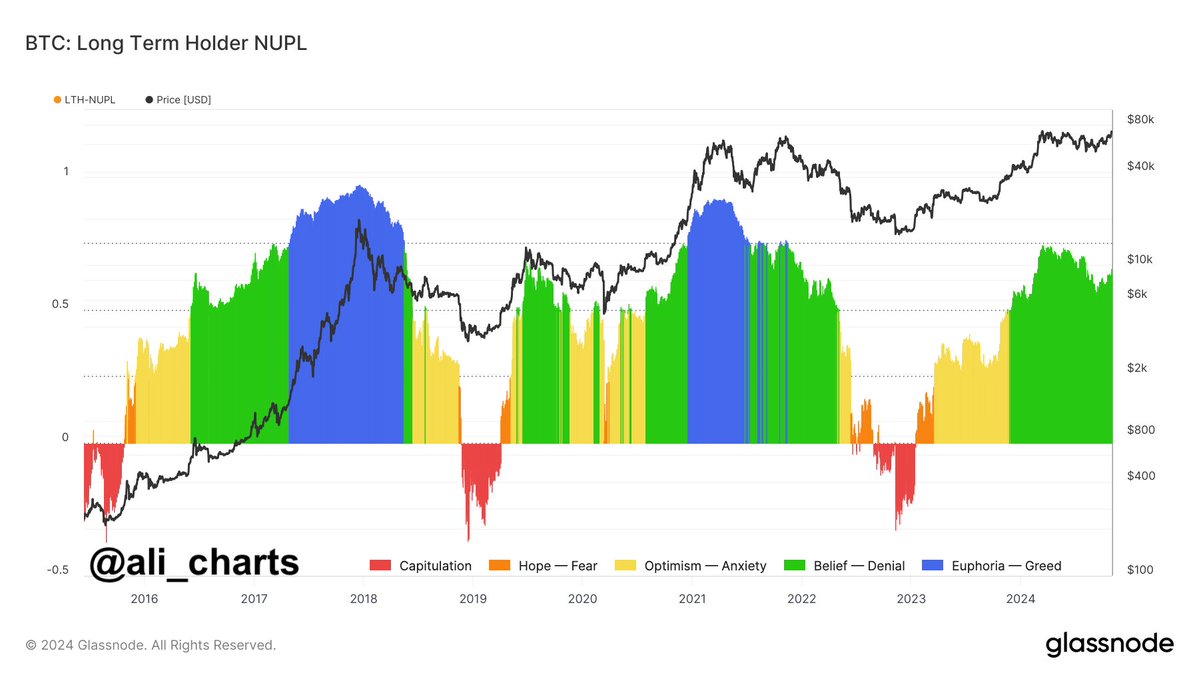

- Bitcoin’s concern and greed index reveals optimism.

- BTC worth motion and MVRV Z-Rating all level up.

Bitcoin [BTC] might be in for a dramatic trip with the US Presidential elections, however the end result will vastly affect its motion.

Traditionally, BTC has proven vital worth motion actions round election intervals, and this time might observe an analogous pattern.

Bitcoin ranges of Concern and Greed Index was at perception as of press time, suggesting worth may rally due the affect of US election outcomes on crypto markets.

The US elections have persistently impacted cryptocurrencies like Bitcoin. As one of many world’s largest economies, the US performs a vital position in market liquidity.

During the last three elections, Bitcoin’s worth responded positively, with merchants anticipating optimistic positive factors amid political adjustments.

Ought to Donald Trump win over Kamala Harris, many analysts consider BTC would rally much more intensely, pushed by expectations of a pro-crypto strategy. Although a Harris win may nonetheless help BTC, the upside might be extra modest compared.

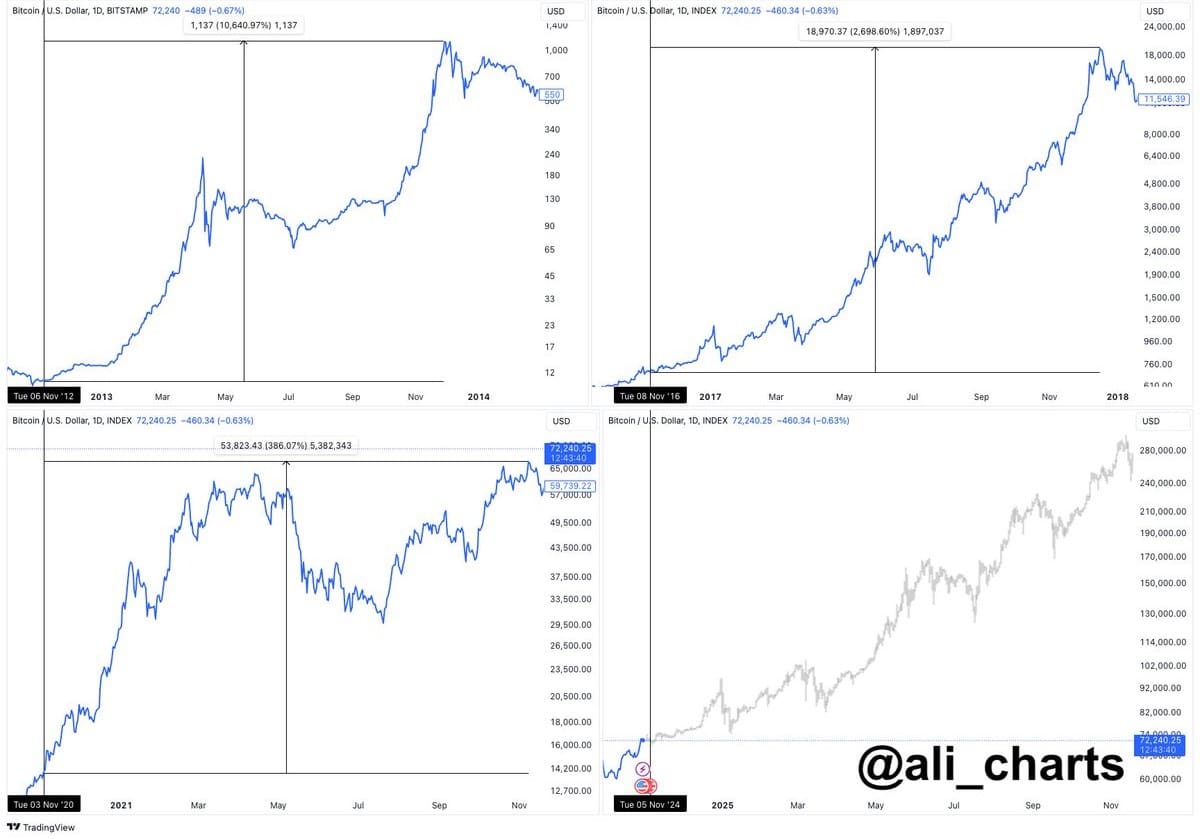

Historic BTC worth motion and MVRV Z-Rating

Inspecting earlier election cycles provides perception into Bitcoin’s potential efficiency. The 2012 election noticed Bitcoin surge by over 10,000%, whereas the 2016 election introduced positive factors of two,698%, and the 2020 election boosted BTC by 386%.

Whereas every election yr noticed successively smaller returns, Bitcoin stays extremely more likely to react to the election’s end result.

With political discourse round Bitcoin and cryptocurrencies turning into extra outstanding this cycle, BTC may expertise even greater volatility.

A Trump victory might encourage better parabolic strikes, whereas a Harris win would probably nonetheless lead to positive factors, albeit at a slower tempo.

By way of Bitcoin’s valuation metrics, the MVRV Z-Rating presently factors to vital upside potential. This rating measures market cap towards realized cap, serving to to evaluate if BTC is overvalued or undervalued.

With the MVRV Z-Rating close to 2, BTC nonetheless has room to climb towards 6, a stage the place profit-taking by long-term holders might result in a correction.

Traditionally, this metric has served as a dependable indicator for recognizing BTC’s tops, and the present readings counsel BTC hasn’t but reached peak ranges.

Merchants following the metric consider BTC might proceed its upward trajectory as shopping for stress builds.

Lively addresses momentum

Technical indicators additionally favor a possible rally. The 30-day transferring common just lately crossed above the 365-day transferring common, making a “golden cross,” a bullish sign usually related to robust upward momentum.

This crossover, coupled with growing transaction volumes—practically double these of the 2021 cycle—signifies rising market exercise and shopping for curiosity.

Nevertheless, if the 30-day transferring common fails to take care of its place above the 365-day transferring common, BTC’s worth pattern may stall, resembling the mid-2021 section when momentum light.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Bitcoin’s worth stands poised to make vital strikes in response to the election’s end result. Whereas the broader pattern suggests optimism, buyers ought to stay cautious, as market circumstances might shift shortly.

With volatility more likely to improve, Bitcoin’s path ahead would largely depend upon the political panorama and continued investor curiosity.