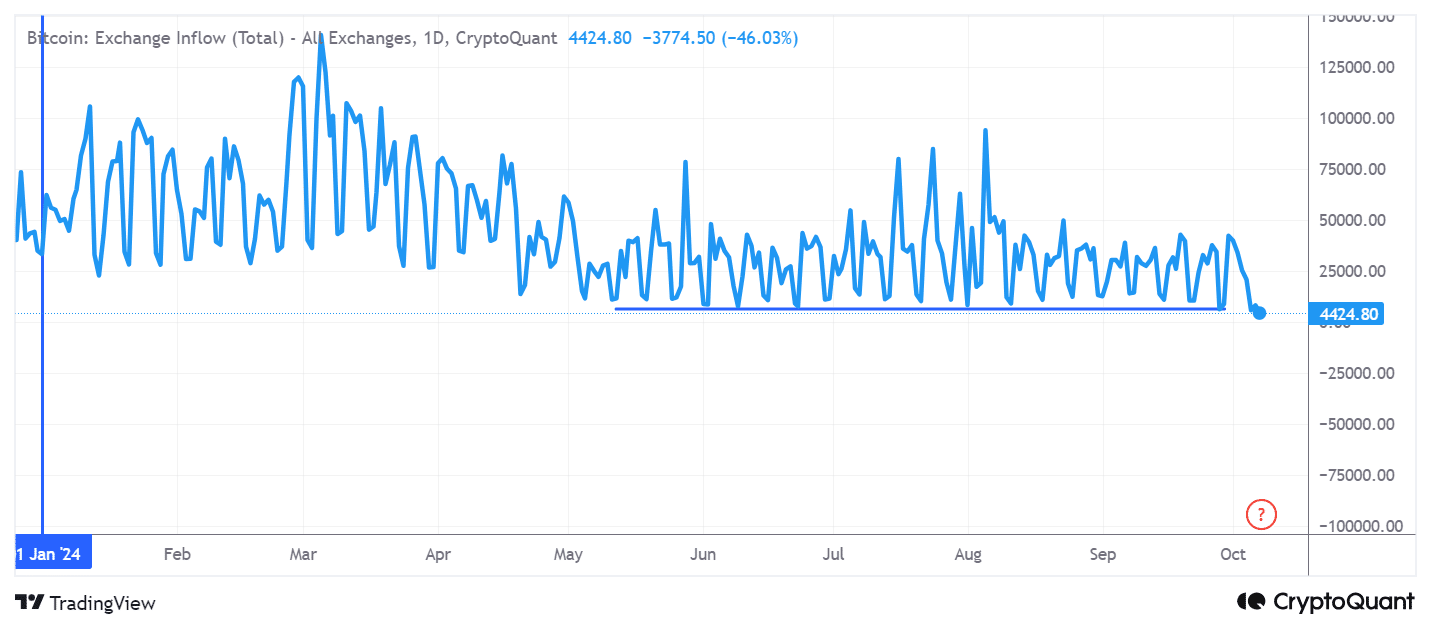

- Bitcoin trade inflows had been declining.

- China liquidity can propel BTC to $77K.

Bitcoin [BTC] continues to attract consideration from traders, together with conventional finance establishments, who’re more and more seeking to Bitcoin as a long-term retailer of worth.

In contrast to in earlier cycles the place Bitcoin was regularly traded for short-term income, a lot of it’s now saved in chilly wallets, signaling sturdy investor confidence.

The start of This autumn has seen Bitcoin trade inflows hit their lowest ranges of the yr, indicating that traders and establishments are anticipating long-term positive aspects for BTC as its market cap continues to develop with widespread adoption.

China liquidity stimulus

Chinese language shares are outperforming international markets, largely because of a authorities stimulus package deal that has injected important liquidity.

This surge in liquidity is impacting risk-on belongings like BTC, which has traditionally proven a robust correlation with Chinese language inventory efficiency.

Following the Individuals’s Financial institution of China’s largest stimulus for the reason that pandemic in late September, Chinese language web shares have soared by $2 trillion.

Many merchants view this surge in Chinese language shares as a possible sign for the same upward motion in Bitcoin. This reinforces why BTC has seen lowered trade inflows setting the stage for larger costs.

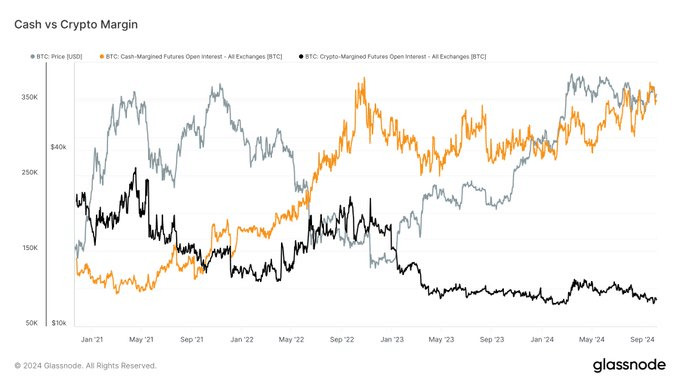

Along with the liquidity stimulus, final week noticed the most important divergence between crypto and cash-margined Bitcoin futures open curiosity.

Extra merchants are actually utilizing money to again their leveraged positions, quite than Bitcoin itself. This shift is a constructive, as money margins scale back volatility and the danger of pressured liquidations, making a extra secure buying and selling atmosphere.

In the meantime, retail merchants proceed to chase high-leverage positive aspects, contributing to the market’s volatility.

This divergence between institutional warning and retail enthusiasm highlights a maturing Bitcoin market. Now, long-term sustainable development is more and more pushed by institutional exercise.

Can BTC attain $77K?

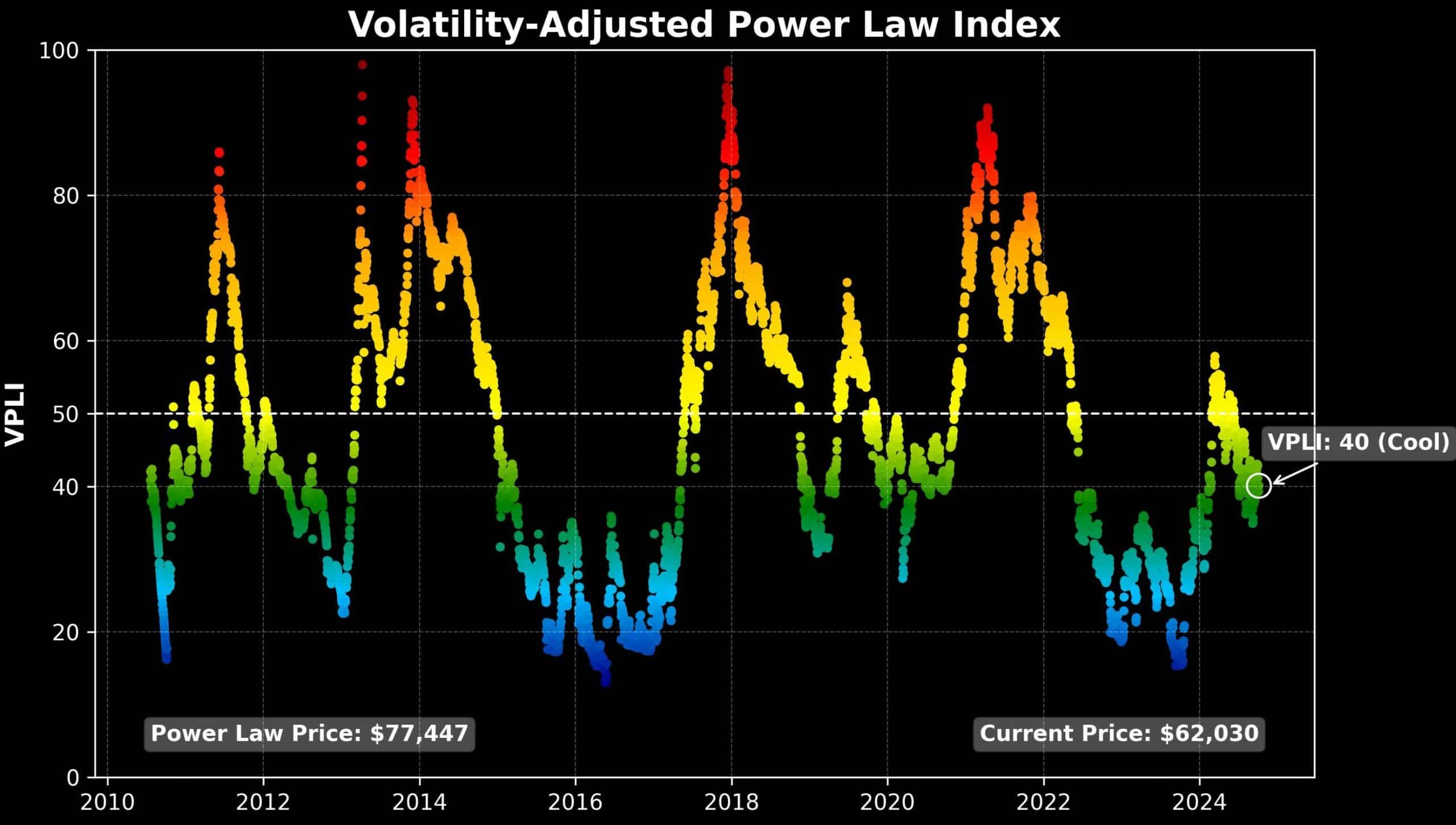

The Volatility Adjusted Energy Regulation Index initiatives BTC’s truthful value at $77K, contemplating long-term development and volatility. Regardless of value consolidation round $60K, the truthful value has risen from $70K to $77K up to now month.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Rising liquidity from China’s stimulus and lowered futures market volatility counsel Bitcoin is gaining momentum for a breakout. Bitcoin seems prepared to interrupt larger, with potential to succeed in $77K as This autumn progresses.

Supply: Sina/X

With international liquidity surging, BTC reaching $77K appears extra life like. That is very true if financial situations and institutional help drive development.