- Declining profitability for Bitcoin’s short-term holders signaled potential worth corrections.

- BTC has surged by 6.08% over the previous week as consumers regained the market.

Because the begin of 2025, Bitcoin [BTC] has proven sturdy resilience, reclaiming $99k ranges. Over this era, BTC has surged from $92768 to $99857.

Regardless of the latest worth upsurge, analyst have shared their issues with BTC’s present market situations. Inasmuch, CryptoQuant analysts have instructed a possible correction, citing declining profitability amongst short-term holders.

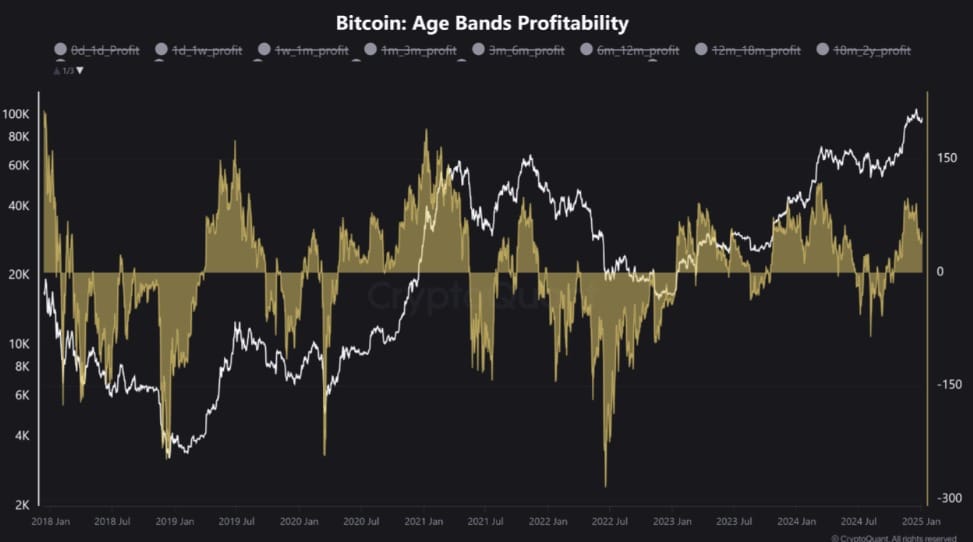

Bitcoin’s short-term holders’ profitability decline

Analyst Crazzy Block noticed that Bitcoin’s short-term holders had been seeing their profitability drop.

The next failure to reclaim BTC’s $108K ATH brought on the profitability margin for STHs to say no considerably.

When profitability for STH drops, it alerts weakening market demand and rising bearish sentiment over the quick and medium time period.

Such a drop in demand suggests an elevated chance of worth correction. So, short-term corrections are inevitable, whereas Bitcoin has large potential for long-term development.

Influence on BTC charts?

Whereas short-term holder’s profitability has diminished with Bitcoin buying and selling beneath $100k, the market appears positioned for extra positive factors within the quick time period.

Due to this fact, different market indicators counsel that bulls are trying to drive costs up and an enormous market correction appears unlikely, particularly within the quick time period.

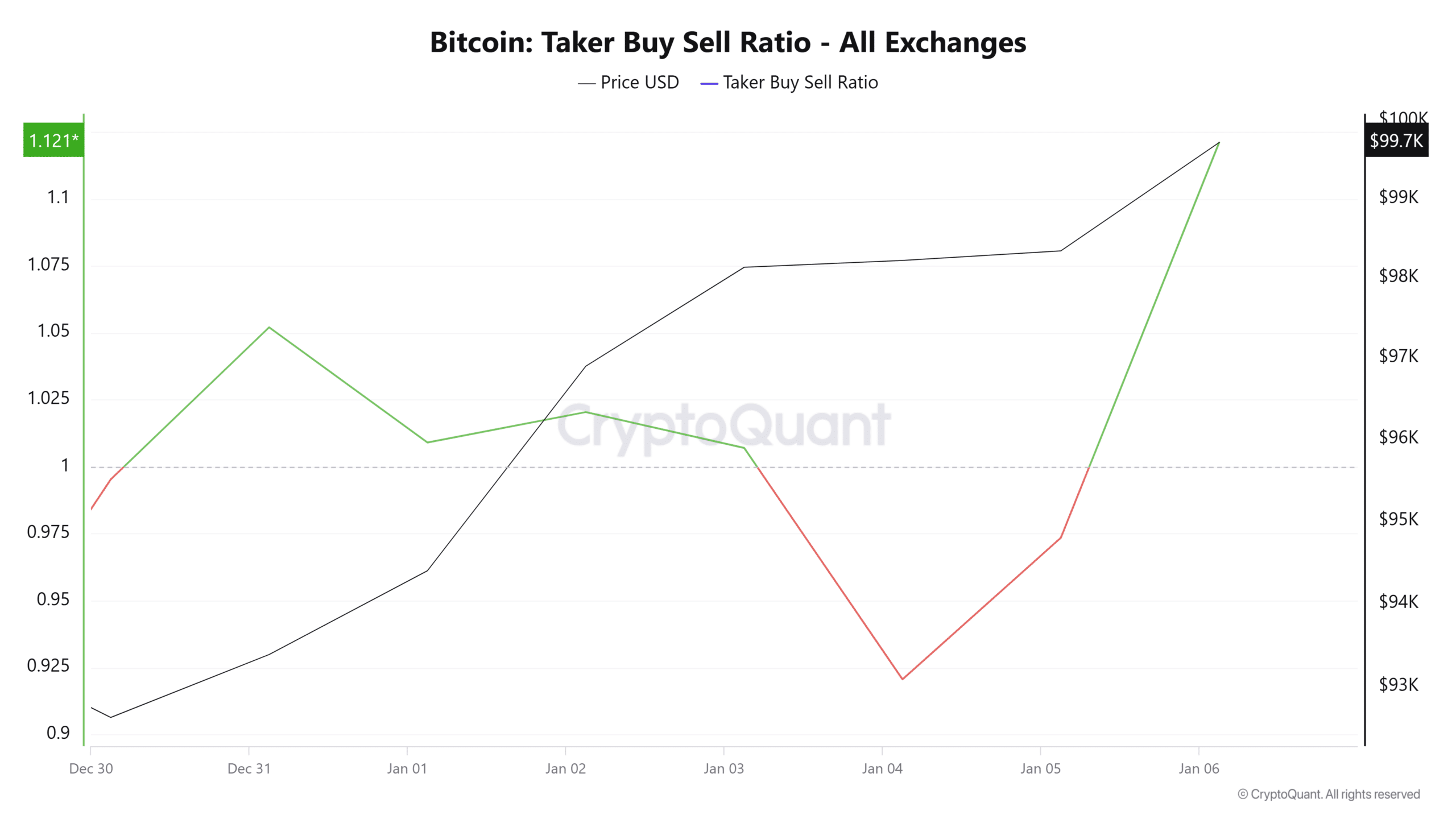

For instance, Bitcoin’s Taker buy-sell ratio has surged over the previous 48 hours to achieve 1.121. With a ratio above 1, it means that BTC experiencing aggressive shopping for actions, with consumers outpacing sellers.

This displays bullish sentiment as short-term momentum in direction of the upside, with consumers dominating the market.

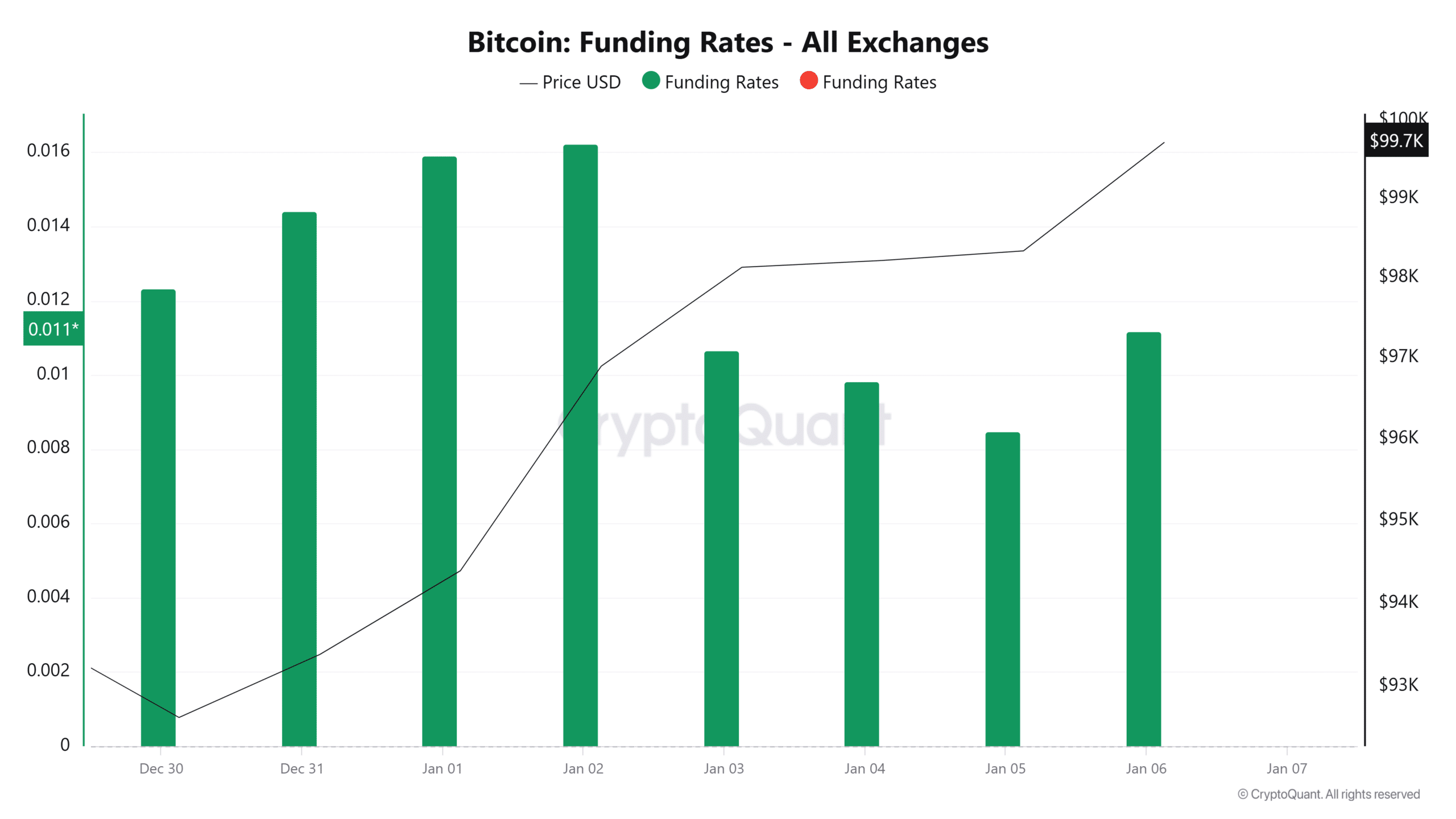

Moreover, Bitcoin’s Funding Price surged over the previous day from 0.0084 to 0.0124. When the Funding Price rises, it exhibits that extra merchants are bullish and are opening lengthy positions.

A requirement for lengthy positions displays market confidence, with traders anticipating BTC costs to rise.

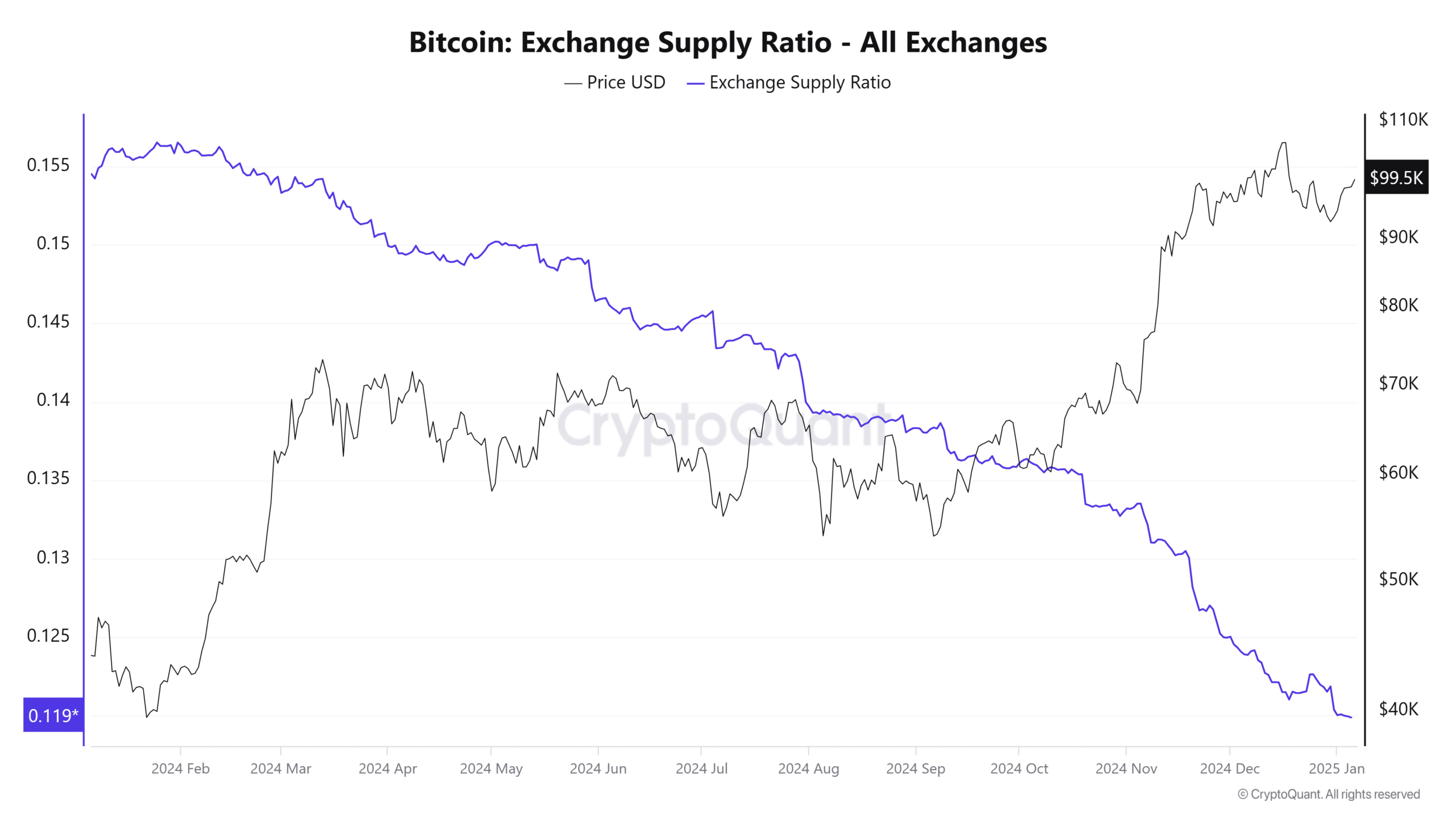

Lastly, Bitcoin’s Alternate provide ratio has declined to hit a yearly low.

With a dip in provide to exchanges, it implies that traders are accumulating BTC by transferring to personal wallets, anticipating costs to rise additional.

Merely put, though short-term holder’s profitability has declined, the market nonetheless appears sturdy, particularly within the quick time period.

Due to this fact, this diminished profitability is but to sign short-term market correction as traders are nonetheless bullish.

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

With bullish sentiments nonetheless prevailing available in the market and consumers regaining management, we might see BTC reclaim $100k and surge to $102,777.

Consequently, if the anticipated correction happens, Bitcoin will drop to $95000.