- Whales’ Bitcoin transfers gasoline sell-off speculations.

- Institutional dedication to BTC stays sturdy, overtaking retail.

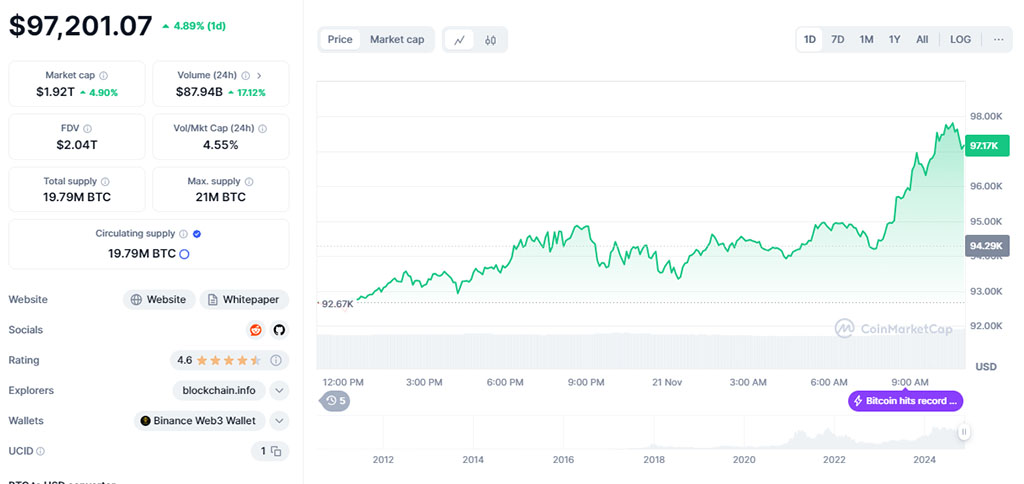

Bitcoin [BTC] is on the verge of creating historical past but once more in 2024. AMBCrypto lately reported that this week can be essential for dictating BTC’s prospects, figuring out whether or not it could align with the cyclical pattern and climb larger or lean towards the financial outlook and decline.

Nicely, seems to be just like the king coin has taken the previous path. On the twenty ninth of October, the main cryptocurrency surged previous the essential $70,000 mark, for the primary time since June.

It reached a peak of $73,620 on Binance—simply over 100 {dollars} shy of its all-time excessive of $73,777. At press time, BTC was exchanging arms at $72,350, up by roughly 2% over the previous day.

This spectacular rally reignited bullish sentiment amongst traders. But, it additionally raised a urgent query: Will this breakthrough set off a wave of profit-taking?

Are BTC sell-offs coming?

Current exercise suggests potential sell-offs could also be underway. In response to Lookonchain, following Bitcoin’s surge previous $71,000, a whale pockets holding 749 BTC (price $53.23 million) turned energetic after remaining dormant for 12 years.

This whale initially gathered BTC again in 2012 when Bitcoin was priced at simply $11, totaling an funding of $8,151 on the time. Now, it has transferred out 159 BTC ($11.32 million).

One other main participant probably making ready to money out is the Authorities of Bhutan. Blockchain intelligence platform Arkham Intelligence revealed that crypto wallets linked to Bhutan’s Royal Authorities moved $66.55 million price of BTC to Binance.

Notably, their final alternate deposit was 4 months in the past, in early July. On the time of writing, Bhutan held 12.47K BTC, valued at $904.34 million.

Supply: Arkham Intelligence

BlackRock doubles down on Bitcoin holdings

Whereas sell-offs loom, BlackRock remained firmly dedicated to Bitcoin. As famous by Lookonchain, the asset administration big bought one other 4,528 BTC price over $322 million on twenty eighth October.

Moreover, previously two weeks, BlackRock considerably expanded its Bitcoin holdings, including 34,085 BTC to its portfolio. This addition was valued at roughly $2.3 billion.

The newest buy introduced its holdings to 408,253 BTC, valued at a staggering $29.09 billion, signaling sturdy institutional curiosity within the asset.

The place are the retail traders?

Regardless of Bitcoin’s outstanding value efficiency, retail seemed to be sleeping on the asset. Google Developments information revealed that search curiosity for “Bitcoin” scored simply 17 out of 100, final week. At press time, the worth was barely up at 23.

Supply: Google Developments

In the meantime, CryptoQuant’s newest report indicated that retail participation was overshadowed by bigger traders.

Whereas retail traders have been regularly re-entering the market, their holdings, nevertheless, have been rising at an unusually sluggish fee.

Moreover, Bitcoin switch exercise amongst retail traders remained comparatively low. Every day transfers totaled simply $326 million on September 21, marking the bottom stage since at the very least 2020.

Traditionally, low switch exercise by retail traders typically precedes value rallies for Bitcoin, a pattern seemingly taking part in out now.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Due to this fact, as Bitcoin approaches report highs, the interaction between whales, institutes, and retail may form its short-term trajectory—one which will set the stage for both unprecedented highs or a profit-taking pause.