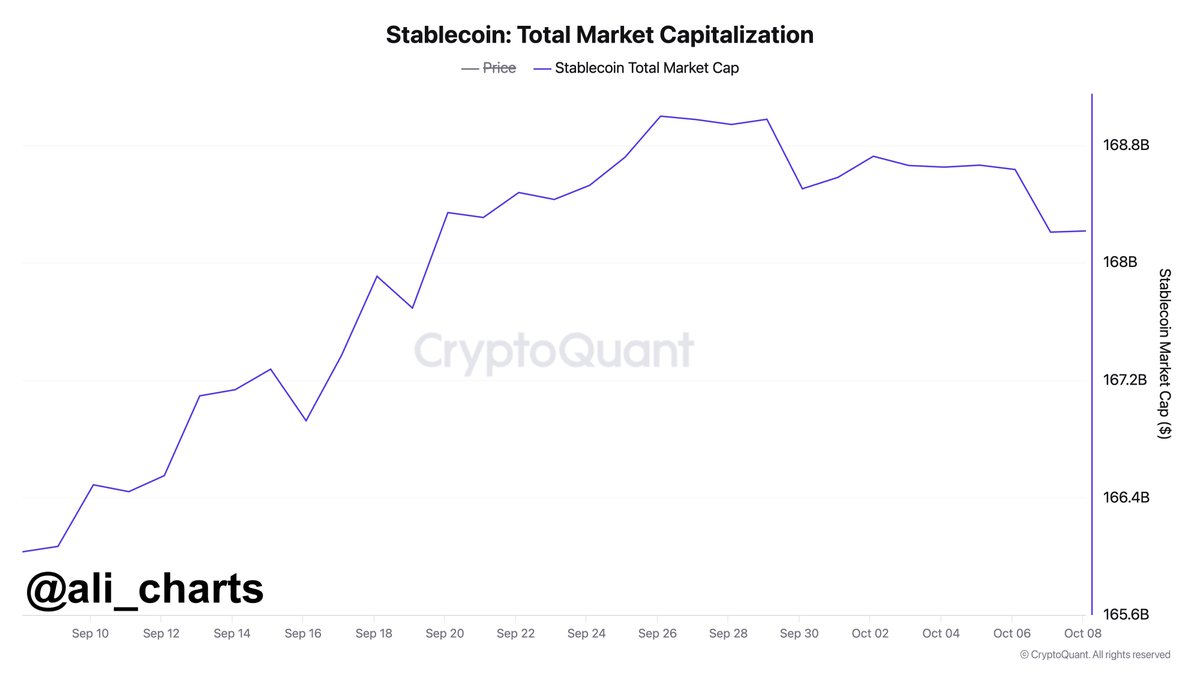

- Bitcoin could also be affected by the drop in stablecoins’ market cap

- RSI signalled potential reversal, regardless of BTC’s value declining on the charts

Bitcoin (BTC) has recorded important value fluctuations just lately, fueling combined reactions within the crypto market. In gentle of such volatility, it’s price stablecoins. This asset class performs a vital position in cryptocurrency buying and selling, offering liquidity and publicity to the market.

Nevertheless, the latest $780 million drop in stablecoins’ market capitalization could also be an indication of decreased shopping for energy. This decline may result in weaker demand for cryptocurrencies, doubtlessly inflicting value stagnation or additional declines.

Bitcoin, because the market’s main crypto, is anticipated to be closely affected, presumably getting into an prolonged accumulation interval or persevering with its ongoing downtrend.

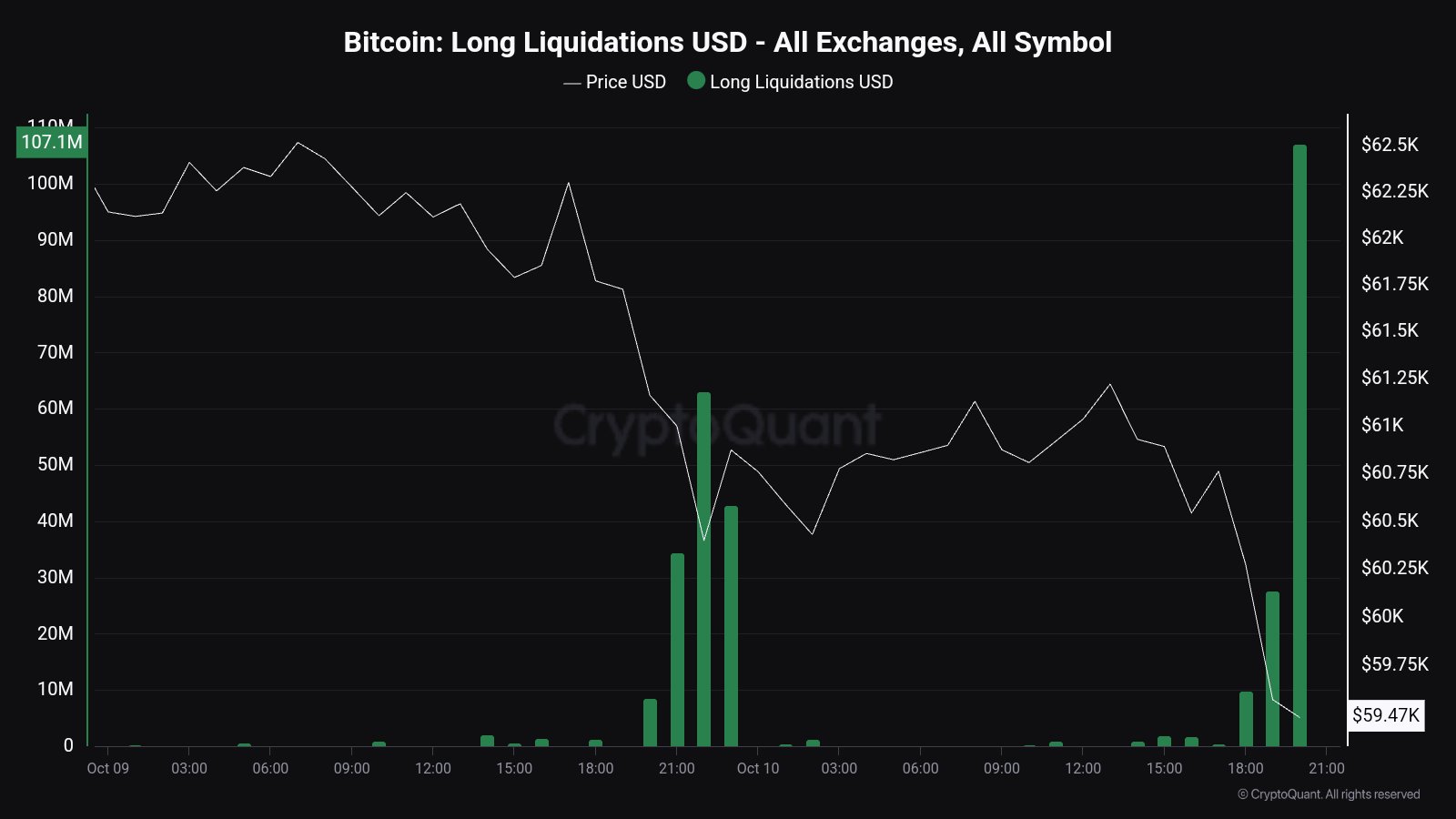

Declining value amidst liquidations

Analyzing the value motion of BTC/USDT on the 2-hour timeframe revealed that Bitcoin has already tapped into liquidity on the $59.5k–$60k vary, even dropping under $59.5k.

Whereas there’s hope for a reversal, if one doesn’t happen, BTC may drop additional, doubtlessly testing $55k or decrease ranges.

Though this correction may not be extensively anticipated, the drop in stablecoins’ market cap means that weaker demand may drive Bitcoin decrease earlier than any reversal.

The chance of BTC dropping to $55k is quite excessive because it has damaged under crucial assist ranges, together with the 100 Day Shifting Common (DMA).

This indicator has acted as each assist and resistance in latest months when BTC has been in a variety. Breaking under it’s a signal of bearish momentum.

Moreover, Bitcoin additionally dipped beneath the 200 Exponential Shifting Common (EMA), additional supporting the case for sustained draw back strain. Throughout this decline, over $107 million price of BTC longs had been liquidated when the value dropped under $59.5k.

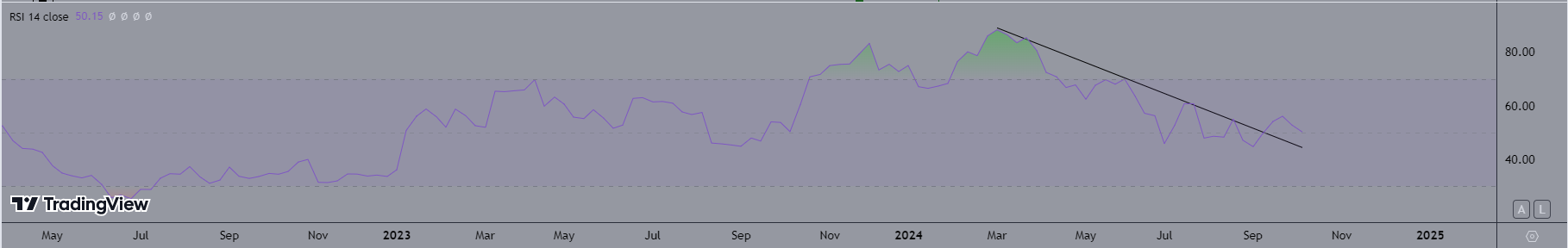

BTC’s RSI breaks above trendline

Regardless of these bearish indicators, there should still be a glimmer of hope for a BTC restoration earlier than the 12 months ends.

Bitcoin’s Relative Energy Index (RSI) broke out of a 200-day downtrend. It gave the impression to be retesting this breakout stage at press time.

If BTC manages to carry above this pattern line, it may sign a reversal and supply some reduction for merchants and traders who’re anticipating a long-term uptrend for Bitcoin.

Supply: TradingView

Staying forward of those market strikes is essential, particularly as Bitcoin’s value stays at a pivotal level.

Whereas additional declines are attainable, the potential for a reversal can also be current, making this a crucial time for merchants and traders to look at BTC intently.