Coinspeaker

Bitcoin Value Prediction 2025: Will BTC Hit $1,000,000?

Bitcoin has kicked off 2024 with spectacular momentum, capturing the eye of crypto fanatics worldwide. As of October 30, BTC

BTC

$72 245

24h volatility:

1.5%

Market cap:

$1.43 T

Vol. 24h:

$46.43 B

is valued at $72,400, boasting a market capitalization of $1.33 trillion. That marks a 1.80% enhance within the final 24 hours, a 7.70% rise over the previous week, and a considerable 12% climb within the final month, in accordance to TradingView.

Supply: TradingView

The main cryptocurrency has weathered a difficult yr, shedding round 65% of its market worth. Occasions just like the Terra Luna crash, the decline of FTX, macroeconomic pressures, and authorized points surrounding Binance contributed to this downturn. Regardless of these setbacks, Bitcoin demonstrated resilience by recovering considerably in the direction of the tip of the yr.

Bitcoin’s File Highs and Resilient Market Tendencies in 2024

In March 2024, Bitcoin shattered its earlier all-time excessive of $69,170, reaching $70,083 on the eighth. Simply six days later, on March 14, it surged additional to $73,750. This spike pushed Bitcoin’s market capitalization to $1.44 trillion, contributing to a complete crypto market cap of $2.77 trillion. Such development highlights Bitcoin’s sturdy efficiency amidst a recovering market.

Following these peaks, Bitcoin skilled a bearish development after crossing the $31,000 mark, dipping under $30,000 for a lot of the previous yr. Nevertheless, the latter months noticed a exceptional restoration, with BTC growing roughly 140.82% over the yr. By mid-October, it was buying and selling at $67,129, with the worldwide cryptocurrency market valued at $2.3 trillion.

Cryptocurrency consultants stay optimistic that sustaining a $30,000 stage may facilitate additional restoration. In April 2023, Bitcoin touched the essential $30,000 resistance for the primary time since June 2022 earlier than dropping under $26,000. It later surged to $45,203 post-Could 2022.

Specialists imagine that sustaining above $45,000 may see Bitcoin attain $60,000 by the tip of 2024. In the course of the first quarter of the yr, BTC reached $73,750, setting a brand new all-time excessive.

Investor warning stays excessive on account of previous volatility. India’s regulatory stance has been agency, with the federal government classifying all crypto transactions beneath the Prevention of Cash Laundering Act (PMLA). The Union Finance Ministry of India declared that digital asset transactions fall inside PMLA’s scope. Whereas this transfer might sound restrictive, the crypto business views it as a step in the direction of vital regulation, making certain higher oversight and decreasing discrepancies.

Spot Bitcoin ETFs have performed an important position in Bitcoin’s development. The SEC’s approval of those ETFs within the US sparked vital curiosity from retail buyers, pushing Bitcoin past its earlier highs.

By the tip of September, following a 50 foundation level fee reduce by the US Federal Reserve and regular charges from the Financial institution of Japan, BTC was buying and selling round $67,000. Bitcoin noticed a 3% rise shortly after these central financial institution bulletins.

Bitcoin’s 2024 Halving Spurs Accumulation

2024 marked Bitcoin’s fourth halving occasion on April 20, decreasing miner rewards to three.125 BTC. Historically, halving occasions are constructive for Bitcoin’s worth on account of decreased provide. Nevertheless, this yr’s halving didn’t set off the anticipated surge, and Bitcoin has since confronted a downtrend. Traditionally, halvings have supplied long-term bullish momentum, reinforcing Bitcoin’s deflationary nature and restricted provide.

Giant buyers, or “Bitcoin Whales”, have begun accumulating Bitcoin once more. As of October 2024, whales maintain 248.60K BTC, in response to CoinMarketCap information. This accumulation is more likely to help Bitcoin worth, contributing to its upward trajectory. With roughly 19.74 million BTC in circulation, the provision stays constrained, additional enhancing Bitcoin’s worth proposition.

Sathvik Vishwanath, CEO of Unocoin, highlights Bitcoin’s cyclical nature and historic developments, suggesting potential year-end development. He notes common features of 26% in October, 36% in November, and 11% in December based mostly on previous efficiency. Vishwanath provides that “lower interest rates drive investors to high-growth assets like BTC, which benefit from a weaker US dollar”.

Whereas previous efficiency isn’t any assure, Bitcoin’s fundamentals stay sturdy, making long-term appreciation probably. Volatility could persist, however Bitcoin under $100,000 will probably be historical past quickly.” As of October 30, BTC stands at $72,400 with a market cap of $1.43 trillion. The halving occasion, accomplished at block peak 840,000, continues to affect Bitcoin’s financial coverage by limiting provide development.

What Specialists Say about Bitcoin’s Future

Himanshu Maradiya, the founding father of CIFDAQ Blockchain, acknowledges the bold nature of predicting Bitcoin to achieve $1,000,000 by 2025. He states:

“While predicting Bitcoin will reach $1,000,000 by 2025 might seem overly optimistic, several factors make such a scenario plausible — the increasing adoption of Bitcoin, various countries approving BTC ETF, the weakening of traditional fiat currencies due to hyperinflation, and the rising profitability for BTC miners are key drivers that could significantly boost its value.”

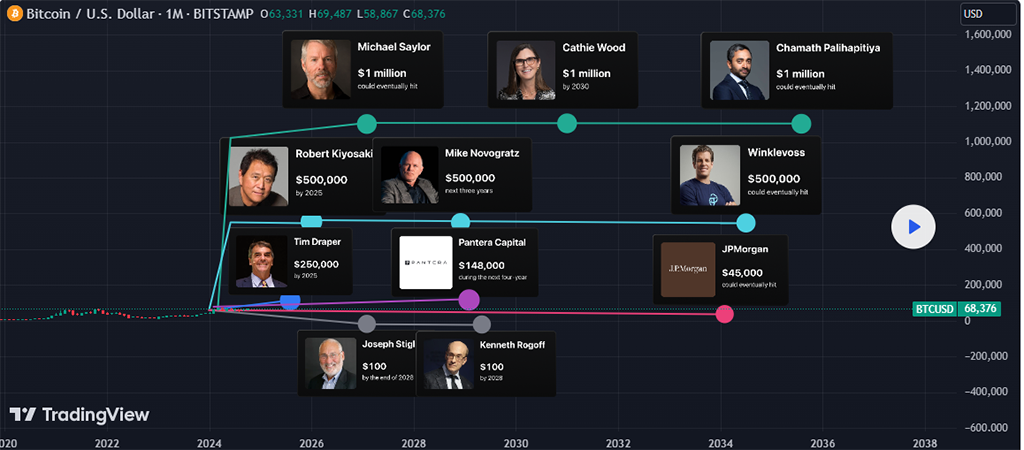

Equally, MicroStrategy CEO Michael Saylor, a robust advocate for Bitcoin, asserts a $1 million valuation is probably going, positioning it as a superior retailer of worth in comparison with fiat currencies and even gold. He emphasizes Bitcoin’s unmatched stability in preserving wealth, significantly in unsure financial climates, which reinforces its enchantment amongst massive buyers.

Supply: TradingView

Enterprise capitalist Chamath Palihapitiya shares this view, attributing his $1 million forecast to Bitcoin’s capacity to operate as a hedge in opposition to world financial instability. He factors to its distinctive qualities that shield in opposition to dangers in conventional monetary programs, anticipating Bitcoin’s position to strengthen as economies face mounting pressures.

Others like Robert Kiyosaki and Mike Novogratz predict extra average however nonetheless spectacular targets. Kiyosaki tasks $500,000 by 2025, pushed by rising inflation and weakening fiat currencies. Novogratz aligns with an identical determine, foreseeing $500,000 inside three years, fueled by Bitcoin’s capped provide and rising consumer adoption.

In the meantime, the Winklevoss twins and Tim Draper help substantial development, with Draper setting a goal of $250,000 by 2024, underscoring Bitcoin’s growing acceptance as each a monetary asset and a mainstream expertise.

Regardless of the optimistic outlook, Bitcoin’s historical past of volatility reminds buyers to method it with warning. Every market cycle has seen downturns adopted by recoveries, reinforcing Bitcoin’s resilience. Solely time will reveal whether or not Bitcoin can obtain the extraordinary milestone of $1,000,000 by 2025 or face new challenges.