- Market sentiment was bearish over the past 4 months as BTC confronted constant rejections from native highs

- Promoting strain has not abated and will drive one other main southbound transfer

Bitcoin’s [BTC] 2024 halving occurred on 19 April. Since then, nevertheless, the promised bull run is but to materialize. At press time, the Crypto Worry and Greed Index had a studying of 46 – An indication of impartial sentiment.

On the weekly chart, Bitcoin continues to current a bearish construction, with BTC setting decrease highs and decrease lows since late Might. Insights into stablecoin flows strengthened the bearish view of the crypto-market over the approaching weeks.

Suspicions of a deeper worth correction

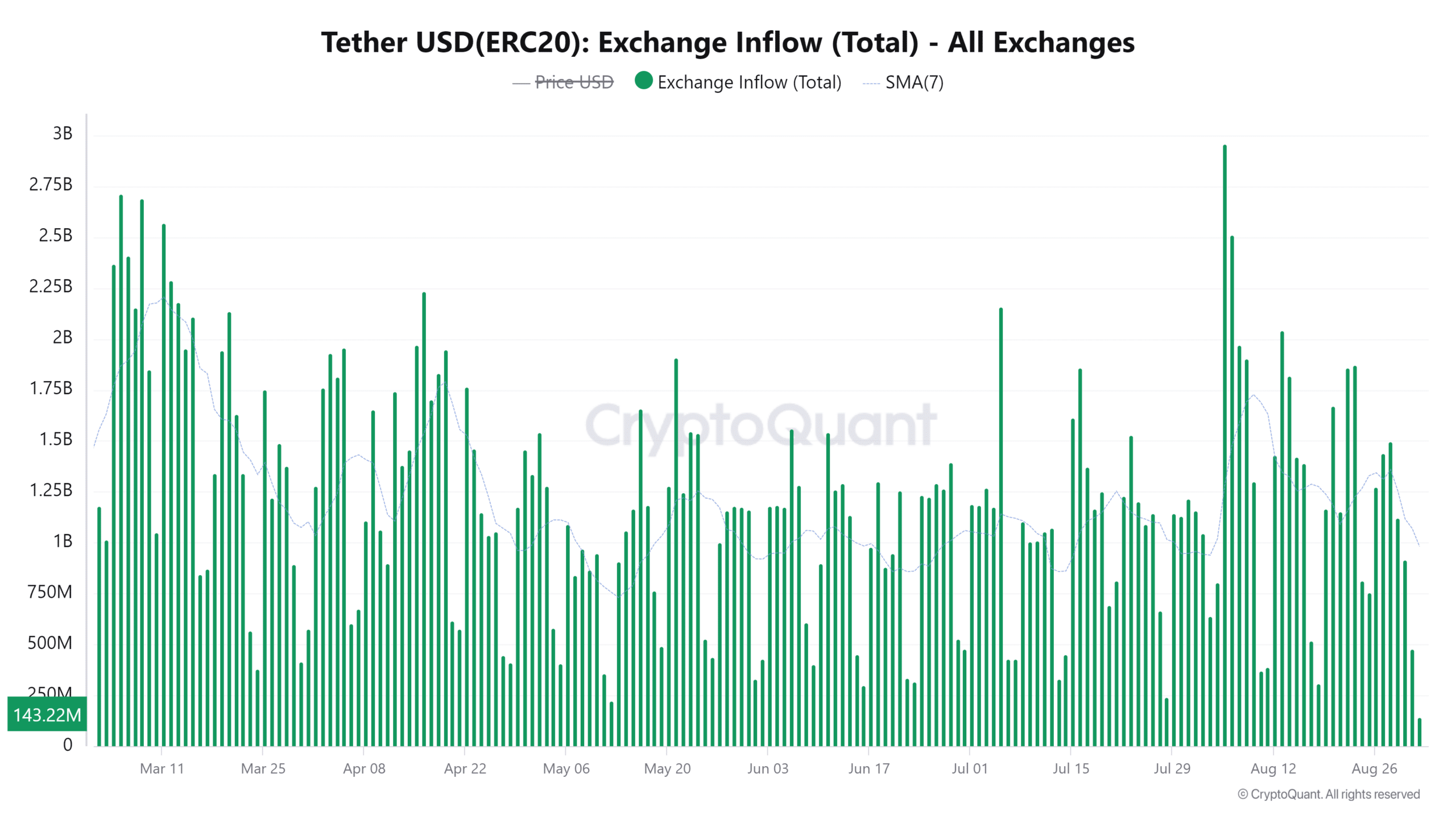

In a CryptoQuant Insights publish, standard analyst theKriptolik famous that there was a giant decline within the inflows of Tether [USDT] to exchanges. AMBCrypto appeared intently on the charts and located that the stablecoin alternate inflows have been at a six-month low.

Supply: CryptoQuant

When Bitcoin and the broader crypto market expertise a big worth drop, stablecoin inflows are likely to ramp up by a big quantity. That is indicative of consumers utilizing the dip so as to add to their crypto holdings.

The newest, sharp worth drop occurred on 5 August when Bitcoin fell from $58.3k to $49k – A 15.9% drop. On that day, the stablecoin inflows stood at $2.9 billion.

Due to this fact, the truth that we noticed unremarkable Tether alternate inflows when BTC fell under $60k might be interpreted as alarming information. It implied that good cash was ready for a a lot deeper worth drop earlier than getting into the market.

How low can the following transfer go?

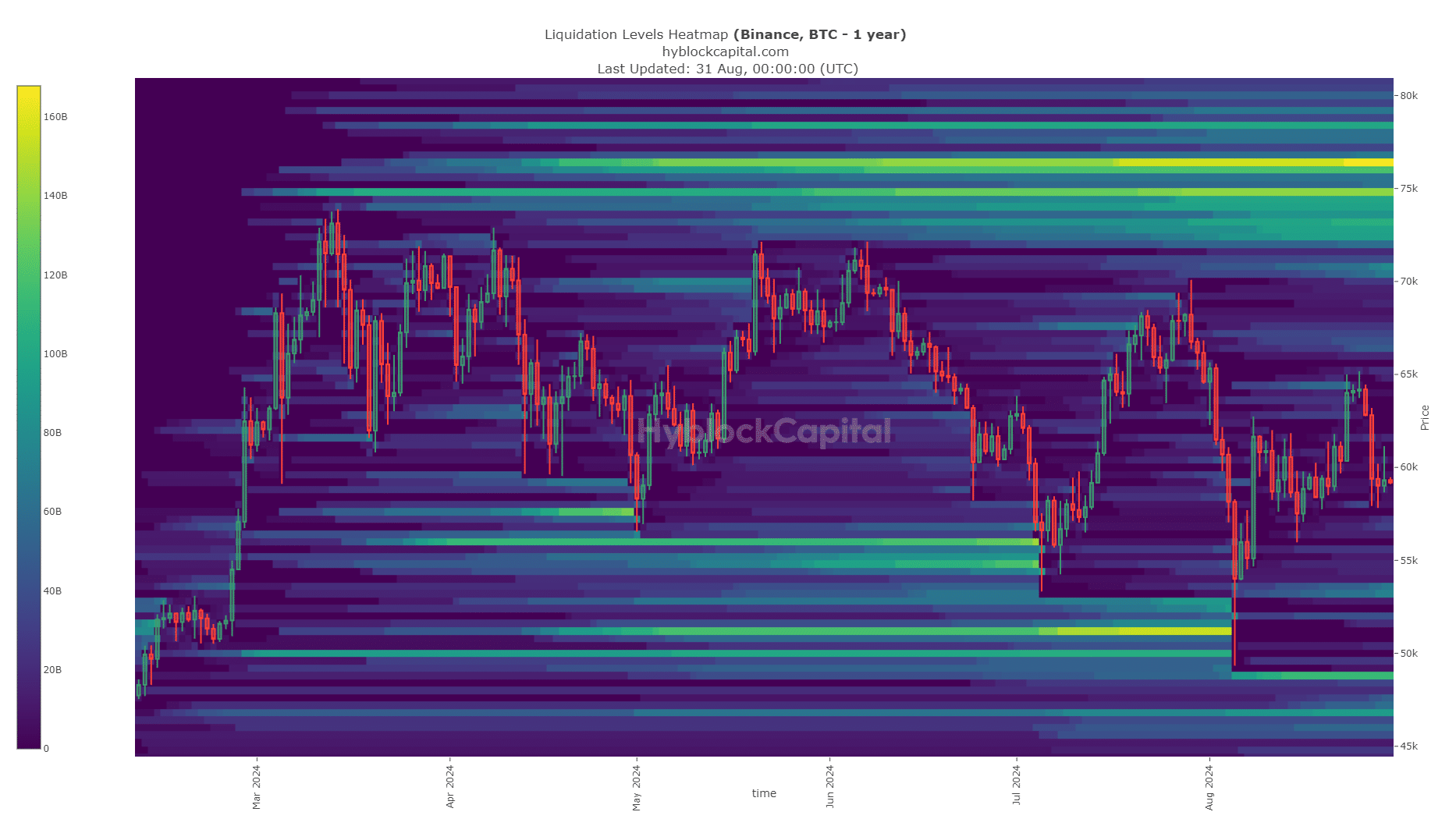

Supply: Hyblock

AMBCrypto’s evaluation of the liquidation heatmap revealed that the following vital magnetic zones for Bitcoin could be at $48.8k and $46.6k. Additionally, there appeared to be a pocket of liquidity at $53.6k. These ranges could be the targets for BTC in case of a worth drop under $56k.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

A latest report warned {that a} plunge under $56k might result in a a lot deeper correction. The bull-bear market cycle confirmed bearish dominance, and the findings from the Tether alternate flows strengthened this bearish view.