- Greater than 98% of BTC addresses have been in revenue, due to its bullish value pattern.

- Accumulation was excessive, however indicators recommended that Bitcoin was getting overvalued.

Bitcoin [BTC] lived as much as traders’ expectations final week by pumping its value nicely sufficient. Nonetheless, the king coin began to consolidate over the previous few days because it continued to maneuver in direction of the $100k mark.

In the meantime, an important BTC metric turned bearish, hinting at a pullback.

Bitcoin traders are getting ‘GREEDY’

BTC managed to push its value by 8% final week. Actually, AMBCrypto reported earlier that this push allowed BTC to flip its $96k resistance into a brand new help, hinting at an additional rise above $100k.

Because of that, 53.24 million BTC addresses have been in revenue, which accounted for 98% of the overall variety of Bitcoin addresses.

Nonetheless, the coin began to consolidate within the final 24 hours as its every day chart turned purple. At press time, the king coin was buying and selling at $97.7k. Whereas that occurred, Ali Martrinez, a preferred crypto analyst, posted a tweet revealing a notable growth.

As per the tweet, long-term BTC holders have been displaying indicators of rising greed. Traditionally, this conduct suggests it might take 8-11 months for BTC to hit a market high.

If this seems to be true on this event, BTC reaching a market high would possibly get delayed. To be exact, traders would possibly see BTC reaching that stage solely by June or September 2025.

Assessing BTC’s metrics

To see whether or not the rising greed available in the market will lead to a correction, AMBCrypto assessed Glassnode’s knowledge. After a pointy decline, Bitcoin’s NVT ratio began to rise once more. This meant that BTC was getting overvalued, suggesting a value drop quickly.

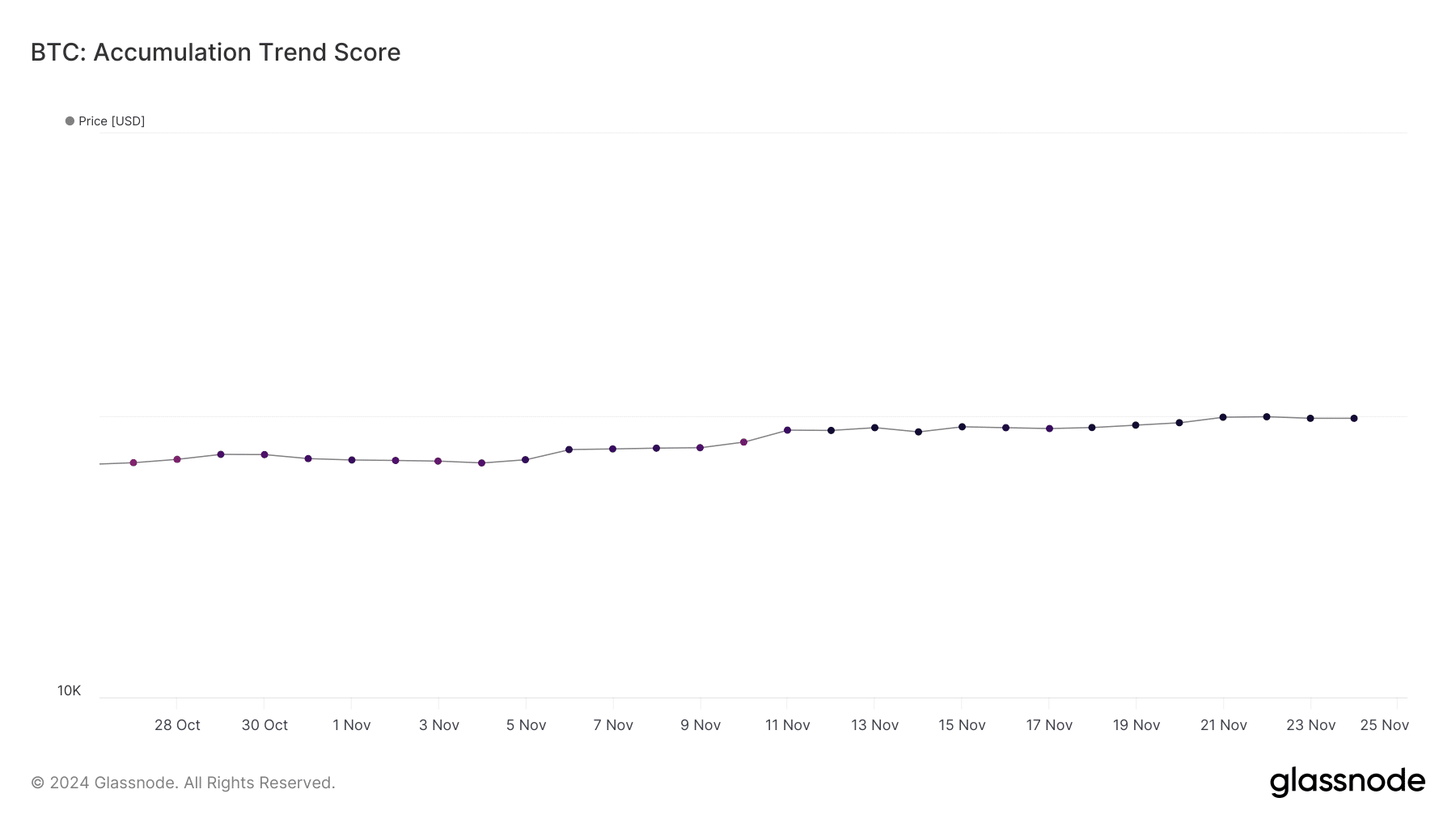

Nonetheless, the market at giant continued to stay optimistic on BTC. This was evident from the coin’s accumulation pattern rating, which had a worth of over 0.9.

For initiators, a worth nearer to 1 signifies excessive shopping for strain. Usually, rising shopping for strain leads to continued value hikes. Due to this fact, the possibilities of BTC not getting affected by the rising greed available in the market can’t be dominated out but.

Other than that, Bitcoin’s Open Curiosity (OI) additionally remained excessive. At any time when the metric rises, it signifies that the possibilities of the continuing value pattern persevering with are excessive. Nonetheless, a take a look at BTC’s every day chart revealed that the coin was testing a trendline resistance.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The MACD displayed the possibilities of a bearish crossover. Furthermore, the Relative Power Index (RSI) was resting within the overbought zone.

This would possibly set off a sell-off, which might limit BTC from breaking above the resistance within the near-term.