- World m2 cash provide has turned constructive.

- Historic patterns point out BTC is likely to be set to surge on the charts now

Bitcoin [BTC], the world’s main cryptocurrency, continues to flash uncertainty amongst merchants, whales, and establishments. Particularly because the market waits for higher circumstances within the closing quarter of the yr.

Traditionally, Bitcoin has surged every time the worldwide M2 cash provide has elevated. Now, with the worldwide M2 turning constructive, merchants are anticipating a possible bull run. One just like these seen in late October 2023 and early January 2024, following which BTC hit new all-time highs.

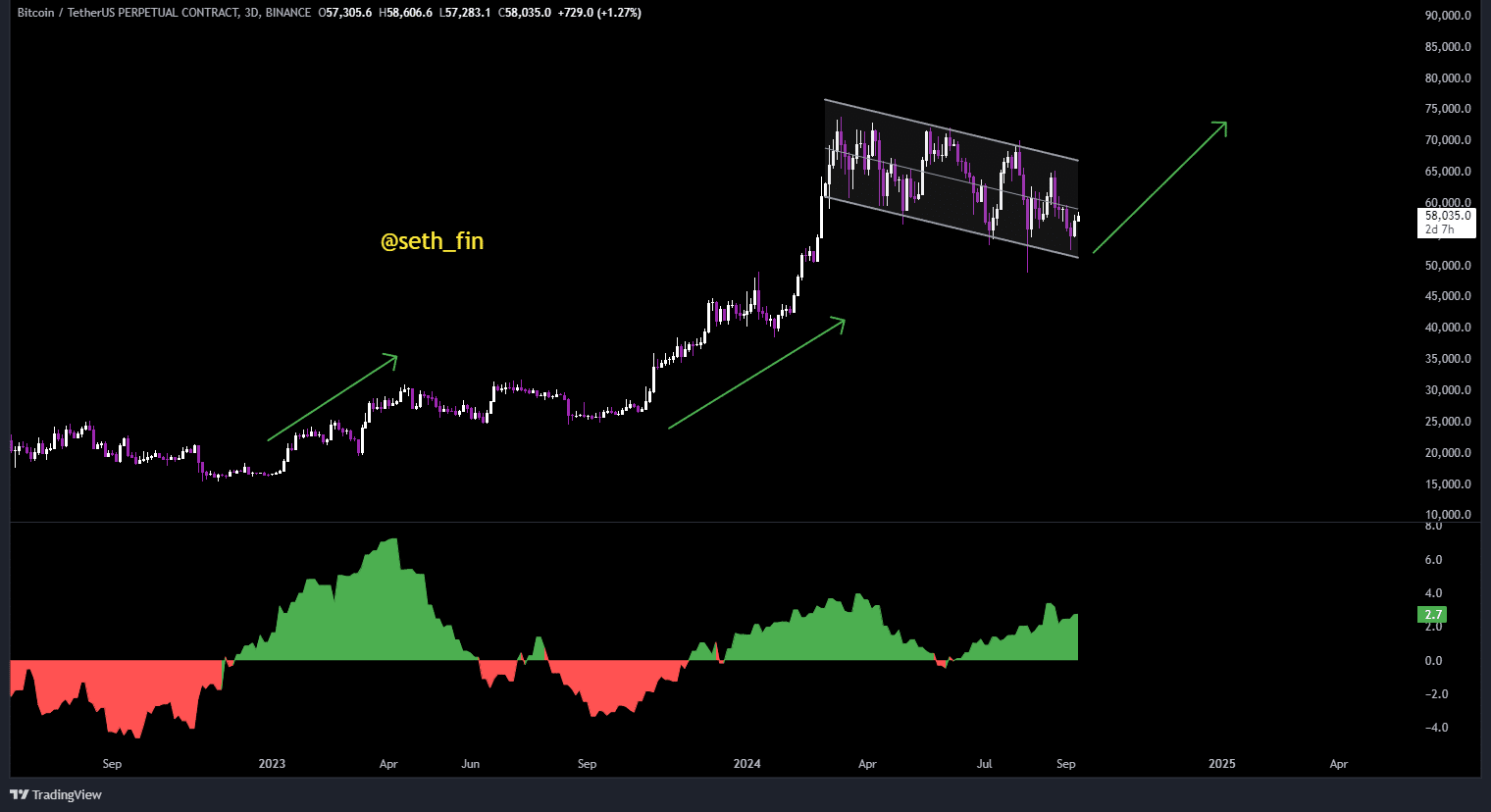

On the time of writing, BTC/USDT appeared to be correcting in a bullish flag sample. One other BTC surge could possibly be on the horizon, with the anticipated Federal Reserve fee minimize being key.

A 25 foundation level minimize appears probably. Nevertheless, in monetary markets, massive strikes must settle earlier than changing into obvious.

Bitcoin buying and selling again at mid vary

At press time, BTC was buying and selling close to the center of its value vary inside a descending pattern channel.

A breakout to the upside might result in a push in the direction of the highest of the channel and a possible breakout. The decrease boundary sat at $51k, whereas the higher resistance was at $66k.

Now, though BTC appeared to be consolidating, its energy stays evident. Particularly since bears have been unable to interrupt the decrease trendline.

If Bitcoin breaks the higher trendline and stays above it, BTC’s value might see a big rally, doubtlessly pushing it new highs. This may be supported by the worldwide M2 versus Bitcoin value chart.

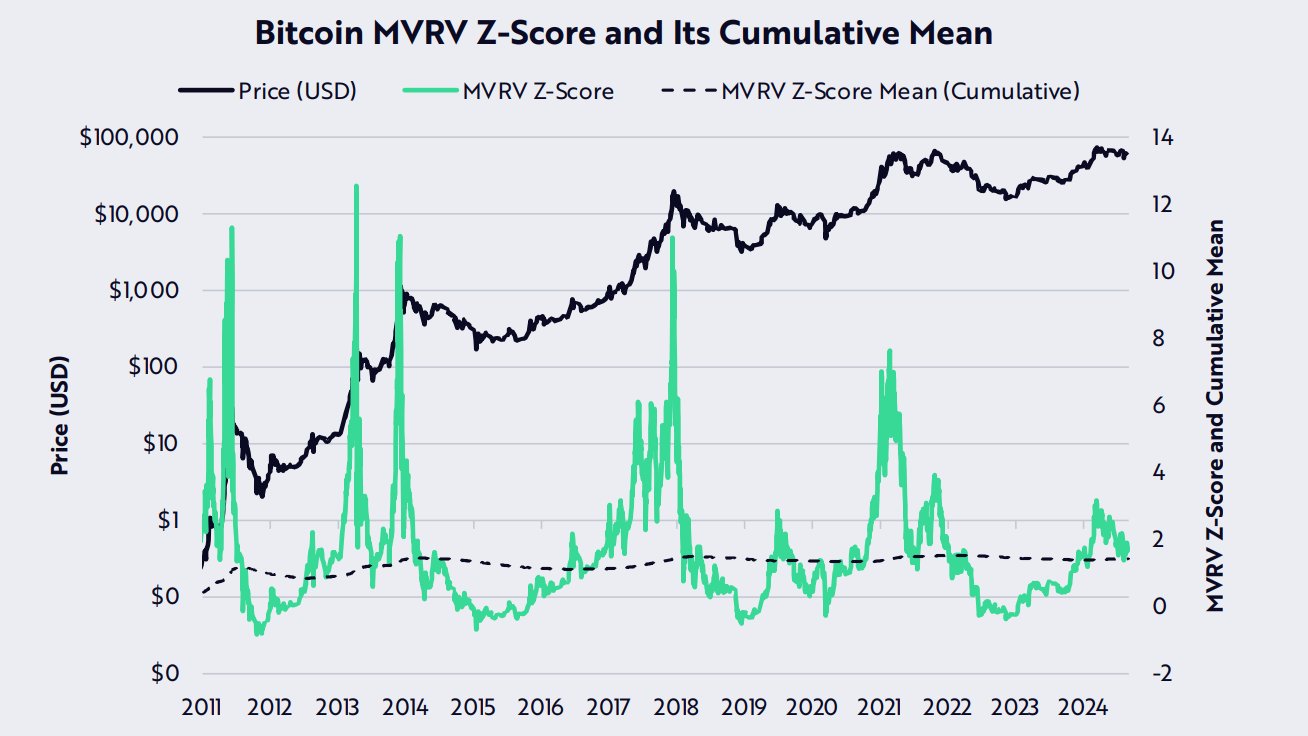

MVRV z-score highlights low unrealized earnings

The MVRV z-score, a key indicator of market sentiment, had a studying of round 1.9 at press time. This steered that BTC has been step by step declining whereas the community’s common on-chain value foundation has risen.

By extension, this implies there are low unrealized earnings available in the market, leaving extra room for upward motion.

Traditionally, every time the MVRV z-score has been at these ranges, Bitcoin has famous important uptrends. The case research of 2012, 2020, and 2023 are good examples.

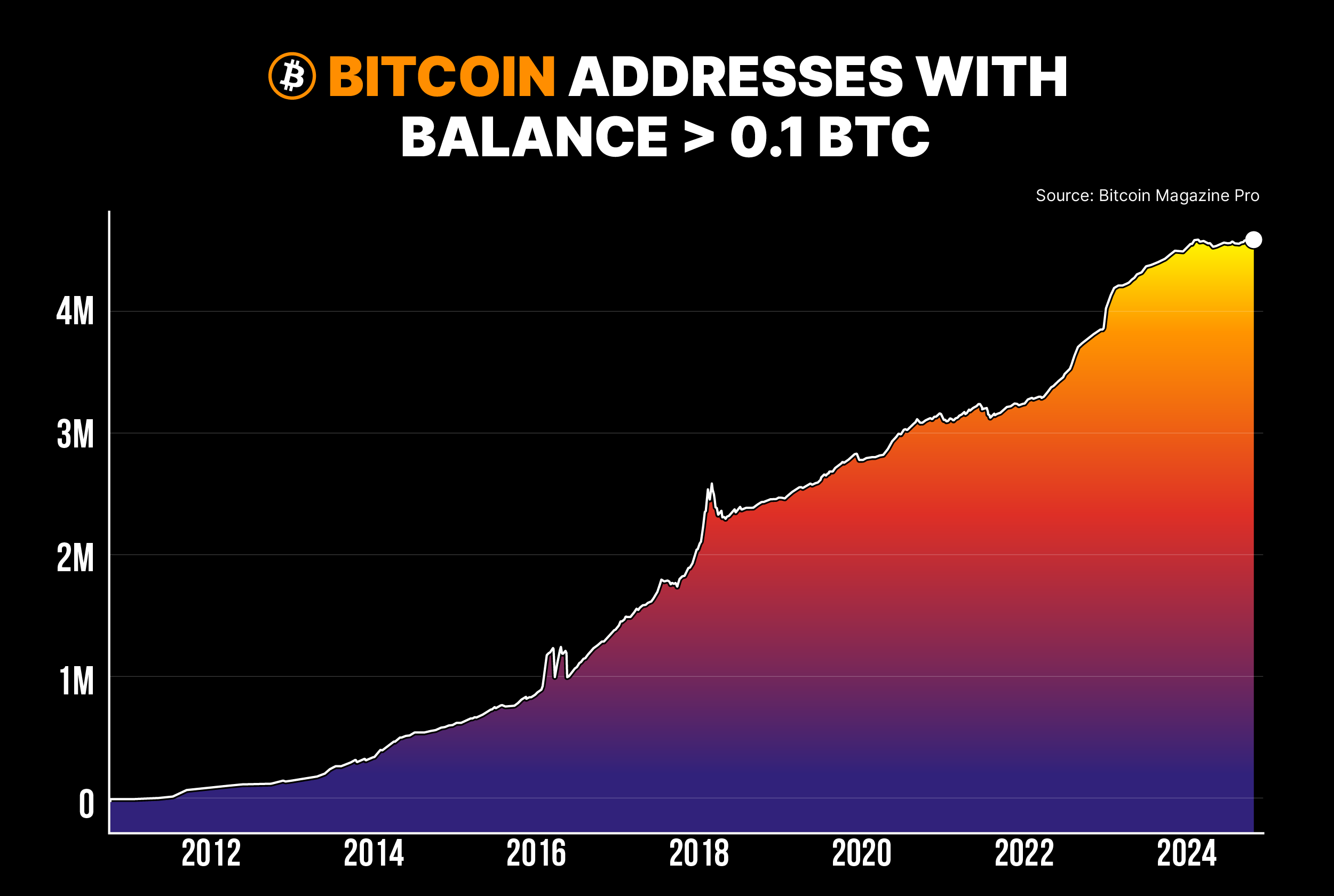

Addresses with greater than 0.1 Bitcoin close to ATH

Moreover, the variety of Bitcoin addresses holding not less than 0.1 BTC is nearing a brand new all-time excessive.

Which means long-term holders, sometimes called “strong hands,” are accumulating Bitcoin, supporting the case for larger BTC costs.

As extra robust palms purchase BTC, it strengthens the market. This will increase the probability of an upward pattern on the charts.

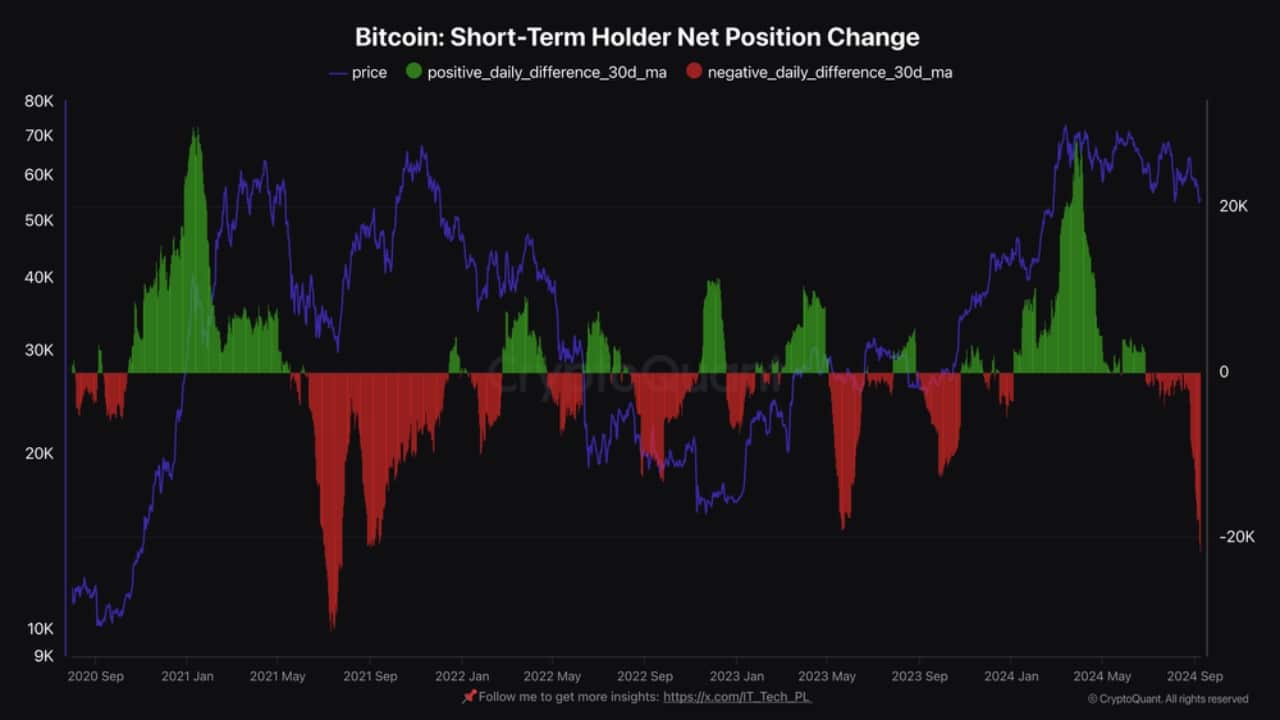

Bitcoin’s short-term holder internet place change

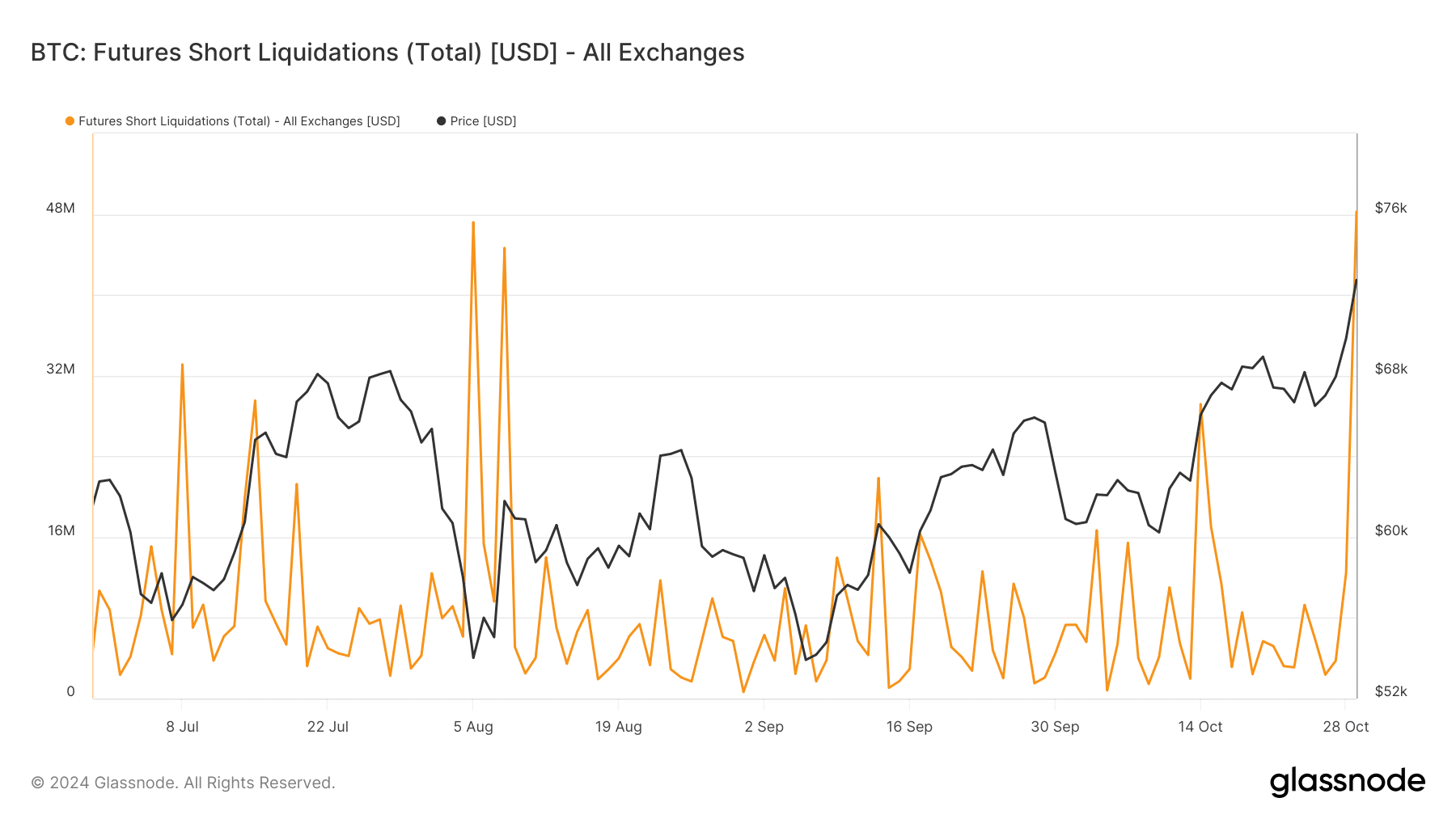

Lastly, Bitcoin’s short-term holder internet place change revealed that many current patrons, who entered over the past “fear of missing out” (FOMO) spike, are actually leaving.

That is usually an indication of market capitulation, signaling a possible backside. When short-term holders capitulate, it usually precedes a BTC value surge.

In conclusion, Bitcoin’s value is poised for potential development. With robust on-chain metrics and historic tendencies favoring an uptrend, BTC might see a big rally if world market circumstances enhance and the Federal Reserve implements a fee minimize.