- Key occasions that would affect BTC’s worth are developing this week.

- BTC has misplaced some positive factors from its earlier buying and selling session.

Bitcoin [BTC] has encountered risky worth actions in current days, exemplified by a notable over 3% decline on the tenth of Could, which drove its worth right down to $60,000.

Nevertheless, indications counsel that these uneven fluctuations could persist, largely influenced by the approaching Federal Reserve conferences.

Bitcoin traders await BLS occasions outcomes

The upcoming occasions scheduled by the US Bureau of Labor Statistics (BLS) this week are noteworthy for traders resulting from their potential affect on funding choices.

Historic knowledge means that bulletins from the Federal Reserve (Fed) have influenced Bitcoin costs previously.

Due to this fact, the upcoming speech by Fed Chair Jerome Powell, scheduled for the 14th of Could, is especially vital.

The BLS schedule signifies two key occasions: the Producer Value Index (PPI) at this time and the Client Value Index (CPI) on the fifteenth of Could.

The PPI measures adjustments in costs obtained by producers for items and companies, whereas the CPI tracks adjustments in costs paid by shoppers for those self same items and companies.

Each indices function important financial indicators that traders depend on to gauge the state of the financial system.

Moreover, the BLS web site signifies an upcoming occasion targeted on employment claims later within the week.

These macroeconomic occasions are poised to affect Bitcoin worth actions as traders carefully monitor them to tell their funding methods.

What to anticipate from Bitcoin worth strikes

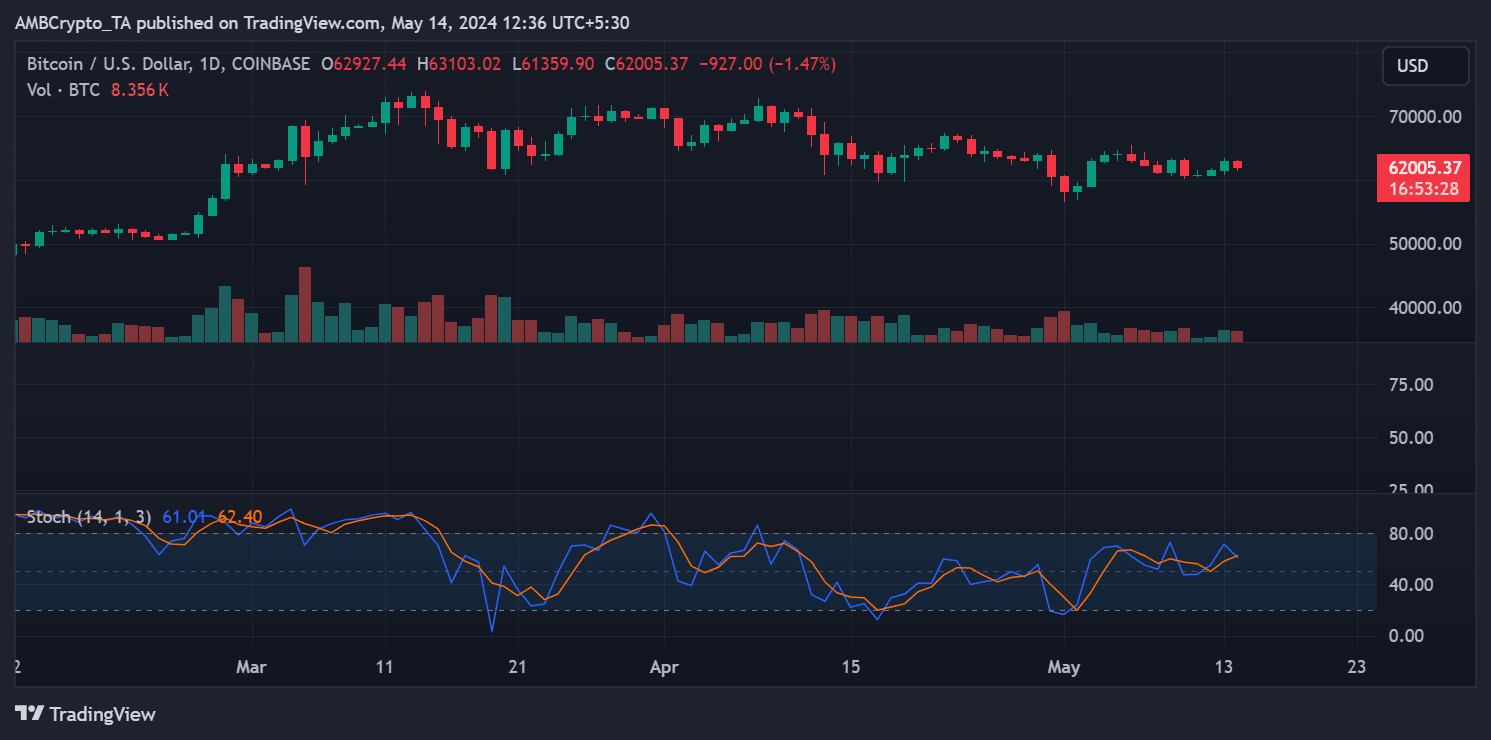

AMBCrypto’s evaluation of Bitcoin’s worth development on a every day timeframe chart indicated a sluggish efficiency over current weeks.

On the tenth of Could, the value skilled a big drop from over $63,000 to round $60,000, reflecting a lack of over 3%.

Whereas trying to get better for the reason that eleventh of Could, Bitcoin might solely attain roughly $62,900. On the time of this writing, it was buying and selling at round $62,000, with a decline of over 1%.

Examination of the stochastic indicator prompt the potential for additional decline, as a crossover was nonetheless ongoing.

Nevertheless, based mostly on current worth motion, the $60,000 stage seems to function a powerful help area. Ought to the value drop additional, round $57,000 may act as one other stage of help to stop additional decline.

Doable rise in BTC quantity anticipated

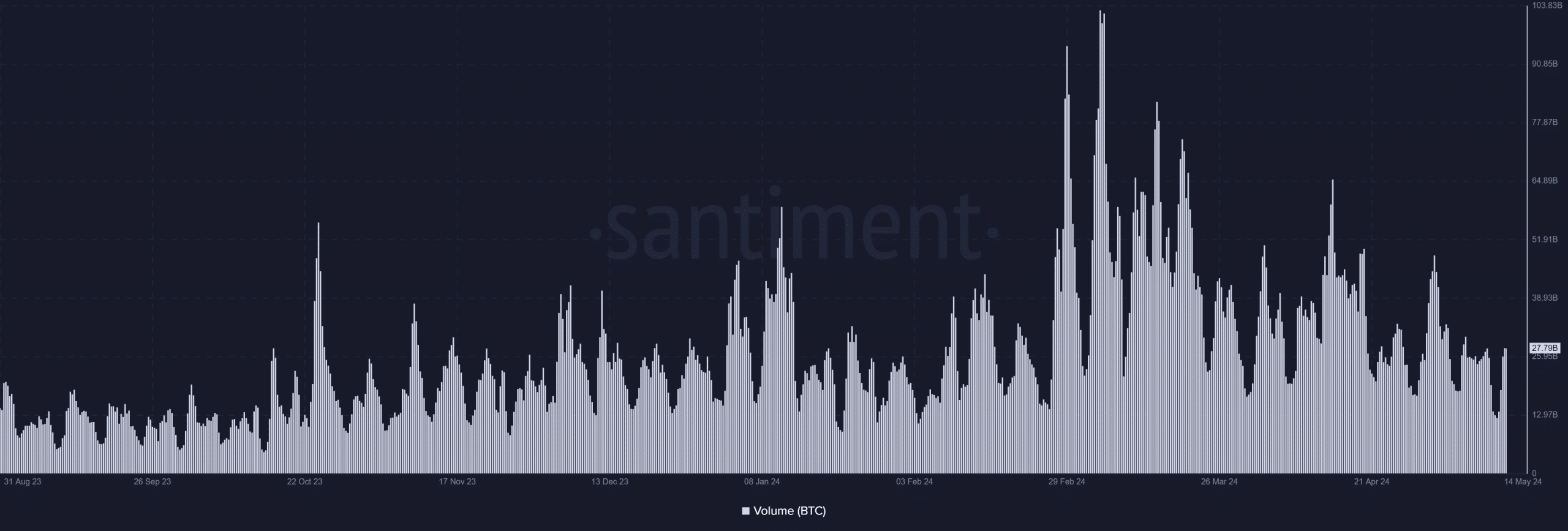

The amount metric for Bitcoin might expertise elevated exercise if the value begins to say no.

The chart revealed that through the earlier buying and selling session, when the Bitcoin worth was rising, the amount was roughly $25 billion.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nevertheless, on the time of writing, because the BTC worth has dropped, the amount has already surged to just about $28 billion.

This uptick in quantity suggests heightened buying and selling exercise, probably indicating elevated promoting stress if the value continues to fall.