- Quick-term Bitcoin holders are sitting on the highest earnings since August after BTC broke above $63,000.

- The widespread profitability has seen market sentiment shift to constructive, which might stir an prolonged rally.

Bitcoin [BTC] traded at $63,790 at press time, its highest value this month. Optimistic macro components have seen BTC defy the standard September drop, and with “Uptober” in sight, bulls look like making their transfer.

Nevertheless, provided that this month’s constructive macro narratives look like exhausted, merchants who’ve held Bitcoin for lower than 155 days maintain the important thing to the following short-term value strikes.

Surge in Bitcoin short-term holder good points

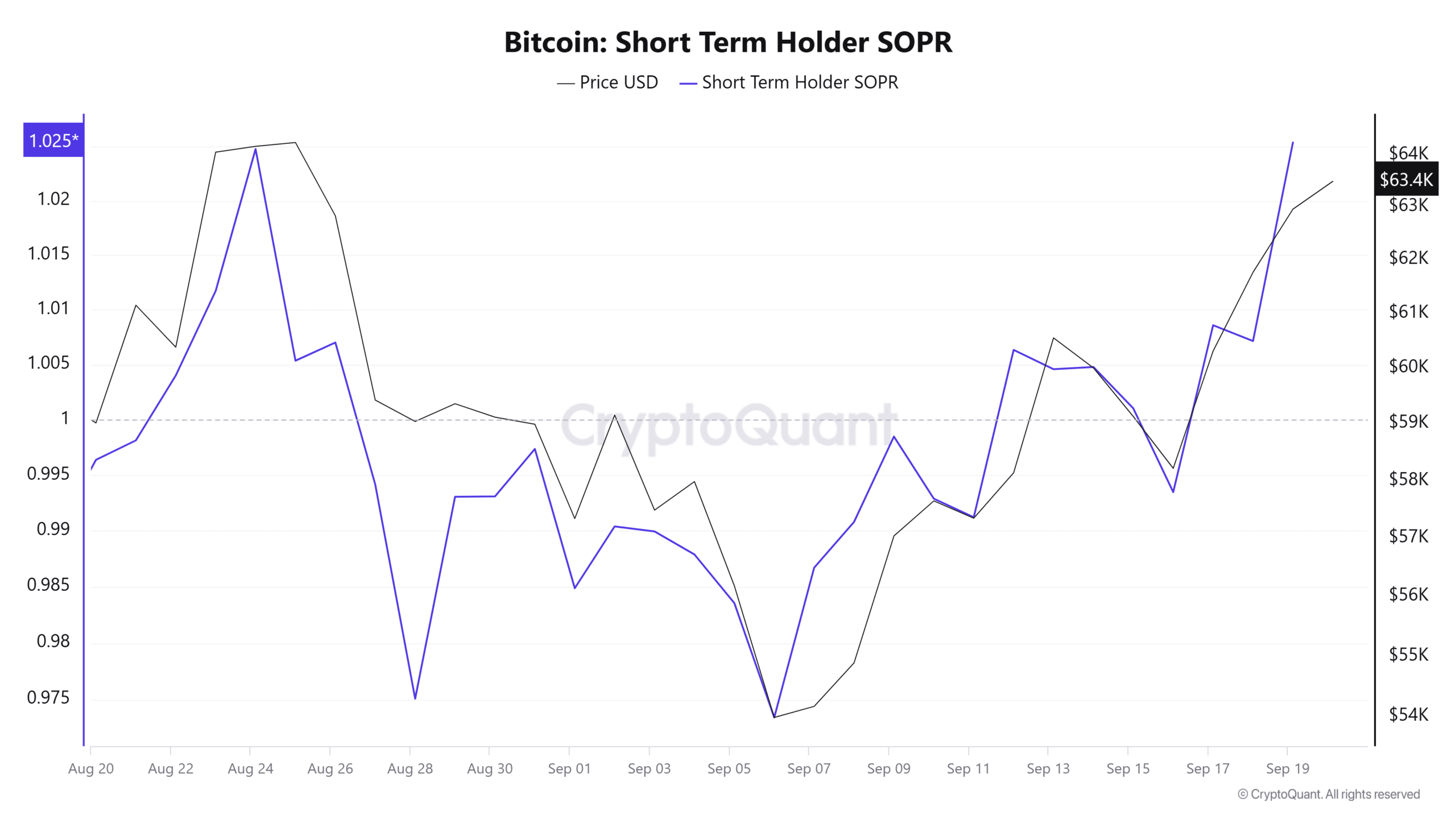

Knowledge from CryptoQuant confirmed that after Bitcoin broke $60K earlier this week, short-term holders turned a revenue. This cohort was beforehand underwater.

The shift in profitability is seen within the short-term Output Revenue Ratio (SOPR), which has made a pointy improve from beneath 1 to its highest stage since late August.

This metric indicated a shift in market sentiment from adverse to constructive. The Bitcoin Worry and Greed Index confirmed this because it elevated to 54, the very best stage in additional than three weeks.

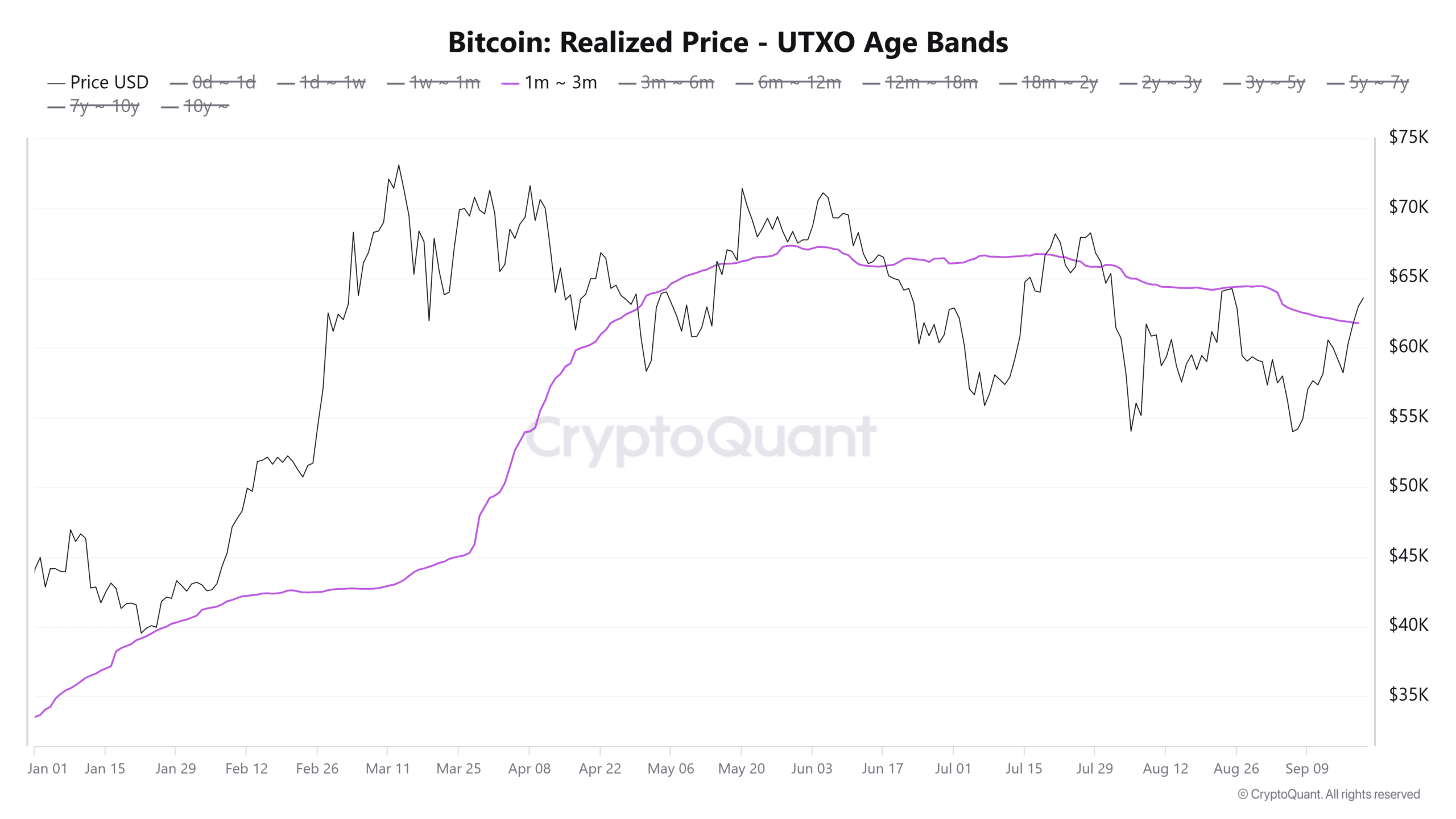

Quick-term holder profitability can be seen within the Realized Worth — UTXO Age Bands. Merchants which have held BTC for one to a few months have been beneath their common purchase value since August.

These merchants re-entered profitability on the 18th of September, after BTC rallied above $61,800.

Per CryptoQuant analyst Avocado_onchain, the common purchase value of short-term holders acts as a powerful resistance stage. With Bitcoin breaking above it, it suggests a powerful bullish pattern.

Threat of profit-taking

The widespread profitability amongst short-term Bitcoin holders exhibits bullish sentiment, however it additionally poses a danger to the short-term rally in the event that they resolve to promote.

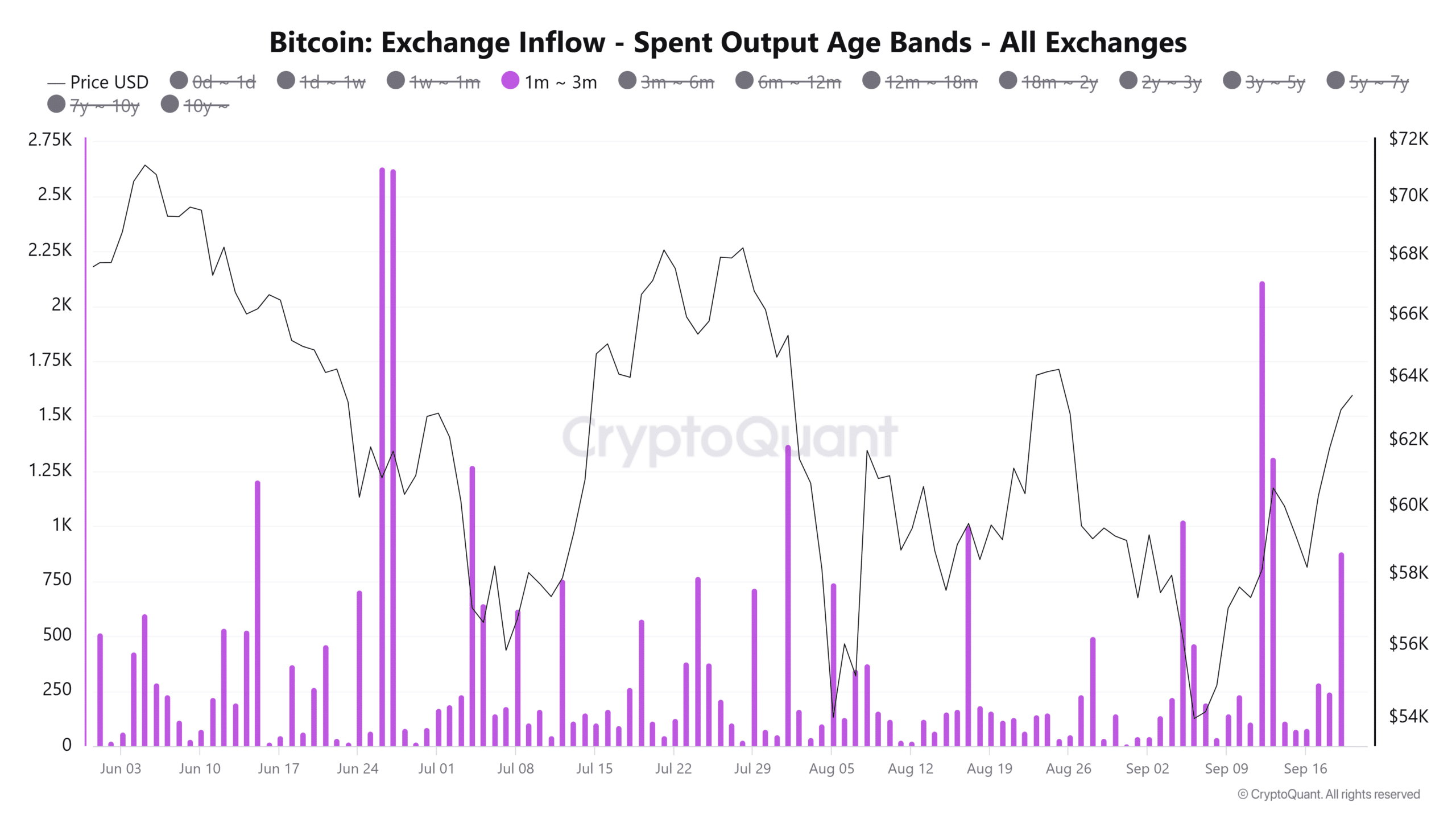

The cash distributed by these holders have reached a weekly excessive as seen within the Trade Influx — Spent Output Worth Bands coinciding with the acquire in value.

This means that short-term holders could possibly be taking earnings after realizing good points.

Nevertheless, provided that the promoting exercise has not dampened the rally, a excessive variety of short-term merchants promoting at earnings might stir the curiosity of recent patrons.

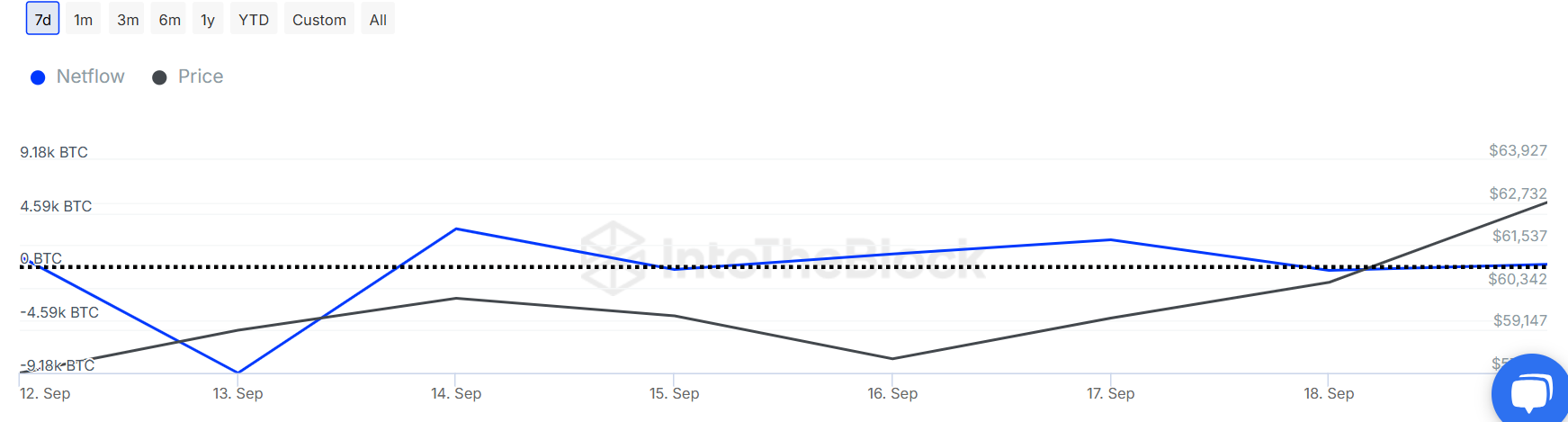

Merchants must also be careful for the $64,000-$70,000 ranges as 4.5M Bitcoin addresses that purchased at these costs are nonetheless underwater per IntoTheBlock knowledge.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

As such, Bitcoin will face resistance because it approaches this zone.

Nonetheless, whales are but to work together with BTC amid the latest good points. Massive holder netflow has been predominantly flat within the final two days after a interval of accumulation. This reduces the chance of enormous sell-offs.