- Although earlier inflows had been value billions, the ETF registered a web outflow on the tenth of June.

- Lengthy-term holders had been cashing out, suggesting an additional decline for BTC.

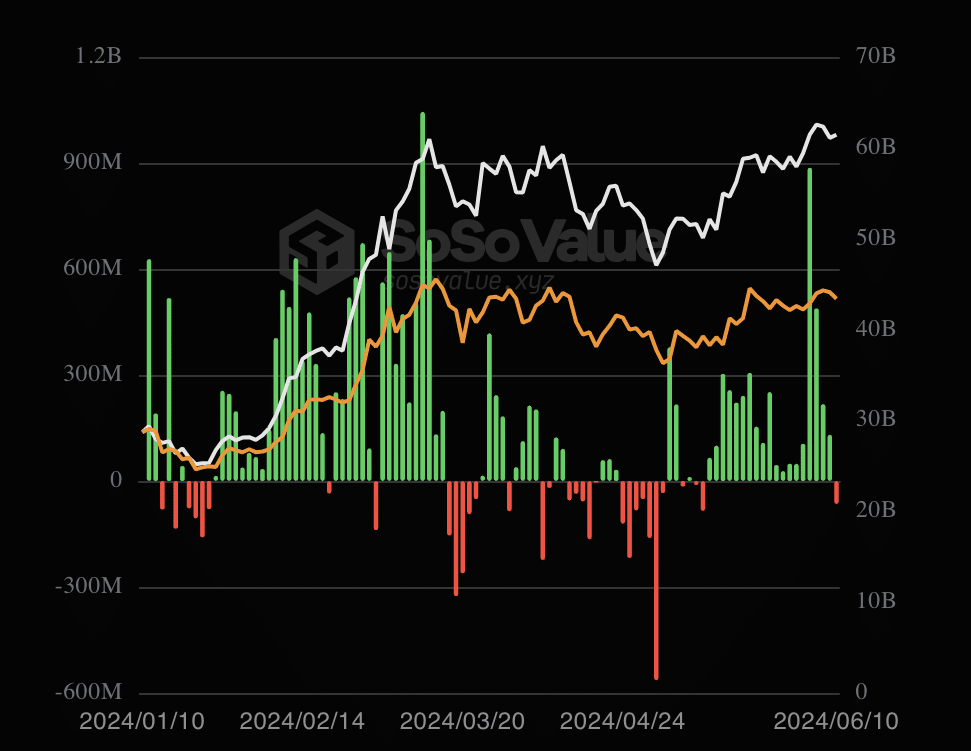

Bitcoin [BTC] ETFs have registered 19 consecutive days of inflows after enduring outflows for an extended interval. Led by BlackRock Bitcoin ETF, the inflows have been value nearly $3 billion in the previous few weeks.

For instance, on the tenth of June, BlackRock recorded an influx of $6.34 million. Bitwise’s IBIT had $7.59 million. Nonetheless, the tides appear to have modified as Grayscale’s GBTC had a better outflow at$39.53 million.

Because of GBTC’s file, the overall outflow was increased than the influx. For the unaccustomed, a Bitcoin ETF isn’t the identical as BTC, the cryptocurrency.

The outflows are taking the highest spot

For Bitcoin ETFs, you don’t have to personal Bitcoin. As a substitute, you solely have to have publicity to the cryptocurrency as the worth affect the Internet Asset Worth of the ETF.

Within the first quarter (Q1) of 2024, the property, led by BlackRock Bitcoin ETF, recorded billions of {dollars} in inflows on a number of days. Due to this, the worth of the coin rallied to a brand new all-time excessive in March.

In a while, the cash stopped coming in, thereby, main Bitcoin to slide beneath $60,000 at one level. However the resurgence in the previous few weeks ensured that BTC’s correction slowed down.

Additionally, it was throughout the identical interval that BlackRock Bitcoin ETF hit $20 billion in AUM. AUM stands for Belongings Below Administration. The AUM displays the influx and outflow of a fund, and the worth efficiency of the property.

Nonetheless, with the latest improve in outflows, Bitcoin’s value may be heading for a decline. At press time, BTC modified fingers at $67,539. This represents a 2.63% lower within the final 24 hours.

Will BTC slip beneath $67,000?

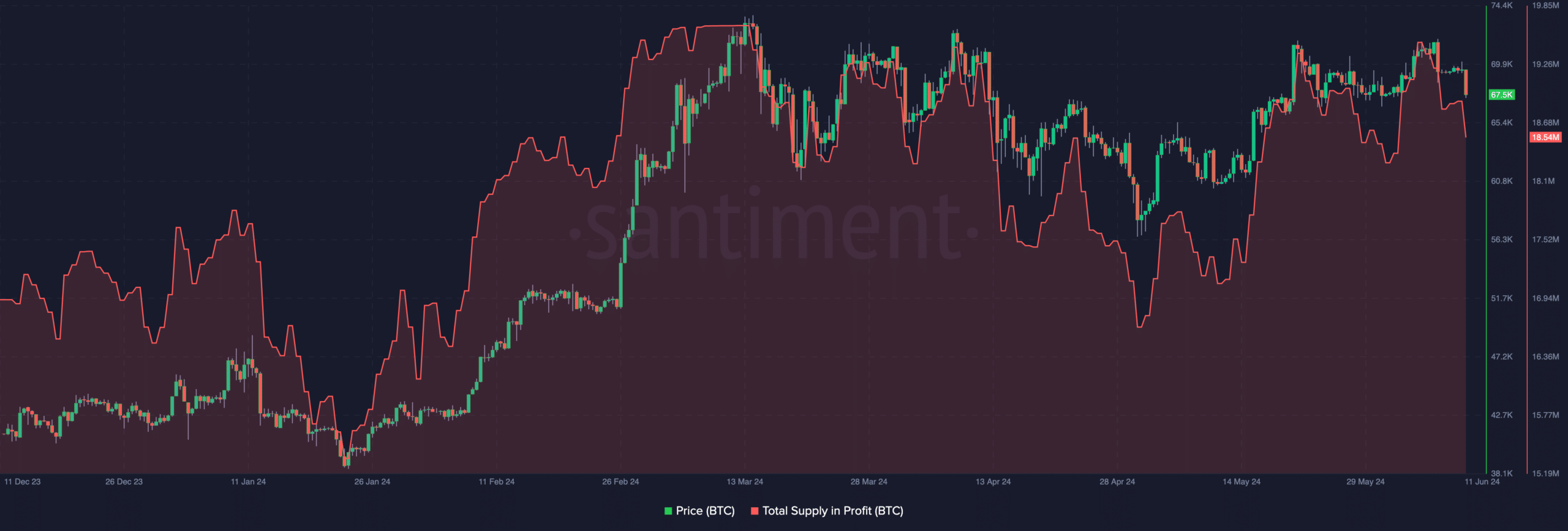

Because of this, the overall provide in revenue dropped. Based on Santiment, Bitcoin’s whole provide in revenue has declined to 18.54 million from a ceiling of 19.64 million.

Ought to Bitcoin value proceed to drop, the availability in revenue may also head downwards. Nonetheless, a decrease revenue provide could possibly be an opportunity for market members to purchase the coin at a reduction.

If this purchase sign seems, Bitcoin would possibly rebound towards $70,000 within the brief time period. Nonetheless, if promoting strain continues, the worth of BTC may lower to $65,000.

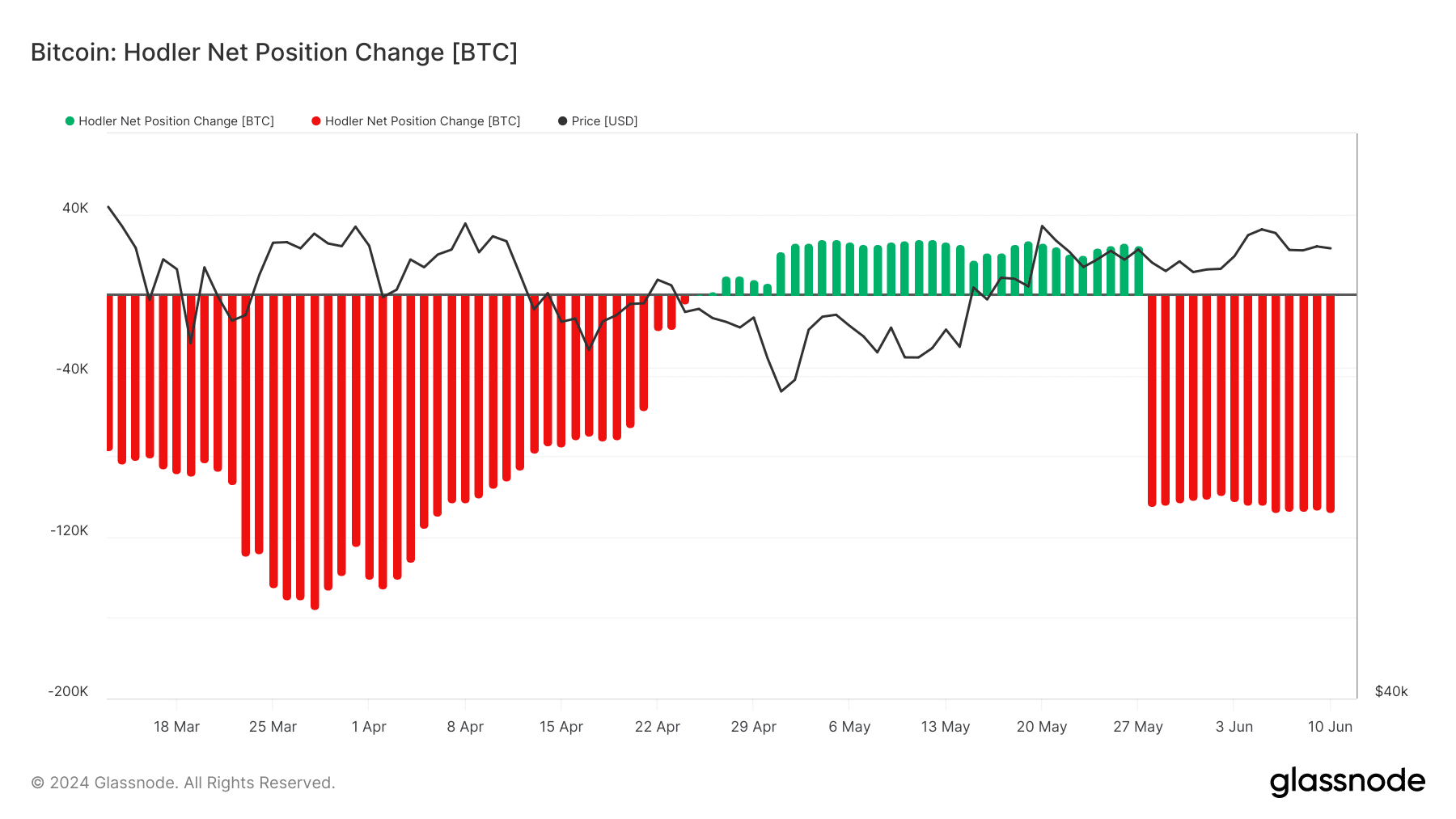

Other than BlackRock Bitcoin ETF and the metric above, AMBCrypto checked out an important indicator. The metric thought-about was the Hodler Internet Place Change.

A constructive studying of this indicator counsel that long-term holders are accumulating. However, a damaging worth implies a rise in Bitcoin cashed out.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Based on Glassnode, Bitcoin’s Hodler Internet Place Change was -107.211 BTC. This suggests that HODLers have been reserving income.

As such, Bitcoin’s value may lower fairly than rebound. Nonetheless, the bearish bias could possibly be invalidated if accumulation begins to come back in giant numbers.