- Bitcoin’s historic post-halving cycles instructed a possible prime between June and October 2025, with projections nearing $200K.

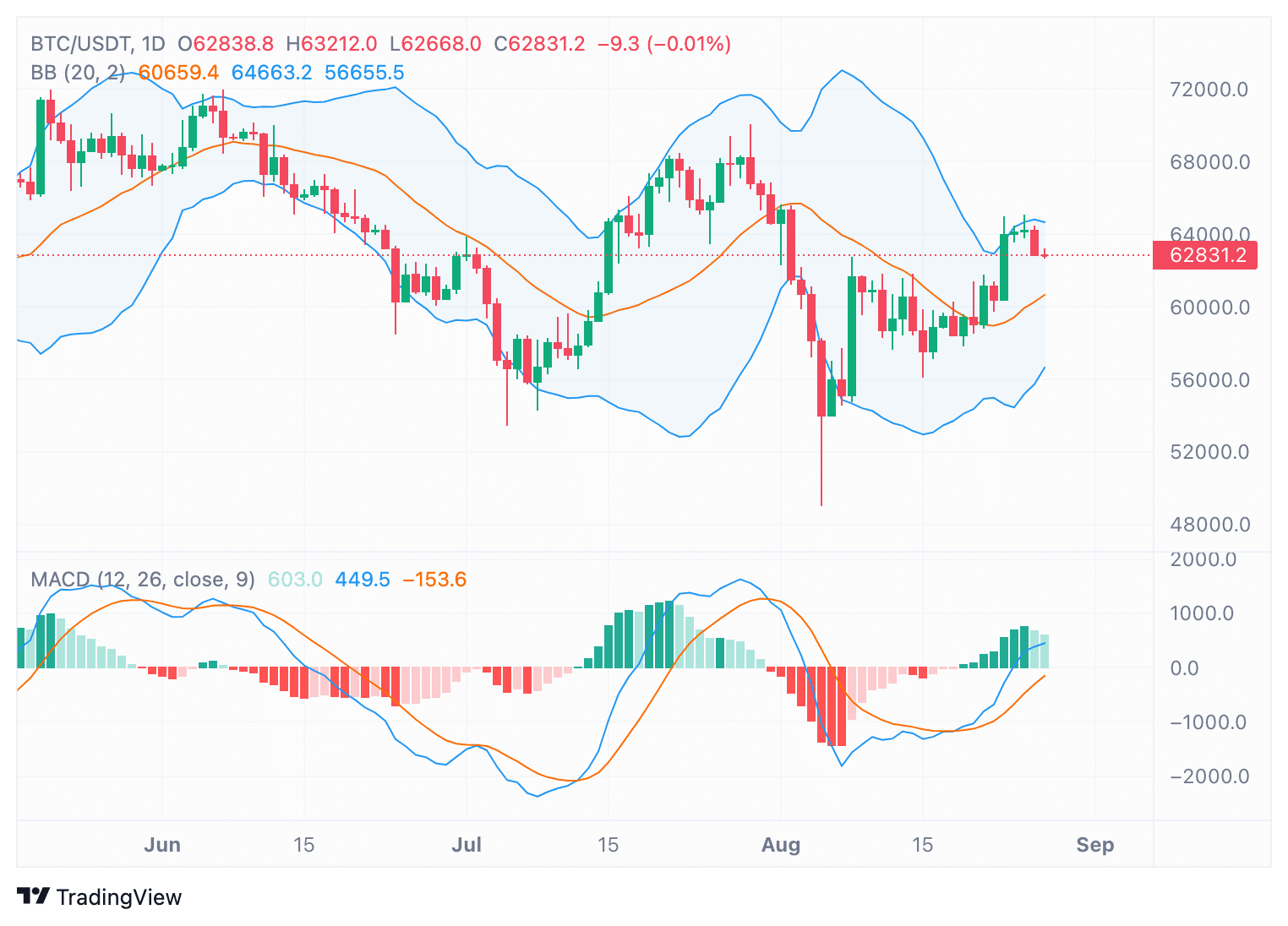

- Technical indicators like MACD and Bollinger Bands confirmed bullish indicators, however merchants ought to stay cautious of potential reversals.

Bitcoin [BTC] closed above $64,000 on Monday after every week of upward momentum pushed by encouraging alerts from the U.S. Federal Reserve.

Buyers responded positively to remarks from Fed Chairman Jerome Powell, who confirmed plans for an rate of interest lower in September.

This bolstered sentiment in each conventional markets and the crypto area.

The current rally helped Bitcoin get better some losses from earlier weeks, although it nonetheless skilled a slight dip of 1.40% within the final 24 hours.

Regardless of this, Bitcoin remained up 3.15% over the previous seven days, with a market cap of roughly $1.23 trillion, per Coingecko.

Historic post-halving patterns

Bitcoin merchants and analysts have been intently watching the Bitcoin’s worth efficiency following its most up-to-date halving occasion.

Earlier cycles have proven a sample the place Bitcoin’s worth peaks a number of months after every halving.

For example, after the 2013 halving, Bitcoin surged over 9,500%, reaching its peak 406 days later. The 2017 cycle noticed a 4,100% enhance, with a peak occurring 511 days post-halving.

In 2021, Bitcoin rose by 636% earlier than topping out 546 days after the halving.

In keeping with crypto dealer Mags, this cycle could comply with an identical trajectory, with the subsequent peak anticipated between June and October 2025.

The projection is predicated on historic knowledge, indicating that Bitcoin might attain a prime between 400 and 550 days from now.

Even with extra average development, equivalent to a 300% rise, the cryptocurrency might strategy the $200,000 mark inside this era.

Bullish momentum forward?

Technical indicators counsel that Bitcoin could proceed its upward pattern within the close to time period.

The Bollinger Bands revealed that Bitcoin’s worth moved in the direction of the higher band, indicating potential overbought situations across the $63,000 stage.

The Transferring Common Convergence Divergence (MACD) has lately crossed bullish, with the MACD line rising above the sign line.

This instructed that upward momentum might proceed, as confirmed by the histogram turning inexperienced.

Nonetheless, merchants ought to be cautious, as a reversal continues to be doable if bullish momentum weakens within the coming days.

Market sentiment stays optimistic

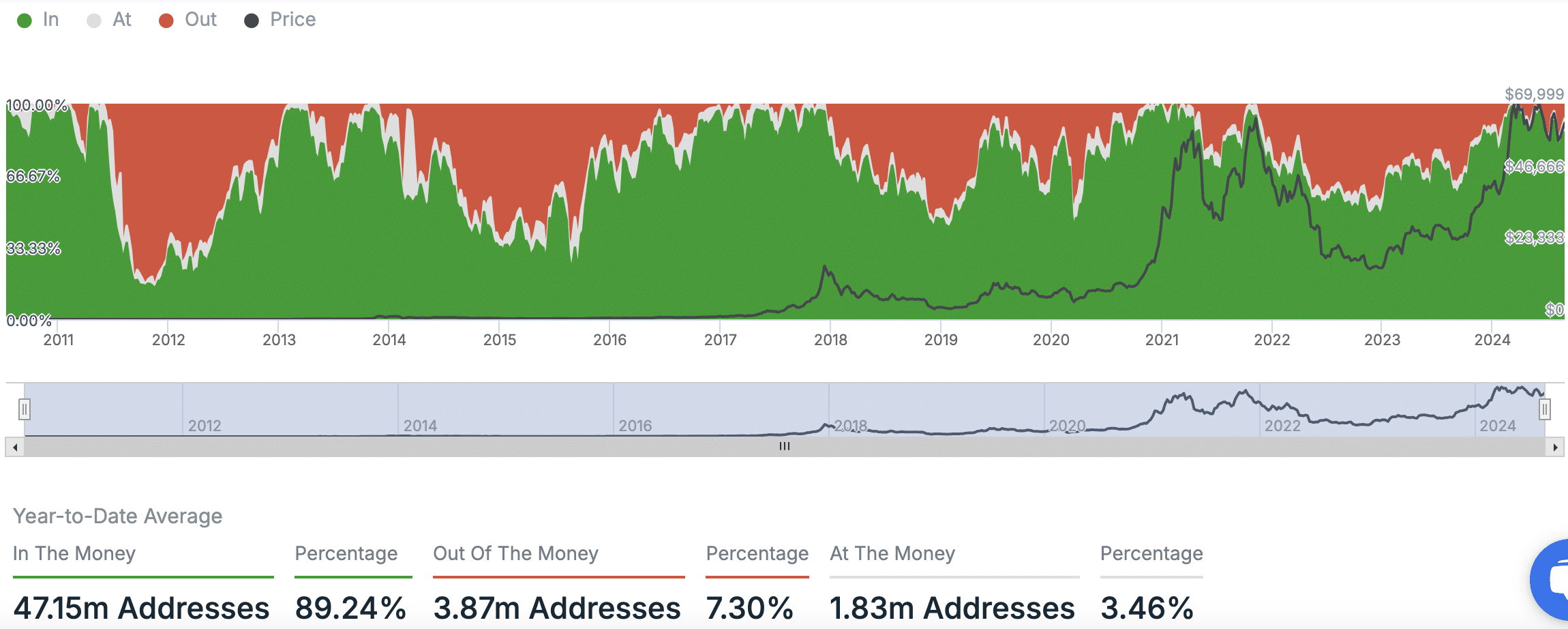

Bitcoin’s market sentiment gave the impression to be largely optimistic, supported by on-chain knowledge and change alerts.

Press time knowledge confirmed that 89.24% of Bitcoin addresses are “In the Money,” which means nearly all of holders had been in revenue.

Solely 7.30% of addresses are “Out of the Money,” reflecting a usually worthwhile place for Bitcoin traders.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

The general market signaled a “Mostly Bullish” outlook, with three bullish indicators and 4 impartial ones.

The Futures market, nevertheless, remained impartial, suggesting that whereas optimism was excessive, merchants had been adopting a cautious strategy as they await additional developments.