- Bitcoin’s post-halving value struggles highlighted market volatility and challenges in surpassing $60,000.

- Mining profitability has dropped considerably, regardless of elevated hashrate and gear effectivity enhancements.

The anticipated affect of Bitcoin’s [BTC] fourth halving, anticipated to drive its value to new heights, initially appeared to materialize as BTC surged previous $70,000 in March, marking an all-time excessive.

Nonetheless, latest developments reveal a special story.

As of the newest CoinMarketCap replace, BTC was struggling to take care of its momentum, buying and selling at $58,629, and has dropped by 2.41% previously 24 hours.

Bitcoin miners wrestle post-halving

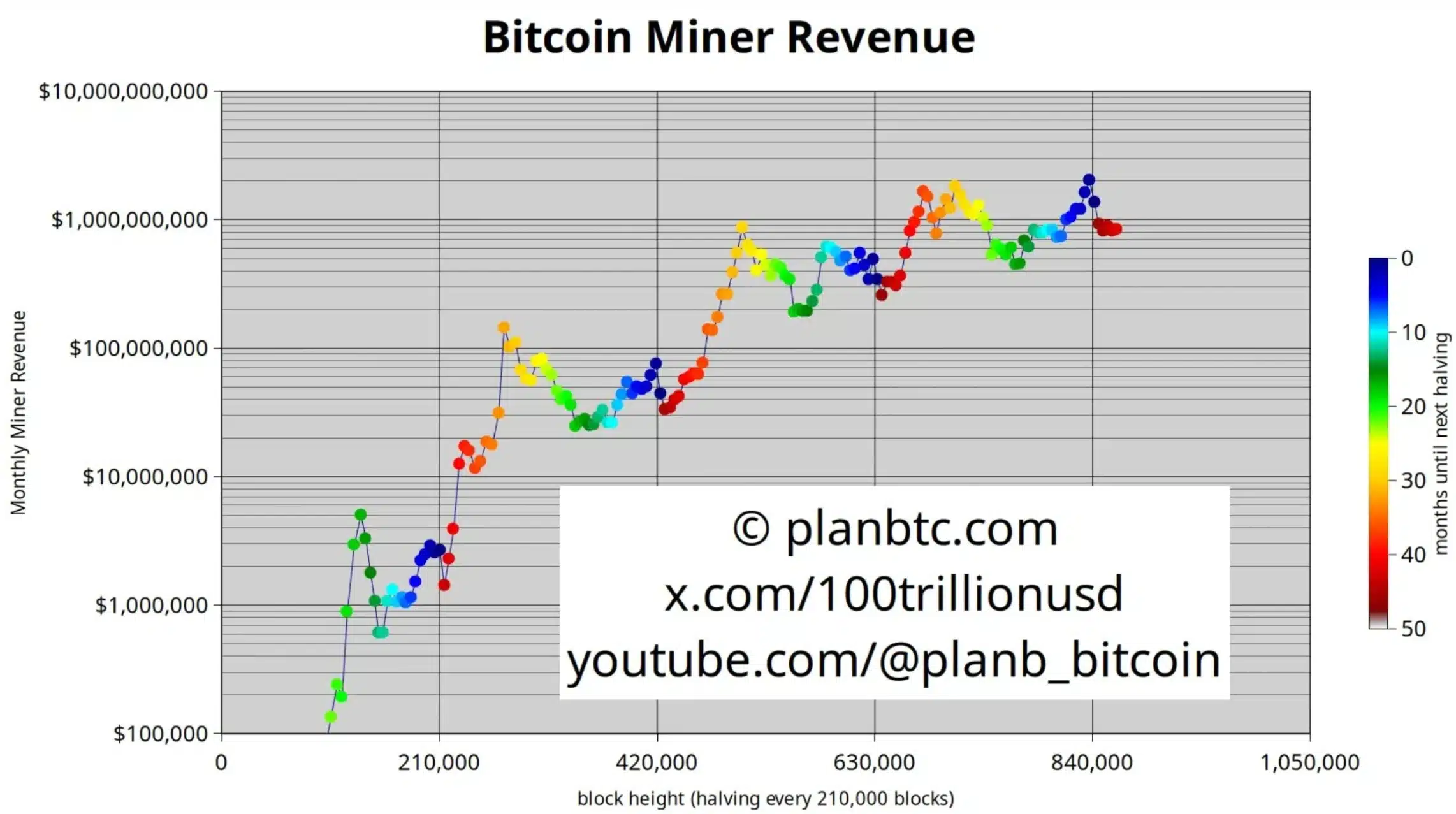

Following the latest Bitcoin halving, miners have encountered their very own challenges. PlanB, the creator of the BTC stock-to-flow (S2F) mannequin, highlighted these points on X, and stated,

“Miners are still struggling with the aftermath of the halving. We need 2x current BTC price to kick-start the bull pump.”

Compounding these challenges, funding financial institution Jefferies highlighted in a CNBC report that cryptocurrency mining profitability took a big hit in August.

In accordance with Jefferies, the typical every day income per exahash—basically, the revenue earned per miner—declined by 11.8% in comparison with the earlier month.

This drop underscores the rising monetary pressures confronted by miners amidst fluctuating market circumstances and rising operational prices.

In accordance with an AMBCrypto evaluation of IntoTheBlock information, the rewards for BTC miners have drastically decreased.

Within the 2020 halving, miners have been awarded 7,010 BTC, valued at roughly $75.99 million.

Nonetheless, within the present 2024 halving, this reward has plummeted to simply 471.88 BTC, equal to round $28.1 million.

This stark discount underscores the monetary pressure miners are dealing with amid evolving market circumstances.

Hashrate sees an increase

Nonetheless, BitcoinMiningStockGuy added,

“And Hashrate is still rising. Bullish.”

This development is additional validated by AMBCrypto’s evaluation of IntoTheBlock information, which revealed a dramatic improve in BTC’s hashrate.

In 2020, the hashrate was 140.93 million terahashes per second (TH/s), whereas it has surged to 695.84 million TH/s in 2024.

This vital rise highlights the intensified competitors and elevated computational energy required within the mining sector.

What’s the answer?

In response to the declining profitability, North American publicly traded mining companies are investing closely in gear upgrades to reinforce operational effectivity.

These developments enable newer machines to realize double the hashing energy of their predecessors whereas consuming the identical quantity of power.

Marathon CEO Fred Thiel defined to CNBC that this improve cycle is essential, because it helps offset the deteriorating financial circumstances within the mining sector.

“No need to add sites or power, just upgrade systems.”

Nonetheless, not all miners are dealing with hardship equally.

For example, Core Scientific, which emerged from chapter earlier this yr, has efficiently repurposed its intensive infrastructure to help synthetic intelligence and high-performance computing (HPC).

Thus, because the trade continues to evolve, it will likely be essential to look at how these revolutionary approaches would possibly supply options and set new benchmarks for overcoming profitability points.