- Bitcoin’s rally to $60,000 was short-lived as concern and uncertainty continued to grip the market.

- Revenue-taking by short-term holders and miner promoting habits urged a insecurity in a bullish reversal.

Bitcoin [BTC] has continued with uneven worth actions after dropping by 2.3% to commerce at $58,740 on the time of writing. The value decline additionally noticed market sentiment shift from “neutral” to “fear.”

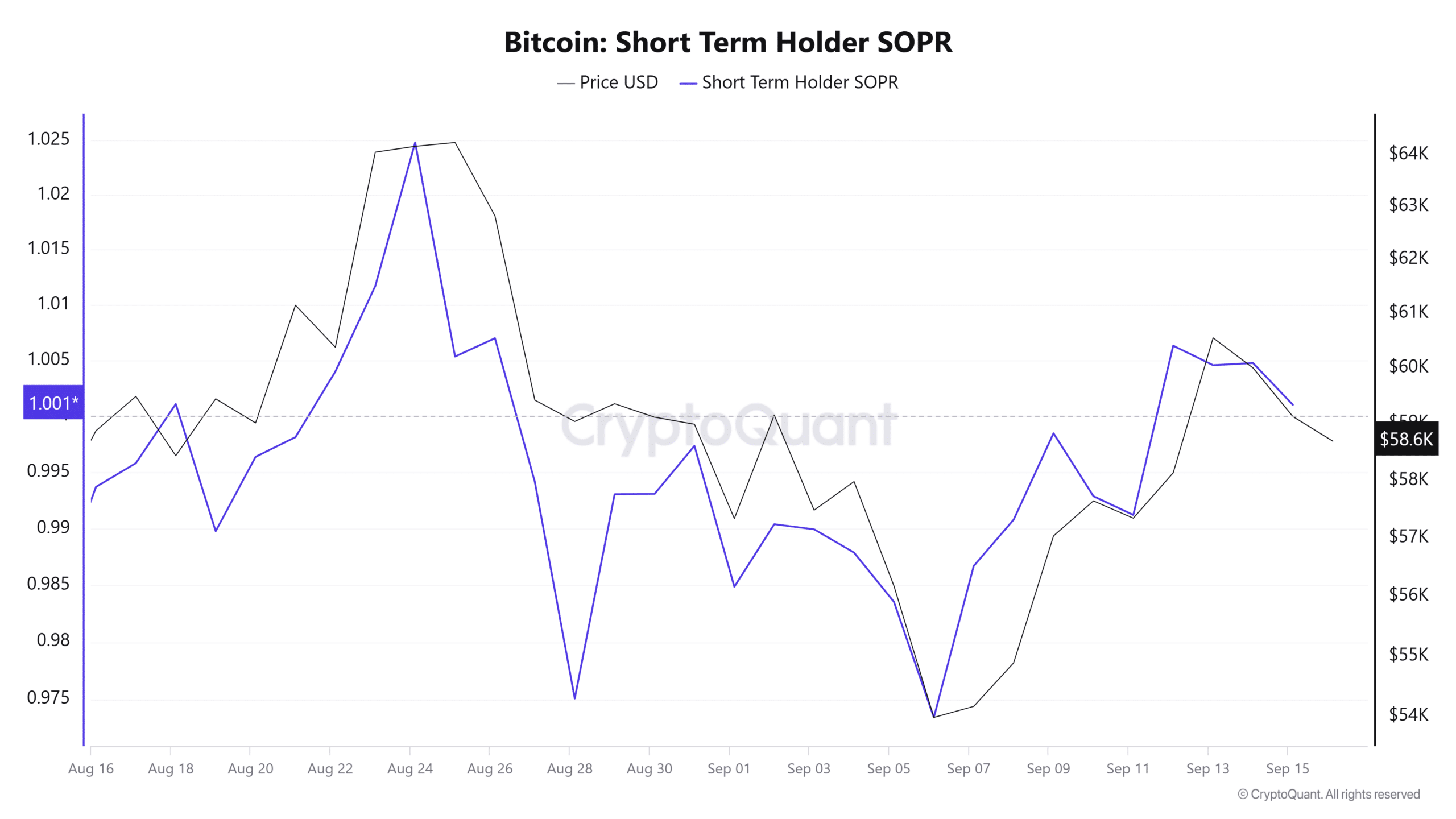

The current surge in BTC’s worth above $60,000 revived market confidence because the short-term holder Spent Output Revenue Ratio (SPOR) broke above 1, in line with CryptoQuant.

Nonetheless, this confidence was short-lived, because the ratio has since dropped to close the break-even level. This indicators lowering revenue margins and the potential of a surge in promoting stress.

As profit-taking habits and concern maintained dominance over Bitcoin, will the costs drop additional or stagnate?

Draw back danger stays elevated

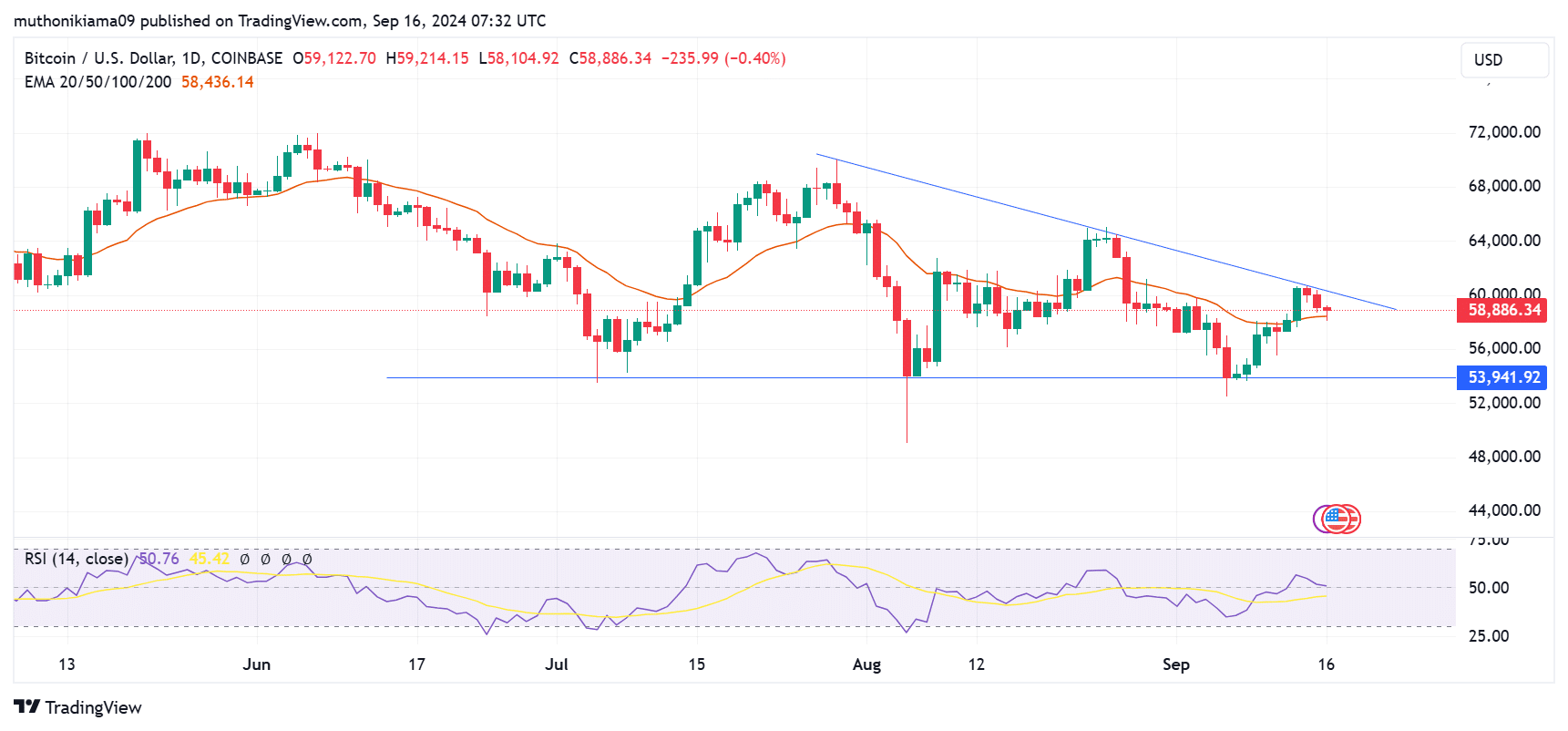

Bitcoin wants to interrupt above a descending trendline to reduce the draw back danger, per a current report by 10x Analysis.

This downtrend appeared on the one-day chart, with BTC going through resistance every time it has tried a breakout.

The failed breakout stems from the dearth of shopping for exercise out there, as seen within the Relative Power Index (RSI) at 50. This metric confirmed a impartial sentiment.

A return of consumers out there may see BTC retake $60,656, which 10x Analysis famous will sign a robust bullish pattern.

Nonetheless, merchants ought to be careful for the 20-day Exponential Shifting Common (EMA). Bitcoin was susceptible to falling beneath this essential level, which may spur additional losses.

Miners are capitulating

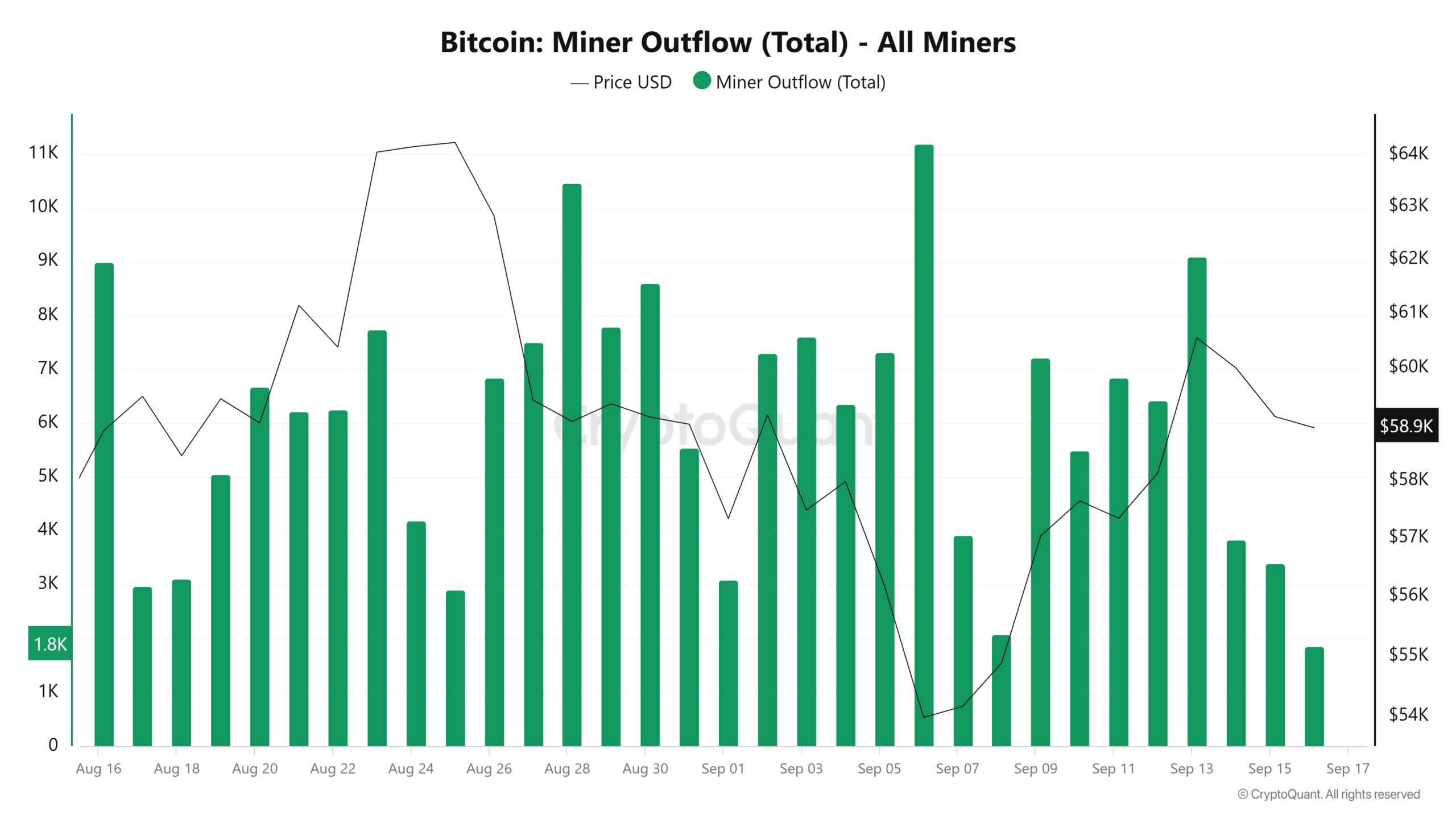

The market uncertainty can be inflicting Bitcoin miners to carry again, as seen within the declining hash fee.

Knowledge from BitInfoCharts confirmed that after Bitcoin’s community hash fee hit document highs above 700 exhashes per second earlier this month, it dropped to 665 EH/s at press time.

This indicated that as miners grew to become much less worthwhile as a result of declining BTC costs, they decreased mining exercise.

Knowledge from CryptoQuant additionally confirmed that over the weekend, as BTC traded at round $60,000, miners despatched 7,230 BTC to exchanges, valued at over $400M.

This knowledge urged miner capitulation, which additionally elevated the draw back danger for BTC.

Do optimistic narratives counsel tailwinds?

The Federal Open Market Committee (FOMC) is predicted to announce an adjustment in rates of interest later this week.

A fee lower is predicted to gasoline positive aspects for danger property like Bitcoin.

Nonetheless, provided that the market is already anticipating the Fed to pivot, the occasion may already be priced in, with the announcement triggering minimal worth modifications.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Furthermore, 59% of buyers anticipate a steeper lower of fifty foundation factors per the CME FedWatch Software.

A big lower may stir issues in regards to the weakening U.S. economic system, which can immediate buyers to desert danger property for safer property comparable to gold.