- Over 28,000 BTC have been accrued by whales and sharks within the final three months

- Bitcoin, at press time, was buying and selling above $60,000, regardless of current declines

Bitcoin [BTC] efficiently crossed the essential $60,000 psychological resistance, leading to a big quantity of brief liquidations over the previous 24 hours. Within the build-up to this worth breakthrough, accumulation patterns from key addresses intensified during the last three months.

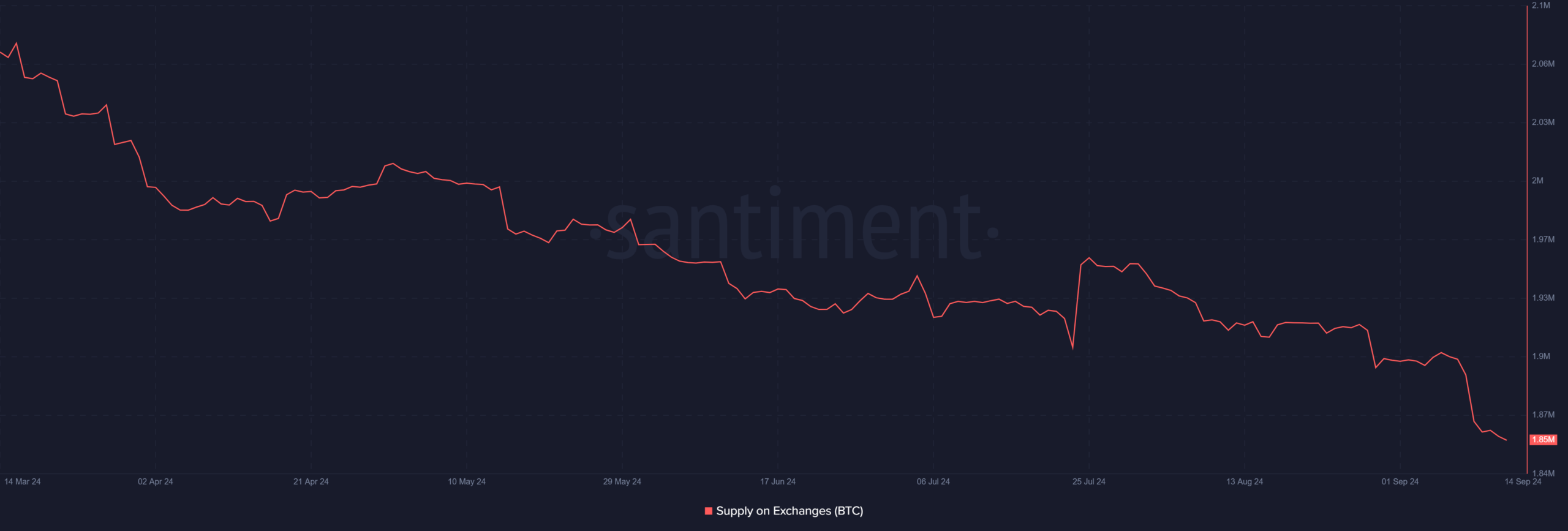

Moreover, BTC provide on exchanges steadily declined too, with extra Bitcoin leaving exchanges.

BTC crosses the psychological barrier

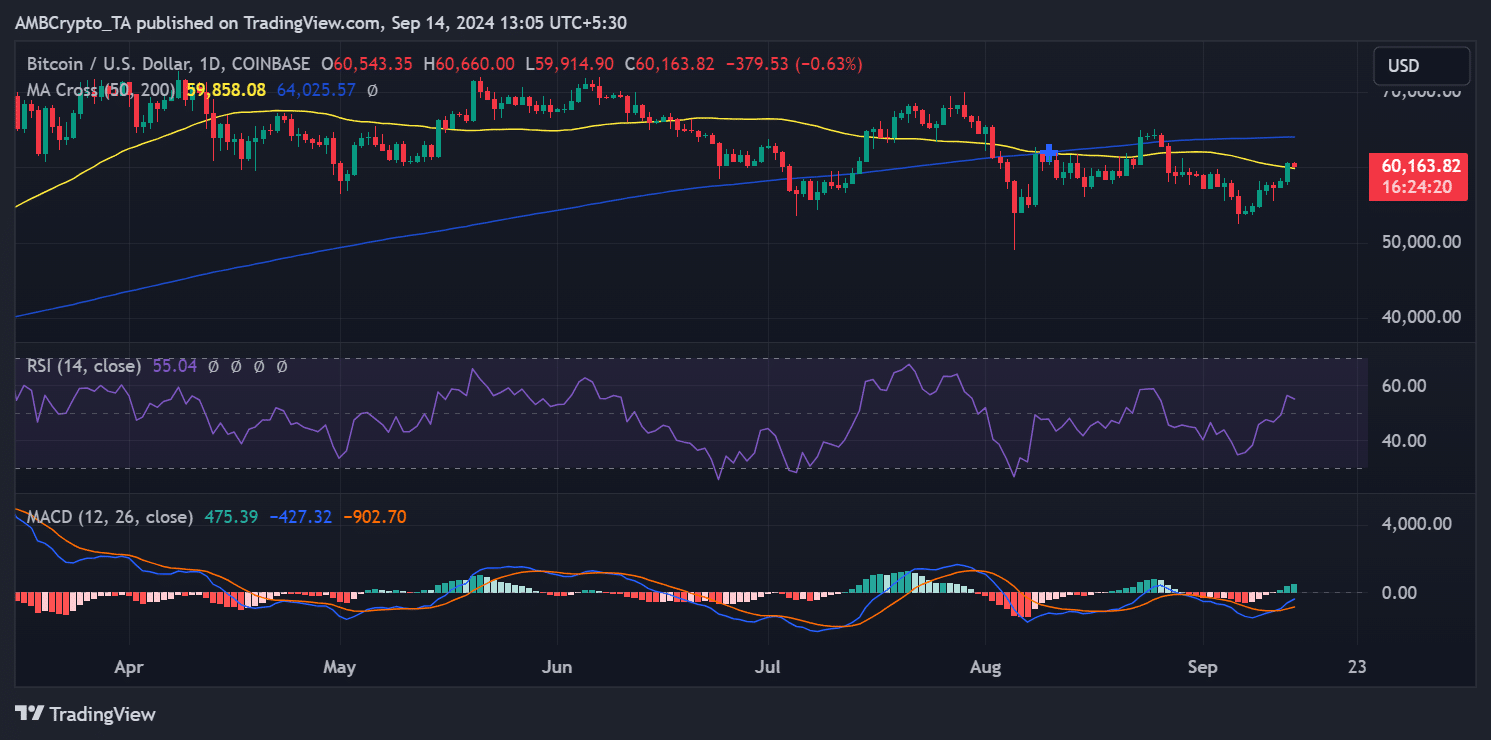

An evaluation of Bitcoin’s worth motion on 13 September revealed a robust upswing, one which pushed BTC above its psychological resistance of $60,000. In truth, at one level, it was buying and selling at $60,543, up by 4% in simply 24 hours. This surge allowed Bitcoin to interrupt above its short-moving common (yellow line), which had beforehand acted as resistance.

Now, whereas the cryptocurrency declined quickly after to $60,177, BTC stays bullish. The identical was confirmed by its Relative Power Index (RSI), with the identical hovering at round 55 – An indication of optimistic market momentum.

The motion above the short-term shifting common and the sustained bullish RSI advised that Bitcoin should be on an upward trajectory. The slight pullback could also be non permanent, with the potential for additional positive factors if shopping for stress continues to construct.

Bitcoin’s sustained accumulation and withdrawal

Latest knowledge additionally highlighted that Bitcoin accumulation and alternate withdrawals have been vital over the previous few months – A bullish pattern.

Based on knowledge from Santiment, addresses holding 10 BTC or extra have accrued over 28,000 BTC within the final three months. These massive holders now management greater than 16 million BTC, exhibiting elevated confidence within the asset.

Moreover, Bitcoin dropped beneath $60,000 on 29 August, which means these addresses have accrued BTC at varied worth ranges. This strategic accumulation throughout worth fluctuations means that these holders are getting ready for potential future positive factors.

The provision of BTC on exchanges decreased considerably too, with 75,000 BTC withdrawn over the previous three months. This has left roughly 1.8 million BTC remaining on exchanges. The decreased alternate provide is a transparent bullish sign because it implies that holders are choosing long-term storage, moderately than promoting. Consequently, this tightens the obtainable provide for buying and selling.

If Bitcoin’s worth maintains its present stage or strikes increased, the mix of accumulation and provide discount on exchanges may additional strengthen the bullish momentum. This may drive the value increased on the charts.

Quick positions take a large loss

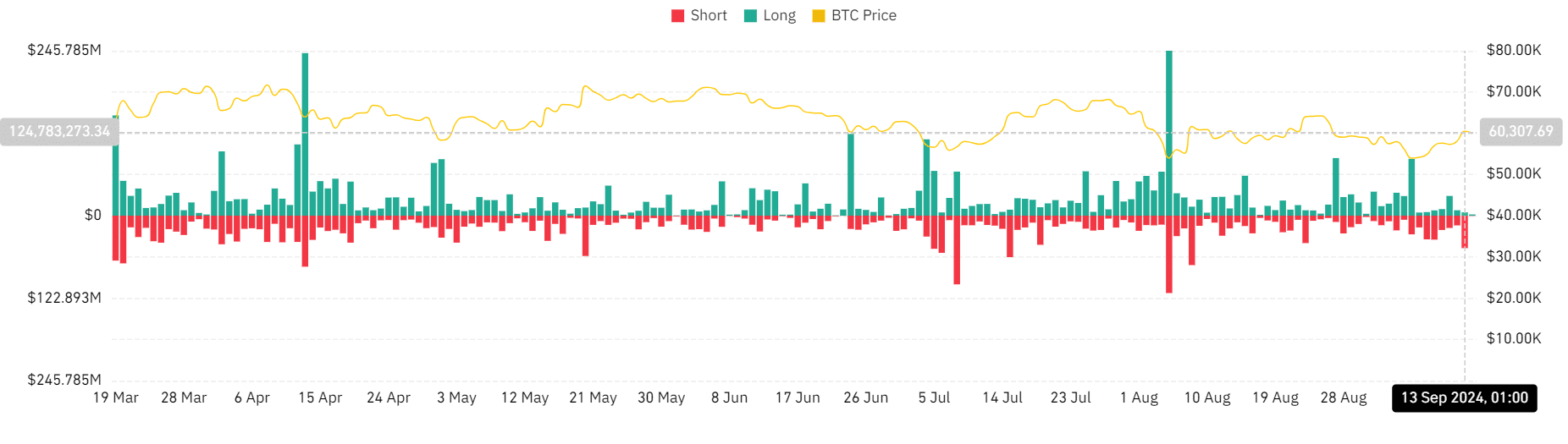

The 4% hike in Bitcoin’s worth over the past buying and selling session led to a significant liquidation of brief positions.

Based on the Coinglass liquidation chart evaluation, brief positions confronted greater than $48 million in liquidations by the tip of buying and selling on 13 September. Quite the opposite, lengthy positions noticed solely $5 million in liquidations.

– Learn Bitcoin (BTC) Worth Prediction 2024-25

This mirrored the same occasion on 8 August, when Bitcoin’s worth jumped from $55,000 to over $61,000, resulting in a comparable spike in brief liquidations.

This liquidation occasion and broader bullish alerts may gasoline additional upward momentum within the brief time period.