Coinspeaker

Bitcoin Miners Promote $2.25B Value of BTC in Single Day

On November 13, Bitcoin miners cashed out because the BTC

BTC

$91 590

24h volatility:

4.2%

Market cap:

$1.81 T

Vol. 24h:

$138.83 B

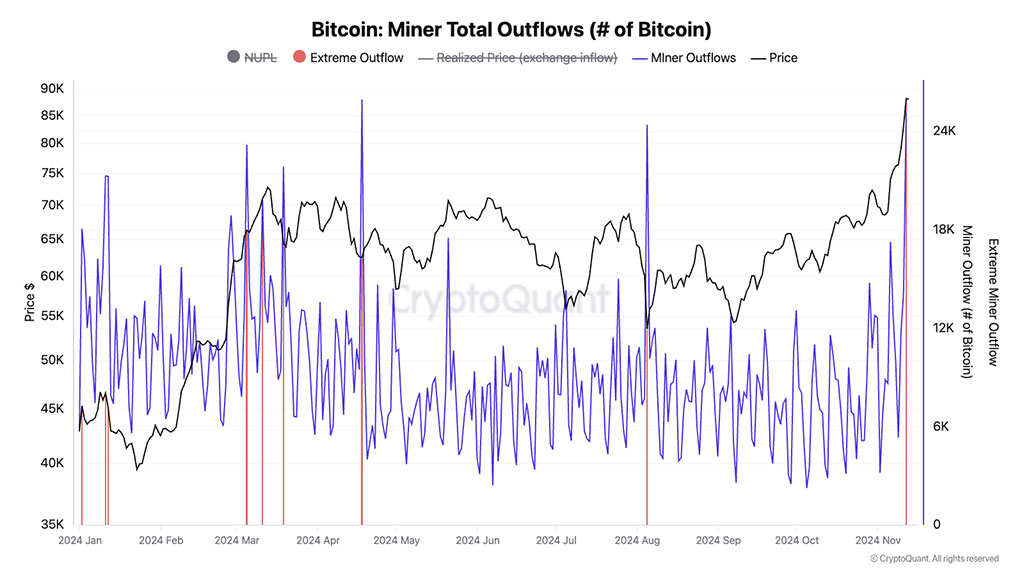

worth hit the most recent all-time excessive (ATH) of $93.4K. On Wednesday, miners bought 25K BTC cash price over $2.25 billion, per CryptoQuant information. This was the best every day miner sell-off since Could 2024, as denoted by a spike in Miner Complete Outflows, which gauges BTC transfers from miner wallets to exchanges.

Supply: CryptoQuant

Often, such a spike in miner sell-off coincides with native tops or worth stalls, as seen in early 2024 (pink traces). Nonetheless, with the present market euphoria and excessive greed, whether or not the historic pattern will repeat stays to be seen.

That mentioned, miners have been intensely competing to supply blocks within the Bitcoin community, as mining problem hit a brand new excessive above 100 trillion items this week. Regardless of the cut-throat competitors, miners had been nonetheless worthwhile, with every day income rising from $29 million to over $40 million up to now two weeks.

The miner revenue bump may very well be attributed to elevated market curiosity in BTC after Donald Trump’s victory, which has been seen as pro-BTC and crypto by market pundits.

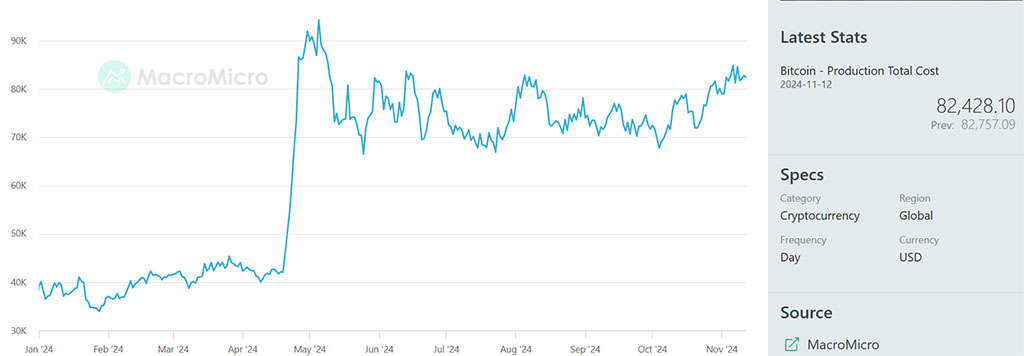

As of November 12, the typical price of mining a single BTC was estimated at $82.4K per MacroMicro information. With BTC at $90K, mining a single BTC had a constructive margin of about $8K, reinforcing present miners’ profitability.

Supply: MacroMicro

Is BTC Market Overheated?

Nonetheless, elevated miner sell-off might weigh on the continued BTC rally and dent the $100K goal expectations. So, what does elevated miner profitability sign about BTC’s present valuation?

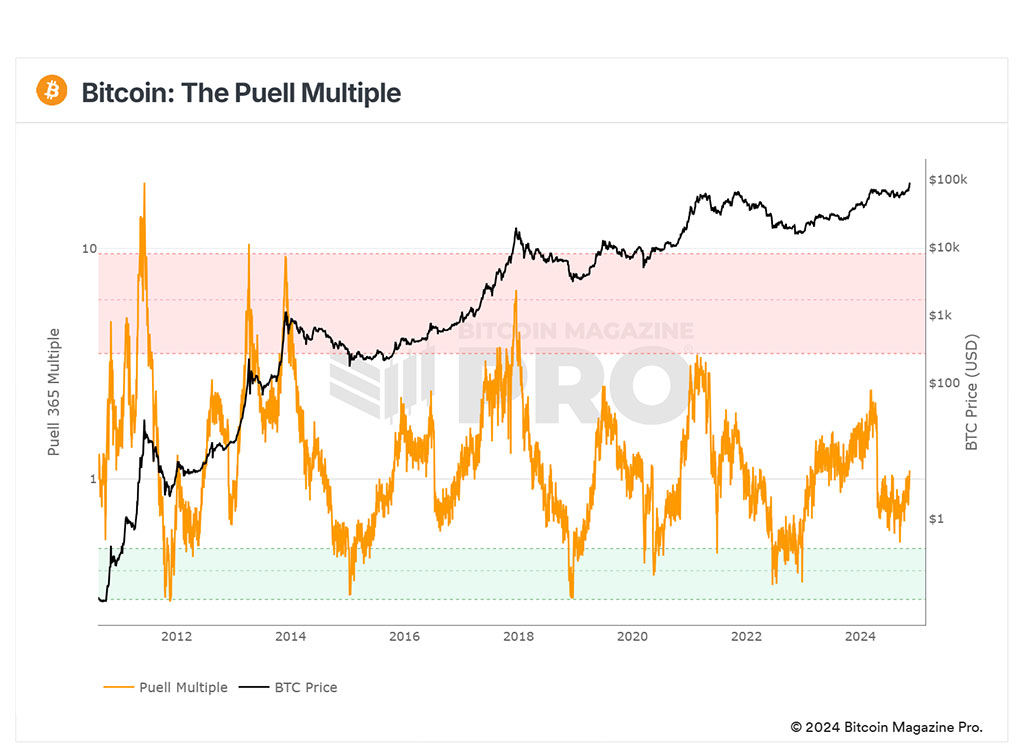

Based on the Puell A number of, which gauges miner profitability and, by extension, BTC valuation, there was nonetheless room for BTC to rally regardless of rallying above $90K. In previous cycles, BTC hit cycle high when Puell A number of reached the higher band (orange) between 4 and 10.

At press time, the metric spiked, indicating that miner profitability improved. Nonetheless, the metric’s studying stood at 1, suggesting there was a whole lot of headroom earlier than hitting the orange band.

Supply: BM Professional

Apparently, the Puell A number of mirrored the 2020-2021 sample. In November 2020, the metric studying stood at 1 earlier than surging to the higher band (cycle high of $69K) in early 2021. Ought to the sample repeat, BTC might hit a cycle high by Q1 2025 primarily based on Puell A number of insights.

Put otherwise, BTC was not overheated or overvalued regardless of the present rally to $90K. Nonetheless, an identical and intense spike in BTC miner sell-offs in early 2025 alongside an overheated Puell A number of may very well be a reason for concern and value monitoring.