- Bitcoin’s value foundation revealed stark distinction between long-term holders and up to date consumers

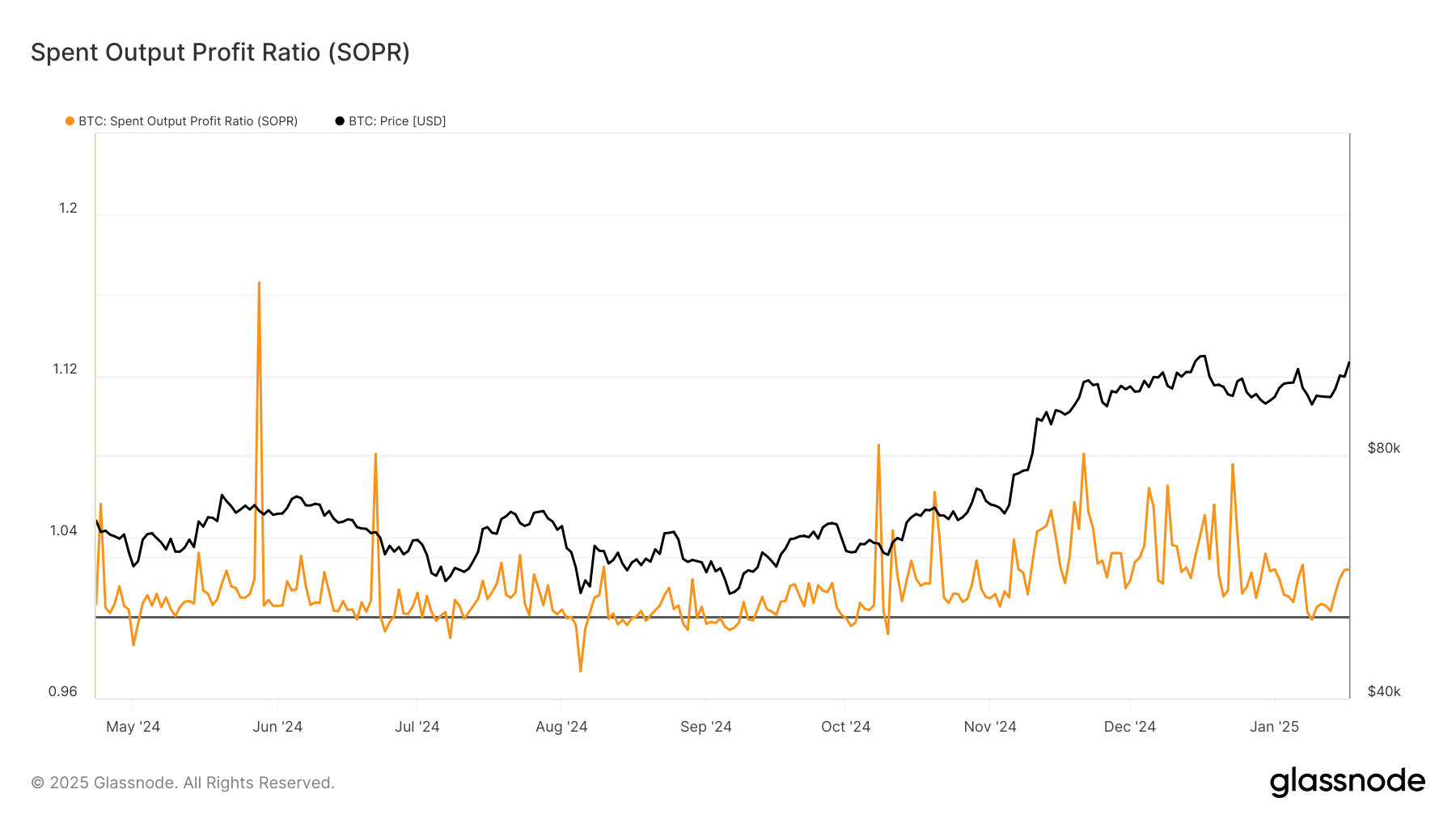

- SOPR maintained 1.04 stage as whale addresses gathered by means of the $105K take a look at

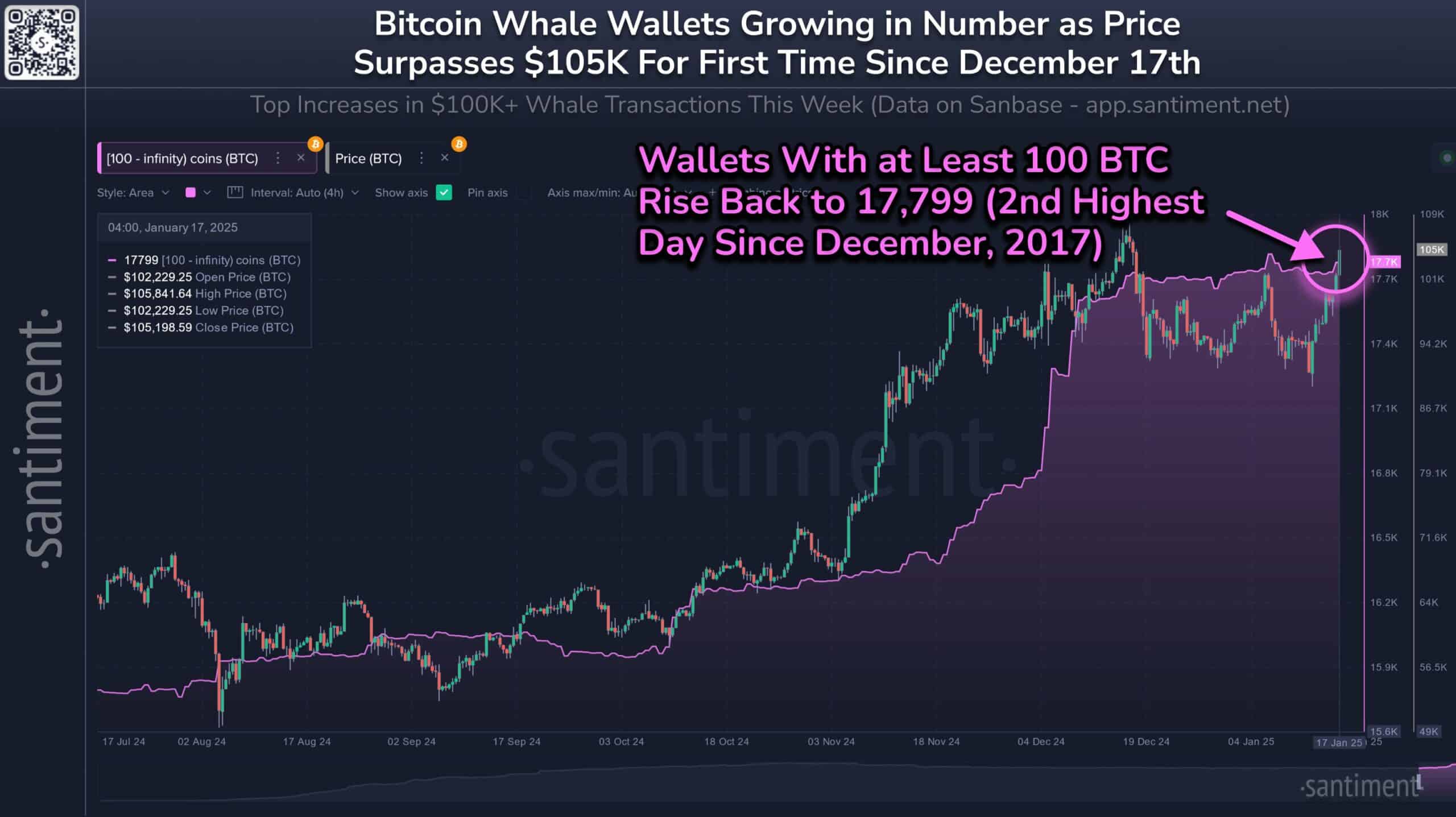

Bitcoin’s market construction has been noting a big shift after whale addresses reached ranges not seen since December 2017. The shift appears to be corresponding with the crypto’s worth motion testing the essential resistance above $105,000.

This institutional positioning comes amid a transparent divergence between long-term and short-term holder habits. The development additionally paints a compelling image of market maturity.

Strategic Bitcoin whale positioning intensifies

On the time of writing, the variety of addresses holding at the very least 100 Bitcoin had surged to 17,799 – Marking its second-highest stage since December 2017. This milestone coincided with BTC’s newest push to $105,841.64 – An indication of strategic accumulation by institutional gamers.

Notably noteworthy is the steep accumulation sample that started in October 2024, when whale addresses numbered round 16,200 – Representing an almost 10% hike in large-holder focus over simply three months.

The acceleration in whale accumulation in the course of the November-December interval notably corresponded with Bitcoin’s sustained break above the $90,000-level.

Bitcoin’s market construction indicators maturity

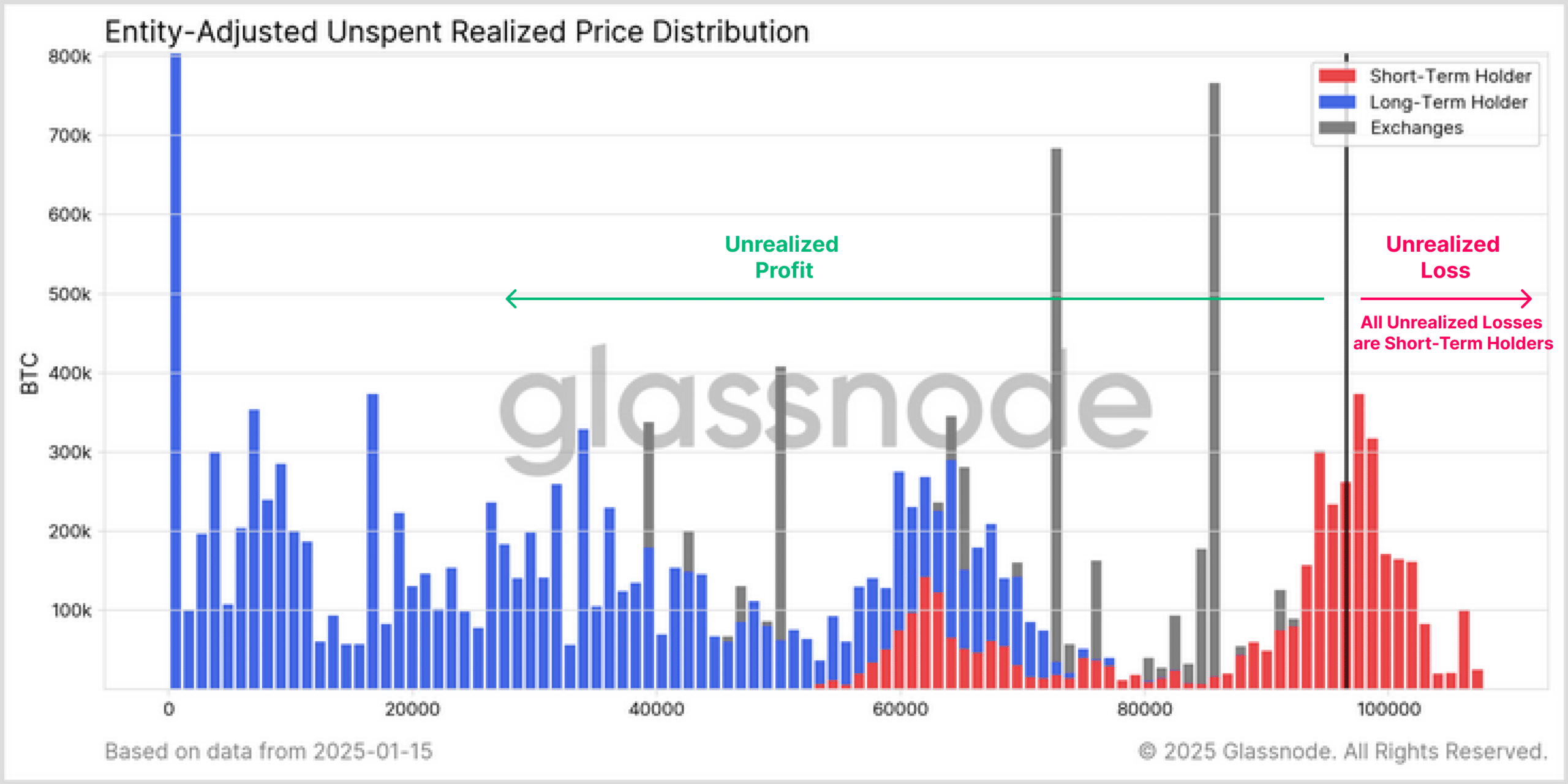

Additional strengthening this bullish narrative, Bitcoin’s value foundation distribution highlighted a telling market dynamic.

The knowledge confirmed unrealized losses completely concentrated amongst short-term holders who entered positions throughout the final 155 days. Lengthy-term holders keep important unrealized income, with substantial accumulation zones seen within the 20,000-40,000 BTC vary.

Most hanging appeared to be the distinction between long-term holder habits, as highlighted by the blue bars clustering round lower cost ranges, and short-term positions marked in pink at larger costs.

Trade holdings, represented by grey bars, underlined periodic spikes above 600,000 BTC. This, once more, hinted at strategic institutional positioning slightly than panic promoting.

Sturdy technical basis helps BTC’s uptrend

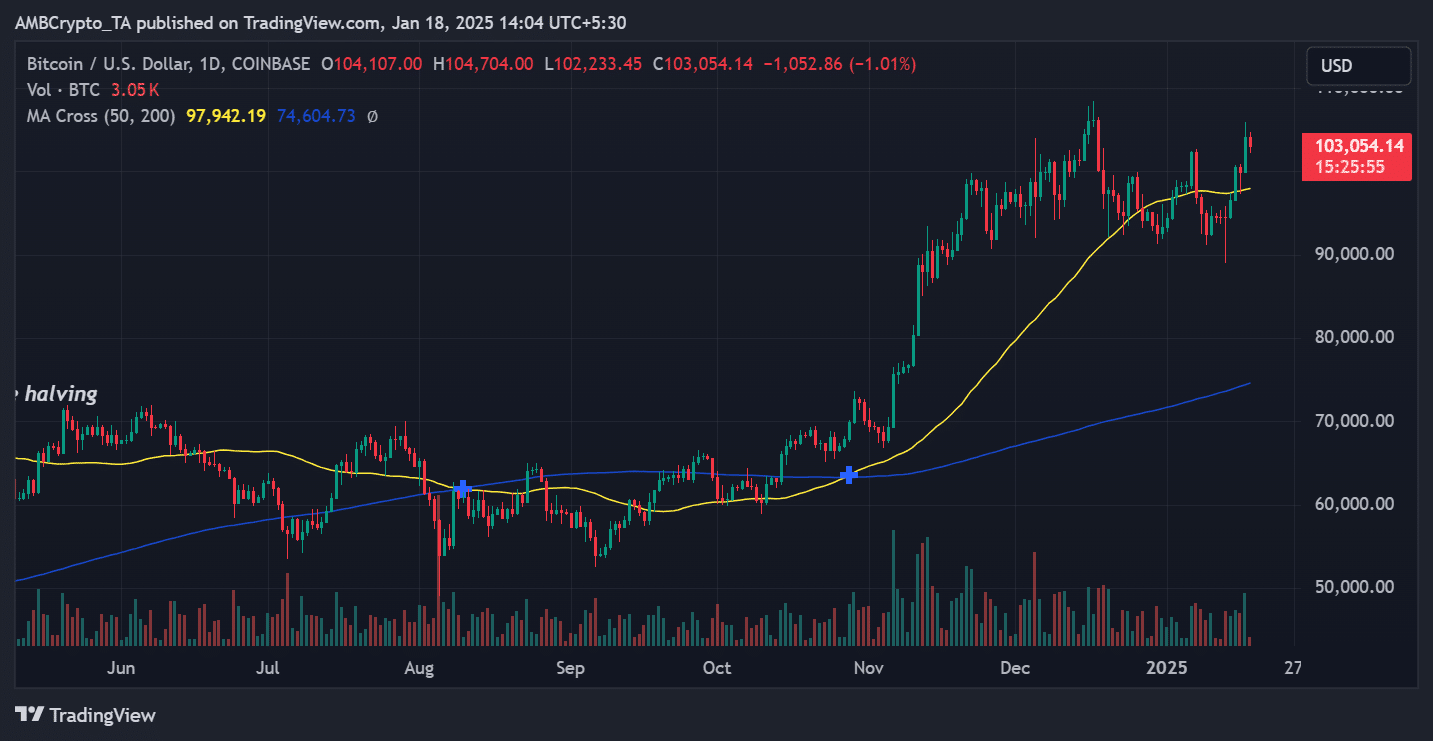

Supporting these on-chain metrics, Bitcoin’s worth motion maintained its bullish momentum on the charts, with the 50-day transferring common at $97,942.19 offering dynamic help properly above the 200-day MA at $74,604.73.

This important hole between transferring averages, over $23,000, highlighted robust upward momentum.

The latest buying and selling quantity of three.05K BTC at $103,054.14 demonstrated sustained institutional curiosity, whereas the sequence of upper lows since November shaped a sturdy technical basis.

The latest pullback from $105,841.64 to its press time ranges represented a wholesome consolidation, slightly than a development reversal.

On-chain metrics affirm Bitcoin’s power

The Spent Output Revenue Ratio (SOPR) added one other layer of confidence, sustaining ranges constantly above 1.0 since November’s surge. This metric, hovering round 1.04, indicated that the majority Bitcoin transactions have been realizing modest income, with out triggering mass promoting.

Lastly, change netflow patterns confirmed a calculated distribution method, with constructive inflows of 308.7 BTC suggesting managed accumulation slightly than distribution.

Historic netflow spikes, significantly these seen in December, have preceded important worth actions, indicating strategic positioning by massive gamers.

– Learn Bitcoin (BTC) Value Prediction 2024-25

Wanting forward, Bitcoin’s skill to carry above the psychological $100,000-level whereas institutional wallets proceed rising may sign strengthening market fundamentals. The convergence of a number of constructive indicators – file whale addresses, wholesome SOPR ranges, robust transferring common help, and strategic change flows – suggests BTC’s market construction stays sturdy.

Nonetheless, merchants ought to carefully monitor the $105,000 resistance stage. A decisive break above this threshold may set off the following important transfer.