- Bitcoin exited the ‘extreme greed’ zone and will help sustainable development

- MVRV and Pi Cycle Prime indicators revealed that BTC nonetheless had room for upside

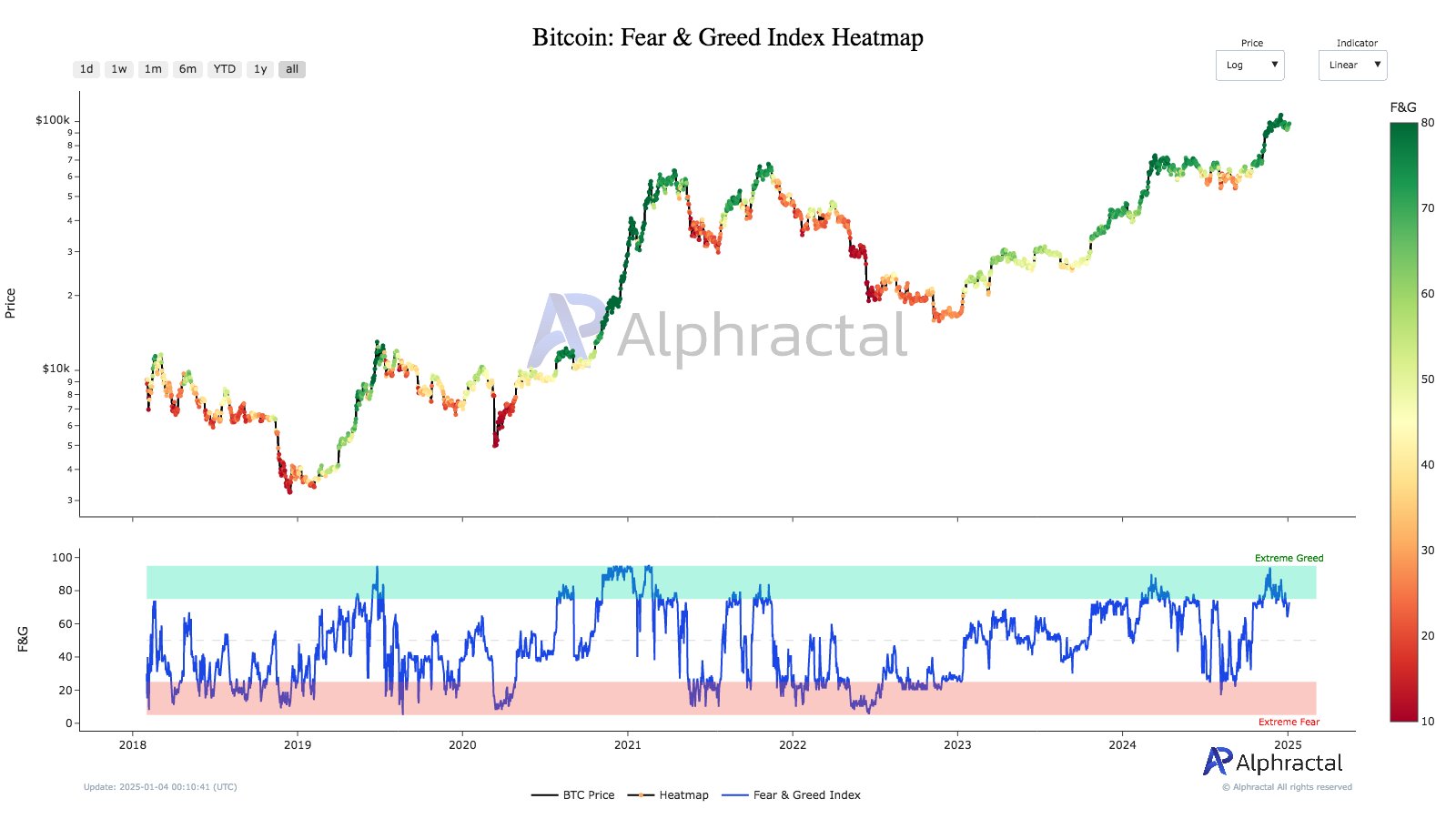

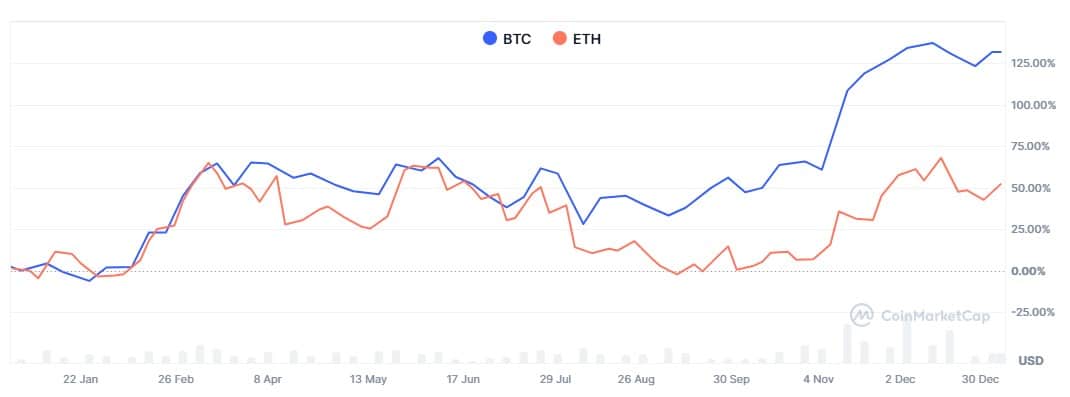

Bitcoin’s [BTC] market sentiment has exited the “extreme greed” zone for the primary time for the reason that “Trump pump” commerce started in November. This could supply BTC much-needed room to develop.

In accordance with the pseudonymous on-chain analyst Darkish Fost, the “extreme greed” section marked an overheated market and a possible pullback. In accordance with Fost, that is what led to the cryptocurrency’s decline from $108k to almost 90k.

A set-up for a sustained BTC rally?

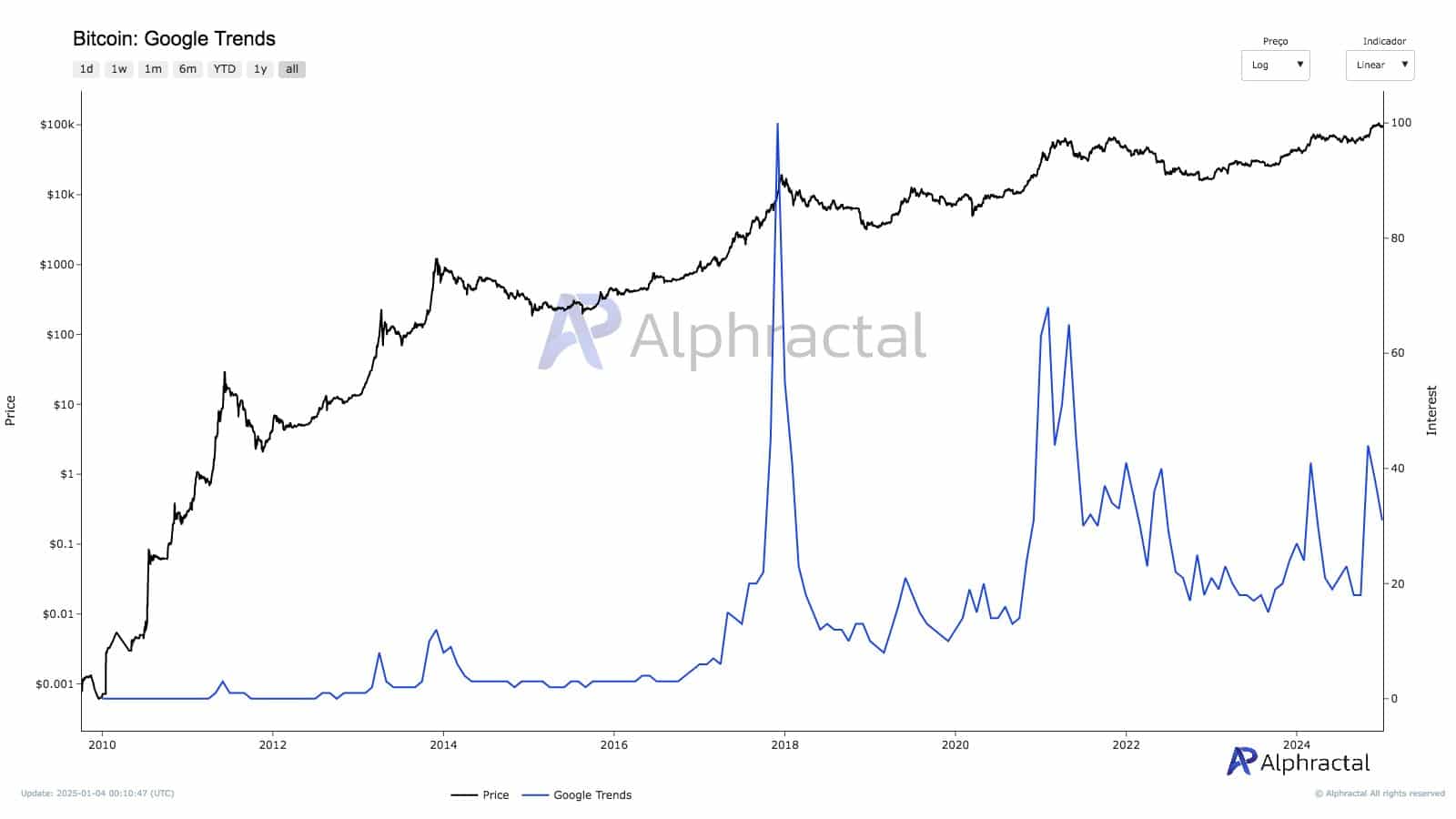

Moreover, new market curiosity in Bitcoin, as tracked by Google Developments, dropped considerably because the asset declined beneath the $100k milestone.

Traditionally, a surge throughout Google Developments is all the time related to euphoria and potential market corrections or tops.

Taken collectively, Darkish Fost famous that the aforementioned tendencies imply that BTC has extra room for development within the close to time period. He acknowledged,

“Overall sentiment remains positive, yet interest from potential newcomers stays relatively low, it may lead to the continuation of the bullish phase in the mid-term.”

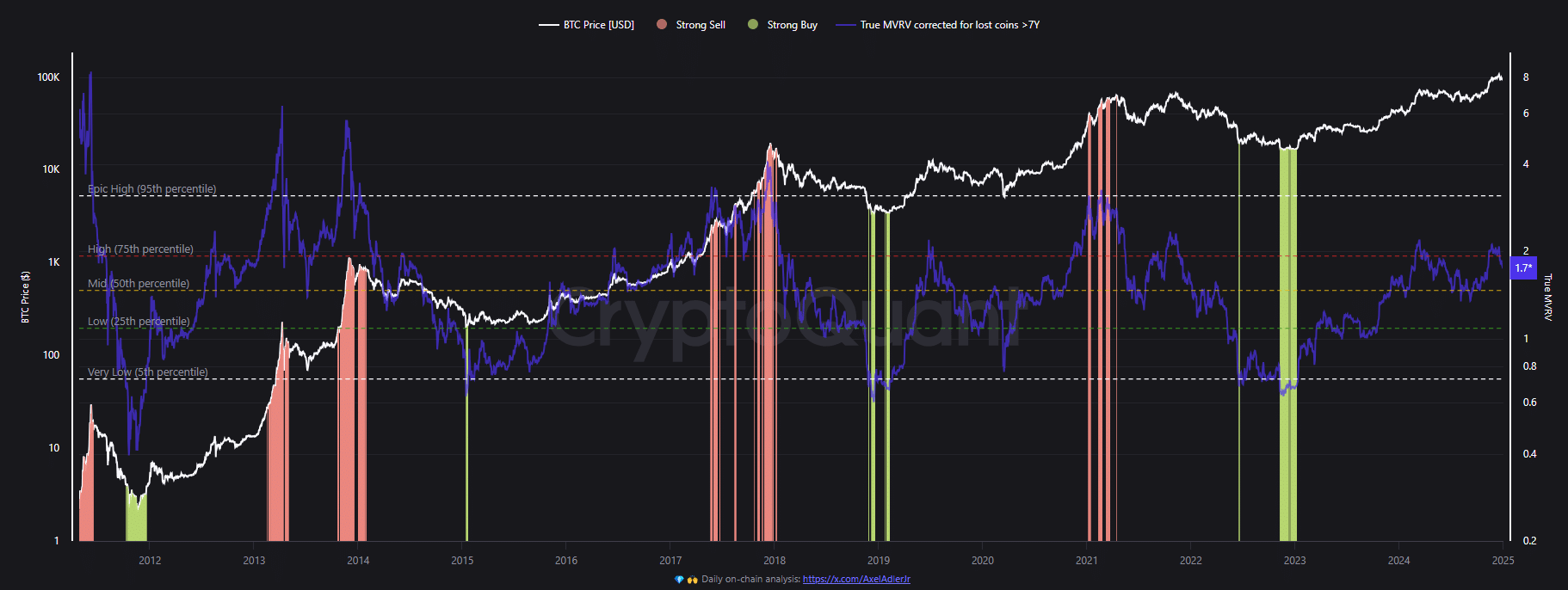

His remark was echoed by the True MVRV (Market Worth to Realized Worth) – A metric used to gauge whether or not BTC is overvalued and to trace the market cycle.

The metric precisely pinned earlier native and market cycle tops. In reality, the 2024 March and December tops had been triggered when the metric tapped 2. Generally, a surge to 4 marked a cycle prime.

On the time of writing, the metric had retreated to 1.7 and was removed from 4, suggesting that BTC’s cycle prime wasn’t shut.

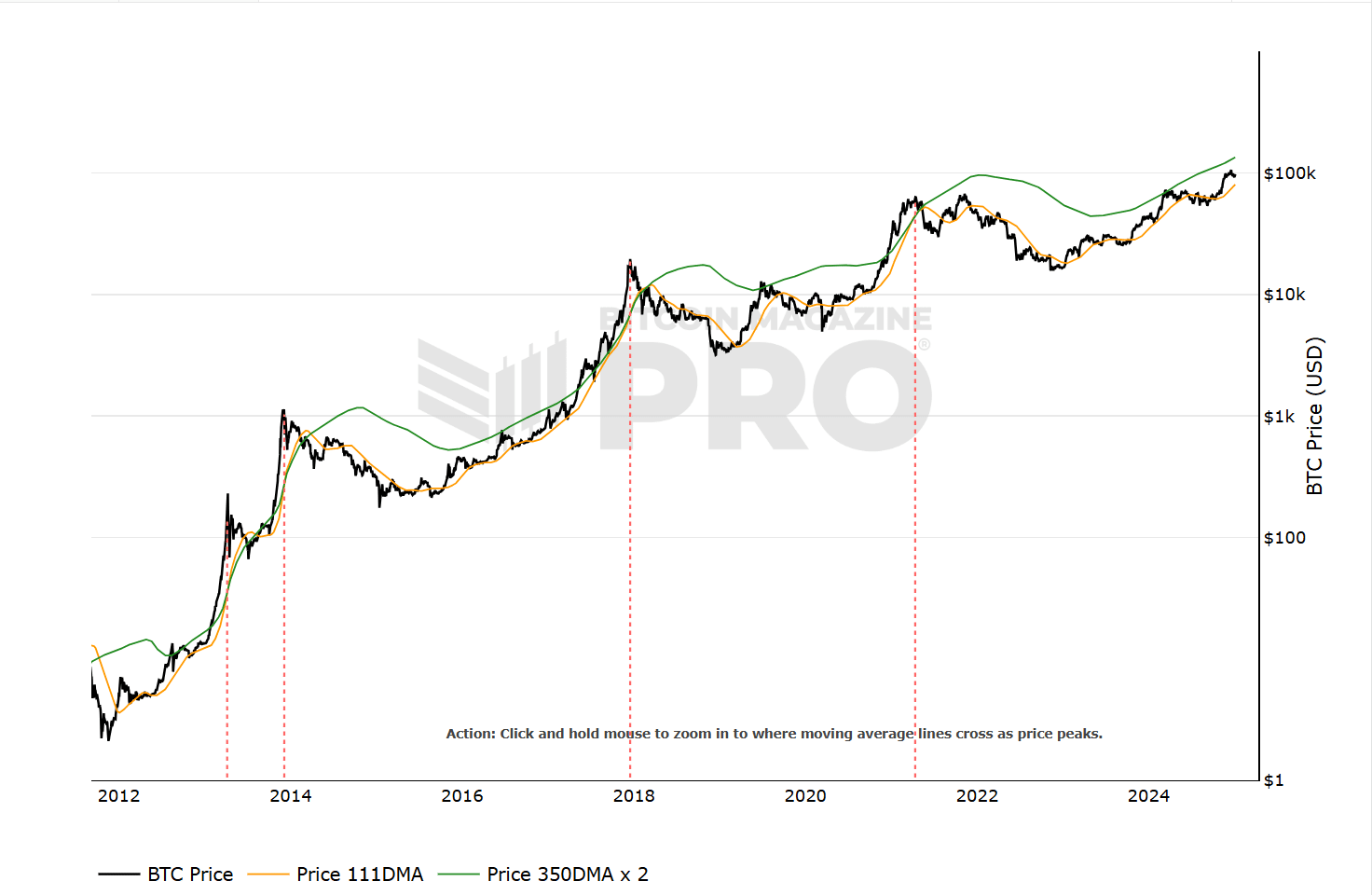

One other cycle prime indicator, the Pi Cycle prime, was removed from triggering this market peak. The metric flagged earlier market peaks when the 111-day transferring common crossed the modified 350-day transferring common and cycle.

Learn Bitcoin [BTC] Worth Prediction 2025-2026

In abstract, BTC’s retreat from “extreme greed” may be seen as a welcome aid for prolonged and sustainable development within the mid-term. The potential for upside was additional illustrated by key market cycle prime indicators that had been but to set off a possible peak for the cryptocurrency.