- Bitcoin worth hit $71,000, main the market to hit a worry and greed index of 76.

- The liquidation heatmap pinpointed $76.900 as the following goal for BTC.

Bitcoin’s [BTC] worth hit $71,000 for the primary time in virtually 40 days, bringing optimism again to the market. The worth enhance aligned with AMBCrypto’s current evaluation which defined how the bull run was not over.

Past the metrics talked about in that article, there have been different causes BTC recovered. First on the register had been the ETFs. For these unfamiliar, a Bitcoin ETF shouldn’t be the identical as BTC.

It, nonetheless, means that an investor has publicity to Bitcoin. As such, if the worth of the cryptocurrency will increase, then the ETF Web Asset Worth (NAV), which represents the worth of every share, would additionally enhance.

The heavyweights are again

Within the first quarter of 2024, billions of {dollars} flowed into Bitcoin ETFs, prompting the worth to succeed in an all-time excessive earlier than the halving. Nonetheless, the issuers failed to draw the king of capital they as soon as had throughout the first a part of the second quarter.

Because of this, BTC slumped, slipping beneath $59,00 at one level. Nonetheless, that situation has modified for the higher. As of the twentieth of Might, the entire netflow into Bitcoin ETFs was $235 million.

This meant that ARK, BlackRock, Constancy, and Grayscale had registered inflows for 4 straight days. If sustained, Bitcoin’s worth could possibly be in line to rise previous $73,000 earlier than the top of Might.

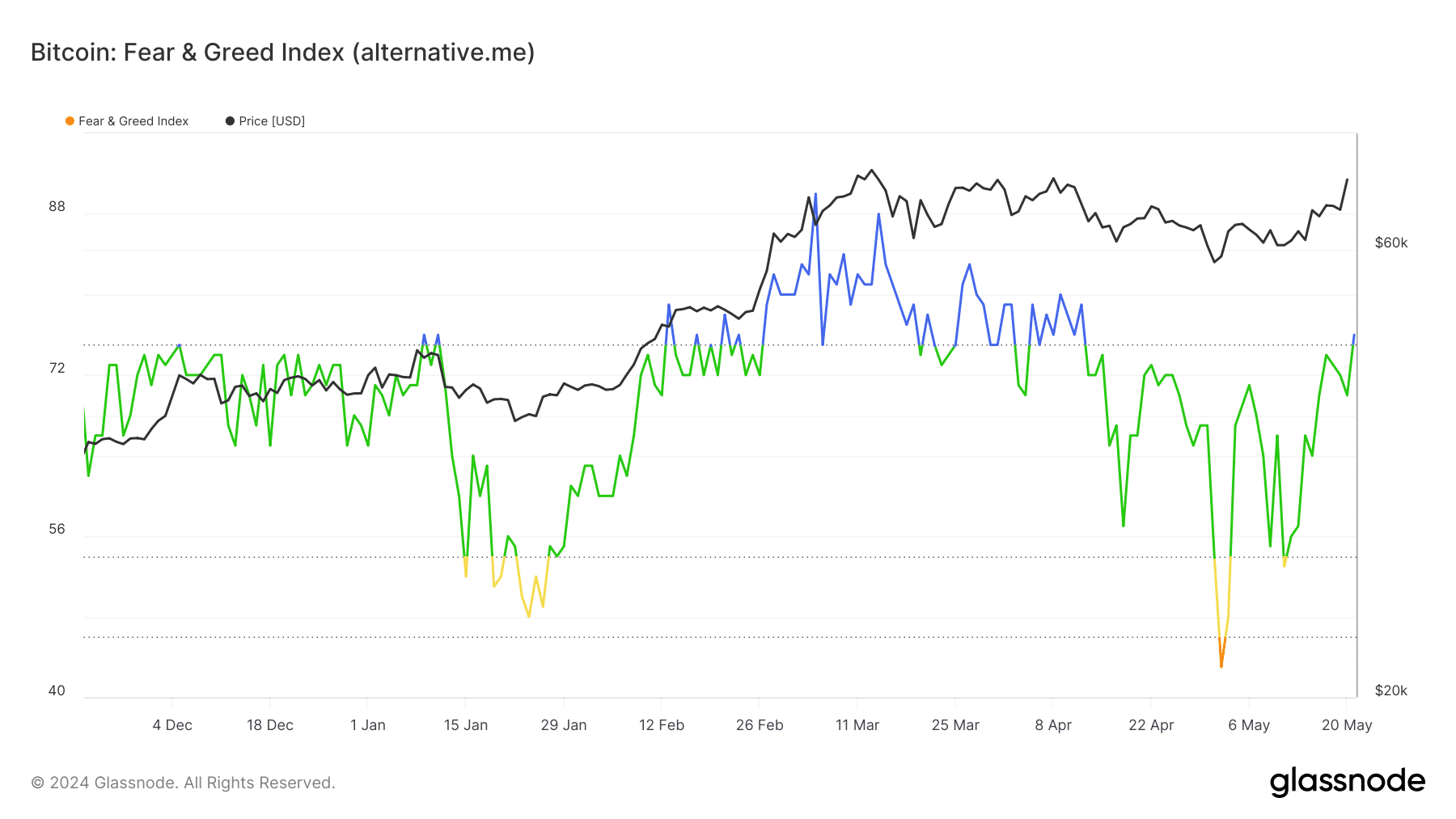

Aside from this information, AMBCrypto appeared on the worry and greed index. In accordance with Glassnode, Bitcoin’s worry and greed index returned to 76— an 8.57% enhance within the final 24 hours.

This studying, represented by the colour inexperienced, implies the market was within the grasping area. The final time BTC rallied to a brand new excessive, the metric hit 90— a particularly grasping (blue) area.

Liquidations pour in: What’s subsequent for BTC?

Because it stands, Bitcoin was not at a degree the place optimistic investor sentiment was exaggerated. With this place, the coin worth would possibly nonetheless recognize, and rising near $75,000 could possibly be attainable in a couple of days.

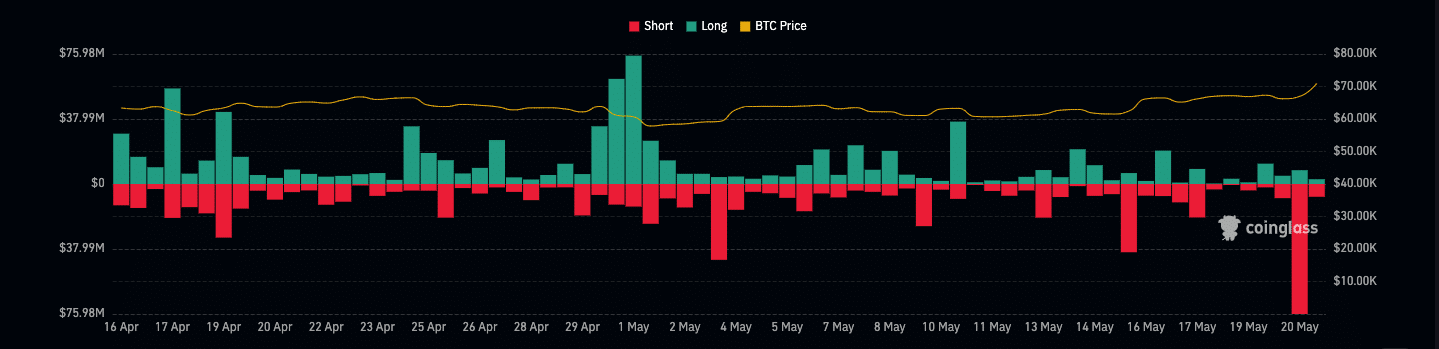

Moreover, it’s noteworthy to say that $96.87 million value of BTC contracts had been liquidated within the final 24 hours. In accordance with Coinglass, quick liquidations accounted for nearly $80 million whereas the remaining had been longs.

For context, shorts are merchants betting on the worth of an asset to lower. Longs, alternatively, place bets on a worth enhance.

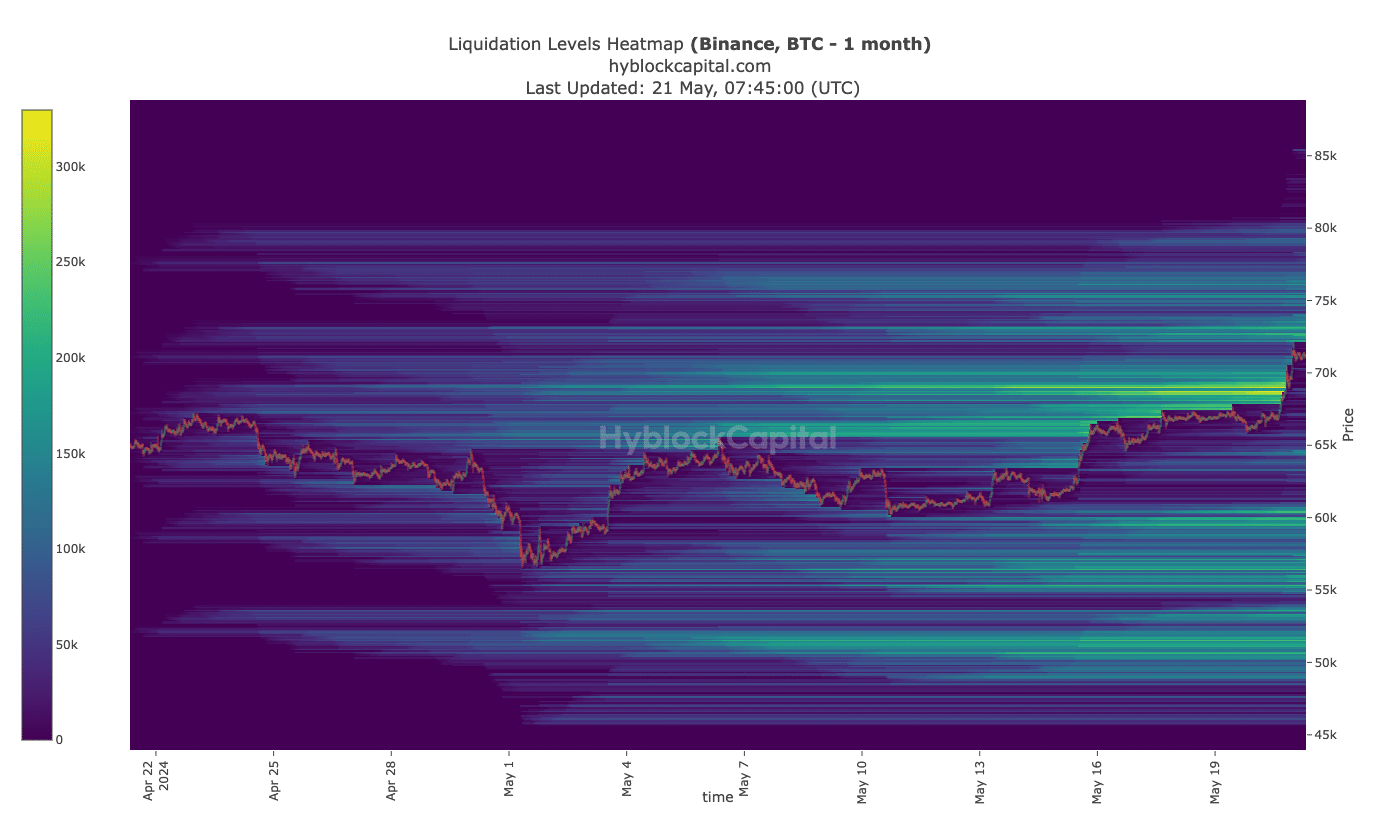

As well as, AMBCrypto analyzed the liquidation heatmap to verify the subsequent degree for Bitcoin’s worth to hit. Liquidation heatmap helps merchants to establish areas of excessive liquidity.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

If liquidity is concentrated in a area, worth would possibly transfer towards the purpose whereas giant liquidations may happen. In accordance with information from Hyblock, excessive liquidity existed from $73,300 and above.

Subsequently, Bitcoin may squeeze previous its all-time excessive, and a goal of $76,900 could possibly be the following peak it hits.