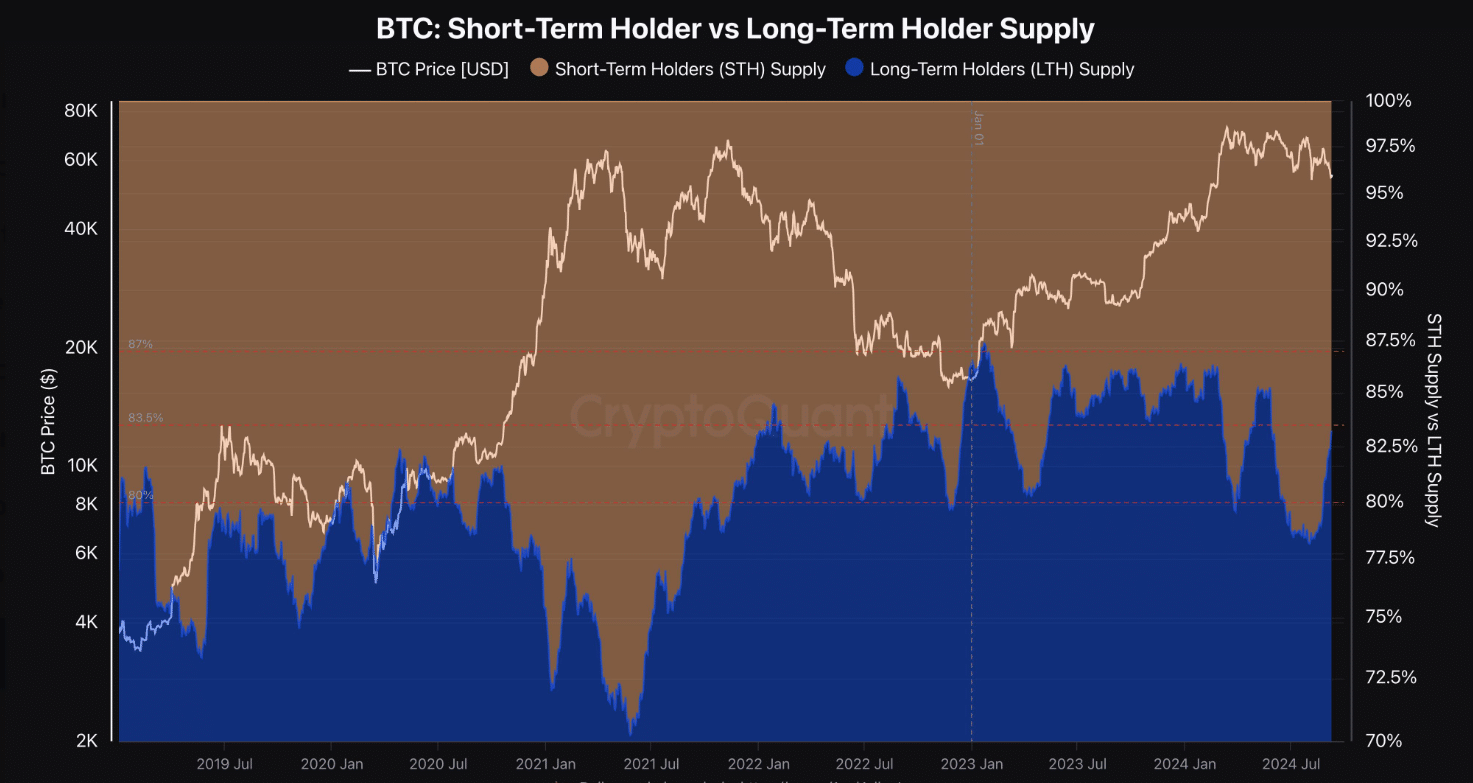

- Brief-term Bitcoin holders began to promote at unprecedented charges as long-term holders amassed.

- The shift in capital comes as merchants selected to stay risk-averse.

Bitcoin [BTC] was buying and selling at $58,200 on the time of writing after a 2.8% achieve. The worth enhance adopted the discharge of U.S. inflation information as merchants purchased into the narrative of the Federal Reserve trimming charges subsequent week.

Nonetheless, regardless of these good points, Bitcoin was nonetheless dealing with challenges. CryptoQuant writer IT Tech famous that short-term holders have been exiting the market.

Within the final two weeks, this cohort has decreased its web place on Bitcoin by profit-taking and loss-taking.

Throughout the identical interval, long-term Bitcoin holders have amassed extra cash, exhibiting a major shift in capital.

Brief-term Bitcoin holders have a extra speedy impression on value and by promoting, they contribute to uneven value strikes.

Nonetheless, the buildup by long-term holders may end in value stabilization and set the stage for a rebound.

Bitcoin holders exit

The weak demand for Bitcoin can be mirrored in its decoupling from gold, on condition that the latter not too long ago reached an all-time excessive.

The top of analysis at CryptoQuant, Julio Moreno, famous {that a} sustained interval of unfavourable correlation between Bitcoin and gold suggests a risk-averse setting.

It confirmed that merchants have been keen to carry much less unstable belongings resembling gold.

Furthermore, Bitcoin was underperforming alongside a weak U.S. greenback. This additionally confirmed threat aversion and uncertainty throughout international markets, which lowered demand for digital belongings.

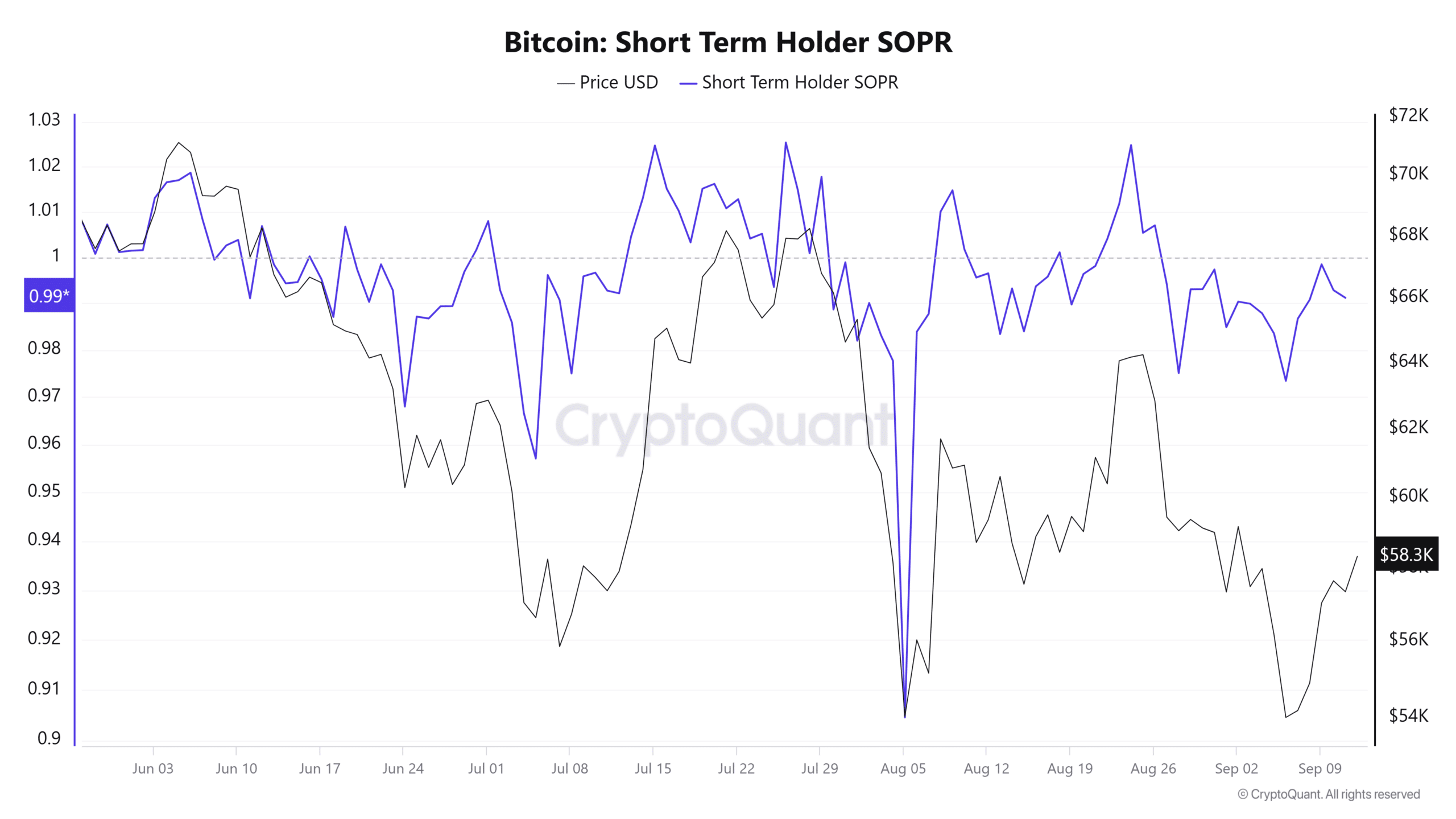

Brief-term Bitcoin holders have been additionally promoting at a loss, as seen within the Spent Output Revenue Ratio (SOPR), which has been beneath 1 because the twenty seventh of August.

Thus. merchants who’ve held BTC for 155 days or much less appeared keen to forego income and exit their positions as a result of worry that costs may drop additional. It additionally confirmed the energy of the bearish sentiment.

Value outlook

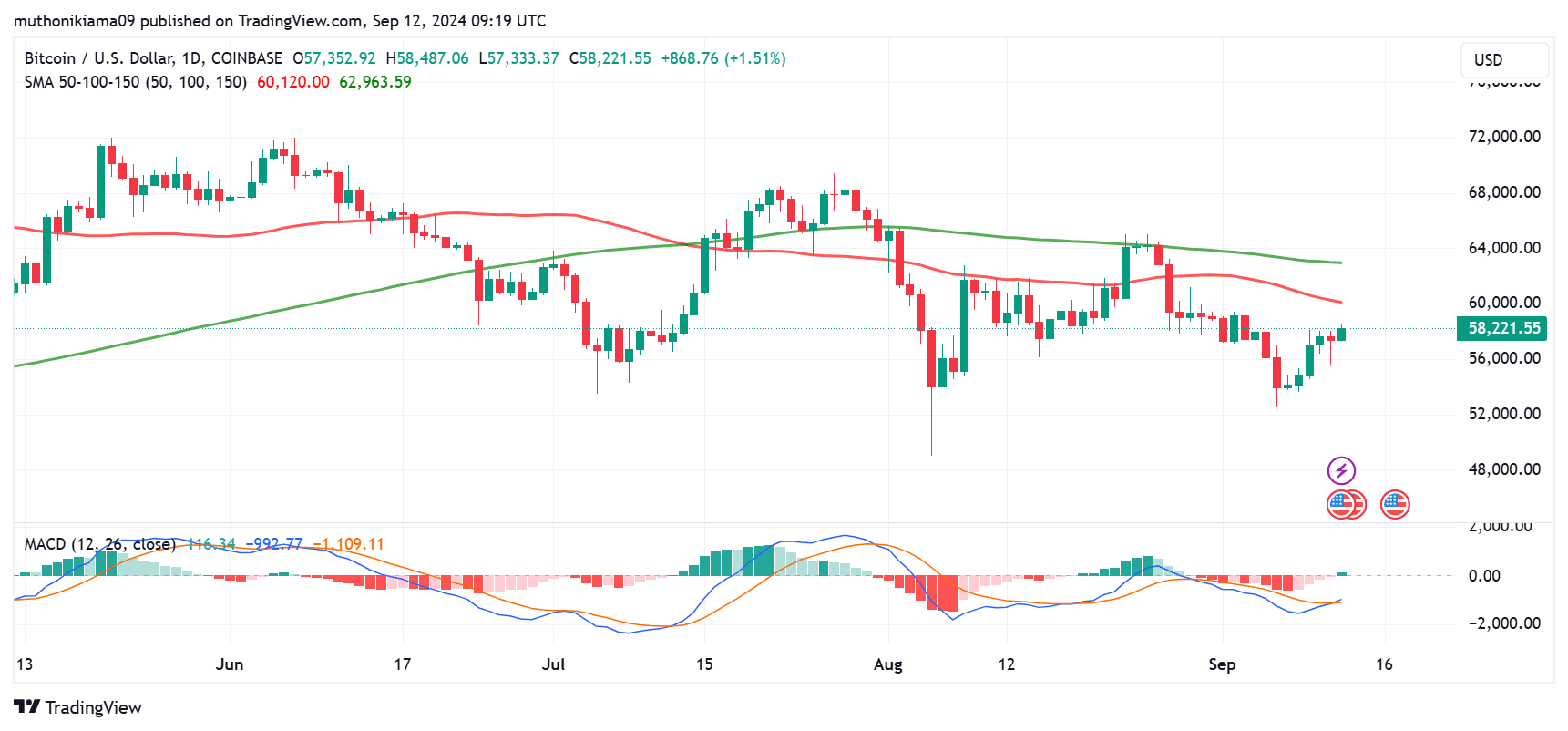

The short-term and long-term sentiment towards Bitcoin remained bearish, as the worth trailed beneath the 50-day and the 100-day Easy Shifting Averages (SMAs).

The 50-day SMA, which was at $60,000 at press time, was the speedy resistance for BTC. If the worth reaches this degree, the near-term sentiment will flip bullish.

Nonetheless, for a extra sustained rally, Bitcoin must reclaim $63,000.

The Shifting Common Convergence Divergence (MACD) indicator additionally confirmed slight bullish momentum. The MACD line has crossed above the sign line, whereas the MACD histogram bars have turned inexperienced.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This development steered that bulls is likely to be gearing up. Nonetheless, a continuation of this uptrend will occur if the MACD line flips constructive.

Regardless of the current good points, the Bitcoin Worry and Greed Index at 31 exhibits the market is fearful. This might see demand proceed to weaken.

![Simply launched: our 3 high small-cap shares to contemplate shopping for in September [PREMIUM PICKS] 8 ReadingBooks](https://www.fool.co.uk/wp-content/uploads/2021/04/ReadingBooks.jpg)