- BTC will explode after the Fed fee lower, in response to Kiyosaki.

- The creator believed cash would flee bonds and different property to BTC, gold and silver.

The much-awaited Fed pivot occasion will occur this week, and market pundits have been upbeat recently. The US FOMC (Federal Open Cash Committee) is anticipated to start its easing cycle on 18th September.

In keeping with Robert Kiyosaki, the creator of “Rich Dad Poor Dad,” the Fed pivot will profit Bitcoin [BTC] and gold. He mentioned,

‘Bitcoin, gold, silver costs about to EXPLODE…When Fed PIVOTS and actual property go up in value, as faux cash leaves faux property comparable to US bonds, fleeing to actual property comparable to actual property, gold, silver, and Bitcoin.”

Inflation to rally BTC?

Kiyosaki additional urged his followers to purchase extra BTC earlier than the Fed begins its easing cycle.

“Buy some (more) gold, silver, or Bitcoin…before the Fed pivots and drops interest rates.”

This would be the first fee lower in 4 years, and market observers can have primed threat property for potential wins. Nevertheless, Kiyosaki has beforehand said BTC and different actual property will profit much more due to unsustainable US money owed.

On September thirteenth, Kiyosaki cautioned that the unsustainable US money owed can’t be solved irrespective of who wins the US elections. He said that the greenback was trash and folks had been higher off saving in Bitcoin and gold than the greenback.

“The dollar is trash. Stop saving dollars, fake money….& start saving gold, silver, & Bitcoin….real money.”

Galaxy’s Mike Novogratz echoed an analogous sentiment in March. In keeping with Novogratz, BTC would admire as US money owed proceed to develop at $1 trillion per 100 days.

Briefly, cash inflation will dent the greenback’s worth, forcing customers to hunt alternate options like gold, BTC, or silver. This huge inflation might shortly push BTC to $10 million per coin, famous the creator in a July value projection.

Within the meantime, BTC was again to $60K after two weeks of struggling under the psychological stage.

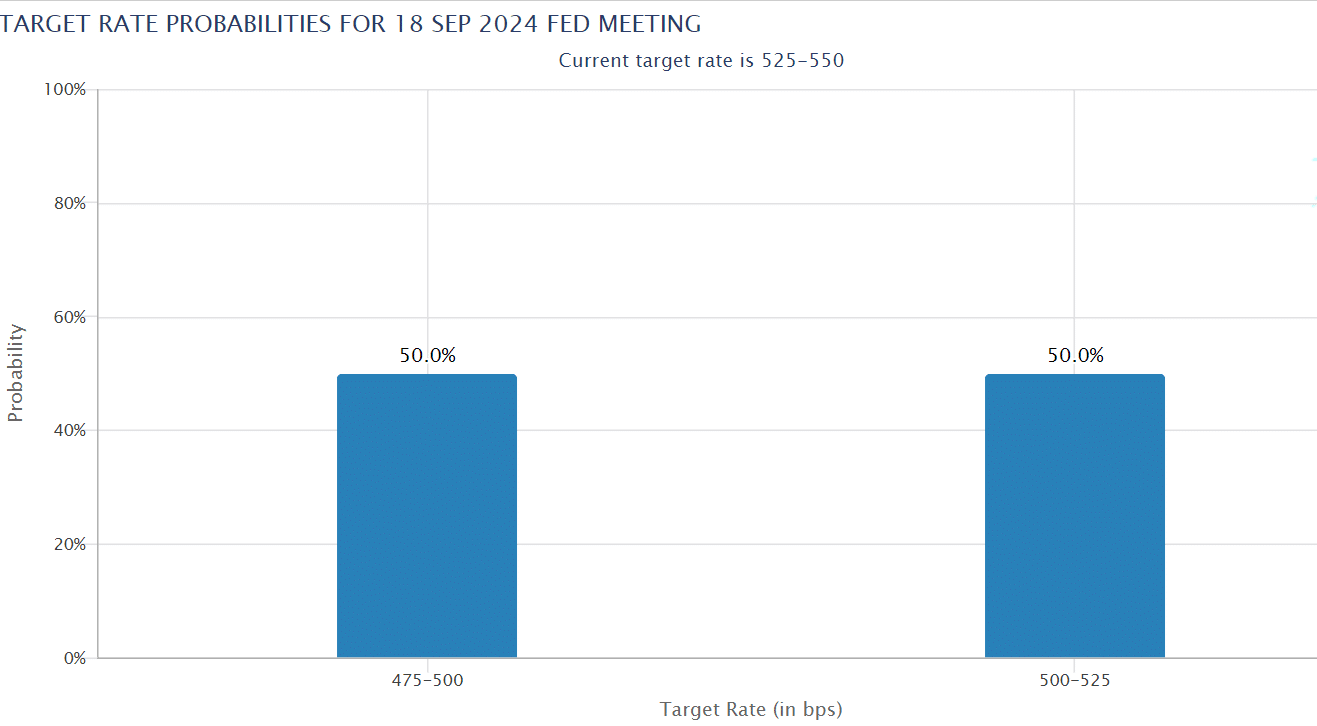

After final week’s US financial knowledge, the markets had been pricing a 50/50 likelihood of a 25/50 bps (foundation level) Fed fee lower. How the market will react to the Fed’s pivot within the brief time period stays to be seen.