- U.S. BTC reserve uncertainty capped BTC’s current upswing.

- Choices market urged prolonged value swings for the following 48 hours.

Bitcoin [BTC] recorded gappy strikes throughout the inauguration day, tapping a brand new excessive of $109.5K earlier than reversing to $100K.

The market appeared cautiously optimistic post-inauguration, with BTC Choices analyst Tony Stewart flagging anticipated volatility for the January twenty first expiry. He acknowledged,

“BTC 21st Jan expiry in 12 hours still pricing 100%. Indicates that the inauguration speech wasn’t the focal point. Market is still cautious of/expecting volatility.”

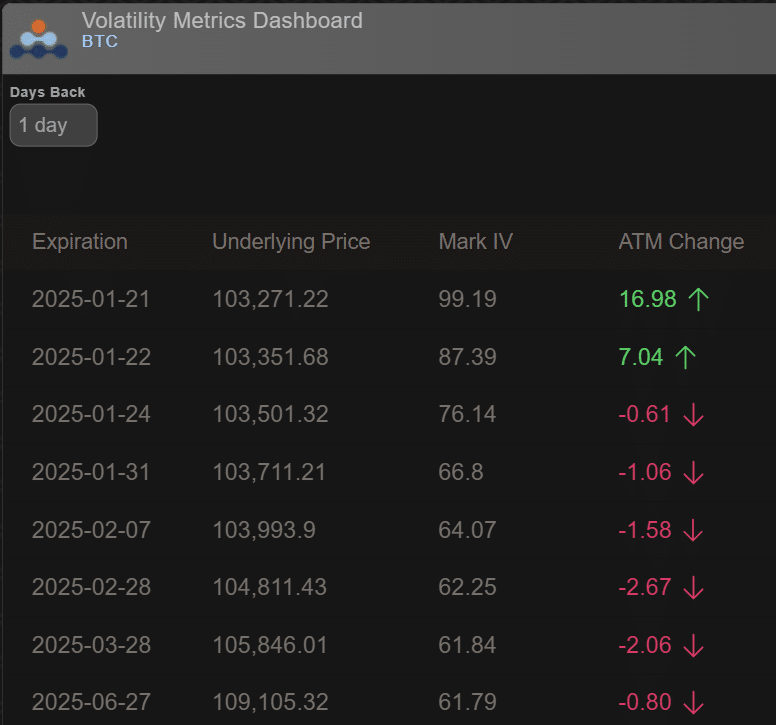

The hooked up chart indicated that the Mark IV (Implied Volatility) was almost 100% for the twenty first of January Possibility expiry. This revealed elevated uncertainty and potential value swings after the inauguration occasion.

On the time of writing, nonetheless, the IV had dropped to 71%, whereas Wednesday Choices expiry had the best IV at 77%. This signaled anticipated potential value swings within the subsequent 48 hours.

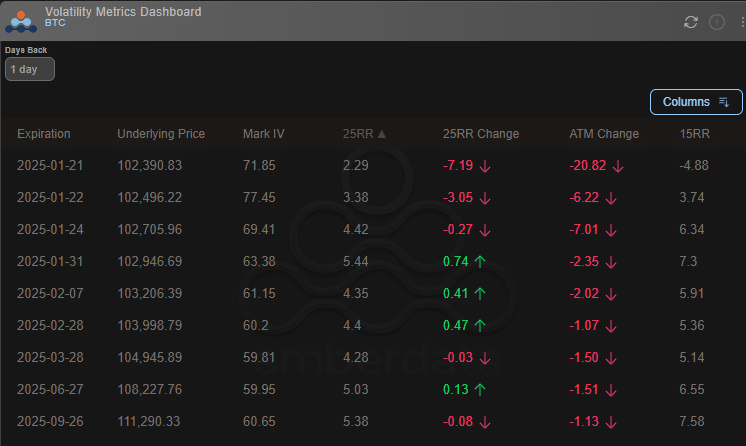

It’s price mentioning that regardless of the uncertainty, there was a premium for name choices (bullish bets), as indicated by the constructive 25-Delta Threat Reversal (25RR).

U.S. Bitcoin reserve uncertainty

Maybe the market jitters had been triggered by crypto lacking from President Trump’s first-day government orders.

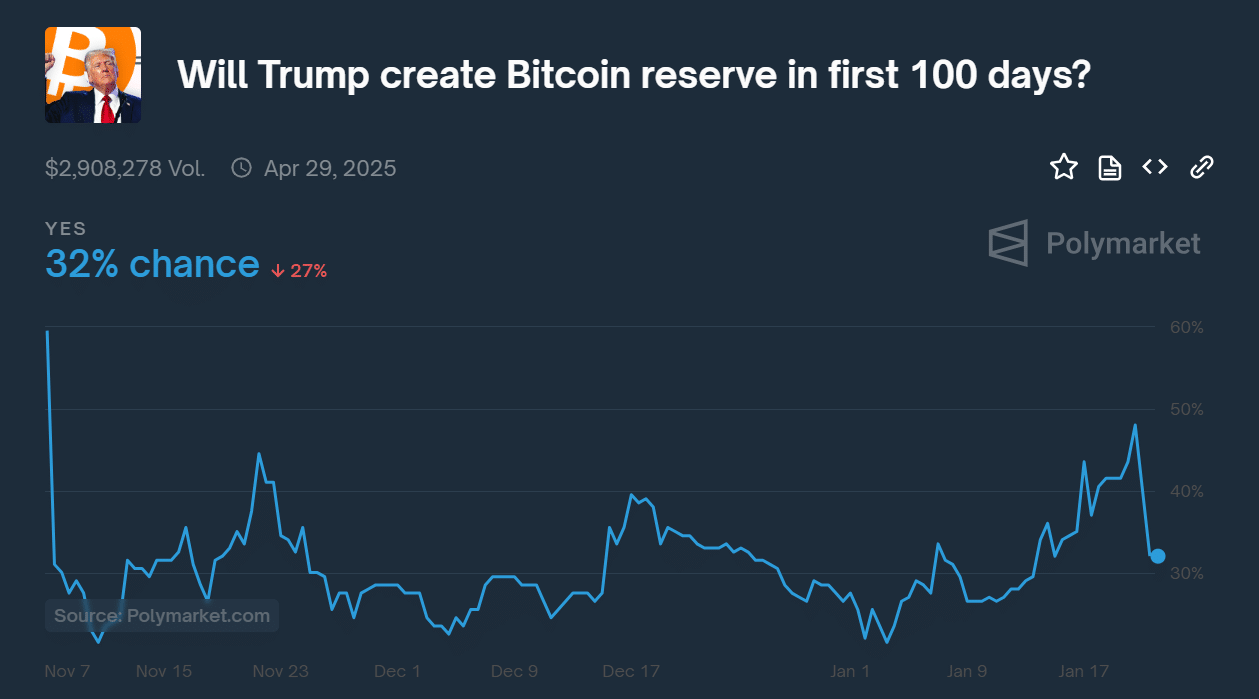

Simply hours earlier than the occasion, Polymarket’s odds of U.S. BTC reserve within the first 100 days shot to 48%, driving BTC’s value to a report excessive of $109K.

Nevertheless, the probabilities dropped to 32% afterward because it turned clear that crypto was not a precedence, at the least on the primary day in workplace.

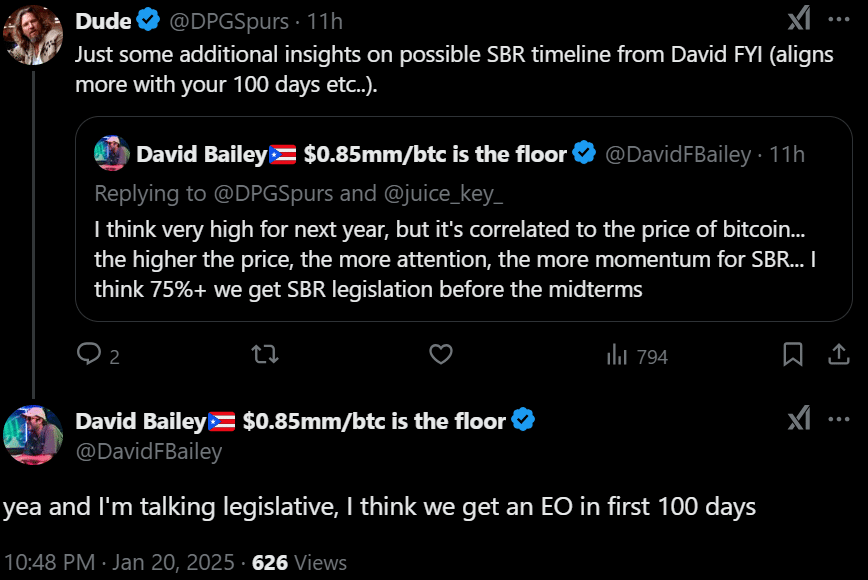

One of many insiders, Bitcoin Journal’s David Bailey, speculated that an government order for a Strategic Bitcoin Reserve (SBR) could possibly be possible inside 100 days. Nonetheless, based on him, the legislative framework might lengthen till the mid-term elections.

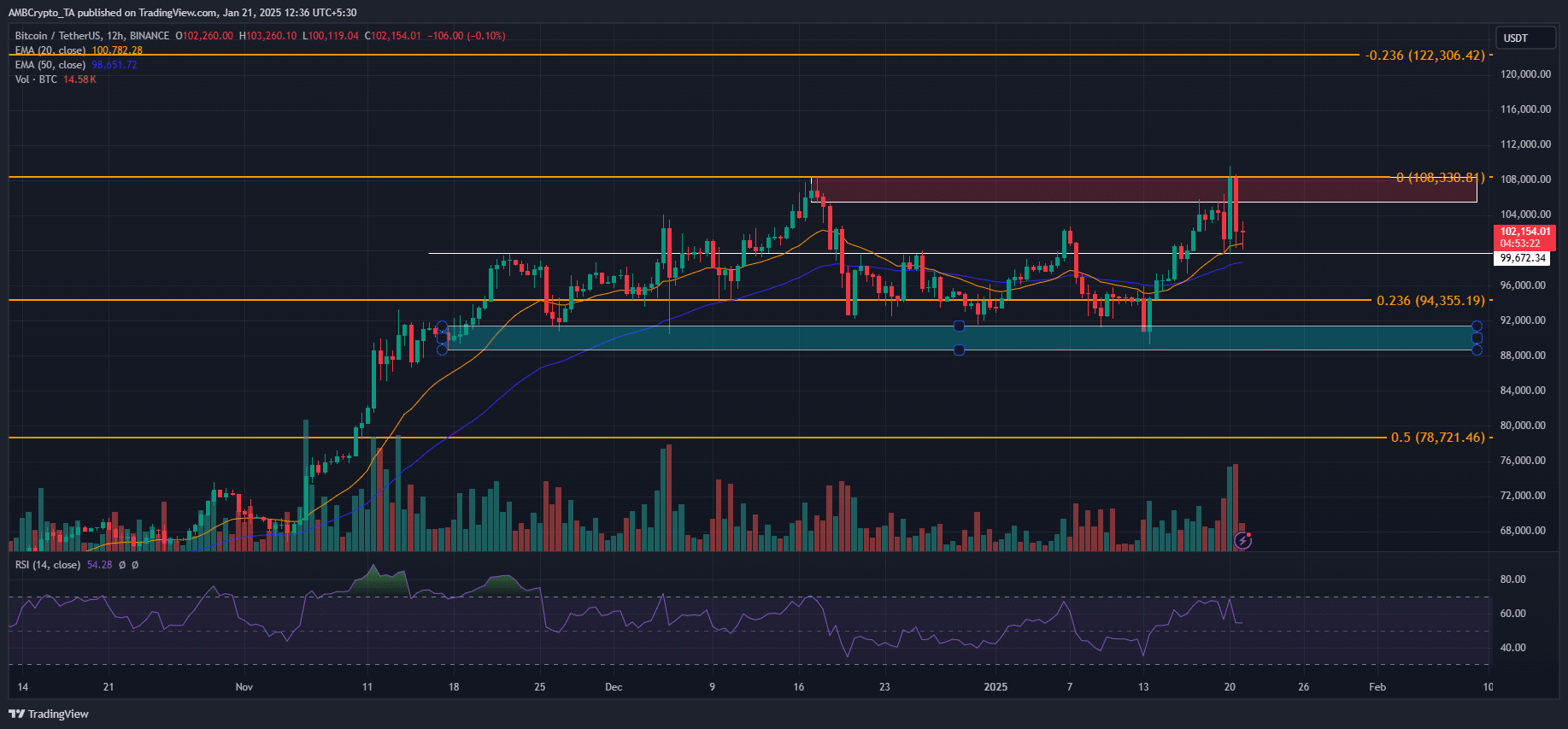

The BTC value dropped under $108K however remained above key transferring averages close to $100K, signaling energy regardless of U.S. SBR uncertainty. A breach under the averages might drag BTC to $94K or range-lows at $90K.

Nevertheless, a robust upswing might make $120K reachable, particularly with constructive updates on U.S. SBR prospects.