Coinspeaker

Bitcoin Surges to $64K, Triggering $100M in Crypto Quick Liquidations

Bitcoin

BTC

$64 774

24h volatility:

3.1%

Market cap:

$1.28 T

Vol. 24h:

$22.90 B

has reclaimed the $64,000 mark, resulting in a big upheaval within the crypto derivatives market. Over the previous 24 hours, quick positions within the crypto market have been liquidated to greater than $100 million as Bitcoin’s value surge caught many merchants off guard.

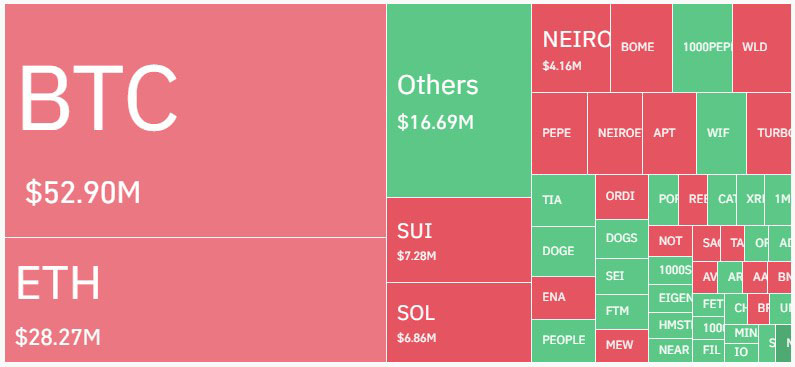

In keeping with knowledge from CoinGlass, over $101.57 million briefly positions have been liquidated throughout the crypto market because of Bitcoin’s sudden value motion. In complete, 54,422 merchants confronted liquidations amounting to greater than $167.18 million. Bitcoin shorts alone accounted for $52.90 million of the day’s complete liquidations, adopted by Ether shorts at $28.27 million.

Supply: Coinglass

Merchants betting in opposition to Bitcoin costs have been significantly hit exhausting, because the speedy ascent left little room for margin calls and compelled liquidations. Bitcoin’s market dominance has additionally seen a notable improve, rising above 58%, which approaches its highest stage since April 2021, in accordance to TradingView.

On October 14, Bitcoin value had risen by 1.90%, reaching $64,040. Buying and selling volumes additionally seen a 52% spike within the final 24 hours. Bitcoin reached $64,173, its highest level in October and the best value it has reached because the finish of September.

Supply: CoinMarketCap

Mt. Gox Delays $9B Asset Return

Bitcoin started its rise on Monday, constructing on a robust comeback from the weekend. Mt. Gox, a crypto trade that’s not energetic, introduced it could wait one other 12 months to return belongings to collectors. This choice helped calm fears of a giant sell-off that might have shaken the market additional. Even with this reduction, Bitcoin and different cryptocurrencies stayed largely regular.

Final week, the individuals in command of Mt. Gox shared their plan to provide again the remaining belongings by October 31, 2025. Virtually $9 billion in stolen tokens, primarily Bitcoin from the 2014 hack, are a part of this plan. Nonetheless, they nonetheless have $2.8 billion price of tokens left, which makes buyers uneasy about the way it would possibly have an effect on Bitcoin’s provide.

Earlier this 12 months, the concept of those belongings being returned prompted Bitcoin costs to drop considerably. The worry of a sudden improve in Bitcoin provide led to vital losses out there. However with Mt. Gox delaying the return, Bitcoin has had an opportunity to get well and attain new heights.

Uptober Surge Continues 9 of Eleven Years

Many analysts are speculating concerning the onset of “Uptober”. Traditionally, October has been a constructive month for Bitcoin, witnessing beneficial properties in 9 of the previous eleven years. This sample has heightened expectations that Bitcoin may proceed its upward momentum all through the month.

Bitcoiner Kyle Chassé shared his optimistic outlook along with his 219,000 followers on X (previously Twitter) on October 14. He acknowledged, “The tides are shifting,” and expressed confidence that the market is coming into considered one of its most “exciting phases.” Chassé additional emphasised:

“The next big rally isn’t just a possibility — it’s a reality waiting to unfold.”

On-chain analyst James Test added his perspective, urging merchants to “Pray for the bears”, highlighting the challenges that bearish merchants would possibly face within the present bullish atmosphere. These sentiments mirror a broader market optimism tempered by warning amongst these positioned in opposition to the upward pattern.

In the meantime, Ethereum has additionally proven power, confirming a breach of the $2,440 stage. The value started the day with a robust rise, reinforcing expectations of a unbroken bullish pattern on each intraday and short-term bases. Technical evaluation signifies that Ethereum has accomplished a double backside sample, with a affirmation line at $2,515.

Bitcoin Surges to $64K, Triggering $100M in Crypto Quick Liquidations