- Bitcoin miners are embracing AI as various revenues amidst a decline in mining earnings.

- Doable miner capitulations flash a BTC purchase sign as spikes in Hash Ribbons persist.

Extra Bitcoin [BTC] miners, like Core Scientific, are massively diversifying into AI (synthetic intelligence) to spice up the income streams after April’s halving occasion.

April’s BTC halving occasion lowered miners’ block rewards from 6.25 BTC to three.125 BTC, slashing their income by half.

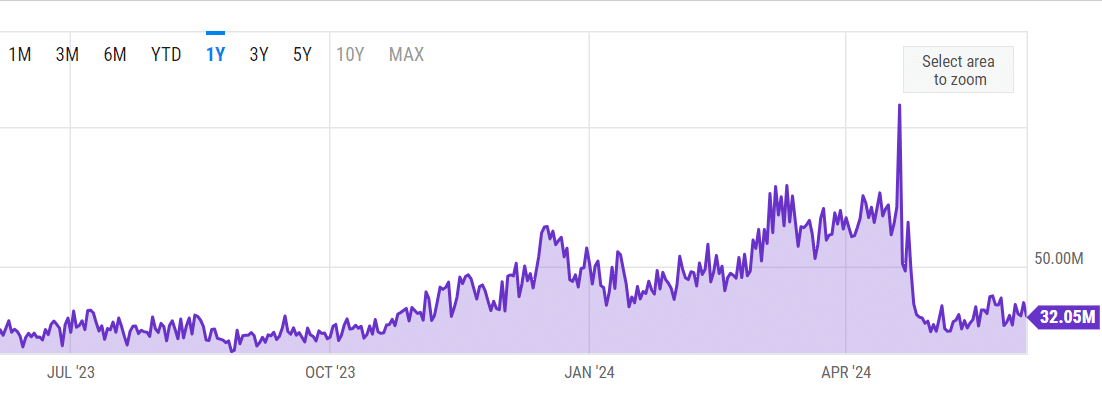

As of fifth June, Bitcoin Miner Income per day stood at $30.05 million. This was down over 70% from the document excessive of $107 million hit on April’s 2024 halving day, per YCharts.

AI to unravel Bitcoin miners’ income issues?

Nonetheless, in response to a current CNBC report, miners are actually shifting their focus to AI computing for its greater rewards and growing demand following the profitable ChatGPT AI mannequin from OpenAI.

Per the report, Bit Digital now will get 27% of its income from AI. Hut 8, one other BTC miner, and Hive generated 6% and 4%, respectively, of their income from AI.

In response to Core Scientific CEO Adam Sullivan, the shift to AI will assist create,

‘Diversified business model and more predictable cash flows.’

The AI diversification may very well be a welcome aid given the reported miner capitulations.

Are some Bitcoin miners exiting?

In mid-Might, an AMBCrypto report discovered that Bitcoin’s community hashrate dropped considerably, alongside potential miner capitulations amidst spikes in Bitcoin Hash Ribbons.

Hash Ribbons monitor quick and long-term transferring averages of Bitcoin’s hashrate. Spikes within the metric exhibit low mining exercise or exit of much less environment friendly Bitcoin miners.

The Hash Ribbons sign has continued, and crypto hedge fund Capriole Investments referred to the newest flash as a ‘tempting Bitocin buy signal.’

‘Hash Ribbons is back. Perhaps the best long-term Bitcoin buy signal there is, Hash Ribbons is now tempting us with the current Miner Capitulation, which started two weeks ago.’

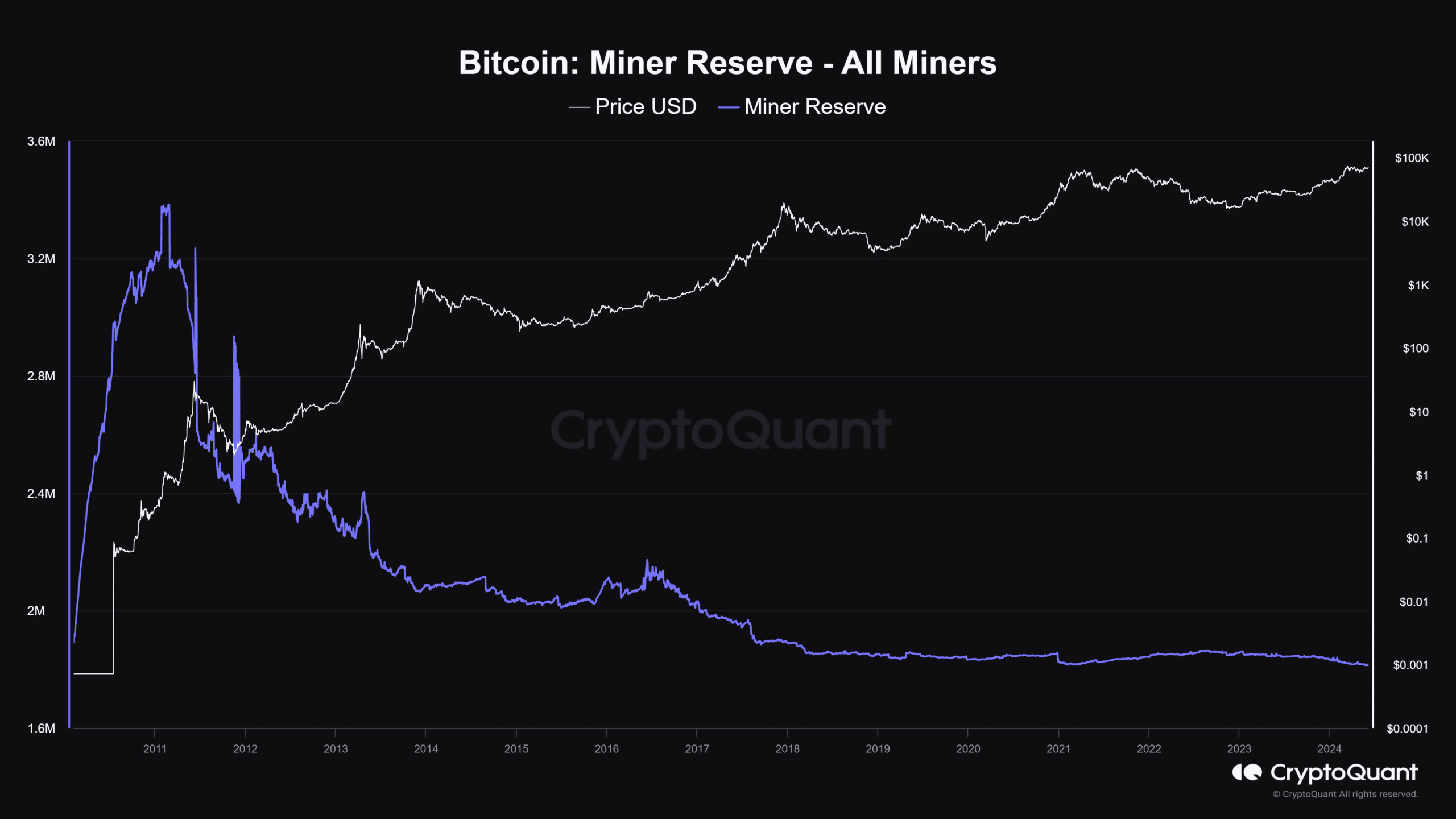

Moreover, the Bitcoin miner reserve hit its yearly low of 1.8 million BTC. The low stage was final seen 14 years in the past and instructed that miners had been offloading their holdings, in all probability by OTC (over-the-counter) markets.

Maybe one other piece that corroborated the Hash Ribbons’ ‘buy signal’ was Willy Woo’s declare that institutional merchants had been ‘risk-on’ and have pivoted to purchasing. Must you copy professionals or look ahead to a spread breakout to leap in?