- BTC broke its earlier ATH when it rose to over $94,000.

- It’s buying and selling at round $92,500 at press time.

Bitcoin [BTC] skilled a dramatic reversal after reaching a report excessive of $94,000 within the final buying and selling session.

This peak was adopted by a pointy decline, triggered by long-term holders liquidating positions value $3 billion.

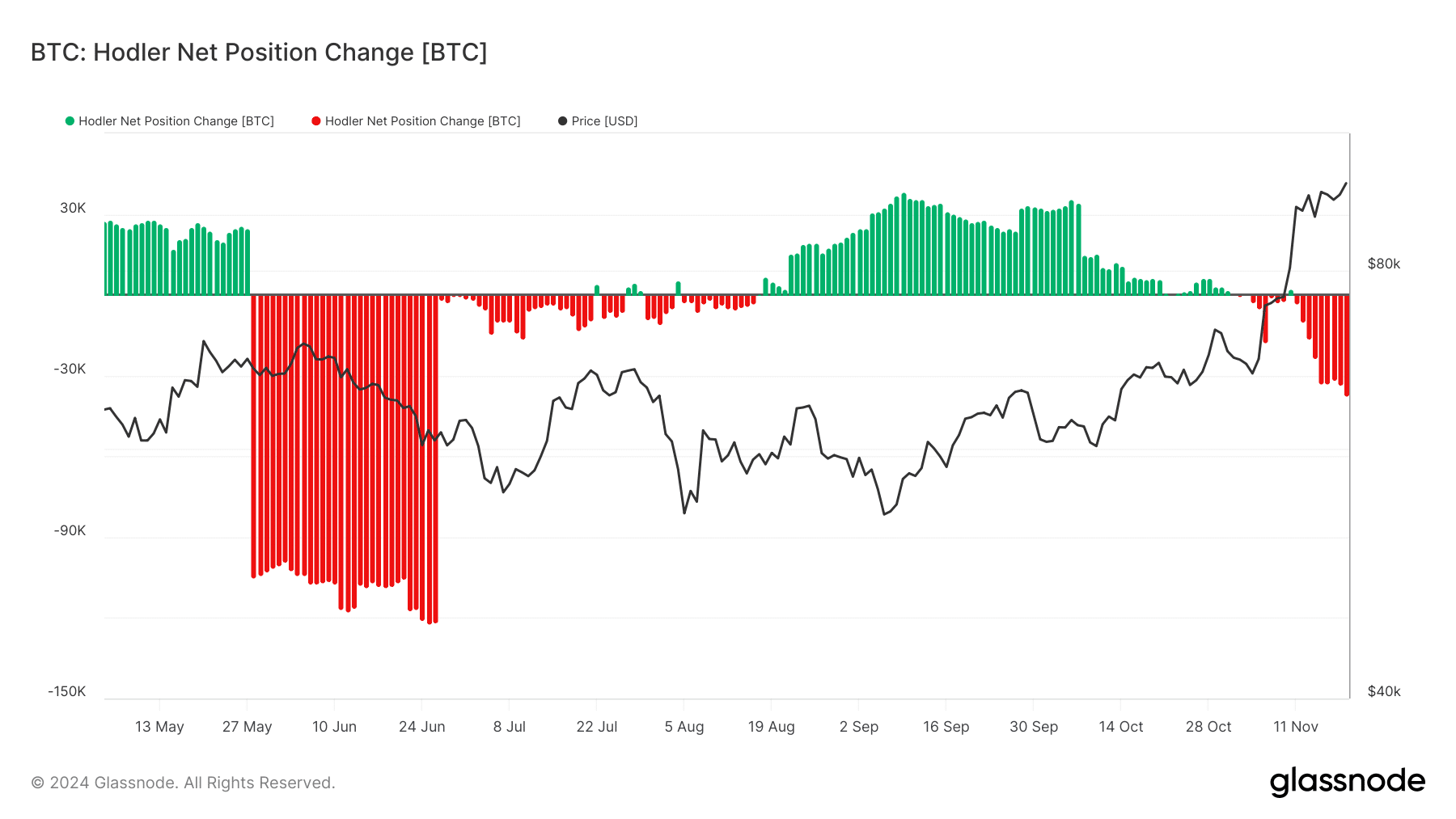

On-chain knowledge indicated that the HODLer Internet Place Change metric has plummeted to its most unfavourable ranges in months, whereas alternate netflows additionally hinted at elevated promoting stress.

This mixture of things has left the market questioning: Is that this the beginning of a deeper correction or a consolidation earlier than additional positive aspects?

Bitcoin slumps: Value motion and technical evaluation

Bitcoin’s value chart highlighted its meteoric rise to $94,000 earlier than retreating to $92,500.

Evaluation by AMBCrypto confirmed that BTC’s value, which began at round $90,000, rose to round $94,105 within the final buying and selling session.

The buying and selling quantity confirmed a major enhance, reflecting heightened exercise throughout the sell-off.

The 50-day shifting common remained above the 200-day shifting common, indicating that the long-term uptrend was nonetheless intact.

Nonetheless, the RSI sat at 76.62, signaling overbought circumstances. This, coupled with the MACD’s weakening momentum, urged that Bitcoin might enter a consolidation section or perhaps a short-term correction.

Assist ranges round $90,000 and $85,000 might be vital to look at, as a breach of those ranges would possibly exacerbate the downturn.

HODLer conduct: Revenue-taking at peak ranges

AMBCrypto’s evaluation of Glassnode’s chart confirmed the HODLer Internet Place Change revealed a major shift in long-term holder conduct.

After months of accumulation (indicated by inexperienced bars), current exercise reveals a pointy transition to distribution (crimson bars).

As of this writing, the HODLer chart has registered its most unfavourable pattern since June. Over 37,000 BTC, valued at over $3.4 billion, has been bought off.

Thus, long-term buyers selected to comprehend earnings as Bitcoin touched its all-time highs.

Such conduct is typical throughout prolonged rallies, the place the attract of report earnings motivates even probably the most steadfast holders to promote.

Traditionally, comparable sell-offs have led to short-term pullbacks earlier than Bitcoin resumed its bullish trajectory.

Alternate netflows spotlight promoting stress

The CryptoQuant chart on Bitcoin’s alternate netflows additional underscored the continued sell-off. A spike in alternate inflows means that holders are shifting their BTC to exchanges, seemingly for liquidation.

AMBCrypto’s evaluation confirmed that the unfavourable stream spiked within the final buying and selling session, with over 8,600 BTC registered. As of this writing, it has remained unfavourable.

Adverse netflows throughout earlier accumulation durations had supported Bitcoin’s value rise, however the current reversal indicators a shift in market sentiment.

If alternate inflows proceed to outpace outflows, it might create sustained promoting stress, making it tough for Bitcoin to get better its all-time excessive within the close to time period.

Nonetheless, a decline in inflows might point out that the majority profit-taking has already occurred.

What’s subsequent after the Bitcoin droop?

After an prolonged rally, Bitcoin’s retreat from $94,000 displays a pure profit-taking section, with long-term holders capitalizing on positive aspects.

The technical and on-chain indicators counsel that whereas the broader pattern stays bullish, the market may very well be poised for consolidation or a short-term correction.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Crucial ranges to look at embrace the $90,000 and $85,000 assist zones and on-chain metrics corresponding to HODLer exercise and alternate netflows.

A reversal in promoting stress or renewed shopping for curiosity might pave the best way for Bitcoin to problem new highs, however for now, warning stays warranted because the market digests these important strikes.