- Bitcoin confronted a important juncture with potential paths to $76,610 or a drop to $51,970.

- Market knowledge and analyst insights steered elevated promoting strain and a bearish short-term outlook.

Bitcoin’s [BTC] market place is at a important juncture because it presently traded at $61,394 at press time. After dipping to $60,000, the cryptocurrency has seen a slight enhance of over 1% previously 24 hours.

Regardless of this minor restoration, Bitcoin has skilled a 9% decline over the previous month and a 4.3% drop previously week.

These actions have drawn important consideration from analysts and merchants alike, who’re keenly observing Bitcoin’s potential to maintain its present stage.

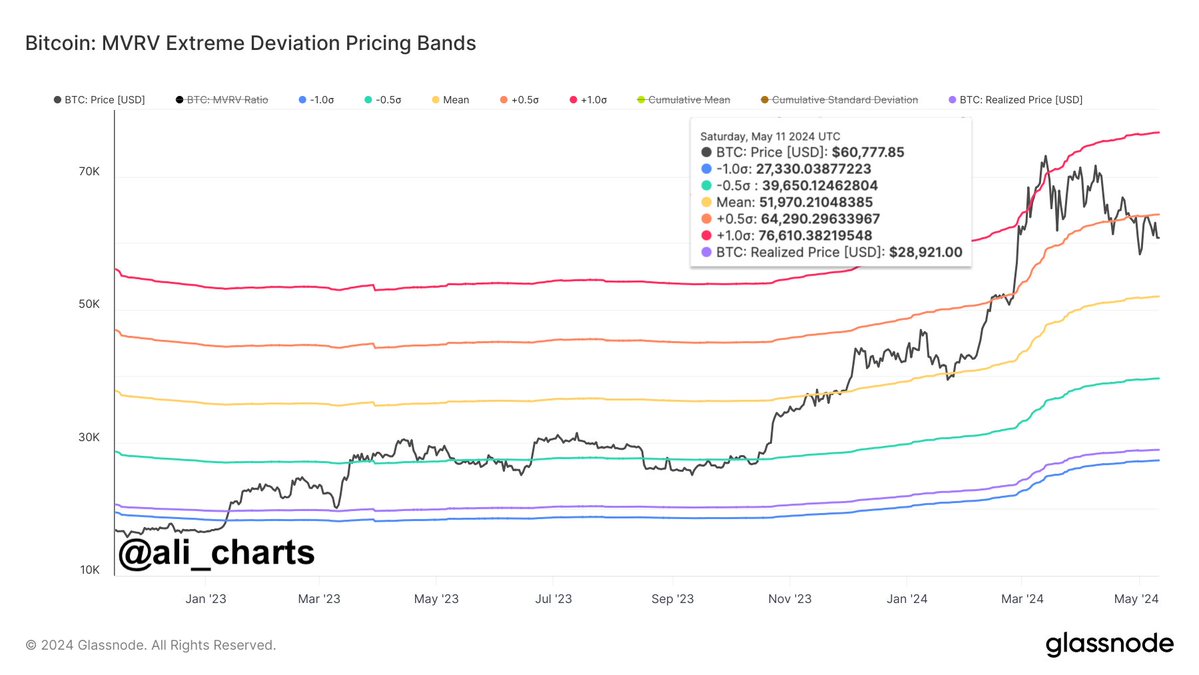

Crypto analyst Ali Martinez not too long ago offered an in depth evaluation of Bitcoin’s potential worth trajectory.

Based on Martinez, if Bitcoin can reclaim $64,290 as a help stage, there might be a pathway to a bullish rise towards $76,610.

Nevertheless, failure to keep up this important help stage may see the cryptocurrency’s worth retract to $51,970.

This locations important emphasis on the $64,290 mark as a pivotal level for figuring out Bitcoin’s short-term path.

Indicators of bearish strain?

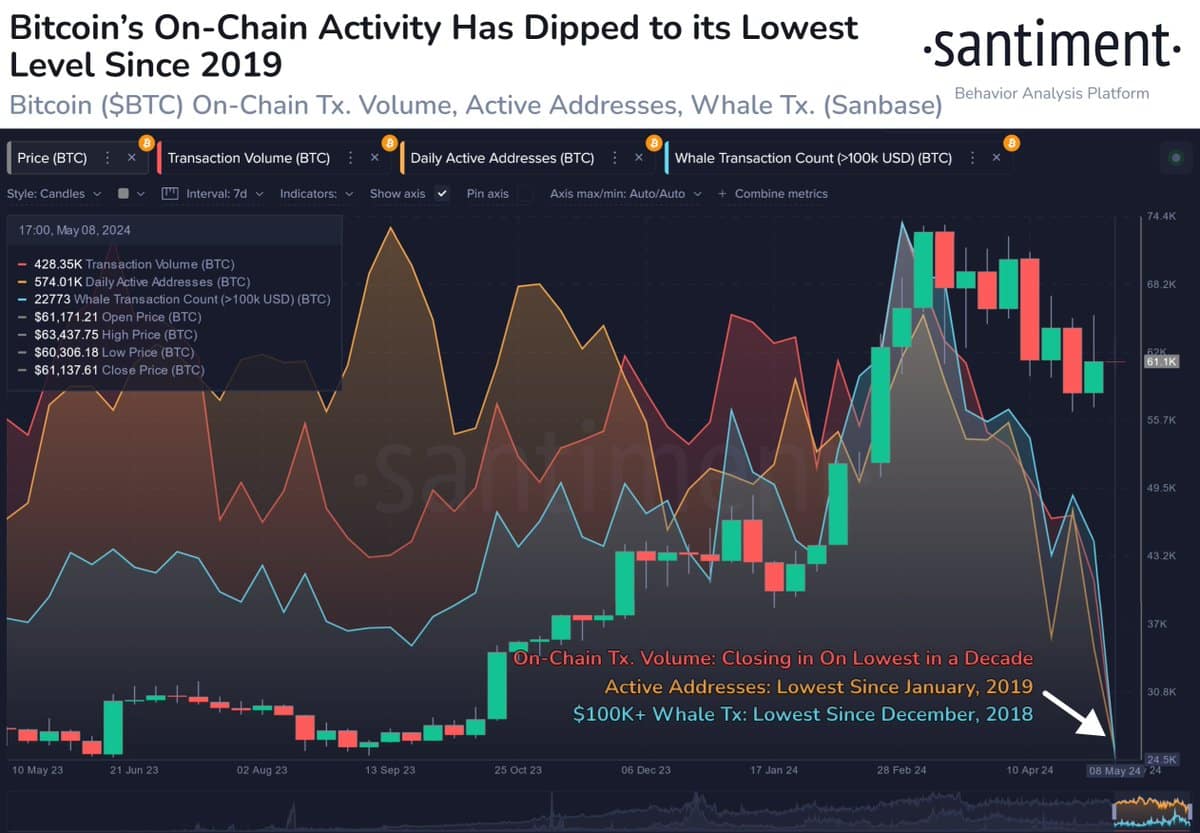

Current knowledge from Santiment has highlighted a noticeable decline in Bitcoin’s on-chain exercise, with transaction ranges nearing historic lows.

This discount in exercise means that merchants are considerably decreasing their transactional engagements, a development noticed significantly after Bitcoin’s all-time excessive.

Whereas decreased on-chain exercise won’t instantly predict a downturn, Santiment interprets this as a sign of accelerating “fear and indecision” amongst market contributors.

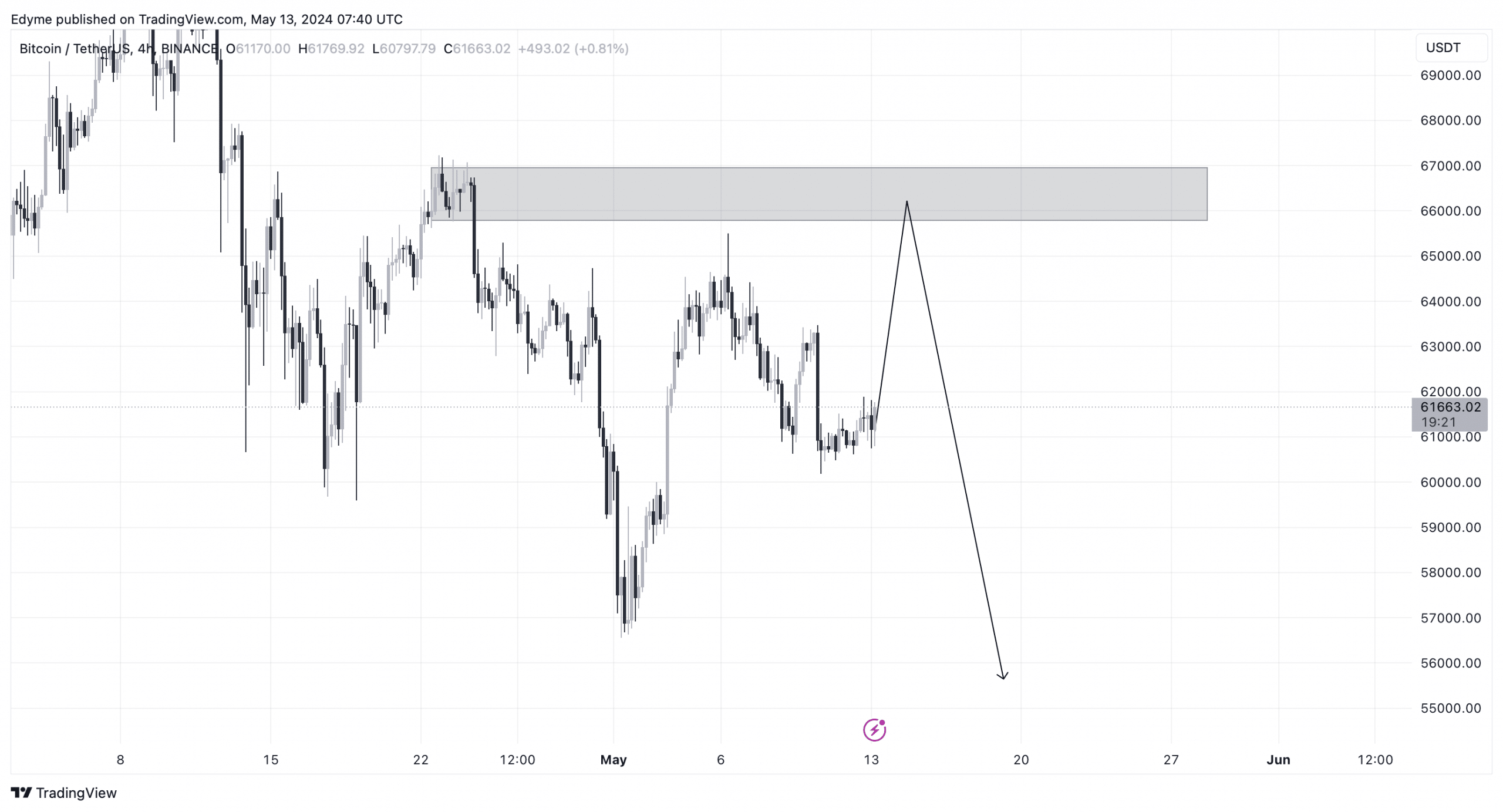

Delving into the technical points, Bitcoin seems extraordinarily bullish on the weekly time-frame.

Nevertheless, a better take a look at the each day time-frame reveals a unique story, with the cryptocurrency exhibiting a bearish sub-structure.

There have been three important breaks of construction to the draw back on this time-frame, hinting at short-term bearish strain.

The 4-hour time-frame additional helps this view, as the present bullish candle could be a brief transfer to take out liquidity at greater ranges earlier than persevering with the downward trajectory.

Extra challenges for Bitcoin

Evaluation of latest market knowledge has additionally make clear the promoting strain surrounding Bitcoin.

Based on a latest report from AMBCrypto, which cited knowledge from CryptoQuant, there was a noticeable enhance in Bitcoin’s internet deposit on exchanges in comparison with the seven-day common.

Moreover, each the Coinbase Premium and Korea Premium indices are within the pink, indicating a dominant promoting sentiment amongst US and Korean traders.

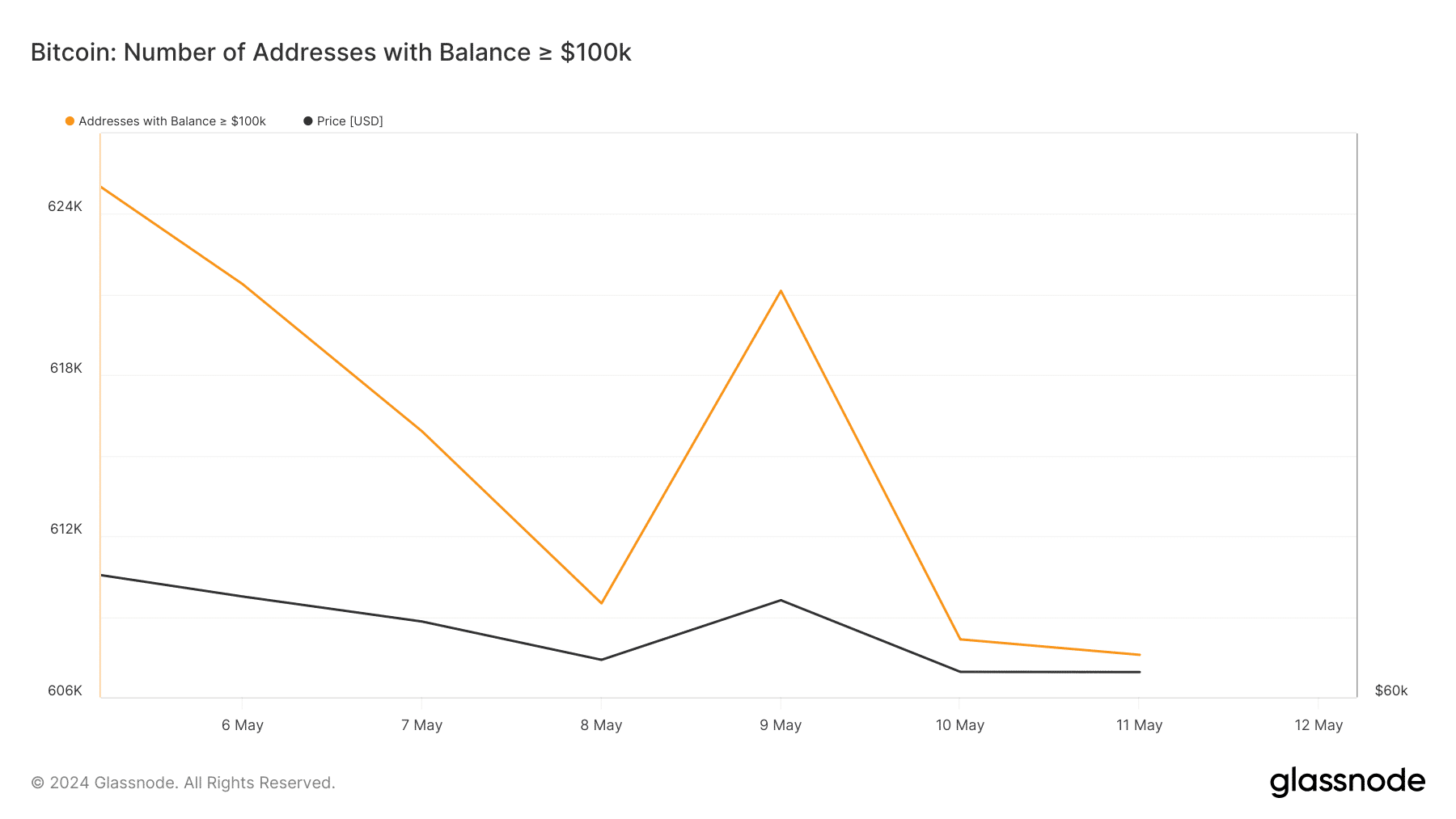

The conduct of Bitcoin whales additional complicates the potential for a worth restoration.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Notably, Glassnode’s knowledge reveals a pointy decline within the variety of addresses holding balances larger than $100,000 during the last seven days.

This development means that main gamers available in the market are offloading their Bitcoin holdings, making it more and more difficult for the cryptocurrency to succeed in the $64,000 mark within the quick time period.