The SEC has requested spot Ethereum ETF candidates to replace their 19-b4 filings, resulting in larger optimism round potential approvals, based on sources.

Bloomberg ETF analyst Eric Balchunas stated on Could 20 that the SEC may reverse its anticipated stance and select to not deny the pending functions. He cited ETF Retailer President Nate Geraci, who claimed the SEC may approve 19-b4 trade itemizing guidelines whereas suspending its resolution on S-1 registration statements.

James Seyffart added that he and Balchunas had heard from a number of sources and that a number of new filings ought to emerge within the coming days.

FOX Enterprise reporter Eleanor Terret stated her sources have additionally confirmed that the SEC has informed issuers to replace 19b-4 filings. She stated earlier that the matter is “evolving in real-time.”

Bloomberg odds at 75%

Balchunas and Seyffart up to date their odds for a spot Ethereum ETF approval to 75% from their most up-to-date predictions of 25% to 30%

Balchunas additionally famous that the matter has develop into an “increasingly political issue,” a subject that has been closely mentioned over the previous week.

On Could 15, Coinbase Analysis Analyst David Han urged that the US election yr may affect the SEC’s resolution. On the time, Balchunas referred to as Han’s statements a “risk-free PR move” and stated his personal predictions carried extra threat to his fame.

Bankless founder Ryan Sean Adams, who agreed that politics may play a task in approvals across the time of the Coinbase report, supported Balchunas’ statements at the moment. He responded:

“This is what political pressure during election years can do.”

Some commentators stay pessimistic. Blockchain Affiliation Director of Authorities Relations Ron Hammond stated on Could 20 that many consider the SEC will deny functions primarily based on political indicators and feedback from issuers.

First deadline looms

Deadlines are quickly approaching. The SEC should resolve on VanEck’s proposal for a spot ETH ETF on Could 23 however could resolve on a number of functions concurrently.

The prediction market Polymarket now suggests a ten% likelihood {that a} spot Ethereum ETF may very well be permitted by the tip of Could, primarily based on crypto-backed bets.

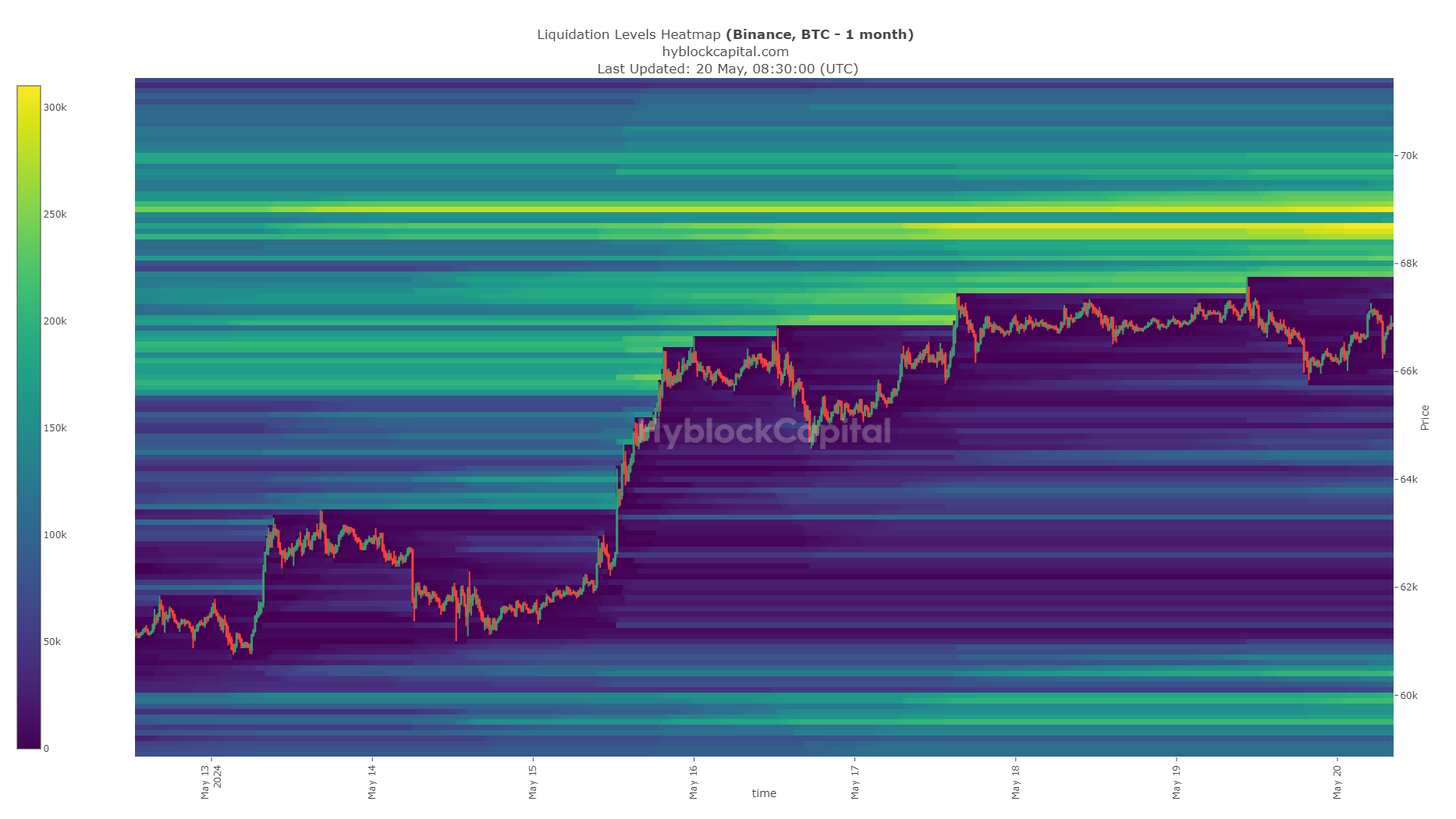

The most recent developments coincide with sudden worth development for ETH. The worth of Ethereum is up 20% over 24 hours, with most of these beneficial properties inside two hours of Balchunas’ announcement. The crypto market is up 6.7% over 24 hours, whereas Bitcoin is up 5.2%.

The put up Bloomberg analysts revise ETH ETF approval odds to 75% amid rumors of SEC flip appeared first on CryptoSlate.