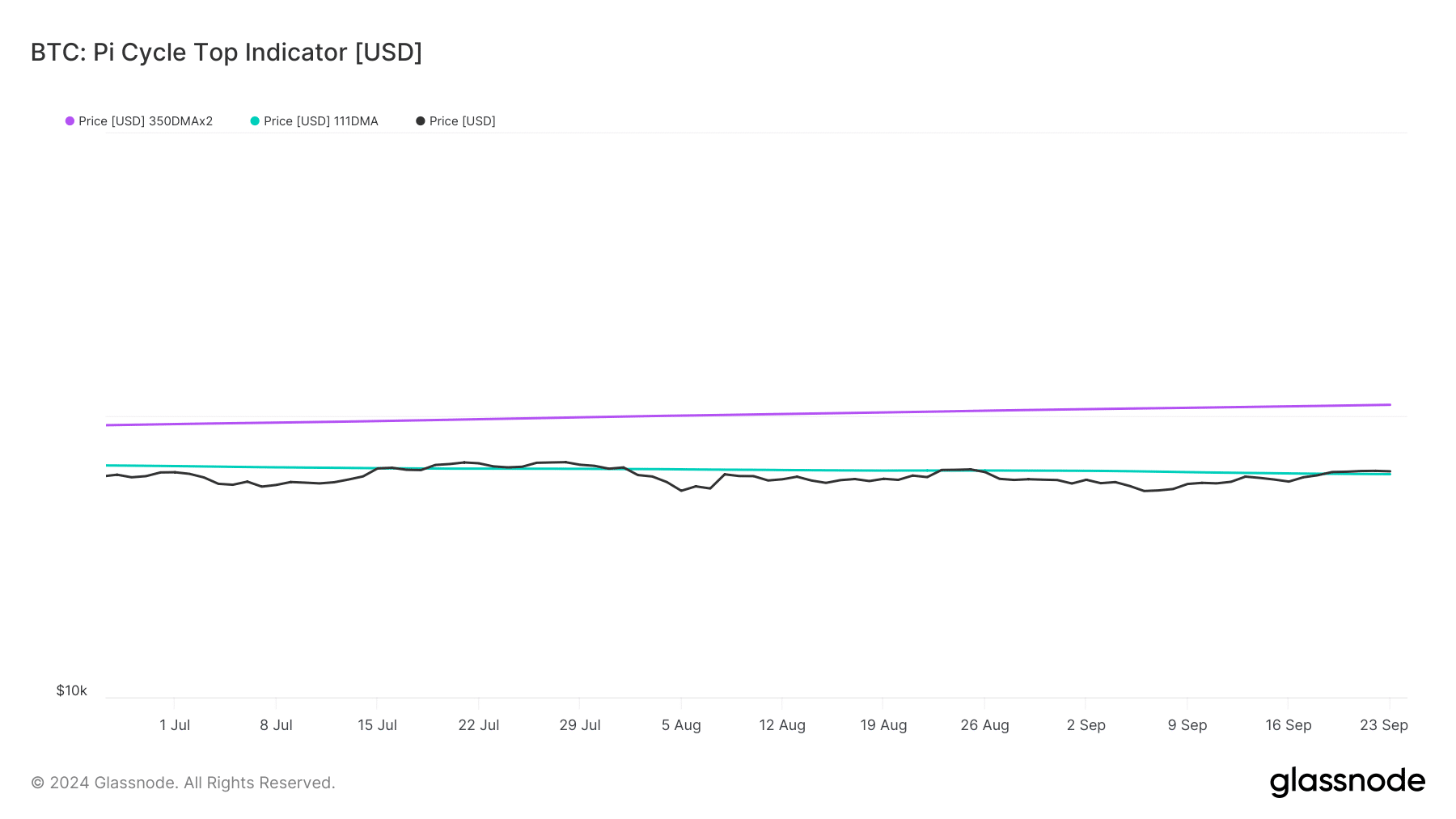

If the Pi Cycle High indicator is to be believed, the upcoming bull rally may as properly push the coin in the direction of its attainable market prime of $109k within the coming weeks or months.

Other than that, AMBCrypto additionally reported earlier that purchasing strain on the coin was excessive, which additionally hinted at a worth uptick. Nevertheless, not all the pieces was within the king coin’s favor.

Our evaluation of CryptoQuant’s knowledge revealed that Bitcoin’s aSORP turned purple. This clearly meant that extra traders had been promoting at a revenue. In the course of a bull market, it could possibly point out a market prime.

We then took a have a look at Bitcoin’s day by day chart to higher perceive the chance of a bull rally. As per our evaluation, BTC was getting rejected at its resistance of $64.1k.

Moreover, the coin’s worth had additionally touched the higher restrict of the Bollinger Bands, which hinted at a worth correction.

Learn Bitcoin (BTC) Worth Prediction 2024-25

If a worth correction occurs, then BTC may once more drop to $62k. However, in case of a bull rally, it will likely be essential for BTC to go above the $64k-$65k vary, and liquidation will rise sharply there.

Often, a hike in liquidation ends in short-term worth corrections.