Coinspeaker

Bitcoin Mining Issue at ATH, BTC Worth Rally and Bull Run Forward?

Regardless of BTC worth

BTC

$66 356

24h volatility:

1.6%

Market cap:

$1.31 T

Vol. 24h:

$32.68 B

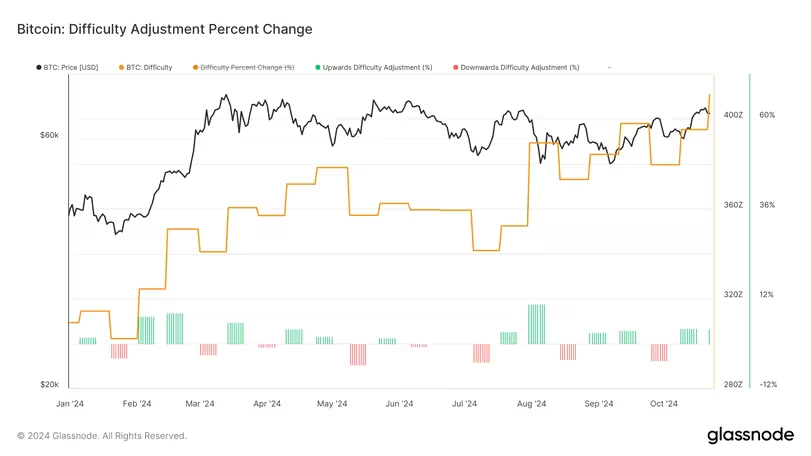

going through rejection at $69,000 ranges and retracing 5%, the Bitcoin mining issue has hit an all-time excessive of 95.67 terahashes (T), surging 4% within the final 24 hours. Up to now this yr, the Bitcoin blockchain has witnessed 22 issue changes, with 13 of them being optimistic.

In issue adjustment this yr, the Bitcoin hashrate surged 27% surging from 72T to 92T. One other good factor can also be that the surge in Bitcoin mining issue comes together with a report BTC hashrate. As of now, the BTC hashrate has surged to over 700 exahashes per second (EH/s).

With the surge within the Bitcoin mining issue, miners face elevated stress to keep up profitability. Thus, with extra demand for computational energy, the mining prices may also enhance.

Picture: Glassnode

Following the Bitcoin halving occasion in April 2024 and a 50% drop in mining rewards, weak Bitcoin miners with outdated tools have moved out of enterprise. After the halving occasion, small miners began to unplug from the community resulting in a 15% drop within the hashrate.

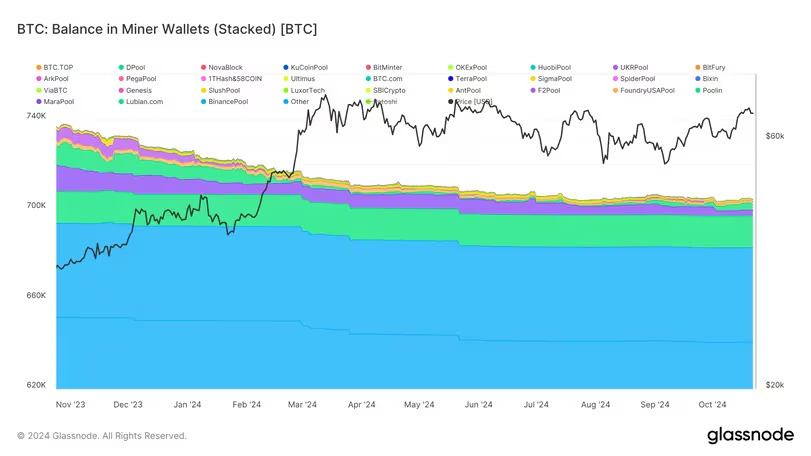

Additionally, different gamers have been promoting their BTC holdings partially with the intention to meet the rising operational prices. In keeping with Glassnode knowledge, miner balances have declined this yr as weaker miners anticipated the upcoming halving and sought to fund their operations. Between November 2023 and July 2024, greater than 30,000 bitcoins exited miner wallets, marking one of many longest distribution durations recorded.

Nevertheless, since July, miner balances have stabilized and begun to point out indicators of accumulation, indicating that the remaining miners are higher geared up to navigate the brand new market surroundings. Going additional, the BTC mining trade is more likely to consolidate amongst sturdy gamers with public miners controlling a report share of virtually 30%.

Picture: Glassnode

BTC Worth Rally and Bull Run Forward?

Bitcoin bull runs are carefully linked to rising miner income; as costs climb, mining earnings additionally enhance. In keeping with Glassnode knowledge, the entire greenback mining income, primarily based on a 7-day transferring common (7-DMA), has surpassed $35 million, reflecting a rise of greater than $10 million for the reason that lows noticed in September.

Nevertheless, for the reason that halving in April, the BTC mining income has stayed under the 365-simple transferring common (SMA) which is presently round $40 million. Traditionally, as soon as the entire miner income surges previous the 365-SMA, it should coincide with a Bitcoin bull run.

As suspected, worth is certainly dipping just a bit bit deeper into the final inexperienced space for extra buy-side liquidity

Typically, BTC wants to carry the Channel High (black) as help

Nonetheless efficiently doing that, regardless of market-wide concern$BTC #Crypto #Bitcoin https://t.co/clfMAlP3fq pic.twitter.com/SC9mUKYUKc

— Rekt Capital (@rektcapital) October 23, 2024

The present BTC worth retracement from $69,000 has led to a bearish sentiment. Nevertheless, the technical chart reveals that the BTC worth is taking help on the higher finish of the channel. Bitcoin should maintain $66,000 for this rally to proceed.

Bitcoin Mining Issue at ATH, BTC Worth Rally and Bull Run Forward?