- Quantity of enormous transactions by whales and traders surged by 7.85%, indicating a bullish outlook

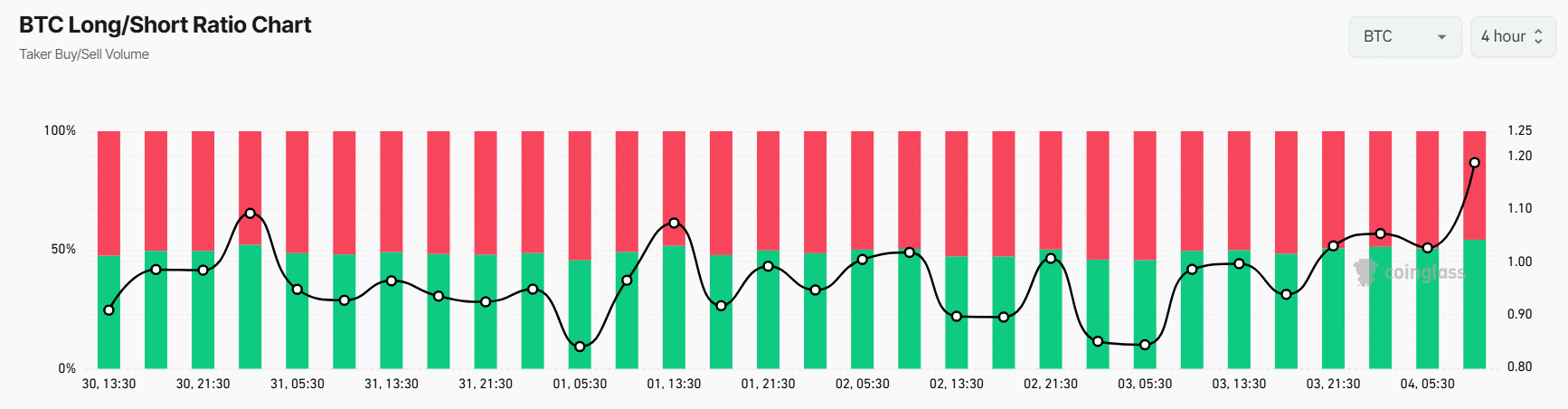

- At press time, 55% of high BTC merchants have been holding lengthy positions, whereas 45% held brief positions

Bitcoin (BTC), the world’s largest cryptocurrency by market cap, is poised for an upside rally after recording an 8% value decline in latest days.

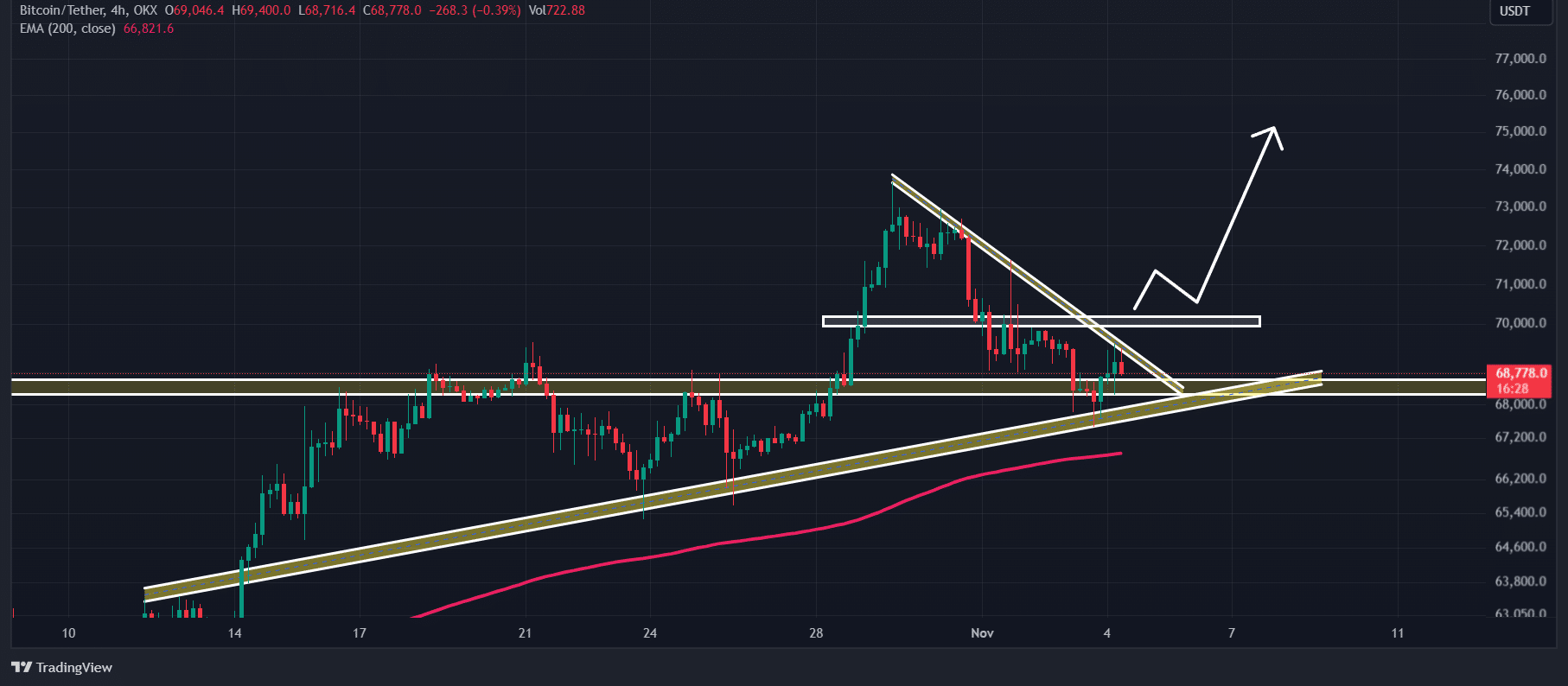

Following a breakout from the descending channel sample on 28 October, BTC soared by greater than 8%. Nevertheless, the most-recent decline seems to be a value correction – A optimistic signal for the upcoming rally.

Bitcoin value evaluation and key ranges

In accordance with AMBCrypto’s technical evaluation, the cryptocurrency appeared to be going through resistance from a declining trendline on the four-hour timeframe. If Bitcoin does register an upside rally, there’s a excessive likelihood that the asset may breach this aforementioned hurdle.

If BTC breaches this trendline and closes a four-hour candle above $70,000, there’s a robust chance the asset may soar considerably. Doubtlessly to hit a brand new all-time excessive within the coming days.

Nevertheless, this bullish thesis will solely work if Bitcoin maintains assist above the $67,500-level. In any other case, it could fail.

On the time of writing, BTC appeared to be buying and selling above its 200 Exponential Transferring Common (EMA) on each the four-hour and each day timeframes, indicating an uptrend.

BTC’s bullish on-chain metrics

Taking a look at this bullish outlook, it appeared that whales and traders have elevated their participation. In accordance with the on-chain analytics agency IntoTheBlock, BTC’s massive transaction quantity surged by 7.85% over the previous 24 hours. This might assist drive the asset’s value greater.

Moreover, BTC’s Lengthy/Quick ratio had a worth of 1.20, underlining robust bullish sentiment amongst merchants. In the meantime, its Open Curiosity rose by 2.9% over the past 24 hours, indicating rising curiosity and the formation of recent positions from merchants.

Primarily based on an evaluation of Coinglass knowledge, 55% of high merchants held lengthy positions, whereas 45% held brief positions.

Value efficiency

At press time, Bitcoin was valued at $69,100, after appreciating by practically 1.1% over the past 24 hours. Throughout the identical interval, its buying and selling quantity skyrocketed by 45%, indicating heightened participation from merchants and traders.