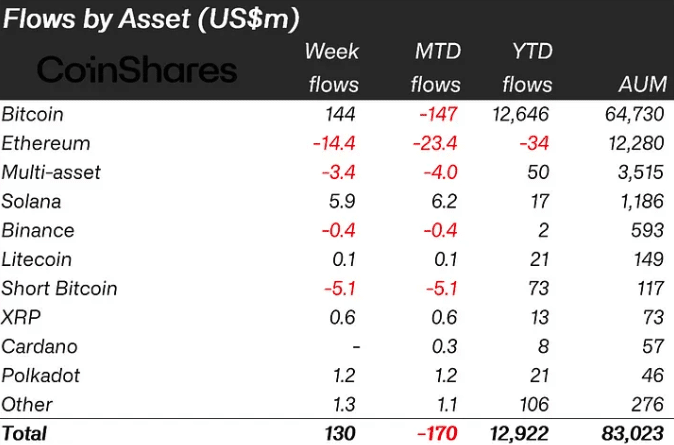

- Bitcoin contributed $144 million to the funding, whereas Solana had $5.9 million.

- Ethereum’s struggles with regulatory uncertainty triggered outflows from its merchandise.

Bitcoin [BTC] funding merchandise have lastly damaged the five-week streak of outflows and attracted $144 million in weekly inflows, in response to a current report by CoinShares.

Each week, the digital asset administration agency launched an in depth about investments in crypto merchandise. For the final 5 weeks, all of them have led to large outflows, regardless of the preliminary sturdy begin to the 12 months.

Quantity falls, capital rises

However final week, the merchandise have been capable of amass inflows totaling $130 million. The report linked the hike to the rising curiosity in crypto merchandise in Hong Kong.

Additionally, ETFs within the U.S. registered low outflows. Nevertheless, Bitcoin was not the one cryptocurrency that ensured the document led to a internet constructive worth.

In response to CoinShares, Solana [SOL] additionally had a hand in it because it registered $5.9 million in inflows. Regardless of the development, the ETP quantity dropped when in comparison with the typical weekly quantity in April.

ETP stands for Alternate Traded Merchandise. In April, the typical quantity was $17 billion. However the metric was not capable of match that final week, because it solely hit $8 billion.

The lower indicated a declining curiosity in interacting with crypto merchandise, with the report noting that,

“These volumes highlight ETP investors are participating less in the crypto ecosystem at present, representing 22% of total volumes on global trusted exchanges relative to 31% last month.”

At press time, Bitcoin’s worth was $62,579. This was a 2.72% improve within the final 24 hours. Solana, however, modified arms at $148.22— a 7.44% improve inside the similar interval.

BTC and SOL are leaving ETH behind

With this worth efficiency, it may very well be potential that committing capital to Bitcoin and Solana-related merchandise was a sensible alternative.

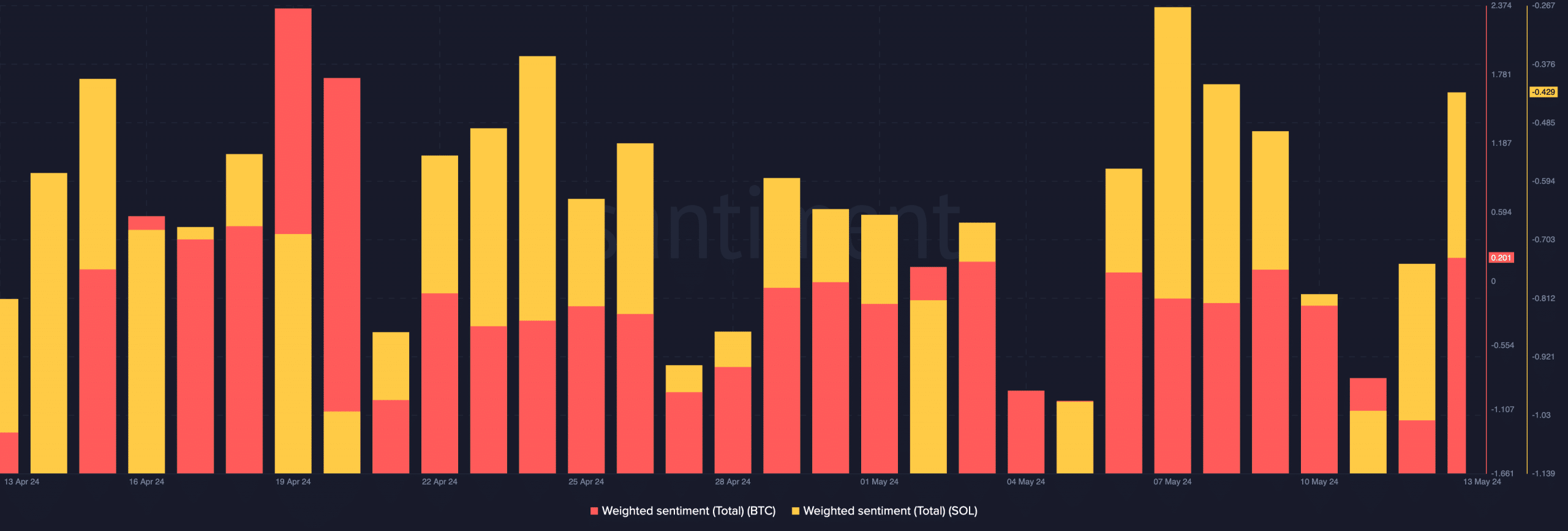

Moreover, it appeared that the market was getting increasingly more assured about BTC and SOL. This was evident from the state of their Weighted Sentiment.

Utilizing Santiment’s on-chain information, AMBCrypto seen that Bitcoin’s Weighted Sentiment was 0.201. This studying implied that feedback concerning the cash have been largely constructive.

For SOL, it was -0.429. Nevertheless, this was a notable enchancment from what the metric was on the twelfth of Could. As such, this was affirmation that the bearish bias round Solana was waning.

In the meantime, Ethereum [ETH] was additionally on the radar. However this time, it was on the dropping finish, contemplating that AMBCrypto reported how the altcoin received extra inflows within the earlier week.

Practical or not, right here’s SOL’s market cap in BTC phrases

Primarily based on the most recent information, Ethereum merchandise had outflows price $14.4 million.

The fading optimism concerning the approval of the Ethereum ETF utility was the main purpose for the decline, with CoinShares explaining that,

“Low interaction by the US regulators with ETF issuer applications for a spot Ethereum ETF has increased speculation that the ETF approval is not imminent, this has been reflected in outflows which totaled US$14m last week.”