- Bitcoin ETFs confronted vital outflows amid U.S election uncertainties and market volatility

- BlackRock’s IBIT defied tendencies, attracting inflows whereas cumulative BTC ETF stood with outflows

With the U.S Presidential election across the nook, the crypto market has seen a surge in volatility.

Bitcoin [BTC] exchange-traded funds (ETFs), particularly, have felt the affect, with notable outflows noticed on 1st and 4th November.

With Election Day now right here, uncertainty surrounding potential political shifts is continuous so as to add to the ups and downs of the Bitcoin ETF panorama.

Bitcoin ETF analyzed

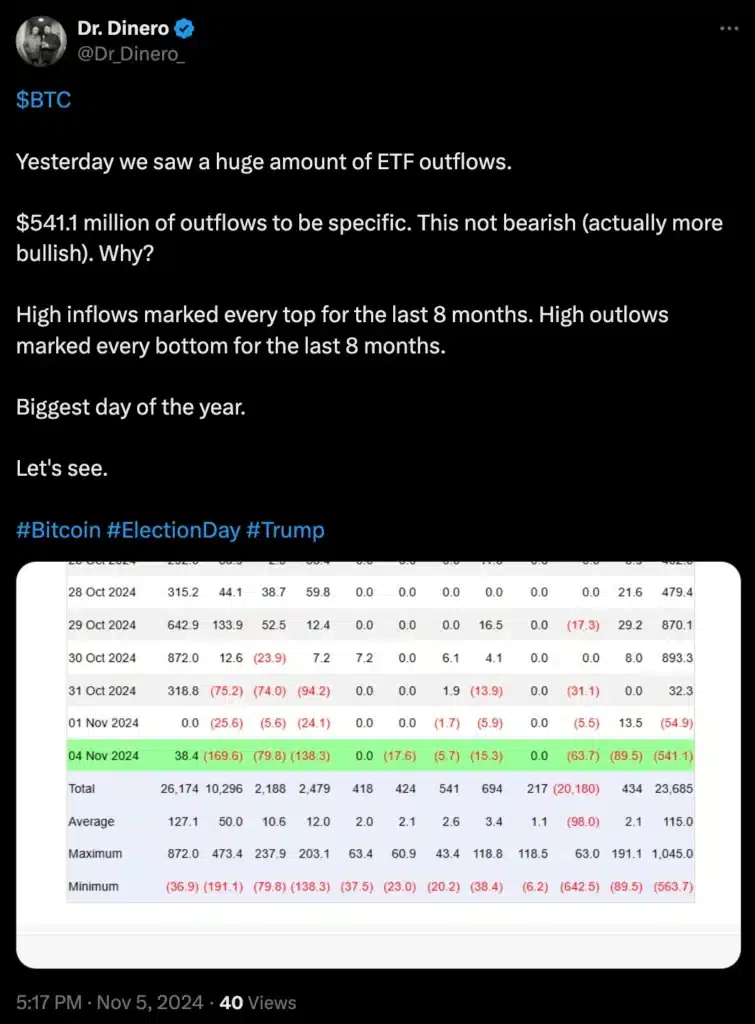

In keeping with the most recent knowledge from Farside Buyers on 4 November, Bitcoin ETFs recorded vital outflows – Totaling $541.1 million.

Constancy’s FBTC led the development, with outflows hitting $169.6 million, adopted carefully by Ark 21Shares’ ARKB which noticed $138.3 million in outflows. Grayscale’s BTC and Bitwise’s BITB additionally confronted declines, with outflows of $89.5 million and $79.8 million, respectively. Grayscale’s GBTC recorded $63.7 million outflows too.

Though most ETFs reported outflows, Invesco’s BTCO and WisdomTree’s BTCW stood out by sustaining secure flows with none outflows.

Regardless of the broader downturn, nonetheless, not all updates had been unfavorable.

BlackRock’s IBIT notably bucked the development by attracting $38.4 million in inflows.

Group response

Reflecting this optimism throughout the crypto group, Dr. Dinero shared a constructive perspective, highlighting hopeful sentiment regardless of current market turbulence.

One other X person famous,

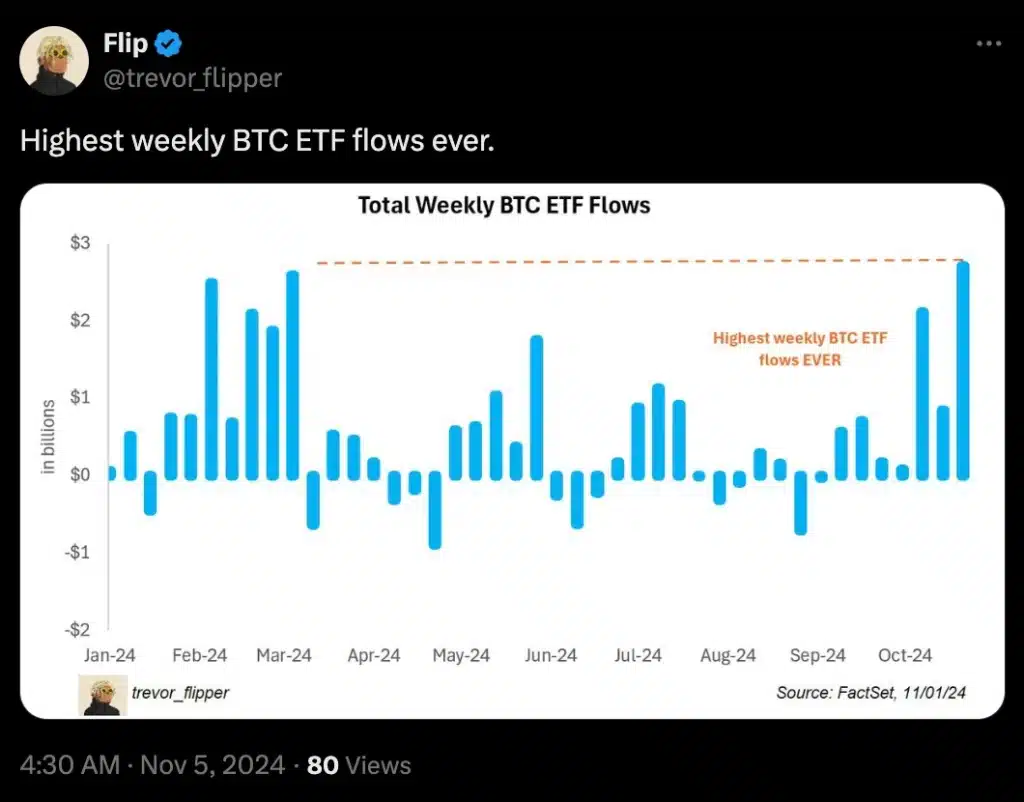

Trying on the cumulative knowledge although, BTC ETFs have generated vital inflows since their launch, with volumes of $23 billion. Notably, BlackRock’s IBIT alone recorded $26 billion in inflows.

Will Bitcoin ETFs cross Satoshi’s holdings?

Eric Balchunas, Bloomberg’s Senior ETF analyst, had beforehand forecasted that BTC ETFs would possibly quickly exceed the holdings attributed to Bitcoin’s creator, Satoshi Nakamoto. It was anticipated that these ETFs will attain this milestone by mid-December.

Nonetheless, a current single-day buy by BlackRock, totaling 12,127 BTC, has accelerated this timeline.

In response to this vital accumulation, Balchunas shared his insights on X. He highlighted the swift momentum ETFs have gained in Bitcoin’s area.

“At this rate, they’ll pass Satoshi in less than two weeks. Altho they can’t keep up this Joey Chestnut-level pace, can they?”

Bitcoin’s worth motion

This current surge in Bitcoin ETF exercise has coincided with notable worth volatility in BTC itself. After touching $73,000 simply days in the past, Bitcoin has now dipped under the $70,000-threshold.

On the time of writing, Bitcoin was buying and selling at $68,807.31, following a slight 0.10% drop over the past 24 hours. On the weekly charts, it fell by over 3%.

Thus, as election season provides an additional layer of uncertainty, the crypto market could be gearing up for additional volatility within the coming days.