- Bitcoin Miner Reserve drops to year-to-date low.

- This means an uptick in miner coin sell-offs.

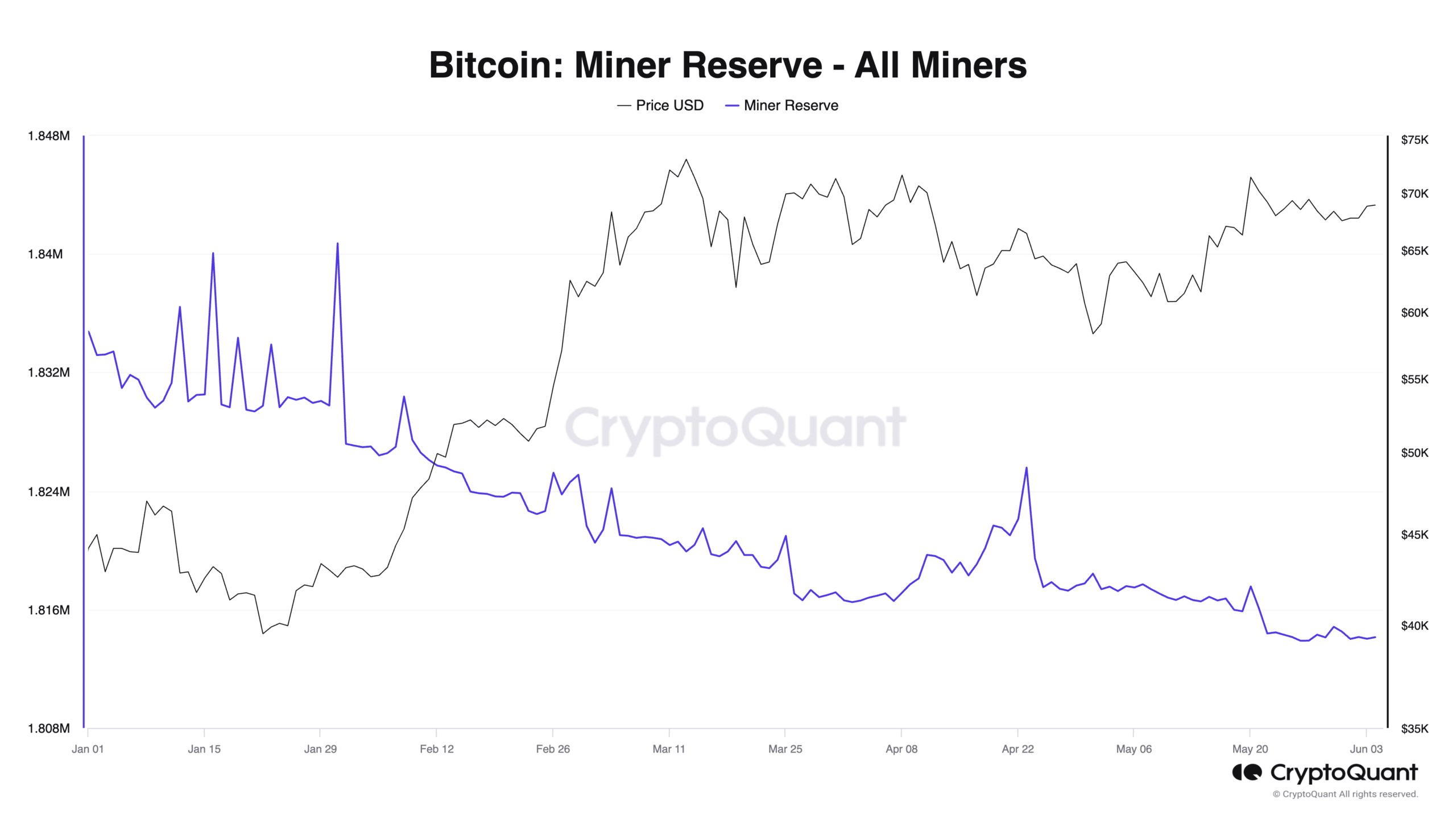

Bitcoin [BTC] Miner Reserve has fallen to its lowest stage for the reason that starting of the 12 months, information from CryptoQuant has proven.

This metric measures the quantity of cash held in affiliated miners’ wallets. Its worth signifies the reserve that miners have but to promote. At press time, 1.81 million BTC valued at $125 billion at present market costs have been held throughout miner wallets.

When BTC Miner Reserve declines, it means that miners on the Bitcoin community are distributing their cash for revenue or to type mining prices.

Information from CryptoQuant confirmed that after an prolonged interval of decline, BTC Miner Reserve initiated an uptrend on eighth April, because the market awaited the fourth Bitcoin halving scheduled for nineteenth April.

After the halving occasion, the metric rose briefly to peak at 1.82 million BTC on twenty third April, after which it re-commenced its downtrend. Since then, the quantity of BTC miners held has declined by 1%.

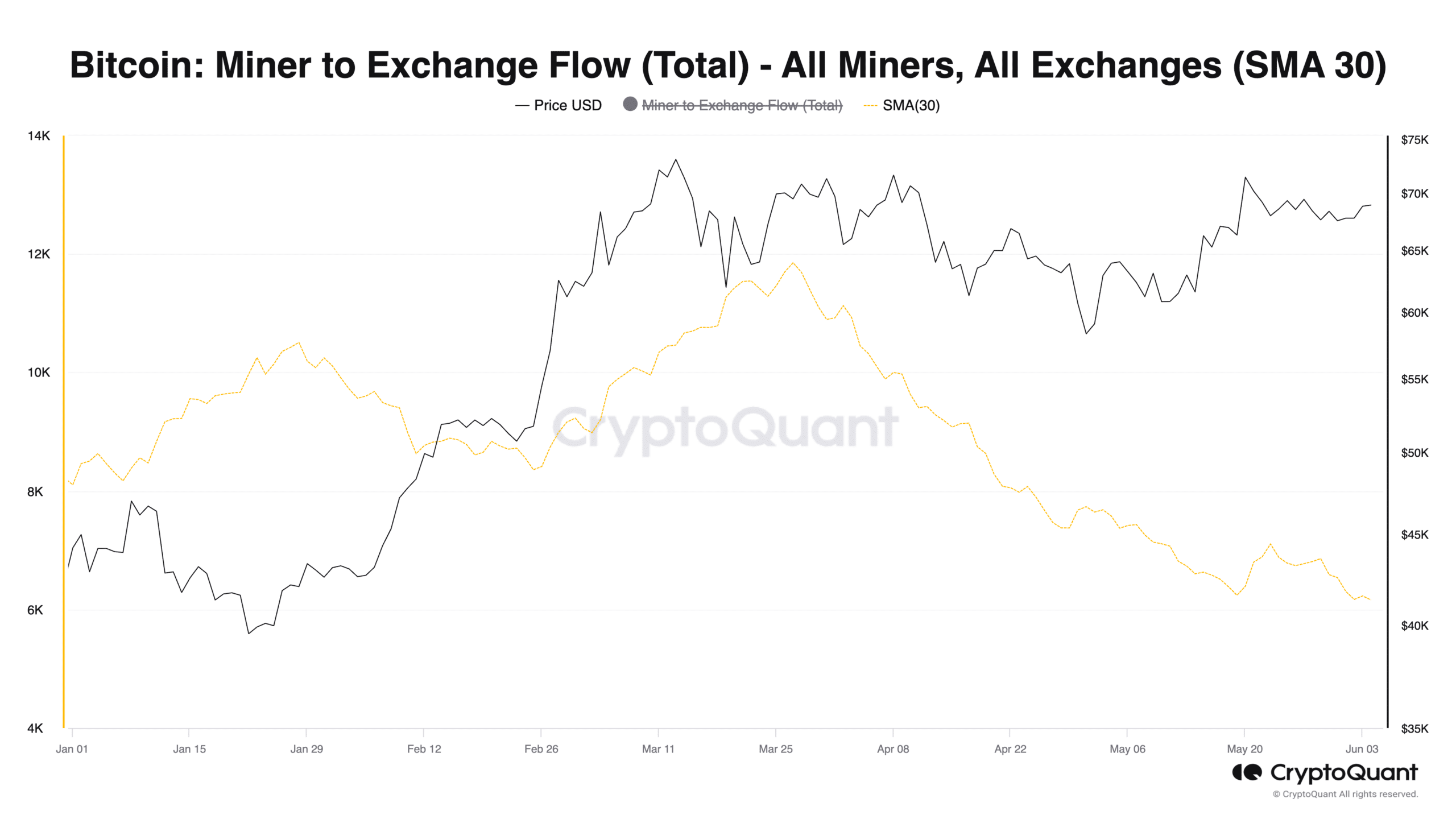

Apparently, there was a decline in miner-to-exchange exercise prior to now three months.

Per CryptoQuant’s information, the circulate of BTC from miners’ wallets to exchanges assessed (utilizing a 30-day shifting common )has declined by 48% since its year-to-date (YTD) excessive of 11,853 BTC recorded on twenty seventh March.

This, nevertheless, doesn’t imply that miners haven’t been promoting their cash. They might have been promoting their BTCs via Over-the-Counter (OTC) markets as a substitute of on to exchanges.

They could even be participating in Peer-to-Peer gross sales, the place they promote on to consumers with out utilizing exchanges.

Bitcoin bulls and bears slug it out

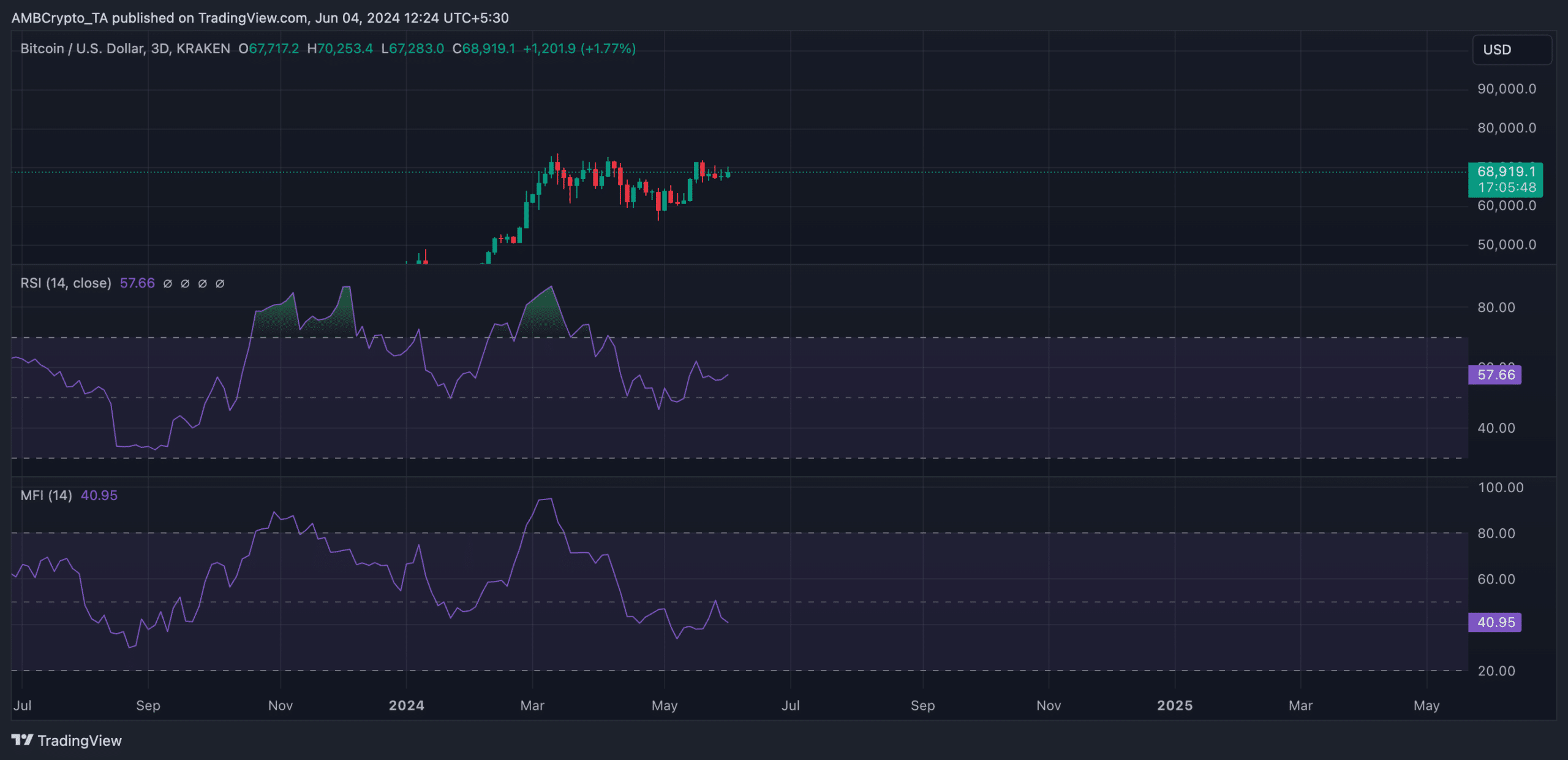

Based on CoinMarketCap information, BTC exchanged arms at $68,988 at press time. The main crypto asset has continued to face important resistance on the $70,000 worth stage.

Assessed on a three-day chart, the coin’s Relative Power Index (RSI) and Cash Circulate Index (MFI) have been 57.72 and 40.95, respectively.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

A mixed studying of the values of those key momentum indicators recommended that whereas the market witnessed an increase in shopping for momentum, there was additionally notable promoting exercise available in the market.

For BTC’s worth to rally previous $70,000, shopping for strain has to extend and surpass profit-taking exercise.