- Bitcoin has rebounded 8.9%, approaching a vital $70K resistance degree, with analysts predicting a possible breakout.

- Key metrics like open curiosity quantity and NVT ratio recommend robust market curiosity and potential for additional good points.

Bitcoin [BTC] is steadily recovering after experiencing a big drop to the $50,000 degree earlier this month on fifth August. At present, the main cryptocurrency is buying and selling at $63,742, marking an 8.9% improve over the previous week.

This value motion has sparked discussions amongst crypto analysts in regards to the potential course of Bitcoin within the coming weeks. One such analyst, Mags, not too long ago shared his insights on X, discussing the present value motion of Bitcoin.

Breakout above $70,000 close to?

Mags highlighted that Bitcoin’s present sideways motion mustn’t essentially be seen as bearish. He identified that earlier than every main transfer, Bitcoin usually undergoes a interval of consolidation inside a selected vary.

Traditionally, these consolidation phases have lasted between 8 to 30 weeks.

As of now, Bitcoin is 25 weeks into its present consolidation part. Whereas it’s troublesome to foretell the precise length of this part, Mags emphasised that Bitcoin stays in a bull market.

If this sample holds, he prompt that the eventual breakout may very well be vital.

As Bitcoin approaches the vital $70,000 resistance degree, different analysts are additionally weighing in on the potential for a breakout.

Captain Faibik, one other well-known crypto analyst on X, famous that whereas Bitcoin bulls seem like in management, the true take a look at lies forward.

He speculated that Bitcoin may retest the $70,000 resistance this week however questioned whether or not the bulls would have the power to interrupt by means of this key degree.

Elementary indicators: What they sign for Bitcoin’s future

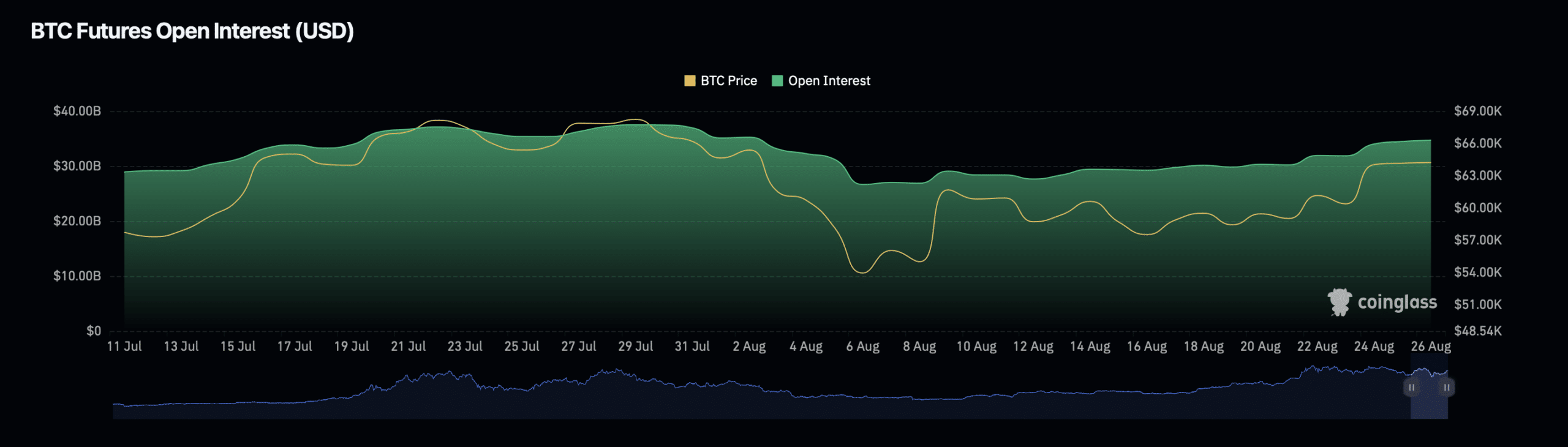

To grasp Bitcoin’s potential for a sustained surge, it’s price inspecting the asset’s underlying fundamentals. In accordance with knowledge from Coinglass, Bitcoin’s open curiosity has seen a slight decline of 1% over the previous day, bringing the present valuation to $34.39 billion.

Open curiosity refers back to the whole variety of excellent by-product contracts, equivalent to futures and choices, that haven’t been settled.

A decline in open curiosity might point out a discount in market exercise or a shift in dealer sentiment.

Nevertheless, regardless of this decline, Bitcoin’s open curiosity quantity, which measures the whole worth of those contracts, has elevated by 1.84% over the identical interval, reaching $39.06 billion.

This improve means that whereas the variety of contracts has decreased, the worth of the remaining contracts has risen, probably indicating elevated confidence amongst merchants about Bitcoin’s near-term prospects.

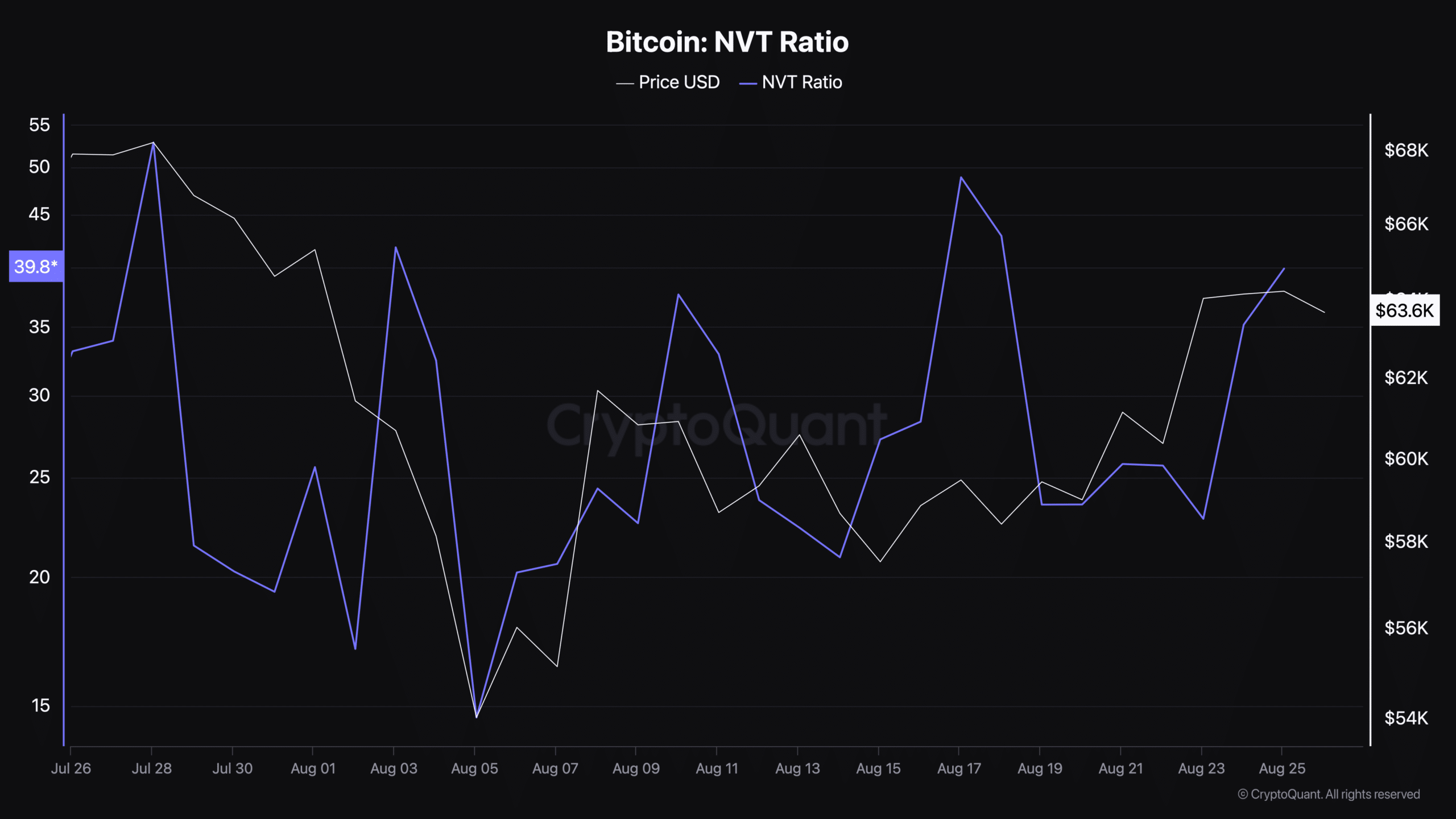

One other key metric to contemplate is Bitcoin’s Community Worth to Transactions (NVT) ratio, which is presently on the rise, sitting at 39.8 in keeping with knowledge from CryptoQuant.

The NVT ratio is a valuation metric that compares Bitcoin’s market capitalization to the amount of transactions on its community.

A better NVT ratio can point out that Bitcoin is overvalued relative to its transaction quantity, probably signaling warning.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nevertheless, it might additionally recommend that the market is anticipating future progress in transaction quantity, which might justify the present valuation.

In Bitcoin’s case, the rising NVT ratio might suggest that traders are anticipating continued value appreciation, supported by the broader market pattern.