- As per the most recent evaluation, the profit-taking pattern would possibly proceed additional.

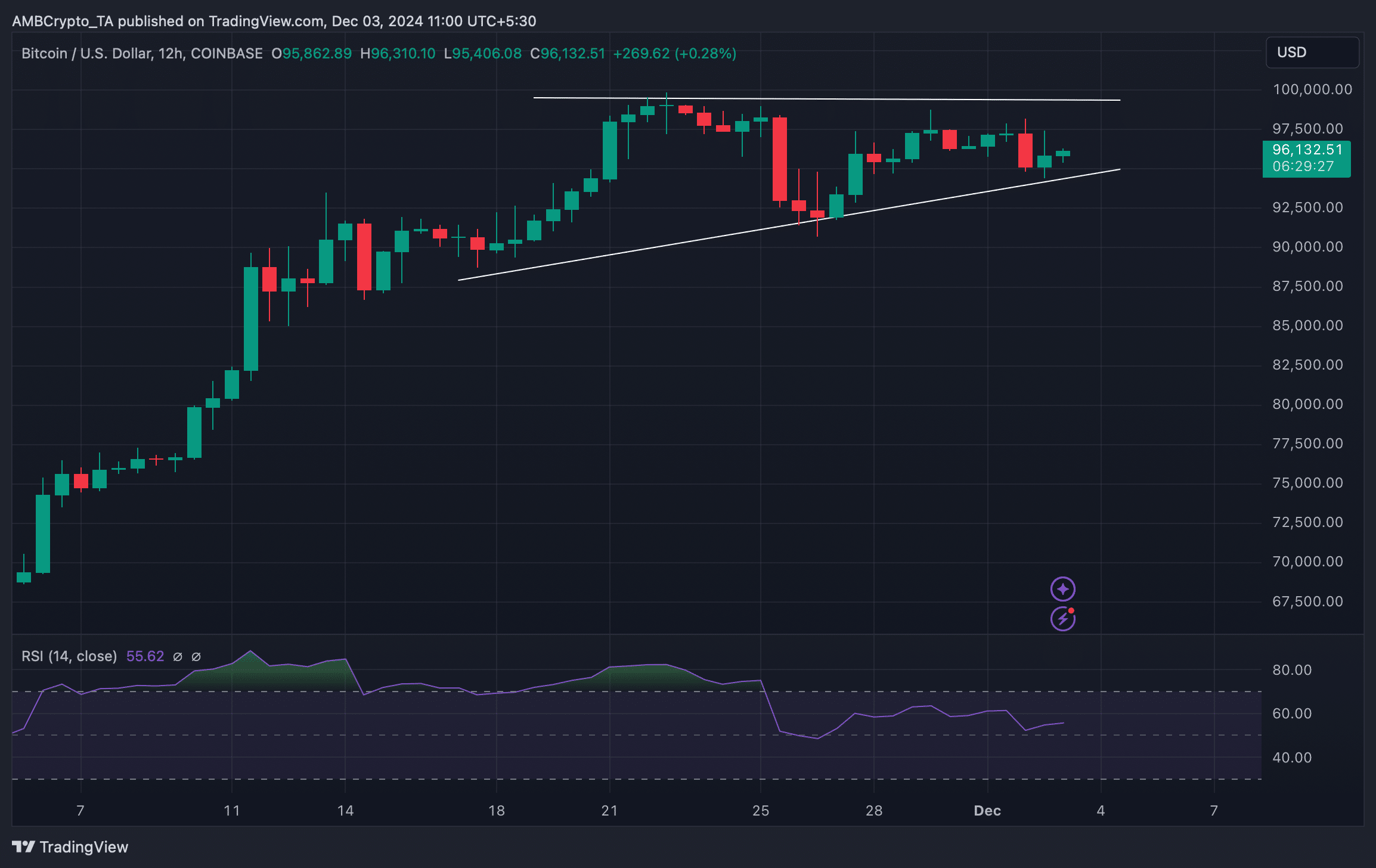

- Nonetheless, a bullish sample appeared on BTC’s 12-hour chart.

Bitcoin [BTC] momentum remained low because it continued to consolidate close to the $96k mark. The most recent evaluation revealed a potential purpose behind this pattern. In reality, the evaluation additionally revealed that the continued pattern would possibly proceed additional.

Bitcoin long-term holders’ plan

After touching $97k on the 2nd of December, Bitcoin’s worth plummeted to $94k. Nonetheless, the king coin gained slight bullish momentum because it as soon as once more crossed $96k.

This worth motion indicated a consolidation part inside this vary, because it was failing to satisfy traders’ expectation of reaching $100k.

In the meantime, Alphractal, a knowledge analytics platform, posted a tweet mentioning how long-term holders’ actions could be influencing BTC’s worth.

As per the tweet, LTHs have distributed a major quantity of BTC at a revenue, growing short-term promoting strain. This pattern is clearly mirrored within the Lengthy Time period Holders SOPR indicator.

Moreover, since late 2023, the addresses of those holders have continued to be at extraordinarily worthwhile ranges, based on the Lengthy Time period Holders NUPL Heatmap.

This indicated that LTHs would possibly take extra revenue, presumably inflicting an extra rise in promoting strain. If that’s true, then this issue might be inflicting BTC’s worth to consolidate. In reality, an analogous pattern was seen throughout BTC’s earlier cycles.

The tweet talked about,

“It’s important to note that this distribution phase by Long-Term Holders can extend over several months, as observed in all previous cycles. This underscores their strategy of capitalizing on bullish cycles to move and realize profits from BTC held inactive for over 155 days.”

Will BTC proceed to consolidate?

Because the aforementioned evaluation recommended the potential for continued revenue taking, AMBCrypto checked different datasets to seek out whether or not additionally they recommend an analogous future, which might limit BTC from shifting up.

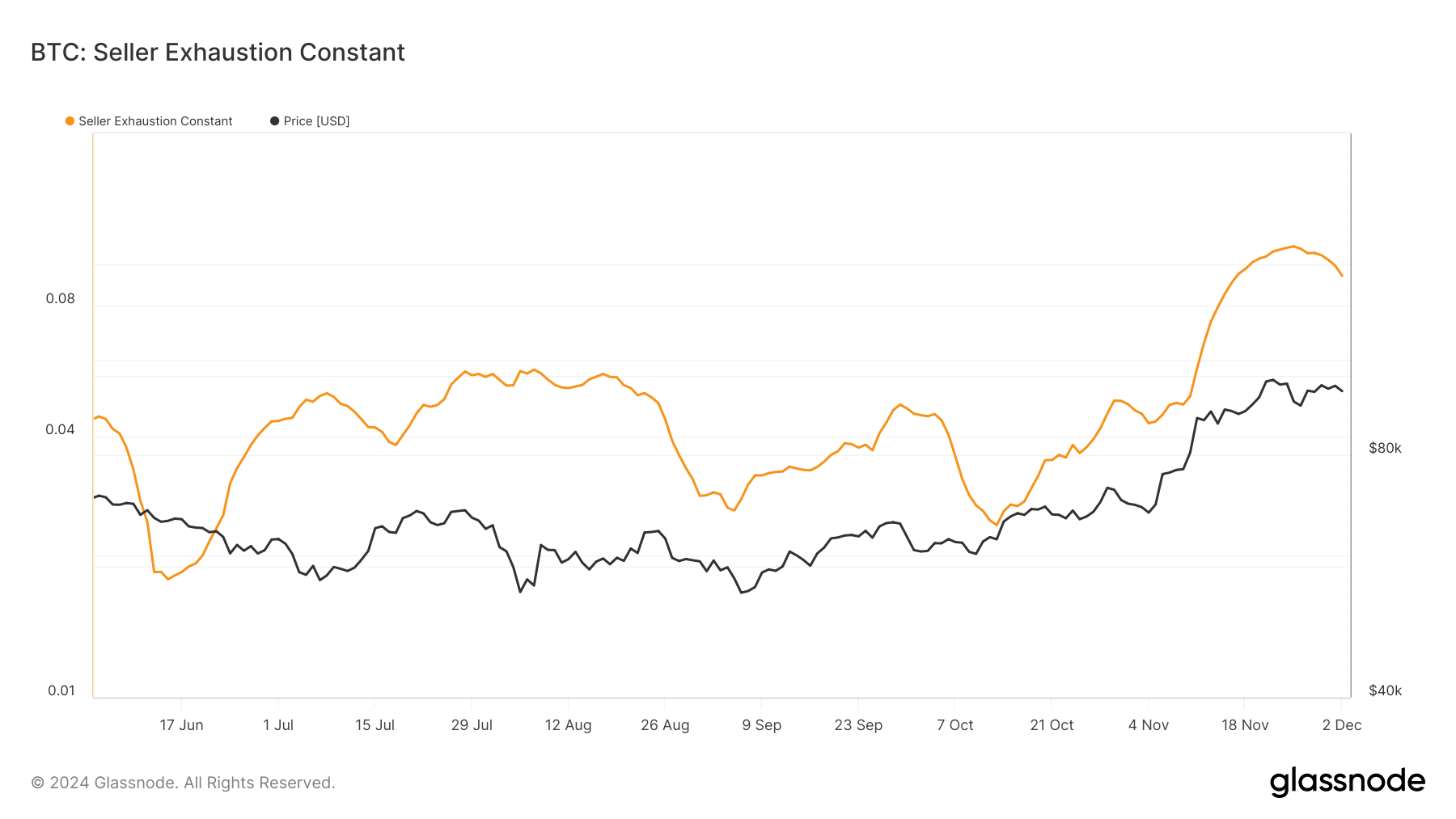

Glassnode’s knowledge revealed that BTC’s vendor exhaustion fixed began to say no after reaching a peak. On fairly just a few events, when the metric dropped, it was adopted by slight worth upticks.

The Pi Cycle High indicator identified that BTC has a market high of over $124k. Subsequently, if revenue taking declines and shopping for strain rises, then it received’t be too formidable to count on BTC touching $100k within the coming weeks.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Moreover, we discovered that BTC’s worth was shifting inside a bullish ascending triangle sample. A profitable breakout above that mark might set off a contemporary bull rally.

The chances of that occuring have been respectable, because the Relative Power Index (RSI) registered an uptick. This meant that purchasing strain was rising, which has the potential to push BTC’s worth up.