- The Mayer A number of, a extensively adopted value indicator, suggests BTC has vital potential for an upward transfer.

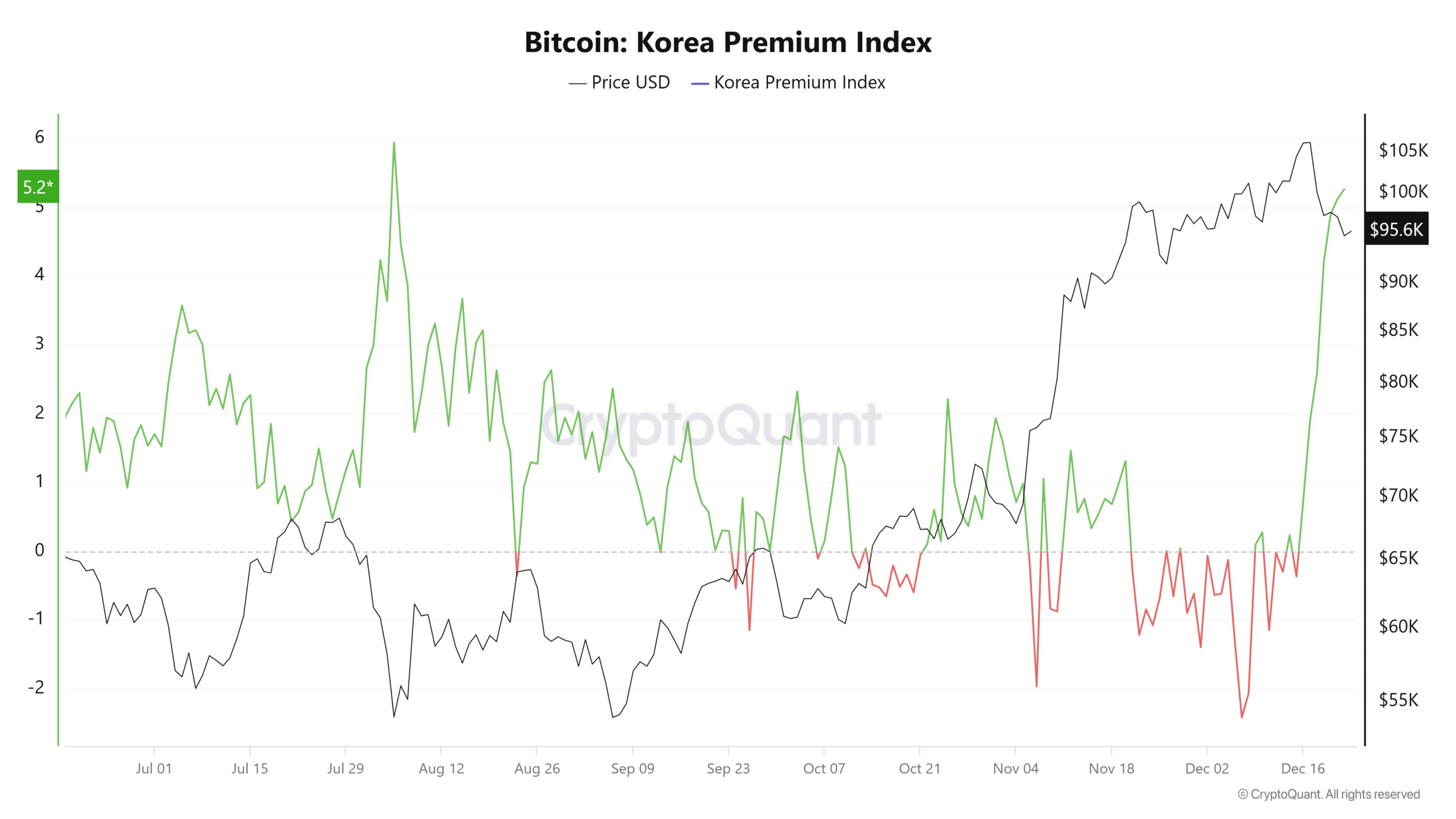

- Premium indexes reveal notable shopping for exercise from Korean traders, which has supported BTC’s value motion.

Bitcoin [BTC] was buying and selling at $95,646 at press time, down 7.89% from its excessive final week. Whereas the each day decline stands at a modest 0.52%, this means that promoting stress has eased, probably creating house for additional good points.

In accordance with AMBCrypto, the pullback to the $90,000 vary aligns with Bitcoin’s total bullish trajectory because the asset eyes a transfer towards larger ranges.

Bitcoin value prediction: BTC set for a rally to $168,000

In accordance with analyst Ali Charts, Bitcoin stays on a bullish trajectory regardless of its latest value decline.

This present value correction is seen as half of a bigger market construction that would propel the cryptocurrency to $168,000 area—a possible peak derived utilizing the Mayer A number of (MM).

The Mayer A number of, an indicator accessible on Glassnode, calculates potential market tops and bottoms by dividing BTC’s present value by its 200-day shifting common.

Primarily based on this metric, the market’s potential high is indicated at an MM of two.4 (pink line), comparable to roughly $168,494. In the meantime, the underside is outlined at 0.8 MM (inexperienced line), or $56,141.

It is very important observe that the Mayer A number of, presently at 1.3, displays a good valuation for BTC however doesn’t immediately dictate market course.

Nonetheless, with room to climb towards the MM peak of two.4, BTC may rally to $168,494, a degree that may place it in overvalued territory.

Establishments and enormous traders hold BTC intact

Institutional and large-scale traders are taking part in a significant position in Bitcoin’s maintaining its value vary. Current knowledge highlights a surge in curiosity from these entities because the cryptocurrency regains recognition.

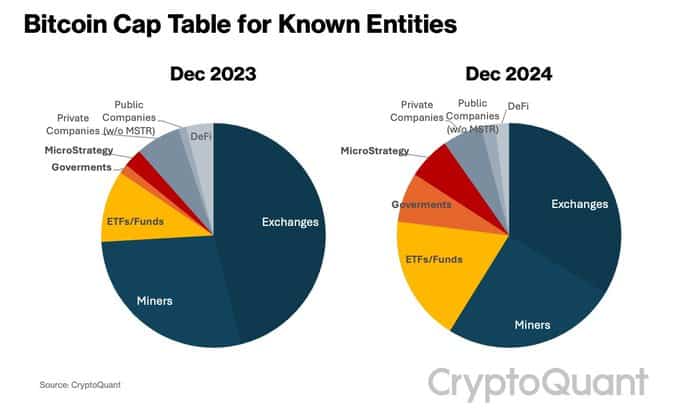

In accordance with CryptoQuant, this group has considerably elevated its share of Bitcoin’s Recognized Entities Cap Desk, rising from 14% final 12 months to 31% on the time of reporting.

If this shopping for development continues, it may positively impression Bitcoin’s trajectory by additional cementing its place in mainstream monetary markets.

AMBCrypto’s evaluation of U.S., Korean, and conventional traders revealed that bullish sentiment persists, suggesting continued confidence in BTC’s potential.

Korean traders speed up Bitcoin shopping for

Within the final 24 hours, Korean traders have proven a significant surge in BTC shopping for exercise, with a spike final seen in August. The present studying of the Korean Premium Index has climbed to five.26, up from a adverse 0.37 on December 15.

This degree of heightened shopping for exercise signifies ongoing accumulation, which may quickly replicate in BTC’s value, probably driving it larger in upcoming buying and selling periods.

In distinction, U.S. traders have proven diminished curiosity, as indicated by a decline within the Coinbase Premium Index. The index stays in adverse territory at -0.1035, an indication of a slowdown in shopping for exercise.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

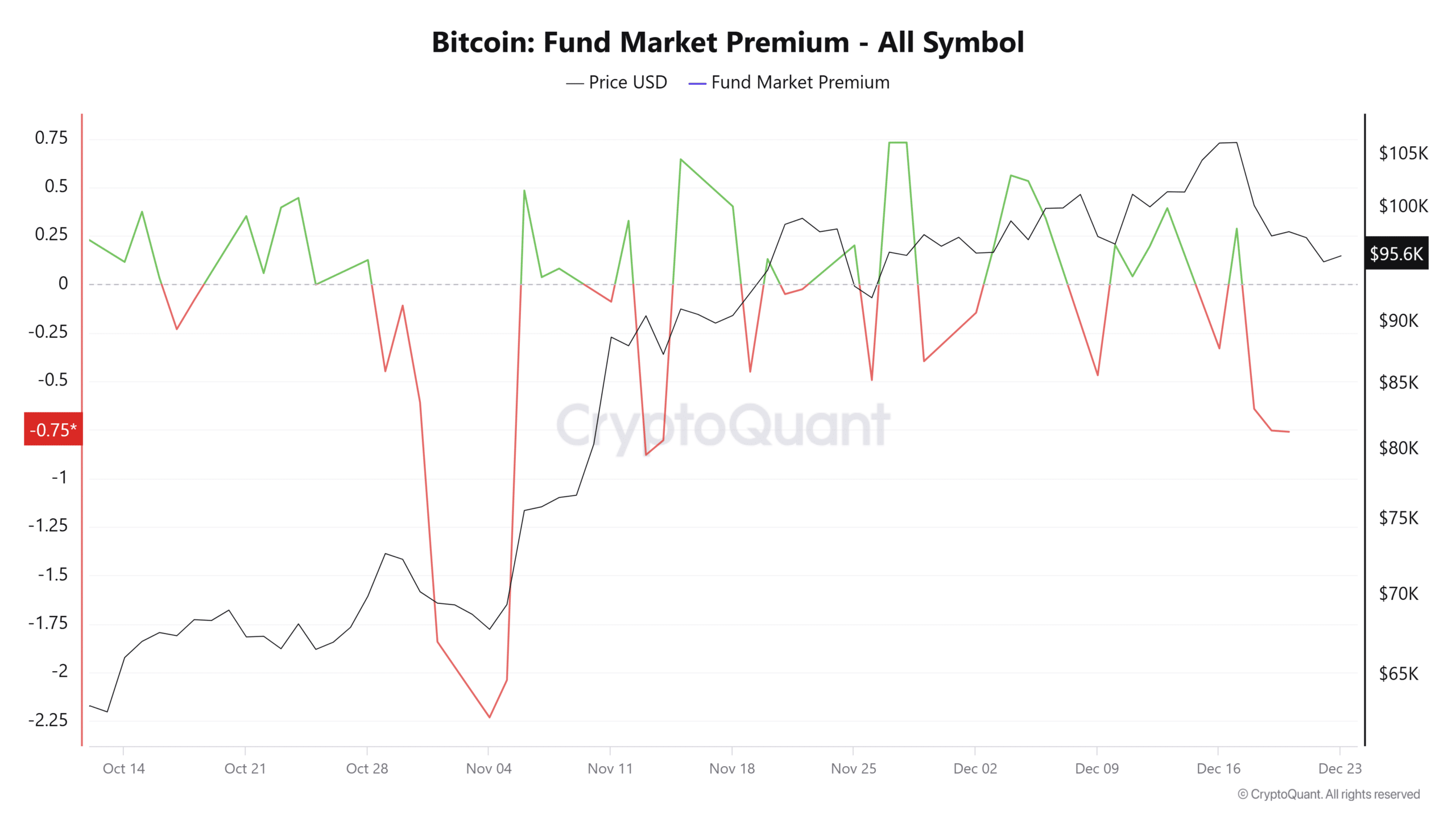

Equally, the Fund Market Premium Index, which tracks institutional Bitcoin shopping for and promoting, mirrors this bearish sentiment. It presently stands at -0.759, reinforcing the decline in institutional demand.

If U.S. and institutional traders return to purchasing, their participation—mixed with the bullish momentum from Korean traders—may push Bitcoin’s value upward to the $100,000 area.